Cracks widening in EUR’s foundations

The EUR has struggled since the ECB meeting last week, despite a surprise removal of an easing bias. It has failed to benefit much from a fall in the USD against most currencies in a risk-on move following the US labor data. Eurozone economic momentum has eased in recent surveys, and this is reflected in new lows in the EUR/USD short, long and real yield spreads. Furthermore, inflation expectations have eased in the Eurozone, and its equity market has underperformed recently. US protectionist rhetoric has become more focused against the Eurozone. AUD resilient despite softer commodity prices recently.

EUR under-performs

EUR has underperformed most currencies over the last week despite the ECB removing its easing bias related to QE purchases at the policy meeting last week. (Draghi takeouts – EUR weaker despite the removal of easing bias; 9-Mar – AmpGFXcapital.com).

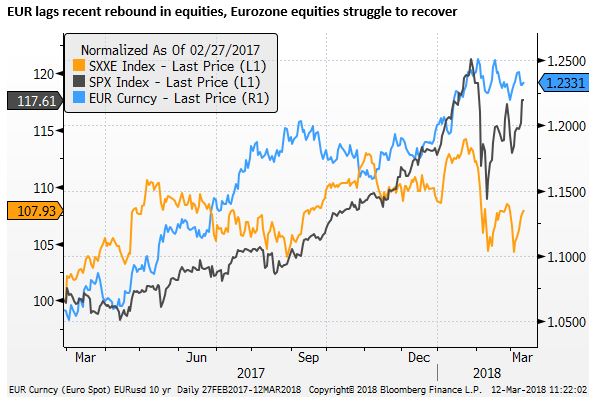

Notably on Friday, despite the sharp rebound in global equities that boosted most currencies against the USD, EUR was largely unchanged; EUR has been somewhat positively correlated with global equities in recent months.

Furthermore, Eurozone equities have significantly underperformed the rebound in US and emerging market equities from the lows in early-Feb, an indication that the strength in the EUR over the last year may be weakening earnings expectations in the Eurozone, in contrast to a weaker USD supporting the outlook for US companies.

EUR yield spread declines to new lows

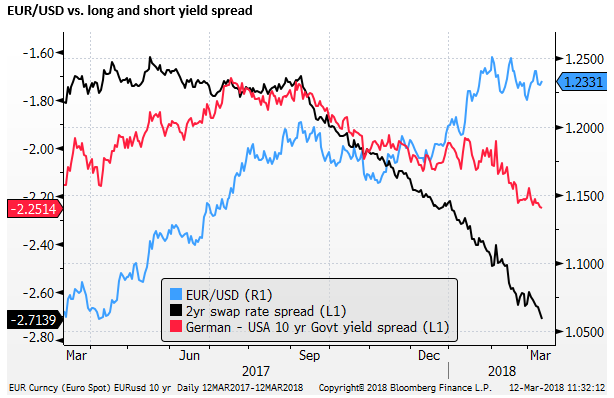

Long and short-term nominal yield spreads for the EUR/USD have fallen to new lows. The 10-year spread is at a low since Dec-2016 (when the EUR/USD was at its low around 1.05). The 2-year spread is a record low since 1999.

While the yield spreads have not been a driver of the USD for much of the last year, they may have stretched so far from current FX levels to limit potential upside for the EUR. EUR is now around its long-run average, and this seems inconsistent with near record low yield spreads.

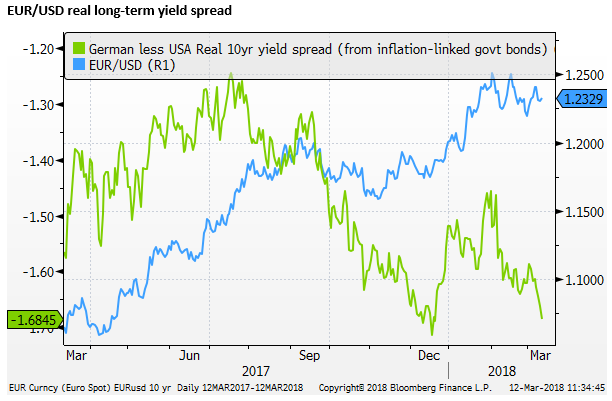

EUR real long-term yield spread returns to near lows

The Real 10-year yield has also fallen sharply over the last month to now approaching the record lows in December, reversing gains up to a peak in late-Jan.

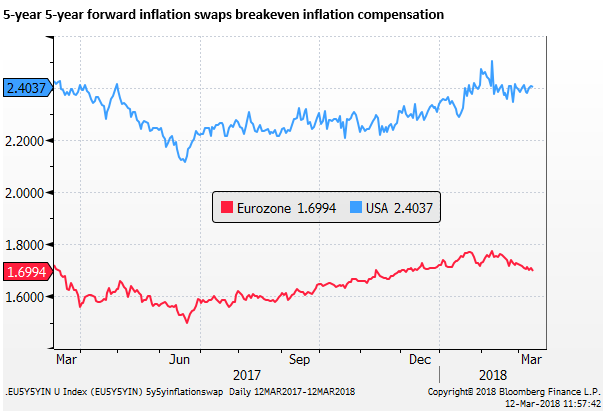

Eurozone inflation expectations fall

Along with a softer real yield spread, long-term inflation expectations derived from the 5year-5year forward inflation swap breakevens, have ebbed in the Eurozone, while they remain stable at more elevated levels in the USD over the last month.

Lower market-based inflation expectations may prolong ECB policy accommodation. Conversely, higher US inflation expectations will embolden the Fed to push on with removing accommodation.

Ebbing Eurozone economic momentum

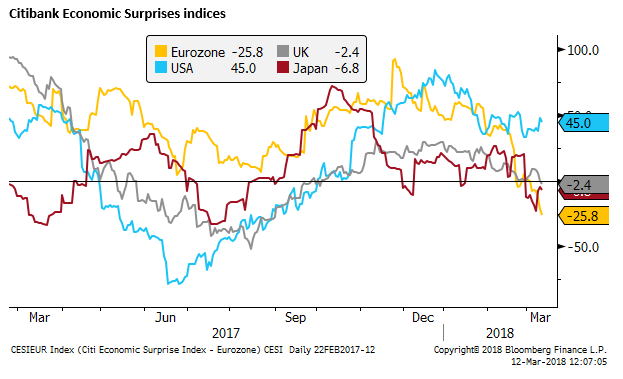

The lower real long-term yield spread and lower inflation expectation spread are consistent with the recent ebbing in Eurozone economic surveys and pick-up in US surveys; including PMIs and consumer confidence.

This divide in recent economic data is reflected in Citibank economic surprise indices (US +45, Euro -26). Industrial production data released last week were weaker than expected in several Eurozone economies. The divided Italian parliament is likely to weaken economic confidence in Italy. Germany’s labour cost index softened in recent quarters.

The trade protectionist to and fro between the USA and the Eurozone is perhaps the most combative of all countries since the US announced steel and aluminum tariffs. This poses a bigger risk for the Eurozone with a large trade surplus with the USA and a significantly larger share of exports as a contributor to GDP growth (Eurozone goods exports 20% of GDP, USA 8%).

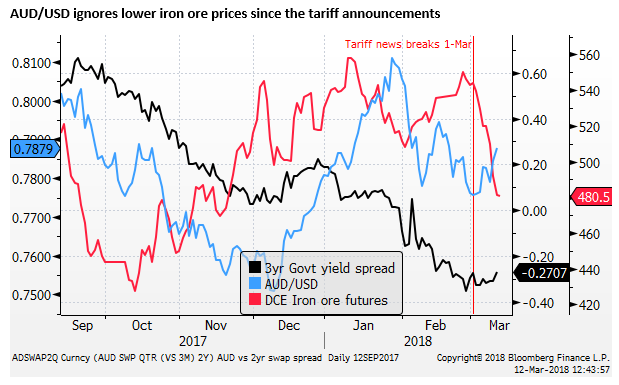

AUD gains despite weaker commodity prices since Tariff news

We had thought that the AUD might be more significantly undermined by the steel tariffs, since Australia is a major producer and exporter of steelmaking commodities. Since the tariff announcements, steel-making commodity prices have eased, but this has had little discernible impact on the AUD.

The steel tariffs have placed a spotlight on a widely perceived over-production of steel globally and weakened confidence in this sector.

Global markets have shaken-off trade war risk

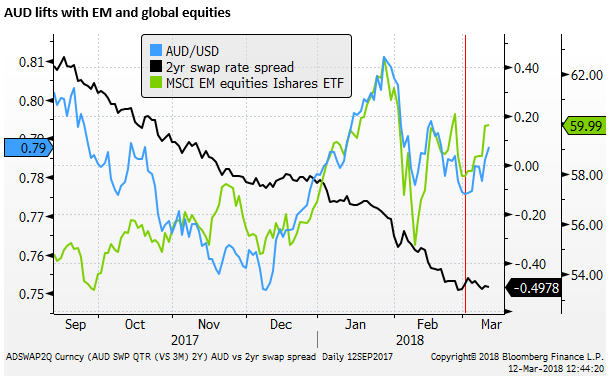

Furthermore, risk of broadening protectionist rhetoric from the US towards China and other major countries might have had a more negative impact on global investor confidence. However, at this stage, the market is tending to shrug off such risk.

The news of a thawing in the relationship between the USA and North Korea from 6-March, helped boost investor risk appetite.

The Goldilocks scenario for equities of strong low inflation global growth was given a boost by the low wage, strong growth in US jobs and labor participation on Friday.

In general, the market may be viewing sustained global growth and moderate inflation pressure as providing support for EM assets. The risk of a trade war led by US protectionism is not significant enough to derail global investor confidence

Global equity markets, particularly EM markets have strengthened since the tariff news, and this appears to have supported the AUD and many currencies against the USD.

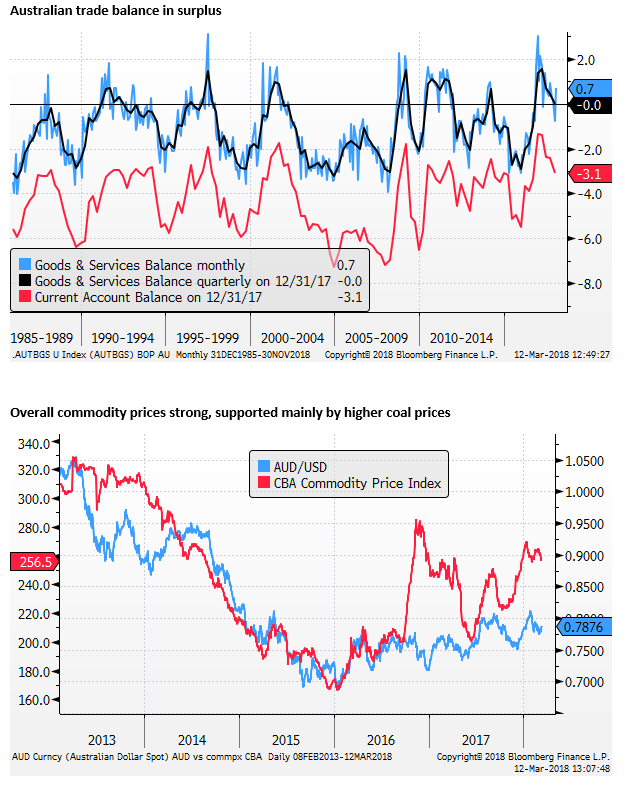

Stronger Australian trade balance

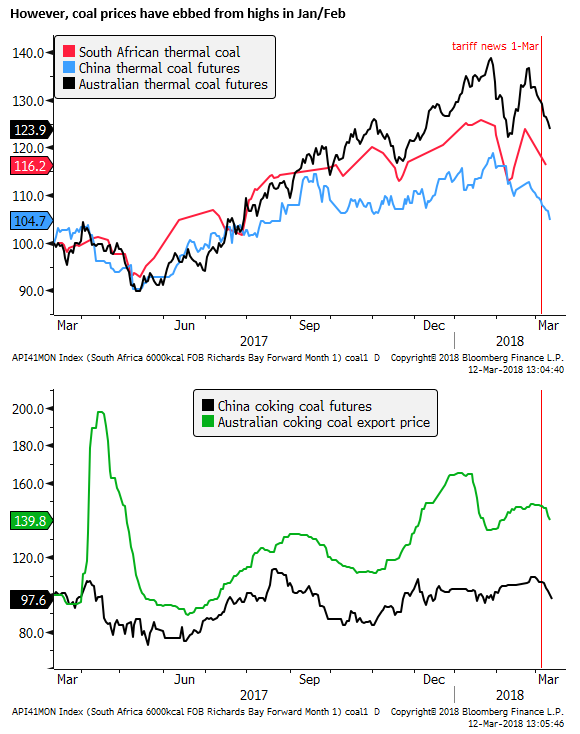

One factor supporting the AUD was a better than expected trade balance reported on 6-March. It returned to significant surplus in Jan equal to 0.7% of GDP. A key factor in this development has been stronger commodity prices in recent months, particularly coal prices, and increased natural gas export volumes.

The AUD may be supported by solid domestic growth indicators, underpinned by government infrastructure spending, fueling strong business confidence and private sector capex. The employment data due next week is likely to remain on a solid improving trend.

However, risks remain from an uncertain outlook in China, weaker steel prices, trade war risks, a slowing housing market and high household debt dampening consumer spending. Political risk remains evident with the Labor Party opposition leading the ruling Liberal-National Coalition in polls. Although the next national election is not expected until next year. Australian cash rates are expected to remain on hold for the foreseeable future, although most see the next move in rates as higher.