BoJ to overshadow the Fed, upward pressure on bond yields and other roadblocks

US economic data has continued to disappoint most noticeably with weak retail sales extending from July into August. This has undermined the USD, although overall FX markets appear in extended choppy directionless patterns. The chance of a Fed rate hike next week has diminished to negligible levels. Judging by recent comments by most FOMC members, we still expect most dots to project a hike in December. But the risk is still that dots are revised down in 2017 and 2018 and attention is refocussed on the gradual and shallow outlook of most Fed members. This might undermine the USD, but the BoJ meeting appears likely to overshadow the Fed this time. Despite the soft US data, longer-term yields globally remain sticky after recent gains, and bond yields appear to be in a rising trend. We see the BoJ meeting potentially propelling this trend with further negative fall-out to global bond markets. Much may depend on the performance of the JPY in the wake of the BoJ meeting. A weaker JPY will tend to reinforce a correction higher in long-term bond yields, spilling over to a further correction in global equities, emerging market and commodity currencies. A secondary risk for global asset markets at this time is the US election. The more the market considers the risk of a Trump presidency or a close outcome, the more it must factor in higher fiscal stimulus and closed borders in the US to trade and people. This would point to more asset market volatility with a bias towards higher yields, a stronger USD and weaker equities. However, while a number of roadblocks appear in the way for emerging markets, several large emerging market economies are exhibiting more government stability and stronger economic momentum, pointing to a more robust medium-term outlook.

Odds of Fed hike fade to black

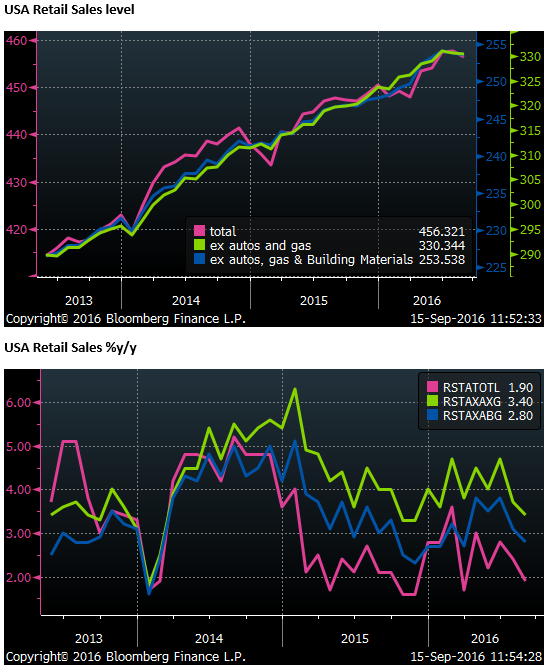

The chances of a Fed hike this year have faded further after a second weak US retail sales report in a row in August, weighing on the USD.

Retail sales grew modestly from around July last year until March this year, surged in Q2, but stalled again in July and August. From a year earlier, growth rates are modest at +1.9%y/y for total sales, +3.4%y/y ex-autos and gas, +2.8% ex-food, autos, gas & building materials (the control group)

Following the retail sales report, the Atlanta Fed GDP forecast for Q3 was revised down from 3.3% on 9-Sep to 3.0% q/q saar. While this would represent an above trend quarter, coming after three soft quarters averaging around 1% saar, it would leave annual growth below trend at around 1.5%y/y.

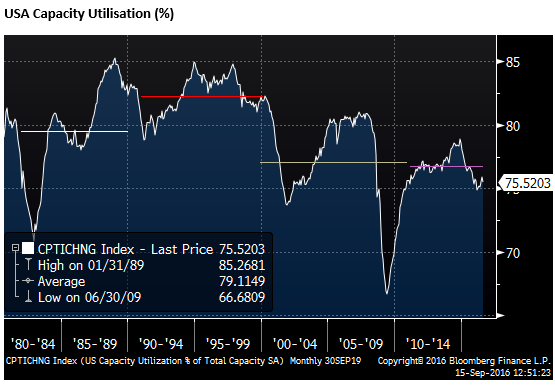

In other data, the first two regional manufacturing surveys for September in New York and Philadelphia improved a little but remained relatively low. Philadelphia recovered more than New York. Manufacturing production was weaker than expected in August, and capacity utilization lower than expected, in general confirming the weak ISM report in August.

Capacity utilisation has been dragged down by the energy sector and a stronger USD from a recent peak of 78.9 in Nov-2014 to 75.5 in August this year (up from a recent low of 74.9 in March). In a long-term view, this is relatively low. It is below its average for the current decade, and much further below the averages in the 1980s and 1990s near 80 and 85%. Perhaps this is a structural decline, but it does suggest headwinds to a strong recovery in capital expenditure.

On Friday, in the USA we see the August CPI inflation data and first reading of the University of Michigan consumer sentiment survey for September. On Monday and Tuesday, we see some housing data ahead of the FOMC policy meeting on 21 September.

The data over the last month suggests that the Fed will err on the side of caution and decide to not raise rates. This would support the argument that Presidential candidate Trump has been making lately that the Fed and Chair Yellen have been holding rates low to support the economy and boost the chances of his opponent Clinton.

The market has essentially given up on a Fed rate hike next week and is pricing in only around 15bp of a possible 25bp hike in December (assuming no move before then, this represents around a 60% chance). Bloomberg’s WIRP page says there is an 18% chance of a hike next week, but this appears to flatter the odds and doesn’t seem to account for the lift in the effective funds rate from around 37 to 40bp since mid-year, the implied probability is more like less than 5%.

FOMC may refocus attention back on gradual and shallow

The September FOMC includes the two to three-year ahead projections and Chair Yellen press conference. In June , the central tendency (9 out of 17 members) was for two more hikes this year (although a significant number of 6 out of 17 members thought there would be only one hike), and no member thought there would be no hike.

If there is no hike next week, presumably most members will still project one hike this year. It will be interesting to see if any Fed member goes for no hike this year.

In June, the mode (6 out of 17) was for four 25bp hikes in 2017, while the median was higher at six hikes. After only hiking once so far in almost one year, the market will certainly doubt the Fed will hike once per quarter next year. It is currently only pricing in one full hike over the next year. An important issue for the market will be how rapidly the FOMC projects hikes next year. It is easy to imagine that members revise down these projections.

And then, of course, the market will be equally interested in how the FOMC see the long-run neutral rate that was revised down again to 3% in June (from 4.25% in 2012). There has been more discussion since mid-year about a lower neutral rate, and while this rate already seems low, some members have wondered if it could be even lower. However, with a 2% inflation target, allowing something for a positive rate of real growth, it probably won’t be revised down again; this time at least.

There seems less scope for the statement, press conference and projections at this FOMC meeting to surprise to the down-side, judging by the less-dovish comments by most Fed members over the last month, but there is still some scope.

We presume that most Fed members will see the outlook as glass-half full, projecting several hikes next year. However, the rate projections in 2017/18 still appear more likely to be revised down. This might attract more attention to the gradual and shallow policy outlook of most Fed members that has received less attention in the market recently than the timing of the next rate hike.

On balance, we see the FOMC as unlikely to support the USD.

BoJ policy may over-shadow Fed

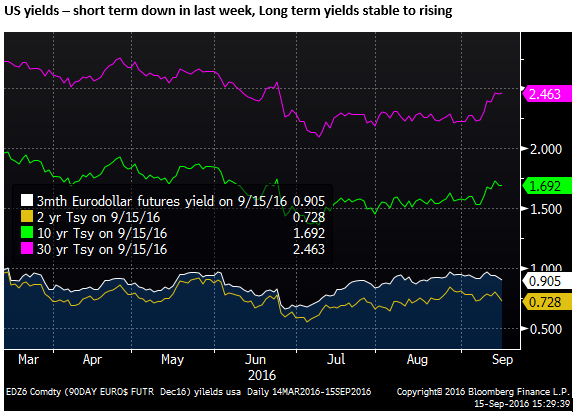

However, the case for a stronger USD recently has more to do with the likelihood that the BoJ implements a reverse policy twist, as we have discussed in recent reports (AmpGFX – BoJ twist may wind equities, bonds and JPY in a declining trio, 14 Sep) tending to weaken the JPY and place more upward pressure on longer-term yields.

Long-term yields arguably still have some ways to rise from what may be irrationally low levels driven by negative 10-year yields in Japan and Germany.

Few major central banks yet see much evidence that inflation pressures are rising. There is some risk in the USA, hence the discussion is about hiking. There is inflation brewing clearly in the UK following the steep fall in the GBP this year, but this is viewed more as transitory and the BoE is focused on dealing with the Brexit fallout to investment and confidence in the UK.

Policy easing biases remain in the Eurozone, UK and Japan. However they are seeing limitations or costs to monetary policies and the market is beginning to revise down expectations of more easing, especially bond buying programs.

The BoJ policy meeting hours before the FOMC meeting is set to wind back its long-term JGB purchases. We expect it to present this in conjunction with a deeper negative overnight interest rate target. This may tend to weaken the JPY and it should steepen the Japanese yield curve; in particular with higher long-term yields. We see this placing further upward pressure on global bond yields, triggering some further correction in emerging market assets and currencies.

How long this lasts may depend on how much global bond yields rise. At some point, the BoJ will still use its bond-buying capacity to prevent an excessive rise in yields. However, the weaker is the JPY, implying easier policy and higher inflation expectations in Japan, the more the BoJ will allow its yield curve to steepen. The higher Japanese yields rise, the higher global bond yields may rise, and the bigger the potential fall-out to global asset markets as investors reverse some of their recent run-up in exposure to higher yielding riskier assets.

As such, we see the performance of USD/JPY having significant implications for other currencies and the broader performance of the USD.

Political risk coming into the mix

In the mix is the US election with potential for much uncertainty if Trump continues to narrow the gap in the polls to Clinton. His policies appear to throw into upheaval geopolitical stability, and propose what appears to be a significant fiscal stimulus and closing US borders to trade as well as Mexicans and some other countries. Whether he would have much success in achieving these policy goals remains to be seen, but the market would price in at least some chance that he does, and this might immediately upset asset prices in the US, including potentially raising US yields, strengthening the USD and weakening the stock market.

There may be a sense of relief if Clinton is voted into power, pointing to more continuity with the status quo. However, overall the political landscape will have changed, especially if it is a close outcome. In which case, there will be agitation to pursue some of the agenda championed by Trump. In any case, Clinton has shifted somewhat towards less openness to trade and more fiscal spending.

Medium term confidence in emerging markets

After a readjustment, it is possible to see emerging market and commodity currencies resuming a stronger trend. Their performance over the next six months may depend on how effective BoJ policy is in turning around the strong JPY trend this year, and the outlook for the US economy that may or may not be convincingly recovering from a weaker period over the last year.

If the market manages to push aside the political risks in the USA, it could draw confidence from recent trends towards political stability and recovery in several large emerging market economies. A number of investment banks have presented more upbeat views in Russia, Brazil, China, India and Indonesia.