Climbing a wall of worry – USD downtrend and rising EM assets

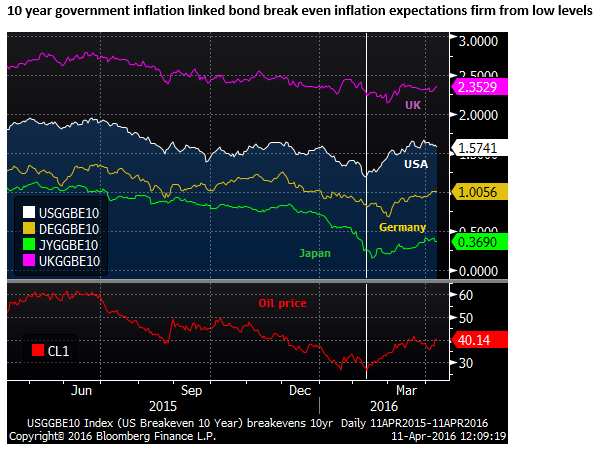

Risk aversion remains elevated. Brexit fears may continue to paralyze the GBP and hold back European assets. However, record low aggregate bond yield indices, held down by QE and negative rates, and the prospect of more in Japan, is forcing investors to move out the risk curve in many asset classes. Emerging markets appear relatively cheap and some emerging economies are recovering or showing more stability, closing the performance gap with developed economies, especially the USA, supporting renewed flows to emerging markets. The oil price recovery has persisted for several months and Chinese growth and financial markets appear more stable. Global inflation expectations have risen somewhat in recent months, helping reduce real yields and improve the global growth outlook. The USD downtrend has developed a life of its own and is helping reinforce the recovery in global risk appetite. Even though the US economy may now be regaining some lost momentum and wage and inflation pressure are building, the Fed may be willing to keep rates down until global growth momentum recovers and key risk factors (such as Brexit and US politics) play out. The near term trends towards stronger emerging market assets and a weaker USD may have further to run as investors climb a wall of worry.

Heightened risk aversion, but record low yields helping boost asset prices

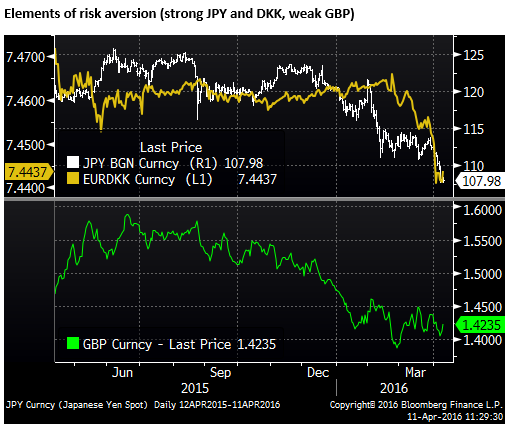

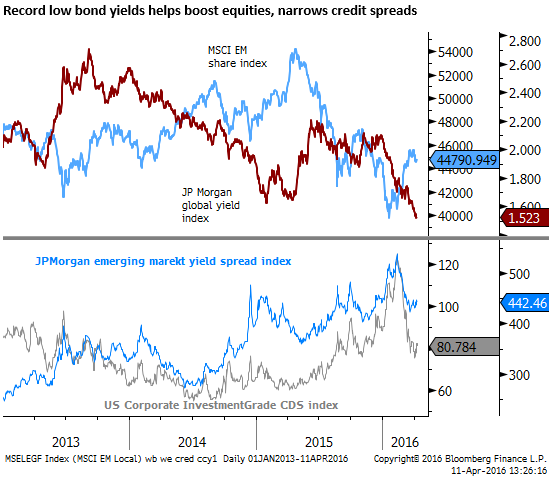

There remains a high degree of uncertainty in global markets undermining investor confidence. The risk aversion is lifting some currencies with negative yields and current account surpluses. The JPY, and Danish Krona are relatively strong. On the other hand, aggregate global bond yields have dropped to record lows, and the extreme lows are helping underpin global asset prices and encourage investors to take more risk to essentially avoid losses on safe assets.

Emerging markets closing gap with developed markets

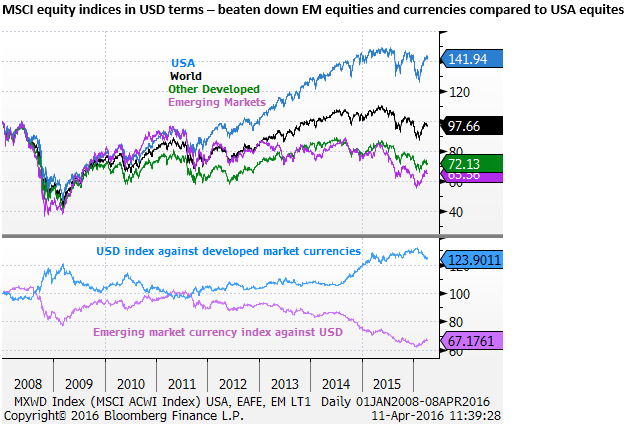

Emerging market assets have been recovering from beaten down levels and are attracting capital inflow as yields are reasonable and valuations appear relatively cheap.

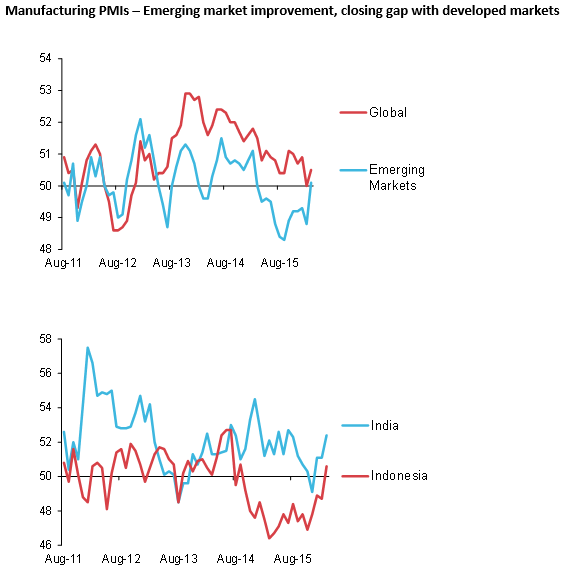

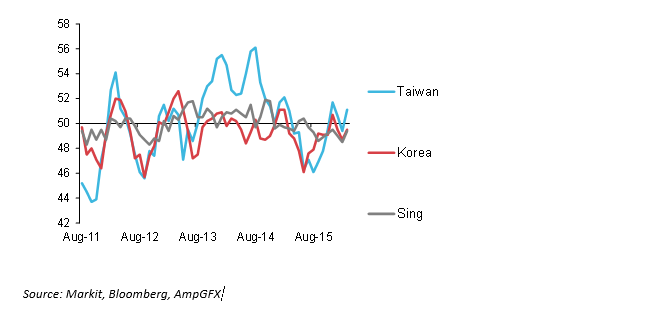

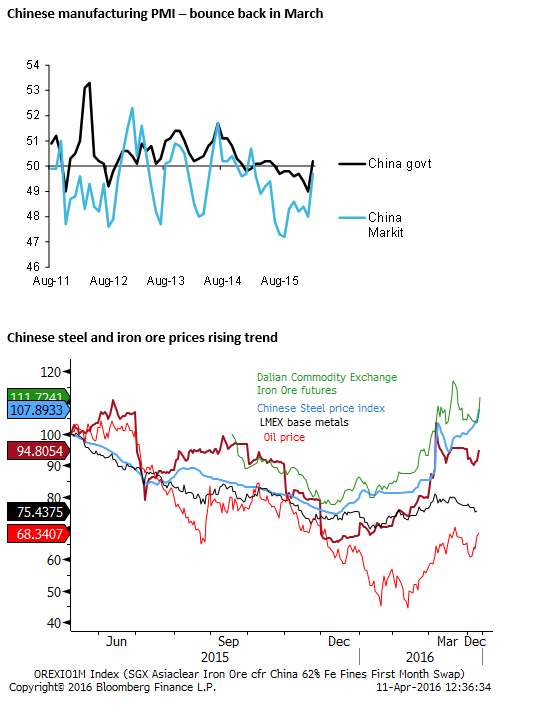

Furthermore, there are some emerging markets that are starting to show better growth momentum, closing the gap with developing economies that have stagnated or are growing more slowly in the last year. PMI data show recoveries developing in India and Indonesia. China’s manufacturing PMI rose solidly in March and moderate improvement was seen in most Asian countries PMIs in recent months.

The rebound in commodity prices has also taken the foot from the throat of a number of other emerging and developing economy commodity producers; including Russia, Brazil, Australia and Canada, whose currencies are relatively cheap after big falls over the last two years.

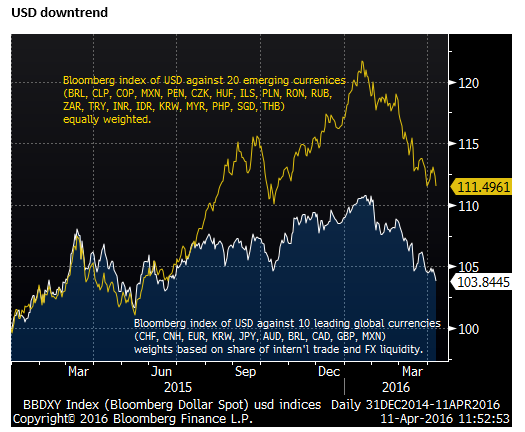

USD Downtrend reinforces global asset recovery

The USD has developed a downtrend that is somewhat puzzling but has become persistent and appears to have something of a life of its own. How long this continues is difficult to say, but it is also contributing to a flow of funds back to emerging and commodity markets, tending to reinforce a more positive outlook for investor confidence. It is helping rekindle some inflationary expectations in the US and a number of other countries via higher commodity prices.

Several countries are expected to keep rates low or further expand monetary policy to offset the appreciation of their exchange rates, helping keep rates and yields at record lows globally. The combination of low yields and somewhat improving inflation expectations is reducing real yields helping reinforce the effectiveness of monetary policy in boosting investment and spending. In other words a weak USD trend at this time is helping reinforce a recovery in global risk appetite.

The USD decline may relate to a pay-back to an overbought USD in recent years that reached its highest level in real effective terms in at over 10 years earlier this year.

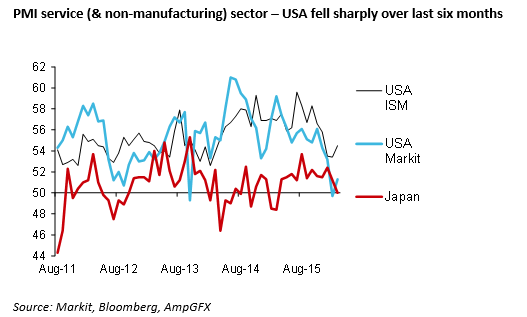

The USA economy slowed down significantly last year under the weight of a stronger USD and weaker energy sector, and rate hike expectations have been kept in check, helping account for some peaking in the USD.

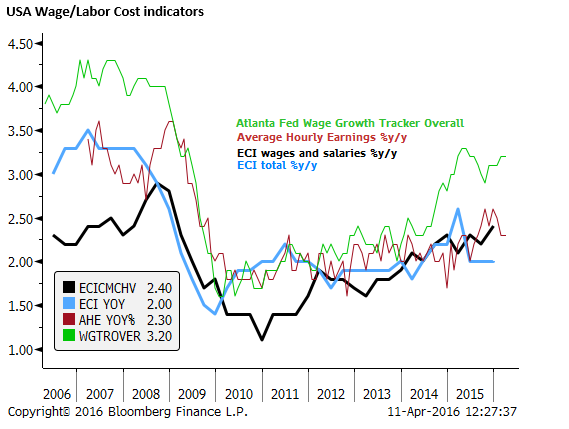

On the other hand the US labor market has continued to tighten. The most recent USA data may be stabilizing and improving. Underlying momentum may still be strong enough to keep the Fed on a tightening path for the foreseeable future. There is at least some upward momentum in wages and inflation has generally been rising faster than expected in the last six months. It is far from clear that the USD should continue to slide for long. If inflation were to continue to rise faster than expected then the dollar may stabilize and begin to take away the positive influence it has recently imparted on global asset prices.

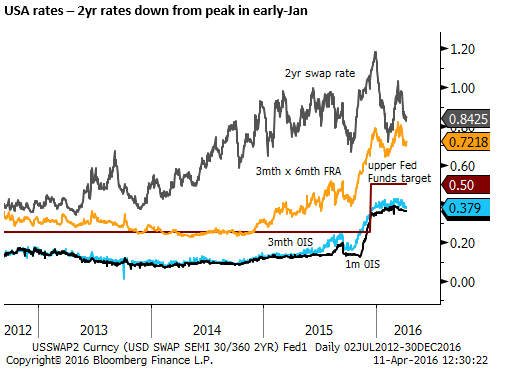

The Fed appears to be taking a less hawkish stance in recent months and the market thinks it may be prepared to look through near term signs of emerging inflation in order to more clearly reduce the risks of a relapse in the recovery. The greater uncertainty in the global economy has tended to make the Fed less reactive to evidence of domestic inflationary pressure.

Chinese economy and markets appear more stable

One of the key global uncertainties that appeared to be paralyzing investors early in the year, but appears less pressing at this time, is the stability of growth and financial markets in China. This remains perhaps the greatest risk, but recent growth indicators have improved, the government is working harder to stabilize its financial markets and perhaps delaying the clean-up in its debt pile and structural inefficiencies, putting it off to a time when it hopes the domestic and global conditions are more favorable.

The fall in oil prices was alarming early in the year, but they have recovered to levels that while still troubling for many oil producers are far less threatening. They have maintained a recovery trend now for several months.

Brexit fears likely to remain high through 23 June Referendum

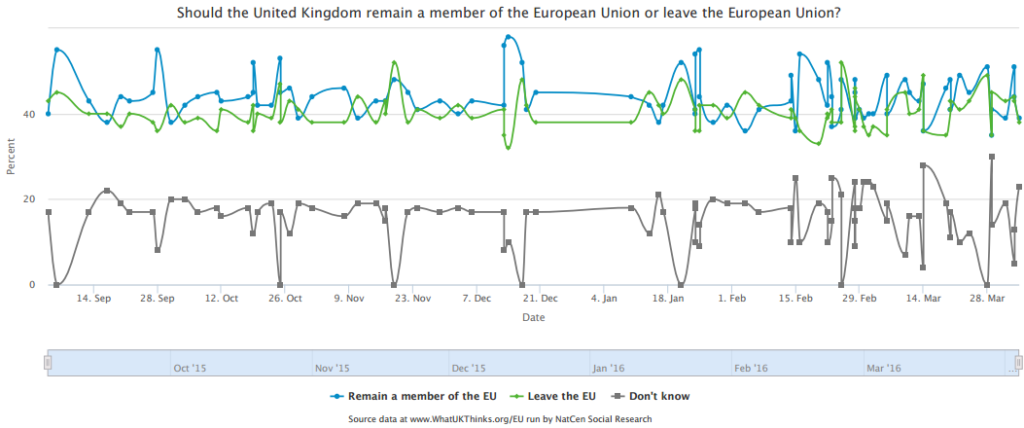

Brexit fears in the UK remain heightened and may intensify heading into the 23 June referendum. This does appear to have been a factor recently in risk averse investor behavior, dragging down the GBP, keeping a lid on the EUR and boosting the JPY.

The GBP has essentially remained steady against the weaker USD over the last several months, albeit quite volatile. The polling for Brexit has been stuck near 50/50% for months with neither side gaining clear momentum. However, betting markets are still favoring Britain remaining in the EU, with odds of just under 70%. Uncertainty is high, but it is more likely that by the second half of the year uncertainty on this front will recede, potentially providing another leg up for global risk appetite, especially for UK and European assets that have been held back lately.

Polling show persistent dead heat with 20% undecided

Climbing a wall of worry

It remains to be seen if the other key risk factors (China and commodity markets) will remain less worrisome, or whether other risk factors may build, including political uncertainty in the USA into the elections in November. Insufficient global growth momentum may also contribute to risk including rekindling debt fears in China, renewed falls in commodity prices in persistently over-supplied markets, protectionist policy trends in many countries, crimping global trade, investment and earnings. As discussed above the downtrend in the USD, supported by a more dovish stance by the Fed could reverse if inflation pressures build more quickly than expected in the USA.

However, it may be the case that the trend developing over recent months in favour of more buoyant global investor appetite, a weaker USD, firmer commodity markets, firmer emerging markets persists for several months as investors climb a wall of worry.