Clouds clear for CAD, but shroud EUR and AUD

CAD has shot up in recent sessions as the NAFTA cloud has been lifted. These may not be great levels to buy CAD, but it could continue to strengthen as inflation pressure builds and oil prices rise to new highs. EUR has dropped on Italian budget risks. Eurozone core inflation slipped in September and economic survey data remain subdued. Event risk is too high to want to buy EUR yet. USD/JPY may be up on higher US yields and some relief in EM markets. JPY may also be weaker in line with the CNY and higher oil prices. However, USD/JPY is approaching key resistance, the Nikkei is relatively strong, and Japanese inflation pressure may be higher than widely perceived. The fall in AUD despite high energy prices is helping support the Australian trade balance, government balance and overall economy. The Australian economy has out-performed official forecasts in the first half of the year and supports the case that the next move in rates will be higher. However, risks emanating from China, US trade policy, EM markets and Australia’s housing market continue to undermine confidence in the AUD.

Clouds clear for the CAD

I’ve had a week off to recharge, and try to get some perspective in the ongoing churn in the FX market. It continues to be a duck and weave market with significant swings inside slow moving or non-existent trends.

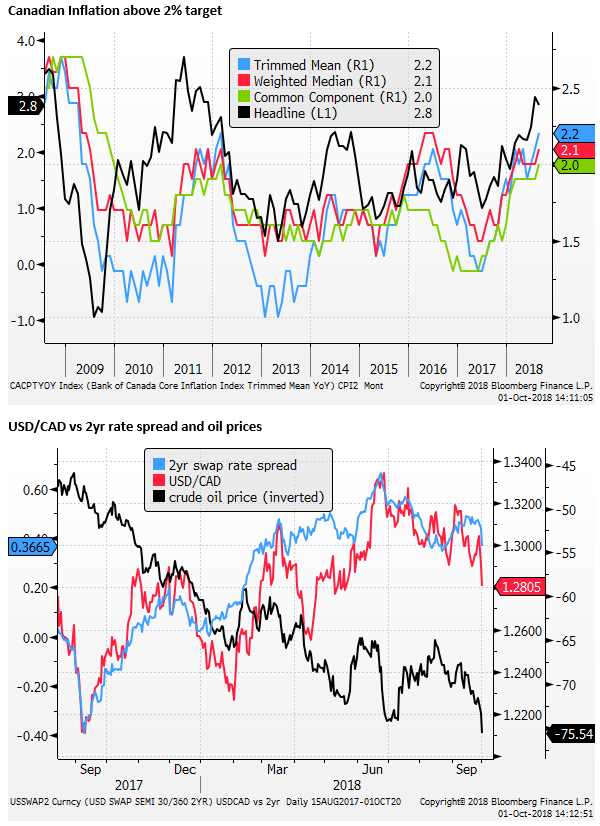

The CAD has shot up in the last two sessions with the cloud of NAFTA negotiations lifted over the currency. These are difficult levels to start buying the CAD, but it could build on its gains in recent days. The economy continues to show strength, the recent inflation data moved somewhat above the target on average for three underlying measures (trimmed mean: 2.2%, weighted median: 2.1%, common component: 2.0%), setting the stage for higher rates, and oil prices are at their highs since 2014.

EUR clouded

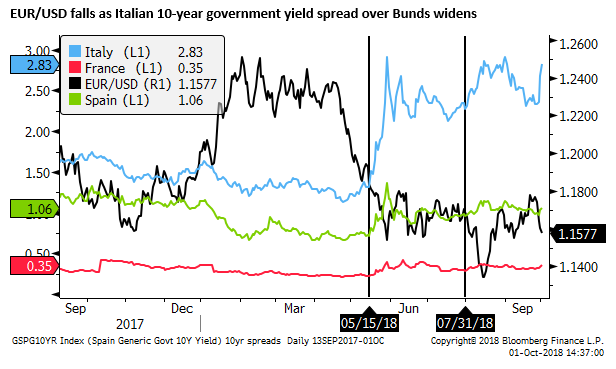

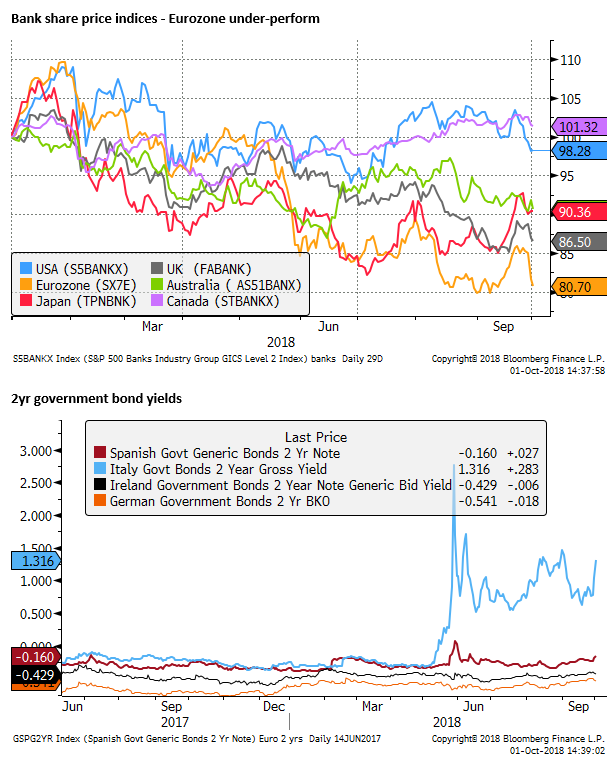

EUR has dropped sharply in recent sessions on renewed concerns over the Italian budget. Typical of the market this year, event risk is hanging over the EUR. The market is wondering if the EU will sanction Italy for breaching budget rules. This might involve the ECB refusing to buy Italian bonds as part of its asset purchase program. The uncertainty has generated another significant rise in Italian bond yields and fall in Italian bank equities. Such developments can lead to tighter financial conditions in Italy and damage its growth and generate a cycle of negative feedback, raising the possibility of an economic crisis.

It remains to be seen whether EU leaders will sanction Italy. The details of its budget are yet to be announced. The draft budget is reported to be a deficit of 2.4% of GDP over the next three years, above the target agreement with the EU of 0.8%, and above the previous estimate given by the Italian Finance Minister Tria of 1.6%. It is due to be submitted to the EC by mid-October.

After the pull-back in EUR, these seem like good levels to consider buying the currency. But the event risk may keep it volatile and difficult to trade in the near term.

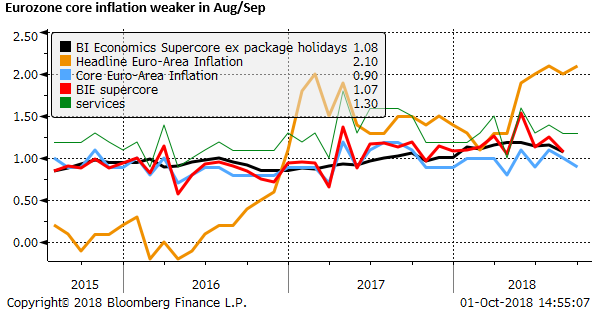

The recent Eurozone economic reports are also not compelling. Core inflation slipped back from 1.1% to 0.9%y/y in the preliminary September report (on Friday). The manufacturing PMI was 53.3 in September, a 2-year low.

The ECB has slowed its asset purchases from EUR30bn to 15bn per month starting this month. This itself points to increased risk for European assets, adding to pressure on Italian financial markets.

Inflation pressure in Japan

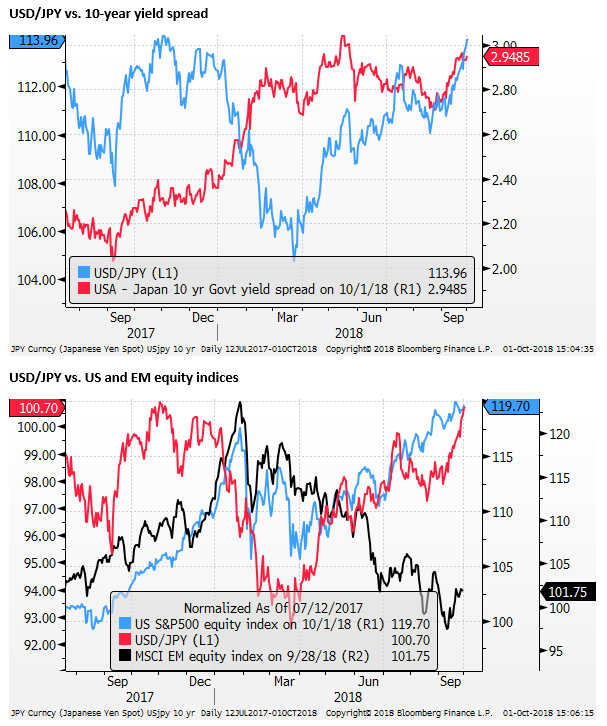

USD/JPY has moved up sharply in recent days, extending gains over the last month to be testing highs in around a year.

It appears to be driven mostly by a rise in US yields and ongoing expectations that there will be no significant change in BoJ monetary policy for some time. The gains may also reflect a modest recovery in emerging market assets and currencies in recent weeks.

Perhaps some of the weakness in JPY may reflect under-performance in Asian currencies, led by a weaker CNY related to tariff concerns.

Asian currencies, including the JPY, may be being held back by their relatively high dependence on energy imports and strong energy prices.

There may be a variety of motivations for a weaker JPY. But it is difficult to say there is a clear fundamental driver for a weaker JPY.

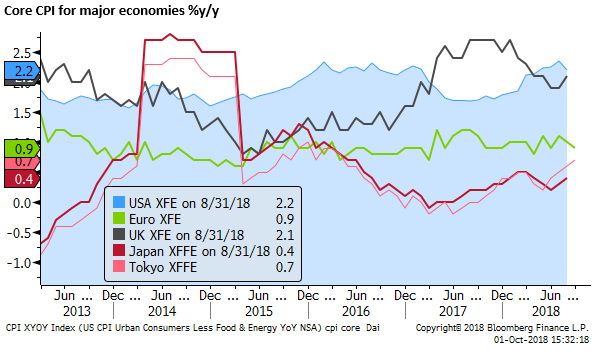

There are reasons to be cautious about selling JPY at these levels. Japan may be closer to achieving its inflation goals than generally perceived. The economy appears to be operating above its potential with no output gap, and inflation is trending higher.

The Tankan Survey on Monday shows ongoing tightening in the labour market and a high in capital expenditure expectations since 1990.

Core CPI (excluding fresh food and energy) in Tokyo rose to 0.7%y/y in September to a high since April 2016.

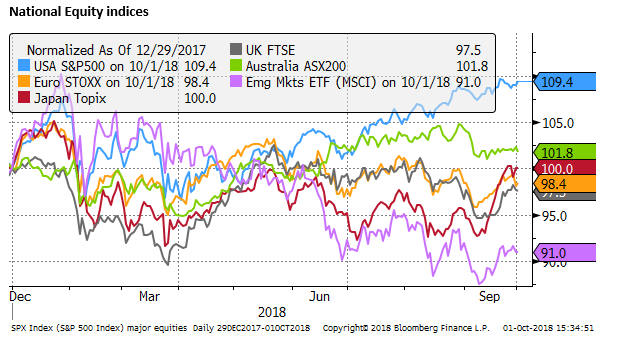

The Japanese equity market has significantly out-performed other national equity markets in the last month, supported in part by a weaker JPY. At some point global investors may see the risk-reward favours buying Japanese equities unhedged, generating support for JPY.

A weak AUD embodies global risks

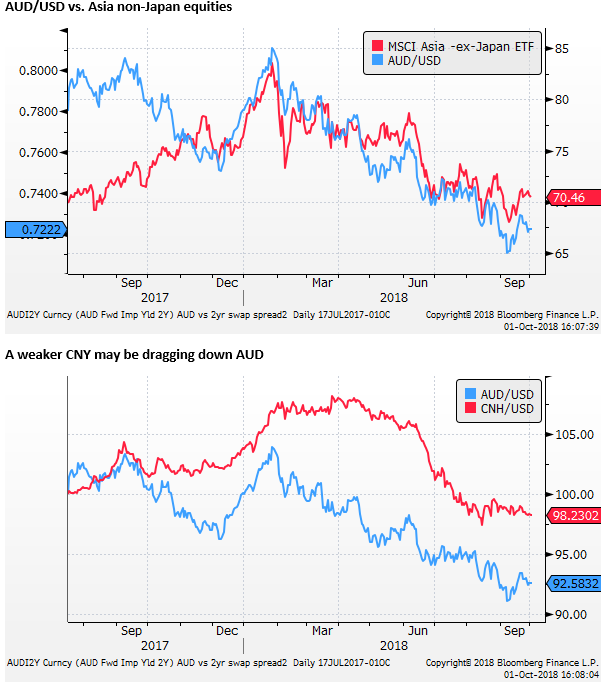

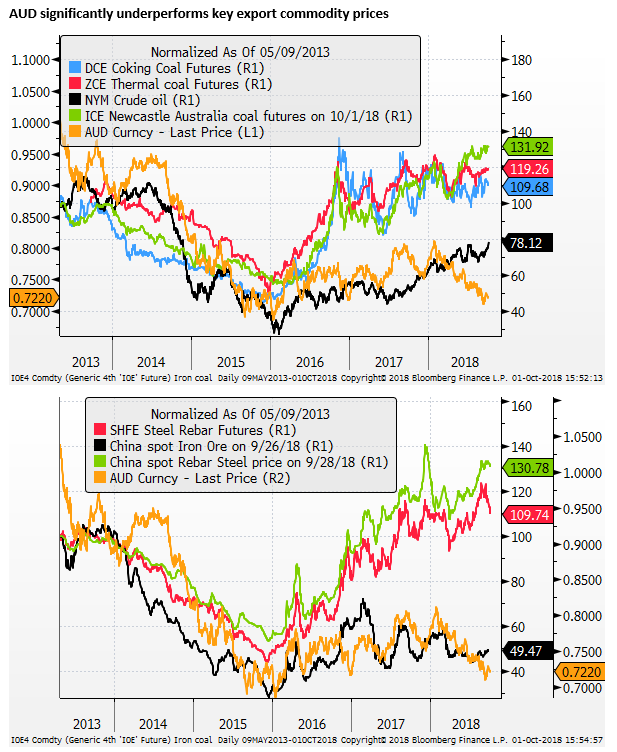

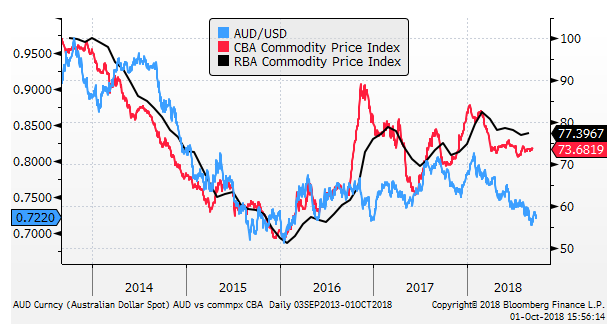

AUD’s fall this year, despite stronger energy commodity prices (including its key export markets for thermal coal and LNG) and stable steel-making commodity prices (iron ore and met coal), has helped support Australia’s trade performance, mining sector profits, and the government budget position. The broader economy has out-performed official forecasts in the first half of the year and has supported the RBA view that the next move in its policy cash rate is more likely to be an increase.

But the AUD appears to have been dragged down by weaker Asian currencies, particularly the CNY, and acting as a risk proxy for China. China is facing intensifying pressure from US trade policy. Its September manufacturing PMI data suggest growth is slowing. While market commentators frequently predict that Chinese policymakers will ease monetary and fiscal policy to underpin growth, the scope for action is limited by government policy to address excesses in debt markets. Shadow-financing continues to contract, suggesting that credit conditions are tightening.

The Australian residential property market is weakening at a moderate but increasing pace in recent months. Australian credit conditions have tightened as financial institutions respond to the Royal Commission into the financial services sector. While this has not had a discernible wider negative impact on household consumption demand, it may be holding back expectations that the RBA will hike rates sooner. It also makes Australia seem more vulnerable to any tightening in global financial conditions that might arise from higher US rates, and stresses in global emerging markets.