Brexit impact over, yields rising, currencies at both ends of risk spectrum fall

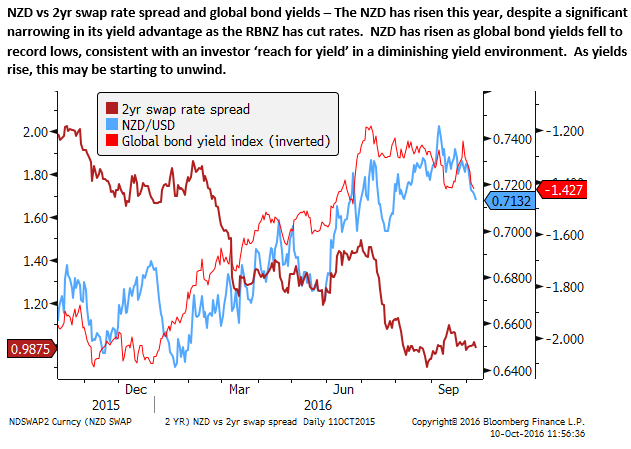

Brexit fear is now close to being fully priced into the GBP, in our view. The most recent slide in October tends to reflect the hard Brexit risk. GBP is likely to remain weak for some time, but it may have seen its low in the flash crash last week. Global bond yields continue their creep up despite dovish comments by the ECB and BoJ since Friday. We can see further rises in global yields unwinding from an extreme low that evolved on expectations of more QE, deeper negative rates, and extreme dis-inflationary expectation. The market has been distracted from the evidence of modest improvement in the global economy and a rising trend in commodity prices this year by Brexit, banking sector woes in Europe and Japan and more bearish long-term forecasts by the Fed since mid-year. Fiscal impetus has turned positive and inflation expectations are now firming, supported by higher commodity prices. As yields rise they will tend to reinforce an improvement in global economic confidence and unwind excessive pessimism on inflation. Higher yields have negative implications for both ends of the risk spectrum, they will tend to weaken extreme low yielders (JPY, EUR, and gold) and also weaken the high yielders, like NZD.

Brexit Risk now largely priced-in

It appears that quite a bit of Brexit risk is now priced into the GBP. It has significantly underperformed its yield advantage against most currencies. In recent sessions, UK yields have risen to compensate investors for the risk of further declines in GBP and higher inflation expectations that arise from a weaker exchange rate.

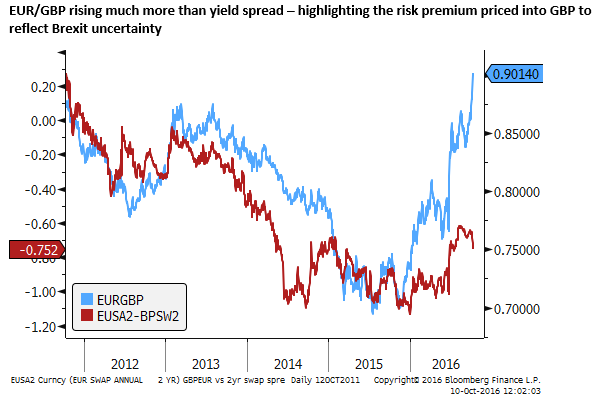

The chart below shows the EUR/GBP vs the 2-year swap rate spread. The EUR has vastly out-performed the GBP, rising to equal the peak in 2011, ahead of the second and more severe stage of the Eurozone debt crisis, and in the same range as the peaks during to 2008/2009 Global Financial Crisis. Meanwhile, the 2yr rate spread peaked in early-August and is far below historical relationships between the two.

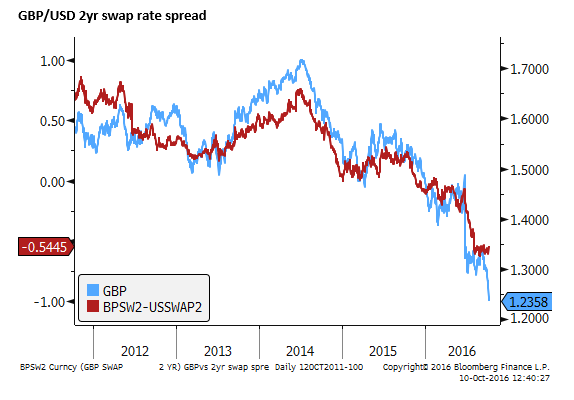

The chart below shows the GBP/USD vs. the 2yr yield spread. Until the recent further fall in GBP/USD, the decline was more or less in line with the yield spread that had fallen since the Brexit vote as UK rate cuts were priced in and delivered. However, in October, GBP/USD has fallen sharply further even as UK rates have risen a little more than US rates.

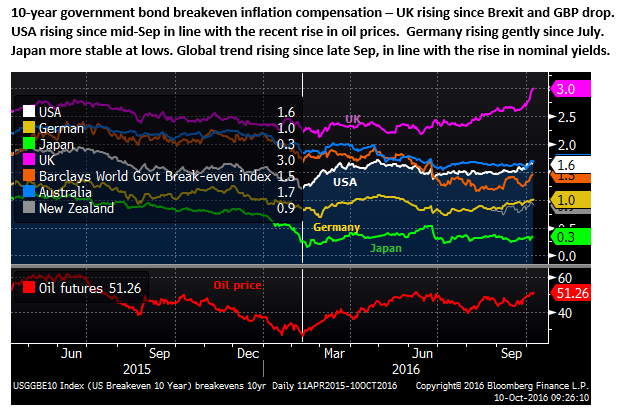

The fall in GBP has resulted in a sharp rise in UK long-term inflation expectations, as shown below in the chart of 10-year government bond break-even inflation compensations. UK 10-year inflation compensation is trading at 3.0%, well above its peers and above the BoE’s 2% inflation target.

The rates market is still pricing in a small chance of a rate cut by the BoE from its current record low of 0.25%, but this is only a few basis points and the fall in the GBP has significantly reduced the probability of a cut.

Economic reports in the UK have so far been significantly stronger than depressed expectations. The slowdown in Q3 is barely perceptible.

Many are fearful of a slow creep in economic demise from prolonged economic uncertainty undermining business investment. BoE board member Broadbent last week said, “A lack of clarity about the UK’s future trading relationships needn’t result in visible, headline-grabbing closures”….”the effect is likely to be more insidious: decisions to expand, that might otherwise have been taken, are delayed.”

However, the hard facts are far less depressing at this point. Importantly, the UK government has hinted strongly that it plans short-term fiscal stimulus and more medium-term infrastructure spending to help support the UK economy. Such considerations might tend to support the GBP.

There are likely to be slow moving investors and individuals that were shocked by the Brexit vote and left carrying the bag so to speak. These slower moving long-term positions represent a weight on the GBP. However, having witnessed the collapse in the GBP many will see it now too late to exit.

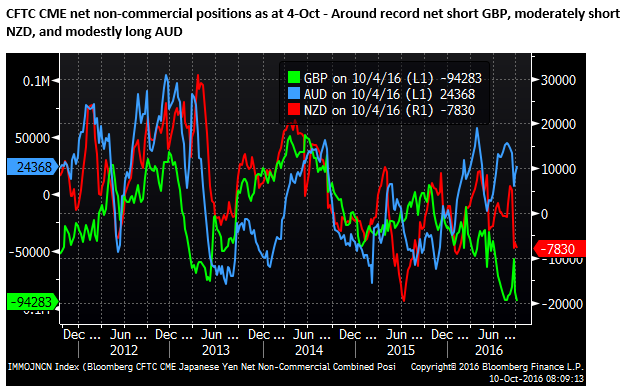

The CFTC CME positioning data shows that short-term speculators are at a record net short GBP position. This dampens downside potential and creates a risk of a short-term recovery in GBP.

The secondary fall in GBP since October now appears to have built in a good deal of the Brexit risk. It arose after speeches by UK PM May stoking fears of a hard Brexit, even for the important financial services sector. May alluded to a change in direction towards policies that give more attention to the concerns of the lower income working class, despite her Tory party’s traditional conservative business friendly bias, and emphasized the intention to control immigration.

Such sentiments suggest the UK is willing to give up all its previous EU trading privileges and widens the uncertainty significantly towards the downside for the UK economy over the medium term.

However, the uncertainty is wide and there is certainly reason to see promise that the UK economy can prosper both over the short and medium term. Certainly, the much weaker exchange rate now affords it a significant competitive advantage.

It feels to me that the negative news for GBP is now largely in the price. It is likely to remain a relatively weak currency for some time, but the case for further significant falls is now less clear.

I have been following the interesting charts of Bloomberg technical analyst Sejul Gokal. He noted that flash crashes seen in ZAR, NZD, and CHF over recent years have subsequently marked medium-term lows for these currencies. The GBP had its flash-crash last Friday, making a low on 1.18 against the USD, similarly, this may be its nadir.

Rising Global bond yields

Another interesting development that we have been following in recent weeks in the rise in long-term bond yields in developed markets. This has extended somewhat further on Monday despite dovish comments from ECB members on Friday down-playing the talk of tapering, and dovish comments from BoJ governor Kuroda, saying he has the scope yet to cut both short and long term rates.

Despite these comments, the market appears to be adjusting to a new sense that these central banks are reluctant to further expand QE, and most central bankers are arguing in concert that they think the effectiveness of further policy easing is now much diminished, calling more forcefully on governments to accelerate reforms and where possible expand fiscal expenditure.

Budget deficits are no longer a dirty word and the debate has shifted to using the low global borrowing costs to fund infrastructure spending that might reap productivity benefits and in essence pay for themselves over the long term. No doubt there are still cautionary voices that budget repair is far from complete, but the momentum in fiscal spending has already shifted to be positive and this trend appears likely to continue.

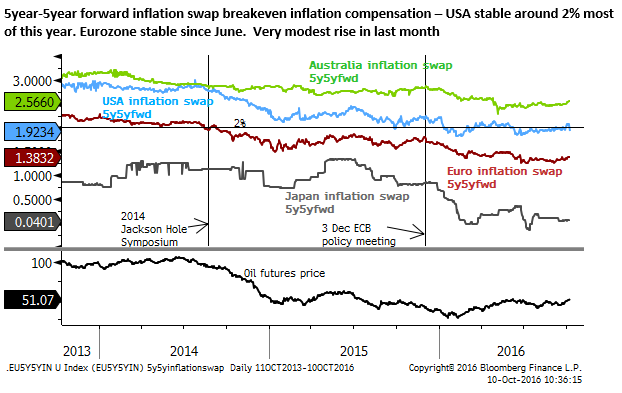

Thirdly, there is upward pressure on inflation coming from commodity prices, helping reverse the decline in global inflation expectations. This was apparent in the 10-year government breakeven chart shown above. While UK inflation expectations have shot up, they have also risen modestly in the Eurozone, the USA, and other countries along with the recent rise in oil prices.

The chart below shows the 5year-5year forward inflation swap breakevens. These have been generally stable for several months, with a very modest rise in the last month.

The chart below looks specifically at the USA. There is a modest lift in market-based inflation expectations since mid-year. The University of Michigan survey of long-term inflation expectations has been relatively stable this year around its record lows, although still at or above 2.5%, above the Fed’s 2.0% inflation target. The core PCE deflator, the Fed’s preferred measure of underlying inflation, has risen to a high since 2014.

Underscoring inflation risk

The current low global inflation expectations appear significantly embedded. Few central banks see any significant inflation pressure in the medium term. The Fed is not forecasting inflation rising above its 2% target at any stage in its three-year ahead inflation projections, which is pretty remarkable considering that its favored core measure is close to 2.0% (at 1.7%y/y) and its core CPI measure is already above this level at 2.3%y/y.

The risk is not insignificant that the Fed is underscoring the inflation risk. The labor market is close to full employment and there is upward pressure on wages growth. Meanwhile, most Fed commentators have emphasized a view that policy is only moderately accommodative and they are likely to hike only very gradually and not very far over coming years.

The Fed appears likely to be slow to respond to inflation risks in the economy, notwithstanding one further hike expected in December. As such, the market may soon begin to price in a risk that they fall behind the curve and allow inflation to creep higher. From the current low inflation mindset, even a modest risk of higher inflation might contribute to further rises in yields and curve steepening.

The chart below shows Fed rate hike expectations. These have risen to the most since May this year, but they still price in less than two rate hikes by the end of 2017.

Responding to commodity prices and firming growth

The most recent rise in nominal long-term yields may be responding to higher commodity prices and firming global economic demand.

The chart below shows the JP Morgan aggregate global bond index vs the S&P/GS total commodity price index. Driven largely by higher energy prices, commodity prices have risen significantly this year, and have risen significantly in the last few weeks, in-line with the recent rise in global bond yields.

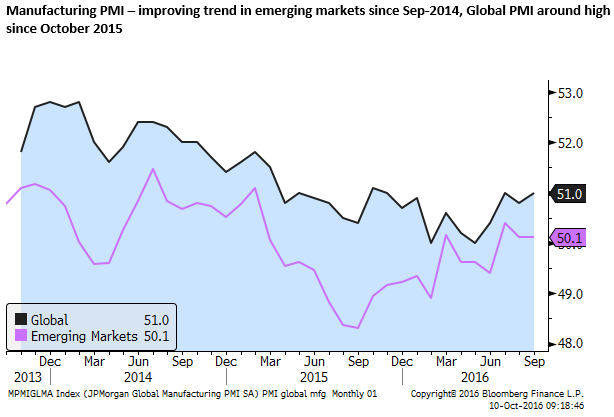

The chart below of global manufacturing PMIs shows an improving trend in emerging markets since September last year and improvement in the global PMI since May. Overall growth may still be sluggish, but the global PMI is at a high since October last year.

Higher oil prices are lifting global confidence

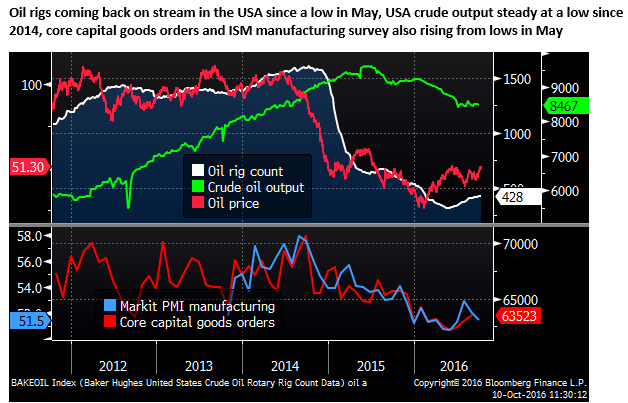

The recovery in oil prices may be partly due to renewed hopes for supply control from OPEC, but it appears to be helping to stabilize the US economy. The chart below shows a recovery in US oil rigs and core capital goods orders in recent months.

More stable to rising oil prices may be seen as helping lift economic confidence in a number of oil producers, including the US, while tending to boost inflation expectations globally. Higher oil prices might also be seen as improving the effectiveness of QE/NIRP policies in Europe and Japan, further improving confidence in these economies. While higher oil prices would reduce the real spending power of consumers, they are likely to still be seen as historically low, keeping consumers in a positive frame of mind.

As global yields rise, expect reversals in other trends

We can see further rises in global yields unwinding an extreme low that evolved on expectations of more QE, deeper negative rates, and extreme disinflationary expectations. This has distracted the market from the evidence of modest improvement in the global economy and a rising trend in commodity prices this year. Brexit and more bearish long-term forecasts by the Fed since mid-year further dampened yields, but on both fronts, pessimism may be overdone.

If yields were to continue to rise, then we might look for the potential impacts on other markets. Diminishing yields have seen investors run toward higher yielders such as the NZD this year. Falling inflation expectations and fear related to Brexit, weak banking sector performance, political risks and diminishing central bank credibility appeared to boost the JPY and EUR. The strength in these currencies themselves generated a vicious cycle, further undermining inflation expectations and central bank credibility.

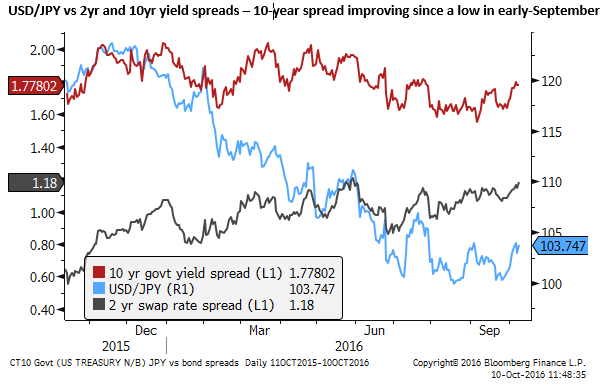

We see gains in JPY continuing to unwind as yields rise. Global investors will also note that higher global yields will tend to improve the USD/JPY yield advantage, as BoJ QE/NIRP/YCC will ensure any rise in Japanese yields is dampened.

EUR has been relatively stable this year, boosted by risk aversion related to Brexit, weak European bank performance and political uncertainty in Italy and several other European countries, and diminishing perceptions of the effectiveness of the ECB’s NIRP/QE policy. On the other hand, EUR has been dampened by the fundamental risks to the European economy related to all the same things.

In the end, we see the fundamental risks to the European economy taking over. As global yields rise, inflation expectations firm and Brexit becomes more fully priced, we see risk aversion that has tended to support EUR diminishing, allowing space for EUR to weaken.

The EUR/USD may yet be dragged back by a weaker GBP/USD, and the recent improvement in the USD yield advantage over EUR.

While risk aversion and falling global yields tended to support the ultra-low yielders (JPY, EUR, and gold), they also tended to support high yielders, like NZD, even as its rates have been cut twice this year.

We see a mixed outlook for emerging market currencies driven by equity flows, but scope for high yielding currencies to retreat from their highs as yields rise.