China is likely to focus on restoring calm near-term

Chinese capital and currency market upheaval last week was severe, and we presume that its authorities will turn their attention this week to further calming nerves. This may allow for a period of improvement in global risk appetite this week. The US labor market report was strong, but without stoking wage growth concerns. This might also help support the US equity market somewhat. However, investors will remain lukewarm at best with a watchful eye of Q4 earnings season over the next few weeks. We see scope for some improved risk appetite to spread to currency markets this week, helping lift USD/JPY and cap EUR. AUD may also improve modestly, but commodity currencies are likely to remain out of favour. After recent strong labour market data in Australia, held up by the RBA as a sign of economic recovery, we see some downside risk if the volatile data does not live up to expectations.

China is likely to focus on restoring calm

The first week has certainly set a bearish tone for global markets. Chinese leaders warned that they were not planning significant stimulus measures to speed up growth in China, but would continue to focus on reforms to deal with over-capacity, excess debt and restructuring the economy.

The Chinese stock market and currency were very unsettled and news reports suggest that much of this was driven by panicked capital outflow from Chinese residents. The Chinese government at end-week tightened up avenues for capital outflow and appear to have helped support the stock market.

Clearly it will not help its cause to have excessively volatile capital markets or currency, so we might expect ongoing efforts to help bolster confidence in stability this week.

Interestingly, the offshore market took little comfort from efforts in China to stabilize its markets. Perhaps it was too soon and nerves still too raw to trust Chinese regulatory efforts to stabilize its markets.

Over the weekend, China’s currency regulator, SAFE, released a statement further aimed at stabilizing confidence in the CNY. It said, “China’s economic fundamentals are strong,”…. “Foreign exchange reserves are relatively abundant and the financial system is largely stable and healthy.” (source: FT article)

We might expect a bit more confidence to ensue for a while, as China continues to calm nerves. However, the broader outlook for China’s economic growth and markets are likely to remain constrained.

Strong US payrolls fail to support US equites

The US equity market closed down sharply on Friday, despite a moderate gain in the Chinese stock market and a much stronger US payrolls report.

In past times, a strong payrolls report might have given more support to US equites, especially since it was accompanied by a lower than expected wage outcome and no change in the unemployment rate that might indicate capacity for jobs to grow for a while yet without triggering a rate hike to cool inflation pressure.

Long term investors playing it cautiously

After a rapid fall in the last week, it would not surprise to see US equities make a partial recovery this week. The WSJ reports on data suggesting that mutual funds and pension funds have a lot of cash on the side-lines. While these longer term players may well act cautiously for some time, a significant degree of bearishness may be factored into the market. If nerves over China cool somewhat this may also improve confidence in US equites for a time.

Earnings season warning

A caveat is that we are now heading into the USA earnings reporting season over the next few weeks, and the tone of the market will depend on these results. An FT article warns to expect weak US investment bank results from the last quarter last year.

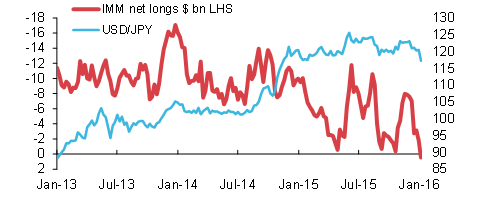

JPY positons long for the first time in QE-era

A number of currency moves over the last week may also be due some consolidation if nerves related to China calm.

Market positioning data from the IMM shows that traders may have got themselves into a net long JPY positon for the first time in the post BoJ QE era. This suggests that risk aversion is a key driving element.

Some EM and commodity currencies could also firm, such as the AUD after reaching lows set in September last year.

However, we would be looking for a relatively short term reprieve for the AUD given the weak state of its key commodity markets that relate still mostly to over-supply issues rather than global market volatility.

AUD faces a labour data test

Key for the AUD this week may be the employment report on Thursday. Recent Australian economic data have lost momentum; including the PMI data for all three components (manufacturing, services and construction), building approvals were also weak in Nov.

The RBA has expressed some confidence in the state of the economy over recent months, noting solid business confidence, strong labour market indicators, and seeing reasons to anticipate firmer investment activity outside of the mining sector. The labour data have been a key plank in this positive spin, and thus the data this week will be important for sentiment.

In the News

Cameron aims to offer Britons in-out vote on EU this summer – FT.com

From the FT article:

David Cameron is confident he can reach a deal on the UK’s terms of membership in the EU next month, paving the way for a vote this summer on whether Britain will sever its four-decade relationship with the bloc.

On Sunday, the prime minister said that the government was “not going to be neutral” on whether the UK should stay in or leave the EU. After the renegotiation concluded, the cabinet would decide upon a formal position and reach a “clear recommendation”, Mr Cameron said. However, Eurosceptics would be able to campaign against that position.

While most of the British business leaders interviewed in annual research by Ipsos Mori in conjunction with the FT said that walking away from the bloc would be negative for the UK economy as a whole, 61 per cent were confident that their individual operations would not suffer.

Public opinion polls still suggest that British voters will opt to remain in the EU, with the average of the six latest polls revealing that 55 per cent would vote to stay in the bloc, according to the poll of polls on the What UK Thinks website.

In his letter last year to Donald Tusk, president of the European Council, Mr Cameron said that he wanted EU migrants to become eligible for certain in-work benefits only after they had worked in the UK for four years. Some member states have suggested that this would be illegal and discriminatory.

Cheniere Energy’s shipment turns US into gas exporter – FT.com

From the FT article: Combined with the new supplies from Chevron’s huge Gorgon and Wheatstone projects in Australia, which are scheduled to come on stream this year, exports from the US are making it a buyers’ market for LNG.

Big five US investment banks hurt by China and oil – FT.com

Results to be presented over the next week and a half are expected to show the big five US investment banks generated even less revenue from trading in the last three months of the year than in the troublesome third quarter.

China steps up capital controls to stem outflows FT.com

From the FT article: The foreign exchange regulator has provided verbal guidance to banks in Shenzhen instructing them to limit dollar buying by individual and corporate clients, according to a person with knowledge of the situation.

The latest tightening comes after the central bank temporarily suspended some foreign banks in China, including Standard Chartered, Deutsche Bank and Singapore’s DBS, from conducting certain foreign exchange transactions designed to arbitrage the gap between the onshore and offshore renminbi exchange rates. All three banks declined to comment.

Intervention by Beijing Is Worsening China’s Market Woes – WSJ.com

WSJ Opinion: China is trying to shift economic growth to a slower, safer path, one less dependent on capital spending and debt. Chinese technocrats know that means opening to ever more market forces, but its ruling elite is still not willing to accept that loss of control.

Pensions, Mutual Funds Turn Back to Cash – WSJ.com

Using data from Wilshire Trust Universe Comparison Service, Morningstar Inc. and the federal government through to Sep-2015, The WSJ calculates that: pension funds had the highest cash levels as a percentage of assets since 2004, and mutual funds the percentage highest since at least 2007. Q3 last year was a period of significant market upheaval, but the market will be feeling in a similar mood to start this year

Catalonia elects Puigdemont as leader amid wider Madrid divisions – FT.com

Political uncertainty in Spain increases:

From the FT Article: Carles Puigdemont will have an explicit mandate to lead Catalonia towards secession from Spain over the next 18 months. His government is tasked with effectively setting up a state within the state, by creating a separate Catalan central bank, tax authority, social security system and possibly even the nucleus of an independent military.

Analysts said the formation of a pro-independence government in Catalonia was likely to raise the pressure on mainstream parties in Madrid to set aside their own differences and establish a unionist common front against Barcelona

Economic News

USA

Non-farm payrolls rose 292K in Dec, much more than 200K expected, and net revisions to the two previous months were +50K. Three month average job gain was 284K, a high since Jan-2015. The average month job gain for 2015 was 221K, continuing a trend of 200K or above for the last few years.

Unemployment rate was steady at 5.0% in Dec as expected. Now consistent with around full employment. Although the Fed still sees some slack in other indicators.

Average hourly earnings were flat in Dec, weaker than +0.2%m/m expected and +0.2%m/m in Nov. The annual rate rose from 2.3%y/y to 2.5%y/y. While below expected this is a new high in data available back to 2010.

Labor Force participation firmed to 62.6% from 62.5, slightly above expected

Canada

Job growth 22.8K in Dec, stronger than 10.0K expected, up from -35.7K in Nov. Three month average 10.5K, six month average 10.4K, 12month average 13.2K. Modest to moderate trend, somewhat slower in the second half of the year.

Unemployment rate unchanged at 7.1% as expected, up from 6.7% a year ago.

Building permits fell 19.6%m/m in Nov, below -2.9% expected, after rising 9.9%m/m in Oct. residential single home approvals fell 0.6%m/m, down 1.0%y/y, apartment approvals fell 33.7%m/m, down 16.0%y/y. Nonresidential approvals fell 22.7%m/m, down 2.3%y/y. Recent volatility increased by a rule change in Alberta, but the data may signal a weaker trend.

Australia:

Retail Sales rose 0.4%m/m in Nov, as expected. They were revised up a touch from 0.5 to 0.6%m/m in Oct. Sales rose 4.3%y/y in Nov, trending around this rate over the last year.

PMI Construction fell from 50.7 to 46.8 in Dec. Three month average of 49.9.

Japan

Labour Cash earnings were flat in Nov, weaker than +0.7%y/y expected. However, regular contracted earnings rose 0.5%y/y in Nov, up from 0.3%y/y in Oct, the fastest rate since 2008.

UK

Trade balance GBP-3.17bn in Nov, a wider deficit that -2.70bn expected, narrower than -3.51 bn in Oct, revised narrower from -4.14bn. Around the annual average.

China

CPI rose 1.6%y/y in Dec, as expected, up from 1.5%y/y in Nov. Stable trend in 2015

On the Radar

USA

- 11 Jan – Labor Market Conditions index

- 12 Jan – JOLTS Job openings

- 13 Jan – Beige Book

- 15 Jan – Retail sales, PPI, IP/CU, UoM consumer sentiment

Australia

- 11 Jan – Job Ads

- 13 Jan – Job Vacancies

- 14 Jan – Employment/ unemployment

- 15 Jan – Housing finance

New Zealand

- 11 Jan – Building permits

- 11 Jan – REINZ house sales

- 14 Jan – Retail sales card spending

- 20 Jan – CPI

Eurozone

- 12 Jan – IP

- 14 Jan – ECB account of the monetary policy meeting

- 15 Jan – new car regos, Trade balance

UK

- 11 Jan – BRC retail sales monitor

- 12 Jan – IP, NIESR GDP estimate

- 14 Jan – BoE meeting

- 15 Jan – construction output

Canada

- 11 Jan – Housing starts, BOC business and bank survey

- 12 Jan – Finance Minister Morneau speech, “Growing our Economy to Strengthen the Middle Class

- 13 Jan – House prices

- 14 Jan – New Home sales

- 15 Jan – Existing Home sales

- 20 Jan – BoC rate decision

- 22 Jan – CPI

Japan

- 12 Jan – Current account, bank lending, Ecowatchers survey

- 14 Jan – Machine orders

China

- 10-15 Jan – Aggregate social financing

- 13 Jan – Trade balance

- 18 Jan – Property prices

- 19 Jan – IP, Retail sales, Fixed asset inv., GDP Q4