BoE dovish, seeing more labour market slack; wages a key focus in both UK and US

The Bank of England monetary policy reports were more dovish than expected. While it significantly upgraded the growth outlook for 2017, it also revised up potential supply. In particular, it lowered its projection of the equilibrium unemployment rate from around 5% to around 4.5%; forecasting stable wage growth in a modest 2 to 3% range and persistent slack in the labour market over the two-year forecast horizon. This left its inflation outlook unchanged from its November quarterly Inflation Report; rising above the 2% target for the next two years or so, mainly reflecting the one-off GBP fall since the Brexit vote, before receding to target, albeit a year or so beyond its normal two-year outlook. As such, it left monetary policy unchanged, including maintaining their QE asset purchase program. It also tended to dismiss the increase in longer-term inflation expectations, anticipating that they will now stabilize at levels similar to pre-global financial crisis levels when inflation was stable around its 2% target (in 2006/07). We thought the persistently stronger than expected economic outcomes since the Brexit vote and rising inflation expectations might see some shift to a less dovish bias in the outlook. But that was not the case. The Bank highlighted three key factors it will be watching: 1. That long-term inflation expectations do not rise significantly further, 2. That wage growth remains stable, and 3. Consumer spending slows as forecast due to slowing real income growth. It is interesting to contrast the BoE view on the labour market with the Fed. As it stands, both have similar rates of unemployment and wage growth. While the BoE sees significant slack, the Fed does not. A key difference between the two is that the US sees above trend growth and further labour market tightening, while the BoE sees growth slowing (albeit less so than in its November Inflation Report), and thus persistent labour market slack. Wages are a key focus in both countries and we see new data from the USA on Friday.

Dovish BoE raise projected supply

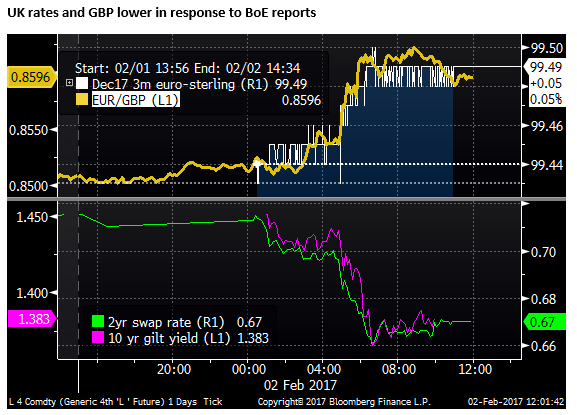

UK rates fell after the BoE reports today (Monetary Policy Summary and minutes, quarterly inflation report), suggesting there was something more dovish than expected.

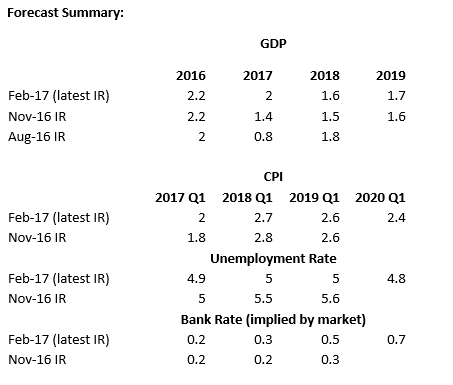

The BoE actually raised its growth outlook significantly for this year (2017) and somewhat for 2018 and 2019. However, this was probably not unexpected by the market.

The dovish element in the reports that was more surprising was that the BoE also revised up the capacity of the economy to grow without generating inflation. Specifically, it lowered its estimate of the equilibrium unemployment rate or NAIRU (non-accelerating inflation rate of unemployment) from around 5% to around 4.5%. As the table above suggests, this leaves the same amount of labour market slack in the updated forecast, notwithstanding the lower projected unemployment rate.

The Inflation Report said, “Given the persistence and extent of weak wage growth over the past couple of years, the MPC now judges that the unemployment rate can probably fall a little further before wage pressures build sufficiently to keep inflation at the 2% target over the medium term.”

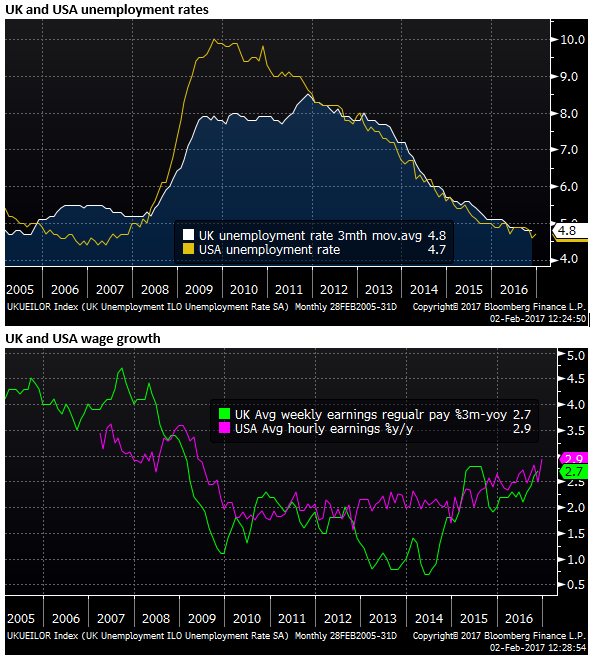

Comparing US and UK labour markets

The charts below compare UK and USA unemployment rates and rates of wage growth. The rates of unemployment have been very similar for the last five years. Wages growth in the UK picked up quite significantly from mid-2014 to mid-2015, albeit from historically low levels below 1% to 2.8% annual growth. They subsequently fell back to around 2% in the second half of 2015, but have been rising again in the last year or so to again reach 2.7% 3mth-yoy in November 2016.

The BoE inflation report said, “Having averaged over 4% prior to the financial crisis, wage growth appears to have settled at around 2%–3% over the past two years.”

Wages growth in the USA didn’t fall as much as in the UK between 2012-2014. But it has been in a gradual rising growth trend since early-2015, last reported at 2.9%y/y in December (the January data is due tomorrow- Friday).

Given the more recent rise in UK wages, it is interesting that the BoE described them as stable and have lowered its estimate of equilibrium unemployment. This seems to be a relatively dovish assessment.

Given the closeness in the movements in the USA and UK unemployment rates in recent years, and the closeness in their rates of wage growth, one may wonder if both countries are at similar places in terms of tightness in their labor markets and wage pressures.

A key point of difference between the BoE and Fed assessments is that the BoE now expects their unemployment rate to creep up a bit. As such it expects more slack in the labour market and lower wage pressures to evolve. It already states that at the current 4.8% of unemployment, they see “discernible slack in the labour market”, and “a slightly greater degree of slack than was assumed in the November Report”.

The USA Federal Reserve, on the other hand, forecasts the US unemployment rate to fall further in the coming years (to 4.5% from 2017 to 2019). It may still see some slack in the labor market, but most Fed members seem to think now that the USA is close to reaching its labor market equilibrium (long-run unemployment forecast at 4.8%).

UK growth outlook below long-run trend

Notwithstanding the upgrade to its growth forecast, the BoE still expects growth to slow. In particular, it expects consumer spending to slow as wage growth remains in the 2 to 3% range, but inflation rises to near 3%, causing real income growth to stagnate.

To date, the BoE have under-estimated the strength in consumer spending that has held up around long-run average levels, but it has just rolled forward its forecast decline. It said, “That slowdown comes a little later than previously assumed”.

The growth outlook has also been lifted in part due to government fiscal stimulus announced in the 23 November Autumn Statement, a stronger outlook for global growth, and easier financial conditions. The BoE said, “Overall, in the central projection that leaves the level of GDP around 1% higher in three years’ time than projected in November.” However, this growth outlook is still around 1.5% lower than in the May Inflation Report before the Brexit vote.

This higher growth outlook did virtually nothing to the BoE’s inflation forecasts because, “The stronger demand profile is in large part matched by a higher level of supply”, related mostly to its downward revision in the equilibrium unemployment rate.

Stable outlook for inflation expectations

The BoE anticipates that the rise in headline inflation, driven by the fall in the GBP exchange rate, will not further significantly lift long-term inflation expectations. It notes that inflation expectations have increased in the second half of 2016, but now sees them at normal levels consistent with the 2% medium-term inflation target.

It said, “Overall, indicators of inflation expectations increased over the second half of 2016, and are around their levels in 2006–07, when inflation had been close to the 2% target for some time.”

“Overall, the MPC judges that indicators of medium-term inflation expectations continue to be broadly consistent with the 2% target and remain well anchored. The levels of medium to long-term measures of inflation expectations have picked up, but are broadly around past averages.”

“Indicators of longer-term inflation expectations derived from financial market prices for inflation compensation rose ahead of the November Report to around past averages. Since then, they have been broadly stable, in contrast to increases in equivalent measures for the United States and euro area.”

The charts below show market-based measures of inflation compensation/expectations for major countries. They have risen broadly across the world, but somewhat more so in the UK since mid-2016. The BoE view seems to be taking a best case view that they are stable and not too high.

Neutral bias with focus on inflation expectations, wages, & consumer spending

Naturally, given Brexit, the BoE commented on the high degree of uncertainty in their forecasts. But it appears to have an equal balance of upside and downside risks to their forecasts and policy outlook. It said, “Monetary policy can respond, in either direction, to changes to the economic outlook as they unfold to ensure a sustainable return of inflation to the 2% target.”

It said that it will be monitoring three factors closely:

- “that the lower level of sterling continues to boost consumer prices broadly as expected, and without adverse consequences for expectations of inflation further ahead;

- that regular pay growth does indeed remain modest, consistent with the Committee’s updated assessment of the remaining degree of slack in the labour market;

- and that the hitherto resilient rates of household spending growth slow as real income gains weaken”

It said, “At its February meeting, the MPC continued to judge that it remained appropriate to seek to return inflation to the target over a somewhat longer period than usual, and that the current stance of monetary policy remained appropriate to balance the demands of the Committee’s remit.”