CAD and AUD in the hot-seat

Little changed to support the rebound in EUR and weakness in the USD on Thursday. In fact dovish ECB comments and on-message statements from senior Fed members suggest the policy divergence is likely to intensify next month. Eurozone industrial production showed a flat trend in recent quarters and US labour data were firm. Eurozone GDP and US retail sales today in focus. A comparison of CAD and AUD reveal much in common, we see downside pressure persisting for both. Weaker oil prices an immediate threat for CAD. Bank of Canada speech tonight in focus. Australian RBA minutes and wage data next week pose downside risk for the AUD.

EUR position squeeze

The bounce in the EUR on Thursday has much to do with positioning. Global risk appetite diminished as witnessed by the fall in global equities and commodity prices. Traditionally this might see a sharp fall in higher yielding commodity currencies where carry trades were once popular. The most popular position at the moment is probably long USD where rates appear set to rise against the lowest and negative yielding major currency the EUR.

However, the news overnight only reinforced the case for a weaker EUR. Draghi made dovish comments and key Fed officials continued to warn they were on track to hike in December, although acknowledging the strong USD will probably be a factor keeping future rate hikes gradual.

US labour market data were on their recent solid track, and European industrial production showed a flat trend over the last two quarters, insufficient to satisfy the ECB prepared to push its monetary policy harder to achieve faster growth.

Given that the rate spread against the EUR is at its widest since 2006, and the recent fall in the EUR has come relatively quickly after a surprising policy agenda shift by the ECB, and hardened view at the Fed on a hike this year, we do not think the market is well prepared and we doubt it is now excessively short EUR.

Undoubtedly investors and traders have moved to a net short EUR position but this trading strategy is likely to remain firmly held. If there were to be a major upheaval in global asset markets it may trigger a bigger correction in the recent decline in the EUR. However, such an event is not likely with overall global monetary conditions still very easy and firmer growth trends in major economies.

The biggest risk to global growth arises from China and this may be significantly threatening the commodity price outlook. But this is also likely to increase the odds of more aggressive policy action by the ECB.

We doubt there will be a significant and sustained squeeze of short positions in EUR. We should remember that the EUR fell rapidly and over a sustained period from late 2014 into early 2015 even though net short positions reported on the IMM were often larger than those reported last week.

The market may gyrate on the Eurozone GDP report tonight and US retail sales. Both significant data points that can affect sentiment. But the ECB is looking for faster growth and the GDP report would have to be very strong to trim its desire to ease further in a few weeks’ time.

Attention in Australian may turn back to weaker commodity prices

While the Australian domestic economic data has shown improvement, the weaker commodity prices overnight mainly for copper and oil, and the weaker trend in energy and mining equities opens downside risks for the AUD.

While the RBA has expressed more confidence on domestic non-mining trends, it also raised its risk assessment on China. They may start to get more notice when the RBA policy minutes are released next Tuesday; especially since mining sector assets are under renewed pressure.

Australian wage data may show further weakness

Also of considerable interest next week is wages data that have been running at record lows since the data series began in 2001.

While the employment data show moderate tightening in the labour markets, there still appears to be considerable slack. The NAB business survey may have showed somewhat above trend economic activity, but its labour cost series was around its lows since 2009, suggesting the wages data next week will remain low, if not surprise to the downside.

A comparison of AUD and CAD fundamentals

With the renewed pressure on oil prices, the market may look for further weakness in energy producer currencies. CAD was modestly weaker overnight. In focus will be a speech by Bank of Canada Senior Deputy Governor Carolyn Wilkens today.

AUD and CAD are two commodity currencies in the hot-seat, it is worth conducting a quick comparison.

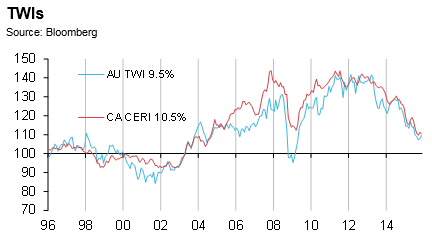

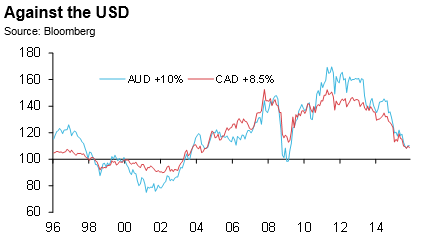

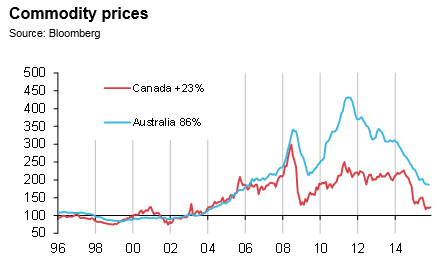

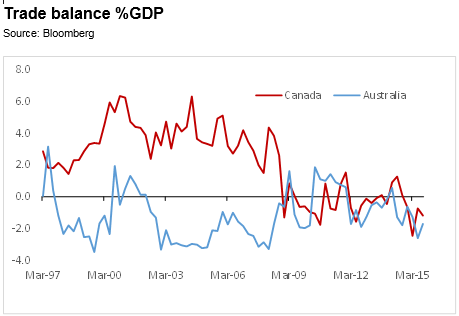

The data in the charts below are re-based on the pre-commodity boom era from 1996 to 2004. Both currencies look similar in respects to overall valuations since this period.

Their TWIs were both once more than 40% above the base period, now they are 9.5% higher for AUD and 10.5% higher for CAD.

Their currencies against the USD are not too dissimilar. AUD was once over 60% above its base period average and it is now 10% above. The CAD was once around 40 to 50% above its base period, now it is 8.5% above

Australian commodity prices were once more than three times (300%) higher than the base period they are now 86% higher. Canadian commodities were double the base period as recently as July 2014, and are now 23% higher.

Both countries are now experiencing trade deficits Most recently around -1.2% of GDP in Canada and -1.7% in Australia.

Domestic economic conditions are also not much different. Both are experiencing moderate slack in their economies and their central banks are exhibiting a mild easing bias. A key focus in both countries is whether policy is easy enough to contribute to a transitioning in growth from troubled resource sectors to other parts of the economy. Both are witnessing progress on this front, but both face another year or two of significant transition left to make and risks are arguably mounting to the downside as commodity prices slip further. We expect moderate downward pressure on their currencies to persist.

Economic news

- USA: jobless claims were steady at 276K last week, a bit weaker than 270K expected. The 4-week moving average rose to 267.8K from a long term low two-weeks ago at 259.3K. Overall still in a lower range for the last seven or eight months.

- USA: JOLTS job openings rose to 5526 in Sep, from 5377 in Aug, above 5400 expected. Down from the peak for the year in July, but at a new high 3mth average.

- Euro: Industrial production rose 1.7%y/y in Sep, down from +2.2%y/y in Aug (but revised up significantly from 0.9%y/y). The annual growth was above 1.3%y/y expected in Sep, but the monthly momentum was below expected. In the last two months IP has fallen 0.4% and 0.3%m/m, reversing a 0.7% rise in July. The level of IP has been little changed since it peaked in February, suggesting flat momentum in in the last two quarters.

On the Radar

- USA: Retail Sales, PPI, UoM consumer sentiment and inflation expectations

- Canada: BoC Deputy Wilkens speaks

- Eurozone: Trade balance and Q3 GDP first estimate

- G20 leaders’ summit hosted in Antalya, Turkey.

What they said

- ECB President Draghi: “Signs of a sustained turnaround in core inflation have somewhat weakened.” … “While the recovery will gradually strengthen the impulse underlying the inflation process, the protracted economic weakness of the past years continues to weigh on nominal wage growth, and this could moderate price pressures as we move forward.”

- ECB member and Bundesbank President Weidmann: said that the influx of refugees into Germany may create inflation pressures.

- Fed NY President Dudley: “After liftoff commences, I expect that the pace of tightening will be quite gradual.” …. “In part, that is because monetary policy is not as stimulative as the low level of the federal funds rate might suggest.” (Fed officials appear to be attempting to shift the market focus beyond what appears to be a very likely hike on 16 Dec – my comment,)

- Fed Vice Chair Fischer: “While the dollar’s appreciation and foreign weakness have been a sizeable shock, the US economy appears to be weathering them reasonably well”…. “Monetary policy has played a key role in achieving these outcomes through deferring lift-off relative to what was expected a little over a year ago.” He said that the October FOMC statement indicated that a move next month “may be appropriate.” (A strong dollar has delated hikes, and it may continue to dampen the potential for hikes over the next year, but the key point for currency trading is that the relative strong of the US economy is placing upward pressure on the USD – my comment).

- UK: BoE Chief Economist Haldane: “There is a chronic and accumulated imbalance between demand and supply, and that has sent skyward house prices” … “At the root of this is something pretty basic, a lack of home-building and a lack of supply.” Haldane, the most dovish member of the MPC, said, “The case for raising interest rates is still some way from being made”…. “Now more than ever, policy needs to be poised to move off either foot depending on which way the data break.” ….. wage growth “appears to be fizzling.”

In the news

- Japan’s government is discussing the size of a corporate tax cut next fiscal year beginning April-2016. “As for corporate tax reform, we will certainly add more deductions to the tax reduction” in fiscal 2016, paving the way for pulling down the effective corporate tax rate below 30 percent”, Abe said. The current rate is 32.11%, and reports from earlier in the month were than it would be cut in stages initially below 31% next fiscal year. (Administration mulls cutting corporate tax rate below 31% – japantimes.co.jp)

Markets on the Move

- US stocks fell 1.4% on Thursday, the deepest fall in the corrective phase since the recent peak on 3-Nov, to a three-week low. All sectors fell in a broad-based market correction.

- Energy stocks in the US S&P fell 2.4% to a two and a half week low

- Metals and mining shares fell 3.2% to a new low for the year, a new low since 2008.

- Steel sector shares fell 2.6% to a low in almost six weeks since 2-Oct.

- Eurozone equities were down 1.7%, but had closed before the US market had fallen further in the afternoon session. UK equities fell 1.9%.

- Oil fell $1.1 on WTI $1.8 on Brent to the low $40s, on both contract types the fall breached previous lows over the last four to five months, sending the market is search of the low for the year set in Aug ($37.75 on WTI and $42,23 on Brent) the lows since 2009, and before that 2005.

- Copper was testing the lows for the year set in August ahead of Thursday, and fell through this low on Thursday with a relatively sharp 2.2% fall to a new low since 2009.

- Iron ore futures in China rose slightly and have been relatively stable for almost two weeks, hovering near the lows July. Firming in Asia today.

- Coking coal futures in China rose 1.3% on Thursday, to their highest in over two weeks. Overall relatively stable around lows for the year for the last two months, but firming slightly so far this month.

- Thermal coal futures in China rose slightly on Thursday, after falling more sharply to a new low for the year on Wednesday, more in-line with the weaker oil prices recently.

- New Zealand Milk powder futures have continued on their steady fall over the last few weeks; down 12.2% this week, down 20.3% from two weeks ago. The fall in the last week suggests downside risk for the Fonterra GDT bi-weekly auction on Tuesday next week.

- Despite the equity market falls and correction on USD, US 2yr swap rate was little changed. The 2yr Treasury yield fell only 0.35bp, and 10yr yields were down 1.85bp. The stickiness of rates may reflect a degree of acceptance that the Fed is likely to proceed towards a hike in December, and contributed to a weaker stock market.

- Eurozone 2yr swap rates were also little changed, down over 5bp this week to -6.4bp.

- Canada 2yr swap rate fell 1.5bp, losing a little more ground than US rates over the last week.

- Australian 2yr swap rate rose around 14bp in the aftermath of the strong employment report but fell back to be up by around 6bp from Wednesday. 3yr government yields have risen somewhat more than 2yr swap rates over the month to-date closing the gap between the two. Month-to-date, essentially since the hope of a near term RBA rate cut has faded, 3yr government bond yields are up 35bp, while 3yr swap rates are up 23bp (lagging by 12bp).