Bund yields leading global yields higher, lifting EUR/JPY yield support

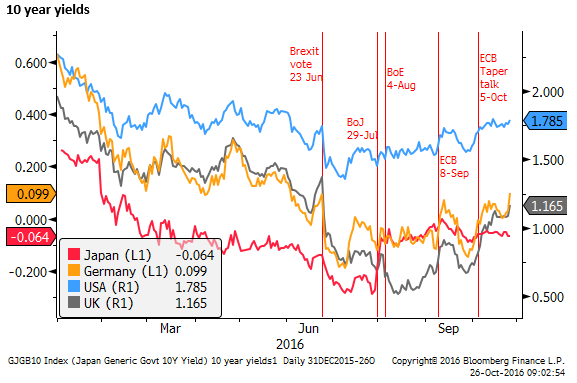

German bund yields have tended to lead global bond yields higher over recent months. UK gilt yields have also risen sharply as a risk premium for a weaker and more volatile GBP is established and the government moves towards an easier fiscal policy, further contributing to higher global yields. Recent economic activity and inflation indicators (headline CPI and long-term break-evens) in the UK and Eurozone support the rising trend in their yields. The market continues to expect an extension of QE in the Eurozone and appears more sensitive to any hint that the extension may be limited or the pace of purchases tapered. The case for higher yields is less clear in the US with mixed economic reports, but activity appears stable and the outlook may improve post-election. Japanese yields have been much more stable since the BoJ implemented Yield Curve Control. If the rising trend in global yields persists, we expect Japanese yields to remain more stable, creating higher yield support for other currencies against the JPY.

German bunds lead global yields higher

Yields are higher in the UK and Germany, tending to lead the US and global yields higher. Japanese bond futures prices are also modestly weaker in the Japanese evening session, although Japanese yields remain relatively stable.

From their low base, the move up in Bund yields of 6bp to 0.09%, is the most significant mover, taking yields through to a new peak since the Brexit vote and triggering broader trends towards higher yields in other markets.

Bunds have been a trigger for global yields recently, spurring a rise in yields after the 8 September ECB meeting where the Governing Council left policy unchanged, disappointing expectations that it might announce an extension of its QE program beyond March next year and/or ease self-imposed restrictions on its QE program such as the capital key or the deposit rate floor on yields below which it cannot buy bonds.

Yields also rose on 5 October after unnamed officials at the ECB reported to have said the ECB was discussing tapering its QE program. ECB officials subsequently attempted to downplay this speculation; Draghi and the council continued to emphasize it would extend as necessary and suggested they would provide more guidance on policy at the December meeting in light of quarterly staff forecasts. There are still widespread expectations that the QE policy will be extended beyond March-2017.

Nevertheless, the market is more sensitive to news that suggests that the ECB is looking to end its QE policy. Perhaps only an extension of the QE program for six months or more with no reduction in the 60bn per month purchase rate on 8 December will satisfy expectations.

UK Gilt yields rise to a high since Brexit contributing to higher global yields

UK gilt yields have also risen to a high since Brexit, reversing much of the fall that occurred in the lead-up to and after the BoE announcement of a rate cut and QE on 4-August. Much of this rebound in yields has occurred in response to the plunge in the GBP inducing higher inflation expectations in the UK. There is also be an increased risk premium on UK gilts related to Brexit uncertainty (and related volatility in GBP). UK economic data have also been resilient and inflation indicators have picked up since mid-year.

The UK might be considered a special case, and its rise in yields should not necessarily have implications for global bond markets. It could even be argued that the weaker GBP is a deflationary impact on other countries that might import now cheaper goods from the UK. Nevertheless, the sharp turn up in UK gilt yields does appear to be contributing to a global rise in yields.

To the extent that gilt yields are rising to reflect a higher risk premium for some lost control over inflation in the UK and/or higher GBP asset and currency volatility, it does support the notion that higher UK yields might spill over to global yields. Furthermore, the UK Chancellor of the Exchequer Hammond has indicated that the government is moving to more expansive fiscal policy to support the UK economy. This should further support the case for higher yields in the UK in a way that should spill over to higher global yields.

The UK announced plans to expand Heathrow airport, consistent with Hammond’s comments that his government wishes to boost infrastructure spending. The project remains contentious and may be delayed. It is unclear if it has any direct impact on the government’s budget accounts, but it is expected to cost GBP16.5bn.

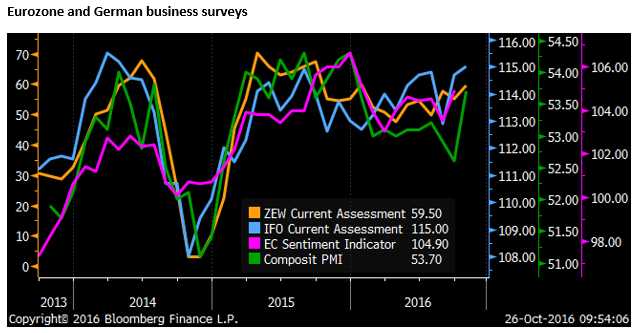

Economic confidence lifts in Eurozone

The rise in Bund and Gilt yields can also claim support from better than expected economic reports. Eurozone business surveys have improved to around highs for the year. The chart below shows the German ZEW survey at a high in October since January, The German IFO survey is at a high since 2014, and the Eurozone composite PMI rebounded in October from its weak September reading to a high since December 2015.

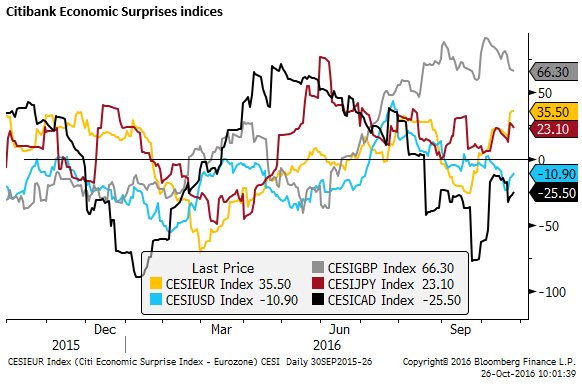

The Citibank index of economic surprises shows the Eurozone index in a rising trend over the last month or so, tending to beat expectations more often than other major economies, except the UK.

Eurozone Inflation outlook improves

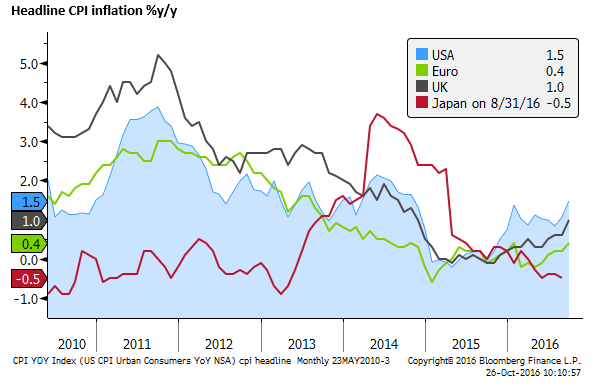

While core inflation measures are still stable, headline inflation has been trending up since April, supported by higher energy prices. Policy makers see headline inflation as a significant factor in determining public inflation expectations, and thus rising headline inflation and firmer global commodity prices are likely to support the notion that the ECB is on track to meet its 2% target.

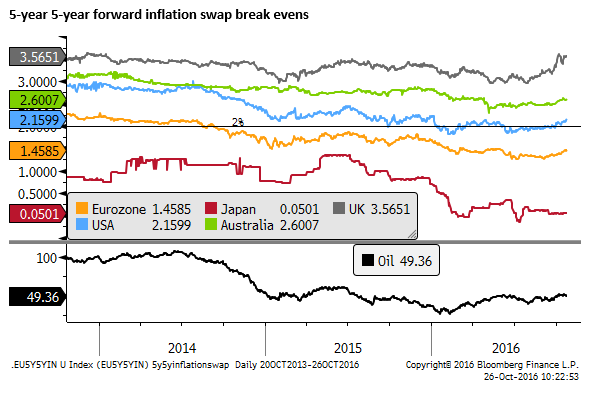

There is some supporting evidence that long-term inflation expectations are rising. The chart below shows the 5-year 5-year forward inflation compensation in the inflation swap market. These have been firming in the last two months in the Eurozone. It has risen more significantly in the UK, while, like headline inflation, remains stagnant at low levels in Japan.

As the ECB assesses conditions ahead of the 8 December policy meeting, it may find less support for an extension of its QE policy for too long. We may hear more noises about reducing the pace of purchases, raising the notion of tapering which has a kneejerk emotive influence on the market.

European bank shares recover

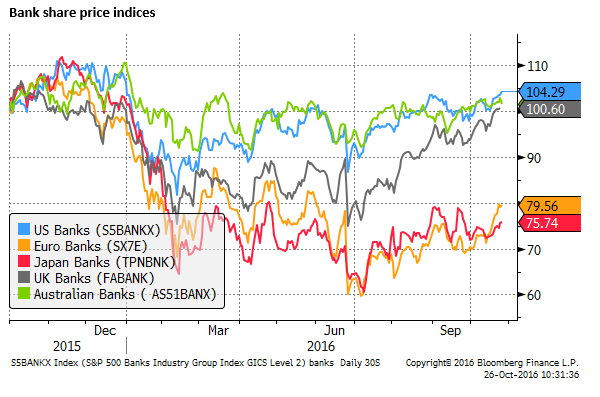

While higher global bond yields might represent a risk to high yield assets, including global equity markets, it does have the effect of alleviating the more intense downward pressure on European bank share prices that have been undermined by negative yields and a flat yield curve.

European bank shares have recovered more significantly than other major country bank shares in recent weeks to a high since early-June.

Mixed EUR outlook, but upside risk on Bund yield rebound

We do not necessarily think that higher bund yields should support the EUR. In fact, higher yields may appear to boost confidence in the effectiveness and scope of the ECB QE policy, allowing this policy to hold down real yields, or be extended and expanded if necessary. Just as in Japan, more confidence in the sustainability of central bank policy might contribute to a weaker currency, even as evidence builds that the policy may be working and economic growth and inflation rise.

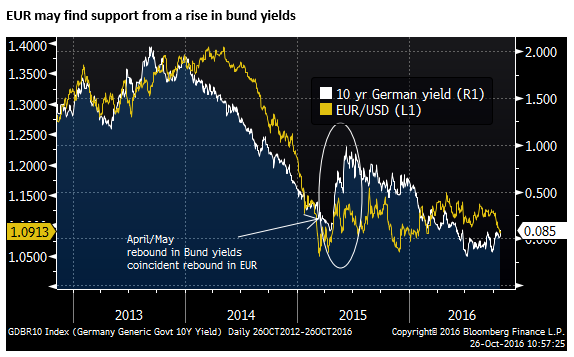

However, the market is cognizant of previous sharp rises in global bond yields during the USA taper tantrum in 2013 and the surprising and sharp rise in bund yields in April and May 2015, not long after the ECB implemented its QE policy.

The 2013 taper tantrum accounts for the bond market’s sensitivity to the recent suggestion that the ECB is considering tapering. The 2015 rebound in bund yields is still relatively fresh in the minds of many investors and will tend to make them wary of a potential repeat jump in yields that may have little catalyst.

The Q2-2015 jump in bund yields was associated with a similar sharp rebound in the EUR from its post QE announcement lows. As such, there is some risk that higher Bund yields, in part driven by improved European economic data and inflation expectations, could see some buying and recovery in the EUR.

EUR and GBP – a love/hate relationship

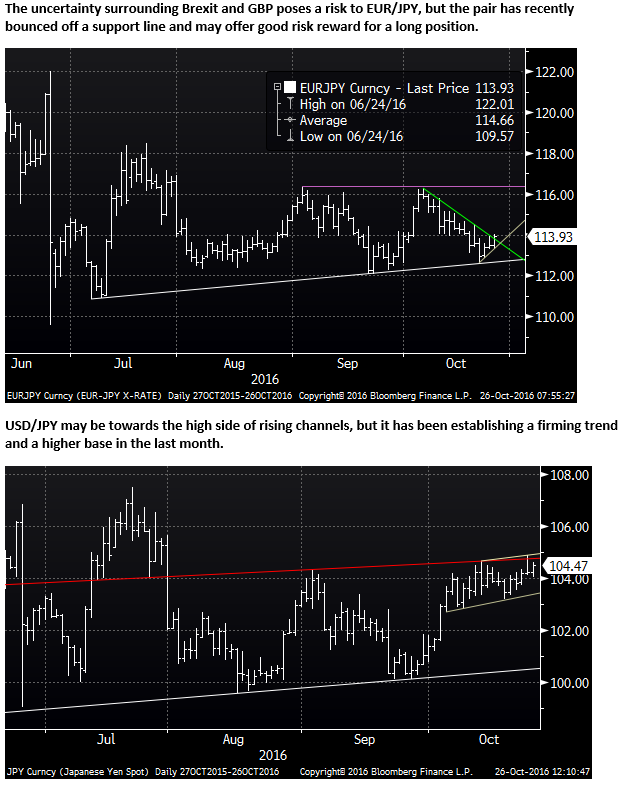

However, EUR has been weak recently, appearing to develop a weaker trend, breaking some key supports. We presume this reflects an easing of the extreme risk aversion related to Brexit and the outlook for European banks.

Brexit fears remain elevated, but over the last month, the market may feel more confident that the risk premium in the GBP and UK rates market is now largely ‘in-the-price’. Instead of capital flight from the GBP and repatriation flows to Europe supporting the EUR, the fundamental factors related to a weaker GBP, Brexit, and still relatively weak European banks have come to the fore to weaken the EUR.

The risk in GBP may now appear two-way with higher UK yields, inflation, economic resilience, and fiscal stimulus offering support, but ongoing fear of weak business investment and relocations of global bank operations to Europe a persistent weight on the currency.

GBP may remain largely directionless for the foreseeable further, but within that we see a substantial risk of a short covering rally that may also offer some support for EUR. The correlation between EUR and GBP is likely to lift now that Brexit fears have normalized, albeit at an elevated level.

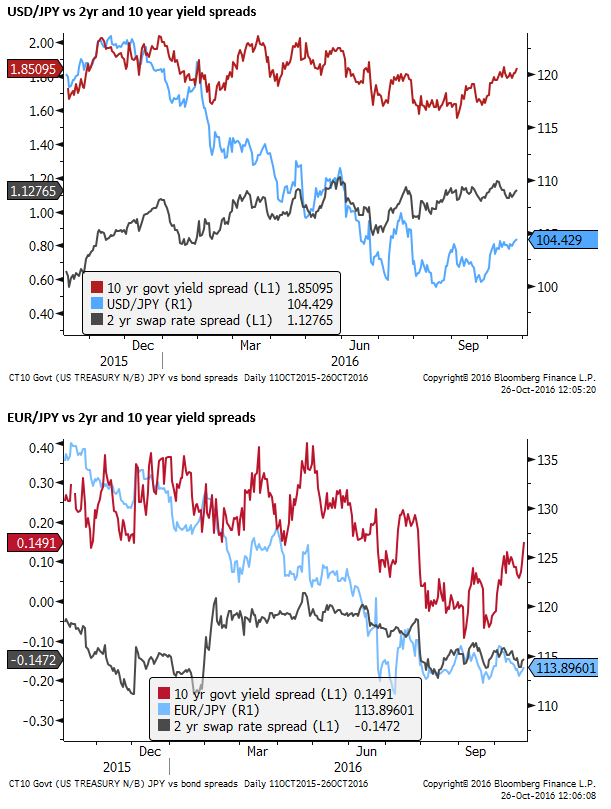

Higher yields may support EUR/JPY and USD/JPY

In looking for implications for higher yields on currency markets, it may tend to support the recent weaker trend in JPY. Japanese yields rose sharply in response to the 29 July policy meeting when the BoJ failed to meet expectations that it might expand its QE policy or lower its cash rate target. Instead, it announced a comprehensive review of its policy. Yields rose somewhat further in the lead up to its 21-September policy meeting where it implemented Yield Curve Control (YCC) and set a near zero or a bit below target for 10-year yields, while maintaining its QE targets and -10bp cash rate target. However, since then, Japanese yields have returned to a more stable path compared to other major markets.

The YCC may tend to keep a lid on Japanese yields compared to other major countries, and this may help sustain a weaker path for JPY if the upward pressure on global yields persists.