Calmer USD and JPY, weaker EUR, more upside for EM and commodity currencies

The recent rising trend in the JPY and falling trend in the USD have had a life of their own this year, unwinding excessive positioning built up from end 2012 to mid-2015 for the JPY and from mid-2014 until January this year for the USD. These trend reversals have contributed to the volatility in global markets that were being buffeted by the upheaval in Chinese markets and commodity prices, and more recently by Brexit fears. The rebounding JPY added to risk aversion, while the falling USD boosted risk appetite, the feedback from a falling to USD to a rising JPY added to the churn and uncertainty. However, the JPY and USD have started to stabilize in recent days and excessive positioning appears to have been significantly cleansed, allowing markets to see more clearly improving conditions in Chinese and EM economies and focus on the rebound in commodity markets. Brexit fears are likely to remain heightened and indeed may intensify as we approach the 23 June referendum. This may tend to keep risk appetite and USD/JPY contained below 110. But investors may still tend to seek out EM and commodity currencies to avoid negative rates and record low yields in major economies. Brexit fears have weighed on European currencies and we may see further gains in EM and commodity currencies against the EUR.

USD and JPY trends have created additional uncertainty and volatility

Two significant trends this year that had a life of their own have been a stronger JPY and a weaker USD.

There have been several other developments that have contributed to global markets volatility, including sharp swings in oil prices and intense uncertainty over the Chinese economy and financial markets. Uncertainty related to these elements have persisted for over a year, but intensified early this year. Brexit fears have also significantly increased this year.

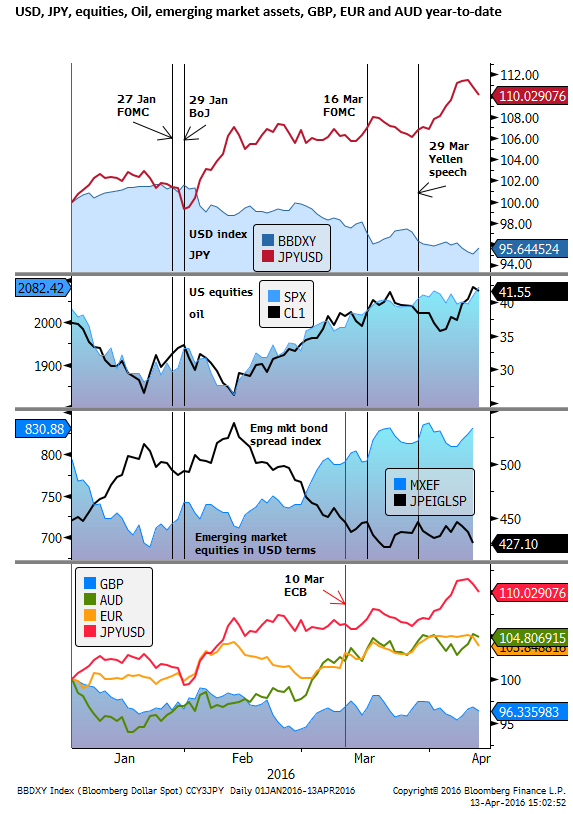

The trends in the USD and JPY have contributed to volatility, making it harder to figure out dominant themes. JPY rose sharply and surprisingly after the BoJ introduced its NIRP in early February, and again as it busted through 110 in early-April. In both instances it appeared to contribute to global investor risk aversion and spill-over to weaker EM and commodity currencies.

The early-February rise in JPY combined with weaker oil prices and weaker developed market bank shares to undermine investor confidence. The fall in early-April combined with increasing Brexit fear and weaker GBP and European currencies, spilling over the weaker EM and commodity currencies.

The weaker USD, on the other hand, has tended to boost investor confidence. The more dovish FOMC statements on 27-Jan and 16-March and Dovish Fed Chair Yellen speech on 29-March contributed to a broadly weaker USD and helped boost EM and commodity currencies.

It is never easy in markets, but the cross-currents in recent months have been particularly turbulent. A weaker USD of course also accentuated a stronger JPY, and the risk-positive influence of a weaker USD spilled over to a risk-negative influence of a stronger JPY, adding to swings in commodity and EM markets.

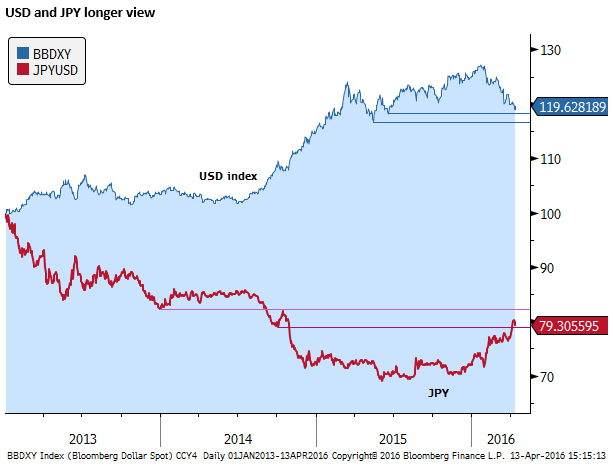

The recent rise in JPY and fall in USD had their genesis in major trends over the last several years during which the market had built up large long positions in the USD and a short position in the JPY.

Japan’s Abenomics and QQE policy drove a substantial decline in the JPY from late 2012 to mid-2015. The last wave in this move appeared to be driven by Japanese institutional investors, led by the GPIF, reallocating funds to foreign assets into and after the second phase of the BoJ’s QQE in October 2014.

The USD rose sharply from mid-2014 to mid-2015 against other major currencies as the market built in an approaching Fed rate hikes and QE/NIRP implemented by the ECB. The USD rose further against commodity and EM currencies up to January this year reaching its peak in broad terms, and a high in over 10 years in real effective terms, in the build up to the Fed rate hike in December and weakening emerging market economies, led by China and the fallout from weak oil prices.

The conditions that drove the rise in the USD up to January this year and fall in JPY up to mid-2015 have not changed appreciably. In fact the BoJ has now introduced NIRP since 29-Jan, adding to a case to sell JPY. The Fed may have downgraded its rate hike forecasts since December last year, but it is still seen in a policy hiking cycle. As such, we might not expect to see a full reversal of the trends that preceded the recent fall in USD and rise in JPY.

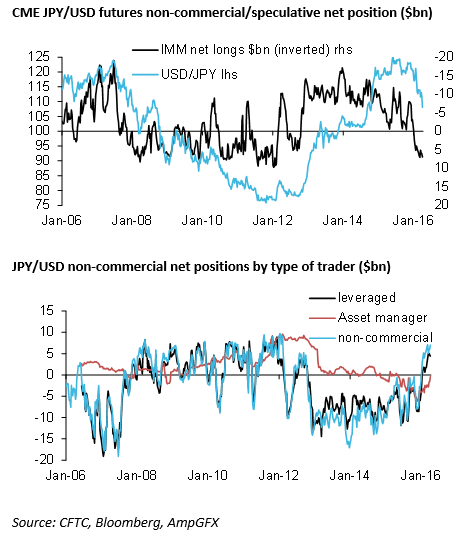

Excessive positions in JPY and USD cleansed

It is possible that the corrections in these currencies have cleansed a good deal of the excess positioning that was in place early this year, and they may now start to stabilize. As such, The USD’s and JPY’s influence on other markets and global investor appetite may also diminish.

The chart below shows that CME futures traders net positions are long JPY since January, rising in recent months to a high net long of $7bn, around the previous peaks seen during periods of sustained global risk aversion; including the global financial crisis in 2008 and the Eurozone crises periods in 2011/2011 and 2012. Breaking down these positions between those that denote themselves as asset managers and leveraged investors, shows asset managers (at least those trading on the CME) are square JPY.

Furthermore, there is a high risk that the BoJ further eases policy as soon as 28 April, in part in response to the deflationary impact of the recent rise in the JPY. This may help prevent further strength in JPY, or even reverses some of its recent strength.

Improved outlook for emerging market assets

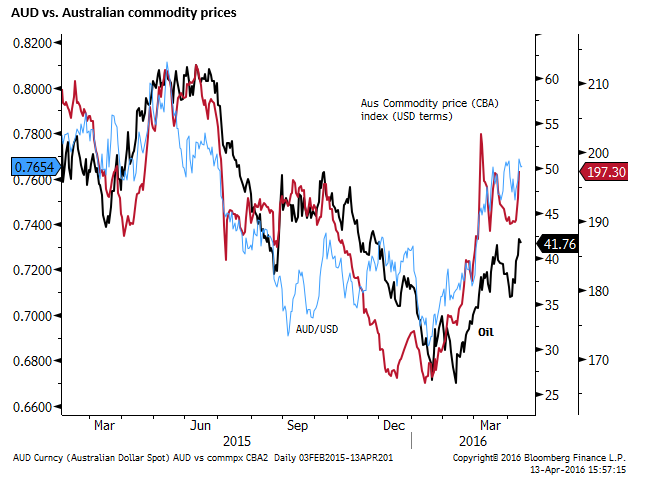

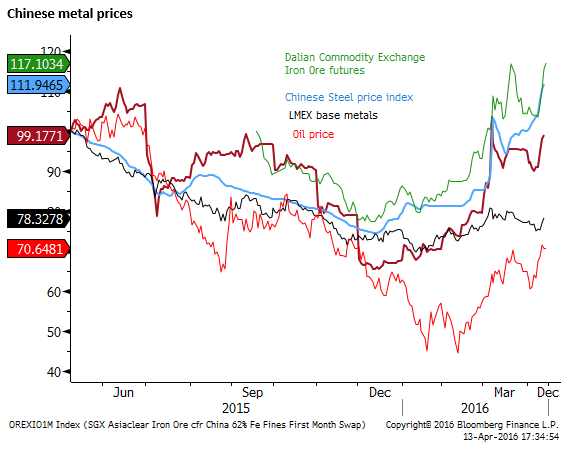

Looking then at the other factors that have been influencing markets, oil prices, Chinese and EM growth and Brexit, at least two of these (commodity prices and emerging market growth outlook) have become less negative. Brexit fear, on the other hand, remains heightened, and may intensify as we approach the 23 June referendum.

The Chinese economic data and commodity prices related to Chinese demand have picked up in recent months. China has taken its foot of the pedal in the arena of dealing with structural problems and debt excesses, and appears to be supporting growth more broadly. While fears related Chinese structural problems are likely to bubble for the foreseeable future, they may have been pushed below the surface for the time being.

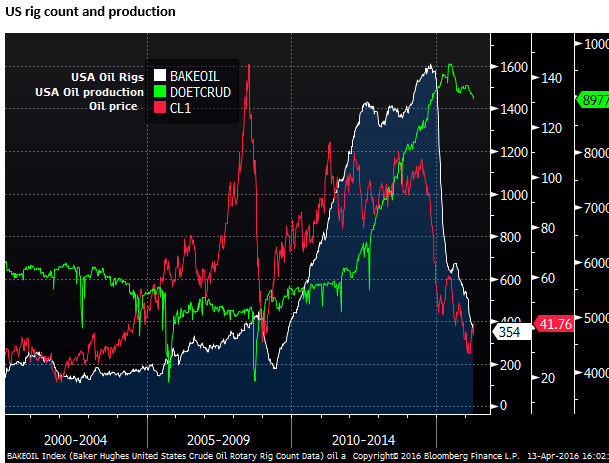

Oil prices have retained their uptrend over several months. Key developments appear to be less production in the US and signs of cooperation among other big producers. Demand may also appear to be better placed to recover with some improvement in the global growth outlook. The market awaits the 17 April Doha meeting of oil producers to agree on capping production. Expectations for this meeting appear to have been downgraded significantly, but at least some agreement may be needed to ensure the gains in oil do not reverse.

Easy monetary policy in the major economies and record low bond yields is also forcing capital to take more risk, as such the recovery in Emerging market assets and higher yielding currencies may continue.

If JPY is now more stable, it may allow the recovery in emerging market assets to continue. It may even become reinforcing if stronger EM assets in turn renew interest from Japanese investors and other speculators to again consider selling JPY to take advantage of its negative yields.

It may be too early to presume sentiment for JPY will quickly turn back to a more bearish outlook for the JPY after its recent strong rally. The 110 level is likely to attract sellers initially. The Brexit concerns may continue to keep a lid on USD/JPY.

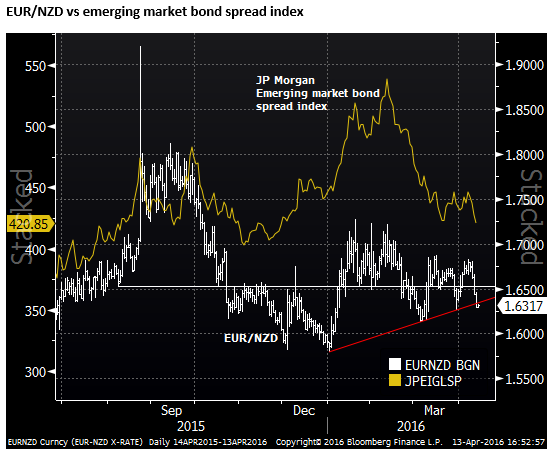

On the other hand, EUR appears to have been held back by the weaker GBP and Brexit fears. If investors remain more upbeat on emerging market assets and continue to seek higher yields and avoid negative yields in a more constructive frame of mind, it may be worth considering buying EM/commodity currency trades funded out of EUR.