Brexit reprising the Scottish referendum, Housing becomes political as election looms in Australia

There is a lot of stewing over the UK Brexit referendum, undermining the GBP, dragging down the EUR a bit, supporting gold and JPY, and possibly even AUD and EM currencies as investors presume the safest place is out of UK assets and even Eurozone assets until this mess is sorted out. A vote to leave the EU would unleash prolonged uncertainty as new deals on trade and a range of other matters would take time in what is likely to be an unfavorable frame of mind from the EU side. There is a great deal of uncertainty over what kind of outcome an exit might have for the UK economy. While many argue it is unlikely to harm the economy and may even help it, the EU accounts for around half of British trade, so risk appears skewed to the downside. The developments underway have parallels with the Scottish independence referendum. The prospect of Scotland opting out significantly undermined the GBP, but it bounced back sharply when they voted to stay-in. In closely run binary polls like both the Scottish and EU referendums with a large pool of undecided voters, there tends to be a swing back to the status quo (better the devil you know) in the end. It is hard to imagine either side of the Brexit debate will gain a clear ascendency ahead of the 23 June referendum, this will keep GBP down in the near term, but a rush back to the GBP is likely thereafter. An early election (July) is becoming increasingly likely in Australia as the debate over tax policy descends into the same old shrill scaremongering and the polling tightens up after the Governing LNC fail to take control over the debate on tax policy. The housing market has become central to the debate which is an uneasy situation when many perceive it to be a bubble waiting to be popped.

Brexit fear a re-run of the Scottish referendum

THE GBP is under pressure on risk that the UK leaves the European Union. The fall has probably also contributed to strength in JPY, gold, and perhaps even the AUD and EM currencies as the market seeks alternatives for the GBP.

The EUR may also have been dragged down somewhat by UK/EU break-up risk. The market may sense some weakening in the geopolitical/economic foundations of the EU if the UK leaves. As such, EUR/JPY is at a new low since April-2013 (when the BoJ first implemented its QQE policy under its then new Governor Kuroda).

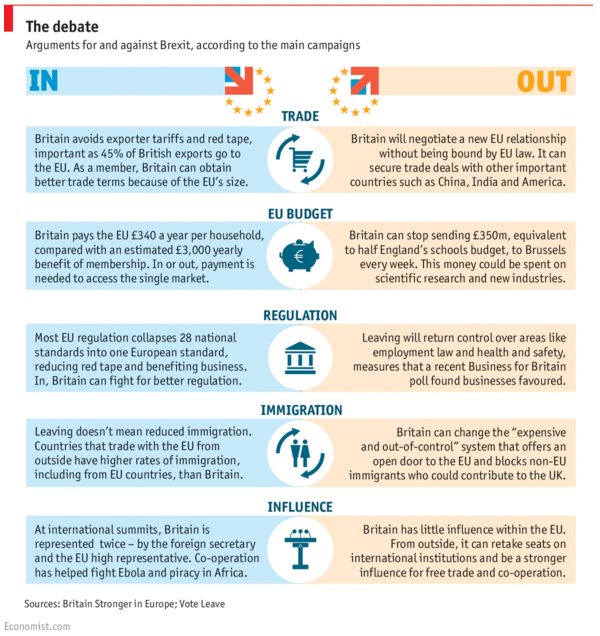

The arguments for and against Brexit are yet to be well articulate, but it is the uncertainty that undermines the currency. Most of that uncertainty tends towards the downside for trade and business and thus may be negative for the UK economy. The ‘out’ camp will claim that exit will not much hurt the economy as new trade deals can be made with the EU, and it may open the door for Britain to improve trade relations with the rest of the world. However, as it stands 50% of Britain’s trade is with the EU, as such the risk is that this is jeopardized.

The situation is not dissimilar to the in-out vote on Scottish Independence that resulted in a sudden plunge in the GBP when the possibility of an out vote became real. But the GBP then bounced back rapidly after the stay-in vote prevailed.

The uncertainty generated by the Scottish independence referendum was arguably greater than that over EU membership since it involved potentially breaking up a currency and fiscal union. The same headaches will not arise in this case. But it still generates a high degree of uncertainty and anxiety that will not be quickly resolved if Britain votes to leave. In which case the safest place for investors to be will be out of GBP and UK assets (unless they become obviously cheap).

A background guide to “Brexit” from the European Union – economist.com

Brexit: for once it’s not about the economy, stupid – theguardian.com

The GBP recovered for around a month up until mid-Feb, as UK PM Cameron’s renegotiations on the terms of UK membership to the EU gained some concessions from EU counterparts relatively quickly. This appeared to improve the odds of a stay ‘in’ vote in a referendum. However, the actual announcement of the referendum, and the spectacle of Conservative Party members splitting into for and against camps, in particular the popular Mayor of London, with ambitions to become PM, lining up against, has regenerated fear than an ‘out’ vote may prevail.

What did the UK achieve in its EU renegotiation? – openeurope.org.uk

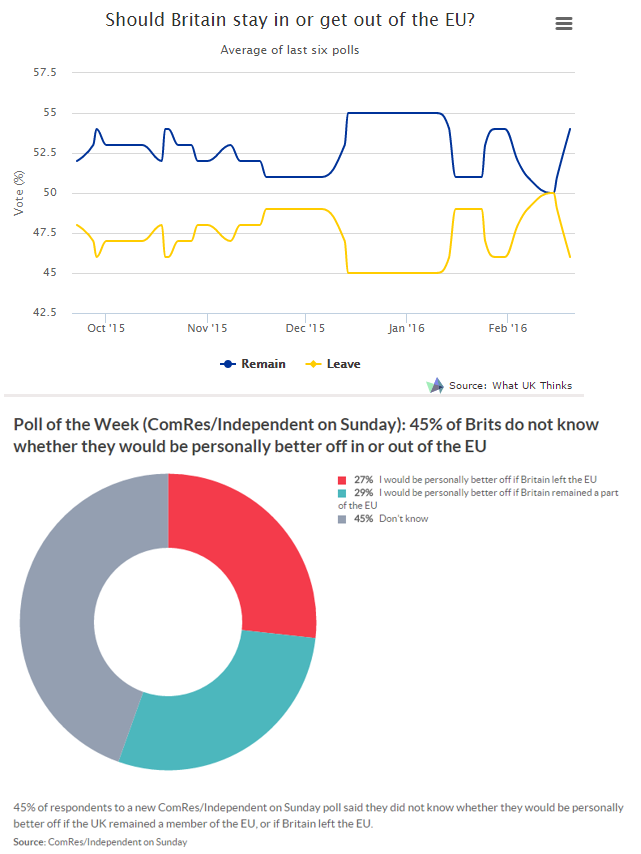

The polling suggests that this will be a closely run race. I guess there will remain a large number of undecided voters up to the last day. In these sort of closely run binary votes, I think there tends to be a late swing from undecided voters to stay with the status quo (better the devil you know). As such, come 24 June, my guess is that GBP will be significantly higher again. I doubt either side will gain the ascendancy in this debate in the lead-up to the event, keeping the uncertainty high over coming months.

EU referendum poll tracker and odds – telegraph.co.uk

Housing becomes political as election looms in Australia

The political debate in Australia over taxation policy ahead of the May budget and an election later this year has been featured in the Australian press in recent weeks. The PM Turnbull has turned the debate into one where he is championing holding up house prices and accusing the opposition party of trying to drive them down with its proposed policy of limits on negative gearing and halving the concessions on investment property capital gains tax.

The problem is that while Turnbull may see high house prices as good for the economy and financial stability, there is growing concern over housing affordability especially from younger voters that haven’t been able to get on the property ladder, and even some older middle class households that are worried how their children will be able to afford to own a home.

The Turnbull led Liberal National Coalition (LNC) government has not been able to control the tax debate. It has been roundly criticized by the media for ditching plans for a rise in the Goods and Services Tax after spending months building up significant public support with the help of state governments and business leaders and other respected economic commentators. Now it has narrowed its potential target on tax reform to superannuation (retirement) funds.

In the process it has made a shrill attack on the opposition Labor party over is proposed tax changes for investment property at a time when Australians have had a gut full of blatant scare mongering and are more prepared that they have been in a generation for leadership and genuine policy reform. Consequently, by being sucked in to the same-old politics, the LNC has suddenly found they have squandered a good deal of its lead in the polls.

The talk is increasing rapidly of the next election being brought forward to July, making the government’s budget in May of much greater significance, setting up the policy it will take to the next election. We should anticipate a heightened political debate coming months.

It would not surprise if there was an early election and the discussion over property investment and the housing market feature highly in the discourse; a topic that is highly emotive and polarizing.

Cabinet digs in as Turnbull backflips on CGT – AFR.com

Getting negative gearing reform right, with a growth dividend to boot, (by Alan Mitchell) – AFR.com

There are a wide variety of views on the state of the housing market in Australia all typically with some vested interest. The article attached below is one of the more bearish discussing research on the ground from a hedge fund short seller. It probably comes under the category of analysis – if you look for what you want to see hard enough you will find it, but it does highlight speculation and over-gearing in Australian housing that has been encouraged by ‘the system’.

It rings true to me that there is a significant aspirational broad low to middle class in Australia that has pursued riches exclusively in highly-geared property investment based on seeking capital gain in a market that has only experienced short periods of mild-downturn in the last 20 years. And the banking system is only too willing to find ways to allow people to borrow more; at arm’s length via mortgage brokers. There is a latent risk of economic and financial instability, in my view, that is not adequately expressed by the Australian authorities (of course we should never expect authorities in any country to sound the alarm too loudly).

Uncovering the big Aussie short – AFR.com