BoJ’s deep throat and China market risks make way for higher Gold/JPY

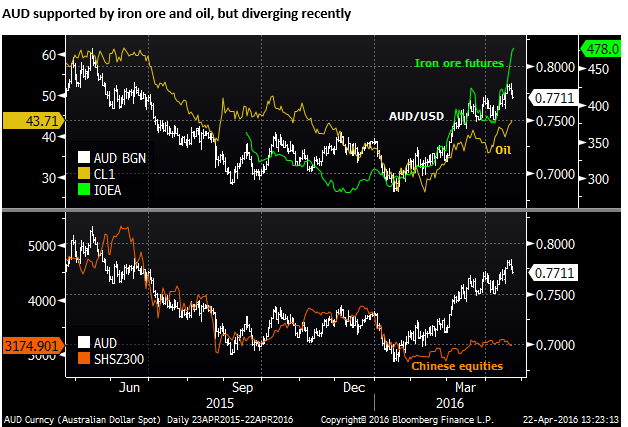

The BoJ’s deep throat policy makes sense this time around after the shock tactics back-fired in January. The market is being massaged to expect comprehensive easing including a further rate cut aimed at a weaker JPY. This time around expect most of the action ahead of the BoJ meeting next week. JPY may weaken near term, but will face significant resistance toward 115 and may be volatile after the meeting with little net new direction. We continue to see market risks building in China; weak corporate bonds, rising yields, steadily declining CNY against its basket, steady capital outflow and lagging equities. AUD has been boosted by iron ore and oil, but is diverging recently and may also be reflecting constrained confidence in China, notwithstanding recent improvement in economic activity. We had returned our focus to long gold in recent days, but it may work better against a short JPY position.

Greater concern over Chinese market developments

This is certainly turning out to be an interesting year in the markets and the swings and roundabouts may continue as aggressive central bank policy action counters substantial risks in the global economy that are rushing in and out more frequently.

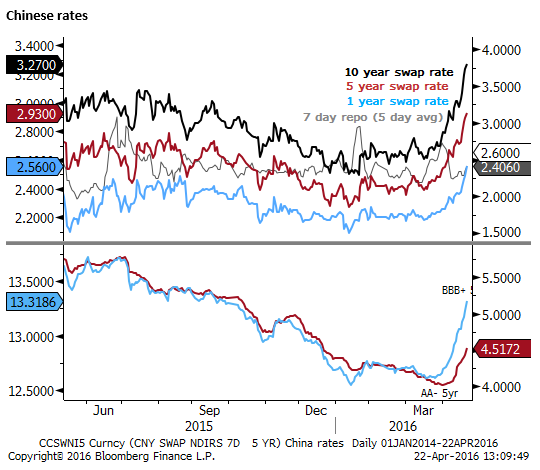

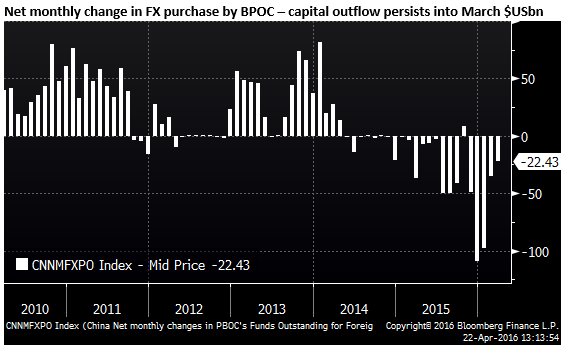

We are seeing increased risks in China with its corporate bond and market-based interest rates rising across the maturity spectrum. Notwithstanding improved growth indicators recently, capital continues to flow out of China and the exchange rate is steadily depreciating against the central bank’s index of a basket of currencies.

The rapid rebound in steel and iron ore prices may have given the AUD a lift this year, but combined with the surge in aggregate loan growth in the first quarter in China it also tends to un-nerve investors that would much prefer to see stable growth with evidence of rebalancing in the economy.

Seeking safety in gold, but may work better against JPY

These concerns had led us to back-out of risk positive yield carry trades and back-into gold that might capture a desire for a haven against fears of weaker asset prices and/or negative interest rate policies of central banks.

Gold surged early in the year as a haven from weak asset prices and from central bank policies that resembled a currency war (competitive currency devaluation). The USD was also relatively weak as the Fed moved towards a lower-for-longer rate policy.

Gold has been a mixed bag in recent months with a number of competing elements. For much of this period the USD has been broader weaker, supporting gold, but risk appetite has been recovering tending to reduce safe haven demand for gold.

In the last week these elements have flipped with risk appetite starting to wane, returning support to Gold, in part because investors are worried about the diminishing influence of central bank monetary policy in supporting growth and some questioning over the sustainability of the recovery in China.

On the other hand the USD has strengthened recently, particularly against the EUR and JPY, in part because US yields have crept up and the market is again thinking about the possibility of a Fed rate hike, albeit not sooner than June.

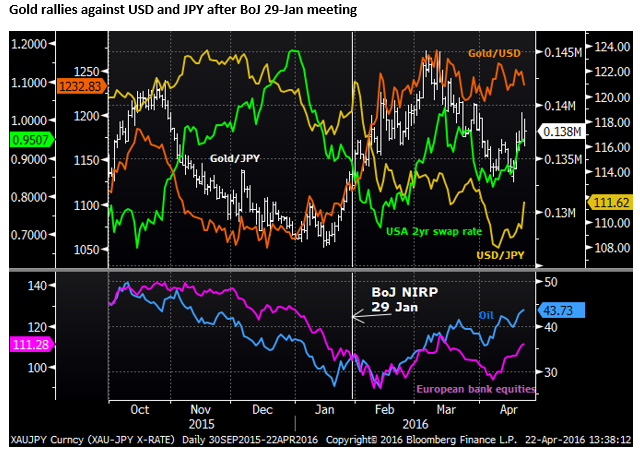

Gold/USD has fallen further on Friday on what appears to be the BoJ using the press and un-named officials to flag a further rate cut by the BoJ next week. Speculation is now rife of comprehensive policy easing dramatically shifting the tone for the JPY.

This has weakened gold against the USD, since a weaker JPY has more broadly spilled over to a stronger USD. However gold has firmed against a weaker JPY. If the BoJ action is successful in boosting global risk appetite then gold might fall further.

However, the BoJ rate cut on 29-Jan did not manage to improve global risk appetite, in fact it had the reverse impact. At the time weak bank stocks globally and a second dip in the oil price undermined confidence. The perverse surge in the JPY in the days after the policy action contributed to risk aversion and a weaker USD, boosting gold sharply.

This time around there appears less chance of BoJ policy easing having perverse or unintended consequences that might undermine risk appetite and boost gold. However, BOJ policy easing may have limited capacity to boost global confidence if the market is again getting more worried about China and losing faith in the effectiveness of central bank policy easing measures.

A conventional response to comprehensive BoJ policy easing might be a weaker gold price against the USD. But there are reasons to think gold will remain resilient. The gains in USD/JPY may be limited given the significant shift in sentiment towards the JPY over recent months. Broader uncertainty over global asset prices might build again in light of poor financial market action in China and sluggish performance in US equities in recent days.

Our enthusiasm for gold against the USD has been curtailed by the probability of aggressive BoJ easing that includes yet deeper negative interest rate policy. But negative rates in Japan that again brings on a sense of competitive currency devaluation trends might not do much to boost global risk appetite. It might generate support for Gold against JPY and indeed might perversely boost gold against the USD if broader risks to global asset markets materialize.

BoJ adopt Deep Throat Policy

Looking more specifically at the BoJ and JPY. It is not surprising that the BoJ is using a ‘deep-throat’ policy of signaling a rate cut ahead of the meeting next week. While the BoJ’s Kuroda saw value is shock treatment in all previous policy easing decisions, this back-fired badly on 29-Jan when he introduced NIRP. This time he needs the market on-side and fully understanding what the policy intentions are.

BOJ Officials Are Said to Eye Possible Negative Rate on Loans – Bloomberg.com

Most analysts that were forecasting further policy easing next week doubted it would include a further rate cut. But the press articles in recent days appear aimed to put a rate cut firmly in the frame with a clear intention of underpinning USD/JPY , if not reverse some of its decline this year.

BOJ Officials Are Said to Share Rising Concern About Yen’s Gain – Bloomberg.com

While the rate cut failed miserably in January to weaken the JPY, negative rate policy is still a potent, even crucial, weapon to weaken an exchange rate, or prevent it from rising further.

Excessive and tired short JPY positions that existed early in the year have been cleansed. Some speculators appear to have reverted to a long JPY position. As such, there is less risk of a short-covering squeeze this time around contributing to a perverse rally in JPY.

Nevertheless, sentiment towards JPY may have changed more permanently, the market is paying more attention to the rebound in the Japanese current account surplus, and global risk appetite is still constrained. While a further rate cut by the BoJ may help lift USD/JPY, it may not appreciably change the tone of JPY and revert it to a sustained weaker trend.

It may well be the case that most of the action will occur this time before we get to the BoJ meeting next week. Afterwards it may be volatile, but it is more likely to be a wash with little net follow-through. Attention may then swing back to other global factors, such as how Chinese markets are faring.