China rotation and stabilization

The Chinese data supported some rotation out of commodity assets towards consumer and service sector assets, but overall risk appetite remained stable as growth momentum in China appeared to stabilise and global interest rate trends are lower over the last month. A very strong USA housing market index and Fed speakers sticking to the party line of a first hike likely later this year suggests EUR may continue its softer tone. UK BoE speakers may see enough reason to keep rate hike expectations alive in the UK, generating some further downside for EUR/GBP.

Commodity related assets weaker, consumer, services and US housing firmer

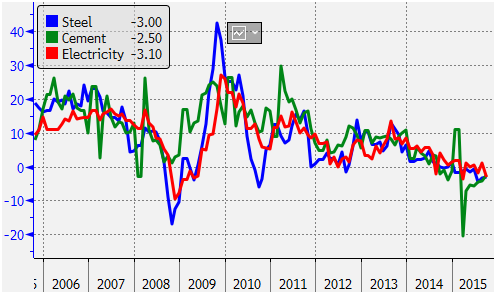

During European and American trading, commodity related assets were broadly weaker probably in response to Chinese economic data that were significantly weaker than expected for industrial production and fixed asset investment. This contributed to falls in AUD, CAD and ZAR trading around the low end of their ranges in around a week.

The Chinese currency fell in the offshore session, as the data suggests that the Chinese authorities will need to continue providing stimulus to ensure the service sector is strong enough to offset weaker manufacturing and heavy industries.

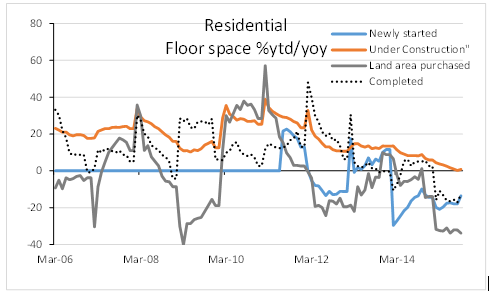

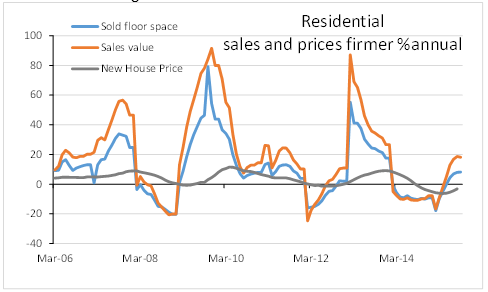

The Chinese property sector data continued to show improvement in sales from a year earlier, but this improvement is modest and may even be levelling off, and the construction side remains overall in decline to cope with excess inventory. As such, it appears that the government will need to continue to rely heavily on fiscal expansion to contain the slow-down in fixed asset investment. Property price data is due on Friday.

Chinese property market activity trend still weak

Source: Bloomberg

Sales and prices firming

Source: Bloomberg

Falling trends in key industrial activity

Source: Bloomberg

The mix in the Chinese data appeared to drive some rotation in the performance of assets from commodity sectors to consumer and service sectors, including the performance of the US equity market. Overall US stocks were flat on Monday, albeit at their high since 21-August set on Friday . In currency markets, those that may benefit from consumer demand from China fared better (AUD weaker, KRW firmer, although overall Asian currencies softened to the weaker end of their ranges over the last week).

Overall risk appetite remains stable in the wake of the Chinese data. Moderation in its overall growth combined with lower global interest rates in the last month on expectations for delayed hikes in the US and further policy easing possible in China supports risk appetite.

Strong USA housing data

The US NAHB housing market index rose to a high since the last housing market boom in 2005, suggesting substantial momentum in this sector of the economy. It should tend to stabilise overall economic confidence and support the USD. However, US rates were down modestly on the day. Housing permits and starts are due tonight.

The Fed President of San Francisco also set an optimistic tone, continuing to predict rate rises starting this year, sticking with the Fed leadership party line.

We continue to see stable to improving global asset markets. Given the US data is showing mixed results, with housing now taking centre stage and Fed leadership sticking to a view that rate hikes are likely this year, we prefer to fund currency bets with sales of EUR. This includes a modestly weaker outlook for EUR/GBP that has moved to its lows in over a week. Several speakers from the BoE may set the tone in coming days.

Canada election

The results for the Canadian election are coming in. Early results have gone to the late-favourite Liberal Party. A strong showing may help support the CAD with a minority government widely expected in the three-way race.

What they said

- US Fed President Williams: “my own view is that the economy is still on a good trajectory.” He continued to say he sees a “gradually rising interest rates, most likely starting sometime this year.”

- ECB’s Noyer: the ECBs’ QE program is about the right stimulus

In the news

- A RBNZ Research discussion paper released on Tuesday argues that, “incoming changes to the LVR restrictions could have a significant dampening effect on Auckland housing market activity and house price inflation.” This suggests that the RBNZ thinks the recent surge in activity in Auckland and surrounding areas may retreat quickly in coming months, opening the door for a further rate cut if needed.

- UK BoE Governor Carney is expected to weigh into the UK Brexit debate in his speech of Wednesday setting the BoE views on leaving the EU.

- China agrees to take a one-third stake to build nuclear power plants in the UK. The announcement is expected during the Chinese President Xi visit this week to the UK. (FT article).

- Japan Post IPO for its insurance and banking units were priced at the top of the marketed ranges, suggesting strong demand for the privatization. The government is expected to raise JPY743bn ($6.2bn) from the sale. About 11% of the company will be solid in this first IPO, set to be the biggest since 1987. Foreign investors have been allocated 20%.

Economic news

- RBA Policy minutes maintain neutral tone. “Signs that the response of the banks to supervisory measures implemented by APRA were helping to manage risks in the housing market. Credit growth overall had been moderate.”

- Australian weekly consumer confidence eased last week from 115.6 to 113.3, around average for the year.

- USA NAHB Housing market index rose from 61 to 64 in October, above 62 expected, a high since 2005, well above the neutral 50 line, suggesting the housing market is strong. The data may well be reflected in the array of other housing data due this week, including starts and permits tonight.

- Eurozone construction output fell 6.0%y/y in August, led by a 9.2% fall in France. Down from -0.3%y/y in July to the weakest growth since March-2013.

- China Retail sale rose 10.9%y/y in Sep, up a bit from 10.8%y/y in August, slightly above 10.8% expected. Sales have firmed steadily over recent months from a low year-on-year growth rate of 10.0% in April.

- China Industrial production slowed to 5.7%y/y in Sep, down significantly from 6.1% in Aug, and below 6.0%y/y expected, approaching the low year-on-year growth rate of 5.6% reported in March, continuing a slowing trend over the last 21 months, around the lows since 2008, and prior to that 1990.

- China Fixed asset Investment slowed to 10.3%year-to-date/year-on-year in Sep, down significantly from 10.9%ytd-yoy in Aug, below 10.8% expected, a low growth rate since 2000, continuing a more rapid slowing trend over the last 21 months.

- China GDP rose 6.9%y/y in Q3, down a bit from +7.0%y/y in Q2, but slightly above +6.8% expected. From the previous quarter, GDP was up 1.8%q/q, as expected, and it was revised up from 1.7% to 1.8%q/q in Q2; annualising at 7.4% in the last two quarters. With weakness in industrial production and fixed asset investment, the services sector appears to be contributing more to growth. Some reports expressed surprise in the strength of the service sector given the sharp further correction in the Chinese mainland equity market in Q3.

- UK Rightmove house price growth slowed from +6.4%y/y in Sep to +5.6%y/y in October

- New Zealand PSI rose from 58.5 to 59.3 in Sep, a high for the service sector indicator since Nov 2007.

On the Radar

- Japan 20 Oct – Department and convenience store sales

- UK BoE Macafferty: Speech at Bloomberg, London morning

- UK 20 Oct – BoE Governor Carney and Deputy Bailey testify to Treasury select committee.

- USA 20 Oct – Housing Starts & Building Permits

- USA 20 Oct – Fed’s Dudley and Powell speak at a market conference in NY

- Eurozone 20 Oct – Current Account balance

- Taiwan 20 Oct – Export Orders

Later this week

- Australia 22 Oct – RBA Assistant Governor Edey speech

- China 20/23 Oct – President Xi State visit to the UK

- China 23 Oct – Property Prices

- Japan 21 Oct – Trade balance

- Japan 23 Oct – PMI flash

- New Zealand 21 Oct – Net migration

- New Zealand 22 Oct – Job ads

- USA 22 Oct – Chicago Fed National Activity Index, Existing Home Sales, Leading index, Kansas City Fed Mfg Index, Markit PMI flash

- Canada 21 Oct – BoC Rate Decision and quarterly Monetary Policy Report

- Canada 22 Oct – Retail sales

- Canada 23 Oct – CPI

- Eurozone 22 Oct – ECB

- Eurozone 22 Oct – Consumer confidence

- Eurozone 23 Oct – PMI flash for mfg and services

- UK 21 Oct – BoE Governor Carney speaks

- UK 22 Oct – BoE Jon Cunliffe speech to BBA, international banking conference

- Taiwan 23 Oct – Commercial Sales & Industrial Production

- Malaysia 22 Oct – Foreign Reserves

- Malaysia 23 Oct – CPI

- South Korea 23 Oct – GDP Q3

- Singapore 23 Oct – CPI

- India 23/30 Oct – Eight infrastructure industries production

Further out

- Australia 28 Oct – CPI

- Australia 3 Nov – RBA rates policy

- Australia 5 Nov – RBA Governor Stevens speaks

- Australia 6 Nov – RBA Statement on Monetary Policy

- Japan 29 Oct – IP

- Japan 30 Oct – Employment, Household spending, CPI, BoJ policy and semiannual outlook report.

- Japan 4 Nov – Japan Post IPO

- China 27 Oct – Industrial profits

- China 28/31 Oct – Leading Index

- China 1 Nov – Manufacturing and Non-Manufacturing PMI

- China 2 Nov – Caixin Mfg PMI

- China 4 Nov – Caixin Services PMI

- USA 26 Oct – New Home Sales

- USA 27 Oct – Durable goods orders

- USA 28 Oct – FOMC

- USA 29 Oct – GDP Q3

- USA 3/19 Nov – Congressional Debt ceiling approach. . (WSJ article)

- USA 5 Nov – Fed Vice Chair Fischer speaks at the National Economists Club

- USA 6 Nov – Payrolls

- New Zealand 27 Oct – Trade balance

- New Zealand 29 Oct – RBNZ Official Cash rate (OCR) review

- New Zealand 30 Oct – Building Permits, ANZ business survey, Credit growth

- New Zealand 2 Nov – Treasury monthly economic indicators report

- New Zealand 4 Nov – Labour report Q3

- Eurozone 30 Oct – Unemployment and CPI first estimate

Markets on the Move

- AUD, after initially rallying on the Chinese data, reaching a high in early European trading above .7300, it fell back through the offshore session to be modestly lower on Monday, now around .7250, at the low end of its range for the last week or so. AUD/NZD traded similarly, back to recent lows.

- CAD weakened steadily from early Europe, through to afternoon American trading, back above 1.30, reversing gains in made late last week. Oil prices weaker, election result awaits.

- ZAR weaker in European trading. BRL firmer, recovering by 1%, about a third of its losses on Friday.

- EUR modestly weaker for a third day since its high on Thursday. EUR/CHF around lows since 4-Sep.

- GBP firmed in European trading, easing in American afternoon, somewhat firmer on the day. In the middle of a recent range, holding gains made last Wednesday. EUR/GBP fell below its recent range to a low since 24-Sep.

- CNH weakened in the overnight session, falling more rapidly in afternoon US trading to a low since 28-Sep.

- KRW rose strongly in Asian trading in response to the Chinese data to make a new high since July, retraced all these gains in the rest of the day and overnight, trading firmer again this morning.

- MYR fell throughout the Asian and overnight session, the weakest currency in Asia; USD/MYR rose above its recent range to a high since 7-October.

- Oil prices fell in the European/American sessions by around $1.5, reversing modest gains in the previous two trading days, in a stable range for the last week, down from its rally earlier in October, still a little above its stable average in September.

- Base metals weaker by about 1.3%, in a range since August.

- Iron ore and coking coal stable, thermal coal drifting to new low long-term lows.

- US 2yr swap rates fell 2bp in the afternoon session, reversing the rise on Friday . Eurozone 2yr swap rate dipped a little further to a new record low of 0.026%.

- Canadian 2yr swap rates 2bp lower in sympathy with the US. UK 2y swap rates 1.5bp higher, although trading had finished before the fall in US rates.

- New Zealand 2yr swap rates remain in a stable range. Australian rates stable after fall last week, near lows for the year.

- US stocks firmer in the afternoon session to be little changed from their highest close on Friday since 21 August.

- However, metals and mining sector stocks in the US fell 2.9%; down for a second day to a low since 5-October. Similarly steel sector stocks were down 3.4% to a low since 6-October. Energy sector stocks were down 1.9%, reversion gains in the previous two days. Consumer, service sector and housing sector stocks firmed.