Dead-cats and body blows, financial crisis echo, RBA scope to become obligation

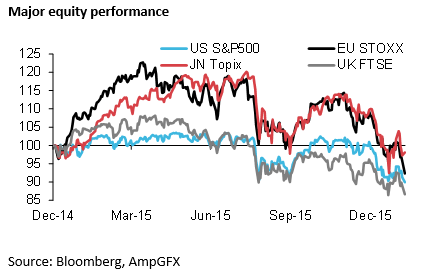

All major equities are again below the lows in 2015 after a dead-cat bounce sending another body-blow to global investor confidence. Bottom fishers will be tentative and choppy bearish markets are likely to persist. Financials (led by Europe) are leading the falls in equities; regulatory pressure implemented in the wake of the global and Eurozone financial crises and litigation and compliance costs since the LIBOR and FX fixing scandals are coming home to roost and creating an echo of the financial stress that undermined global economic confidence in the crises of the last decade. EUR is whippy as investors cope with Euro-centric financial sector stress, but this is only likely to embolden the ECB to adopt more aggressive policy easing measures. It is possible they emulate the BoJ and adopt a tiered cash rate policy resplendent with a much lower more negative marginal cash rate. The outcome would be much lower yields across the EUR curve and a weaker EUR (we much prefer to sell EUR against Gold; as discussed in our previous two reports). Australia has proven resilient to global economic and financial stress, but its banks are being infected by global pressures, and we see a significant risk that RBA scope to cut rates turns into an obligation before long. We see a fallback in the AUD (again we prefer to sell against gold).

Dead-cats, new lows and body-blows

The bearish sentiment in equity markets has reasserted despite more stable Chinese currency and equites, time-out in China as it celebrates the Lunar New Year, a recent recovery in oil markets, policy easing measures delivered and expected by the BoJ and ECB, and move dovishness in Fed and BoE rhetoric. A key flashpoint for global market risk aversion is recent sessions is a sharp fall in the value of bank equities in Europe, with contagion to global financial sector assets and in turn other equity sectors.

The fall in European bank asset values appears to have been in part caused by their exposure to the energy sector and emerging market economies that have been undermined by weak oil prices and slowing demand from China. But there also appears to be a reassessment of the still to be resolved large balance sheets and non-performing loans in the Eurozone.

Perversely, since low (negative) interest rate policy has been implemented by the ECB to boost European nominal economic growth and thus support European equites and other asset prices, these low and negative rates are reported to be damaging Bank profitability, and contributing to weak European equities and global risk aversion.

From a technical perspective, market sentiment may have taken another body-blow that it will struggle to recover from, continuing to suggest this will be a more prolonged period of equity market weakness.

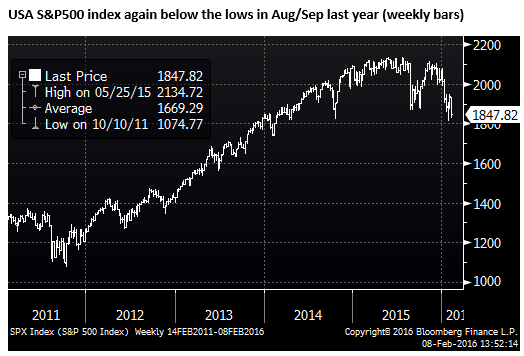

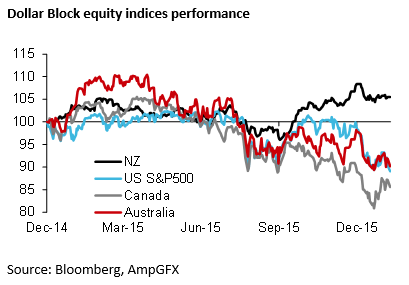

The US S&P500 index (the world’s leading equity index) is again trading below the lows in August and September last year. It fell below these lows over a few days in mid-January, only closing below on one-day. After what might be described as a dead-cat bounce over the last couple of weeks it is again below and closing below on Monday.

All the major equity markets are trading below their lows in 2015, after a relatively lackluster bounce in recent weeks. Investors may start to go fishing for bargains and this may make for choppy trading, but there is likely to be a long pervading pall over this market for the foreseeable future.

Whippy trading in EUR on Euro-centric risk aversion

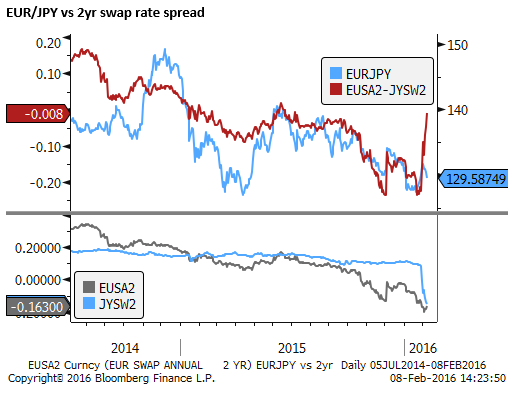

With financial sector weakness so apparent in Europe, it is interesting to note the strength in the EUR exchange rate and relatively stable short term EUR rates. The odds are surely increasing for more decisive ECB policy easing at its next policy meeting on 10 March.

Some of this rise in short term rates appears to in fact represent increased bank funding costs associated with fear or stress in the bank sector. But it is also the case that the market is not sure that the ECB will further cut rates into more negative territory.

This is making for some whippy trading in EUR; risk aversion created some short-covering in the EUR, and higher bank-funding costs (Euribor and swap rates) may also be generating some short-covering in the EUR against other higher yielding currencies; on fear this funding stress might rise further (even though it still remains modest compared to previous crisis episodes). Even if you can see a medium term case for a lower EUR, investors and traders will be wary of implementing this position in the midst of significant global and European capital market volatility.

Three-month Euribor June futures yields rose 4bp on Monday. EUR 2yr swap rate rose 2.5bp on Monday. At -16bp, 2y swap rates are barely changed since the ECB policy meeting on 21-Jan, where Draghi said, “It will be necessary to review and possibly reconsider our monetary policy stance at our next meeting in early March, …….. . In the meantime, work will be carried out to ensure that all the technical conditions are in place to make a full range of policy options available for implementation, if needed.” Cash rates are already -30bp, so it appears there is still considerable scope for Eurozone rates to fall further and weaken the EUR.

BoJ policy easing has driven JPY rates much lower

In contrast, Japanese yields have fallen sharply since the BoJ cut its marginal cash rate by 20bp to -10bp on 28-Jan. Even though Japanese cash rates are still 20bp above those in the Eurozone, JPY 2yr swap rates are almost the same as those for EUR. At -15.5bp, JPY 2yr swap rates are down 24.5bp since the BoJ cut its marginal cash rate on 28-Jan. The market is pricing in deeper rate cuts in Japan.

Eurozone financials a new fountain of risk

Credit risk premia have risen globally and more so for financials. But the epicenter for the latest hit to financials credit risk appears to be in the Eurozone.

In the last week, in the Eurozone, sub-ordinated financials CDS index is up from 208 to 310 (+102pts), Crossover (between investment grade and below investment grade) rose from 368 to 460 (+92pts), senior financials CDS rose from 92 to 137 (+45pts), investment grade corporate rose from 92 to 121.5 (+29.5pts) and sovereign CDS rose from 21.5 to 27 (+6.5pts). These are the highest risk premia since around the peak of the taper-tantrum in 2013 and essentially since the tail-end of the Eurozone sovereign and banking debt crisis in 2012.

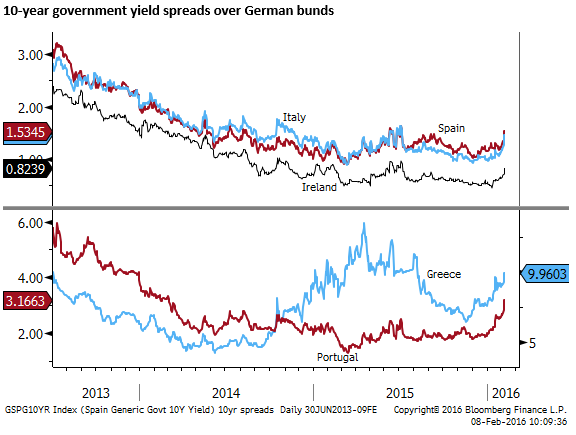

Somewhat more surprising, given ECB QE purchases of government bonds, is that the higher risk premia for European banks has spread to significantly wider spreads in European government bonds over German bunds. Spain and Italian 10 year spreads are the widest since July last year (during the most recent Greece debt/political crisis), Portugal is at its widest since March 2014.

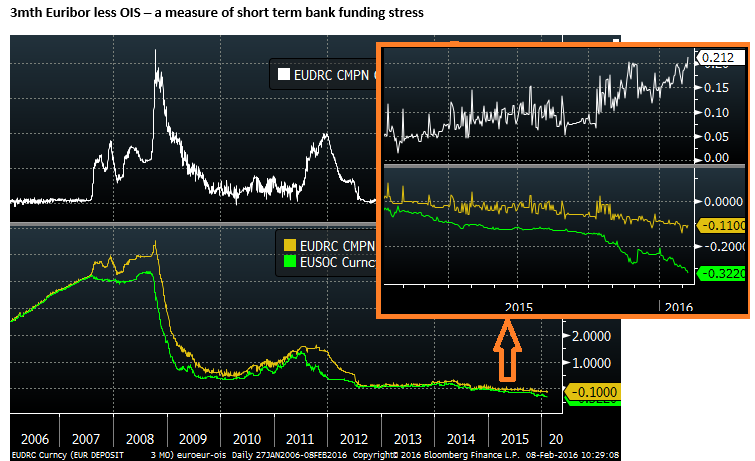

In the 2007/09 sub-prime and global financial crisis and the 2011/12 Eurozone crisis, many European banks were forced to rely on special term funding facilities from the ECB, including USD-funding, to manage their global assets. As such, with renewed stress on Bank debt and equity markets, we naturally turn to see if banks are again suffering short term funding stress. The chart below shows the spread between 3mth bank deposit rates and the three-month Overnight Interest Rate swap rate that approximates the average cash rate expected over the next three months. The wider the spread the tougher/more costly it is for banks to find term funding.

The level of bank funding stress is still very low compared to these previous episodes of banking crisis, but the spread has widened to 21bp from around 14bp at end-2015, and 10bp in mid-2015; the widest level since the 2012 crisis.

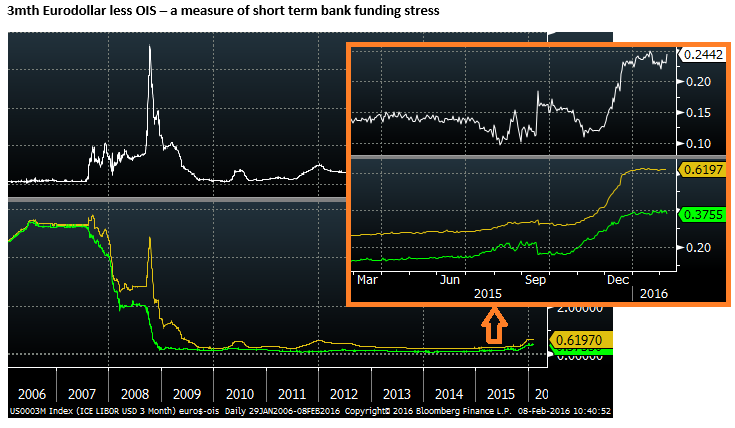

Similarly, the chart below looks at the same data for USD bank funding, the spread between the USD 3mth bank deposit rate and USA 3mth OIS. This spread pushed up as the market anticipated the first Fed rate hike in December from around 12bp in November to around 23/24bp since end-Dec. It is not exactly clear why the spread should rise just because the Fed raised rates. These are also the widest levels since 2012.

Overall, we can conclude that short term funding stress may have lifted somewhat due to renewed concerns over bank solvency, but this is still very low compared to previous periods of banking stress.

The probably reflects quantitative monetary policy ensuring excess liquidity remains in the Eurozone banking system and the regulatory pressure on banks to hold more liquid short term assets and pass regulator stress tests.

However, these rules and negative interest rates are also hurting bank profitability which may also weaken their capacity to write-down NPLs and expand their lending to support the economy.

The negative interest rates on many of the securities that banks are forced to hold must presumably be passed on to customers (rates and fees charged for deposits). Banks may have difficulty forcing smaller households and businesses to pay for depositing cash balances.

This begs the question, should the ECB cut rates further if these negative rates are hurting bank profitability and contributing to weaker European equity prices and damaging confidence in the Eurozone.

ECB may emulate the BoJ an opt for a tiered cash rate and much lower marginal rate

Perhaps the ECB will emulate the recent BoJ decision to implement a tiered cash rate policy mechanism to help shore up Japanese bank profitability even as it introduced negative cash rates.

The Bank of Japan used a three-tier rates policy system, continuing to pay banks 10bp on the first tier of cash balances held by banks and the Bank of Japan, zero rates on a second tier, and -10bp on the third tier. The third tier is the most relevant to money market rates as essentially the marginal cost of new funding. The sharp fall in JPY yields across the curve suggests that the policy approach has been successful.

The ECB may see merits in this approach and similarly move to tier its policy decision. But in doing so that are likely to significantly lower the marginal tier well below -30bp.

We continue to see much lower EUR yields in coming months, induced by ECB policy that is currently far from factored in across the curve. As such we remain negative on the EUR (preferring to sell it against Gold).

Financials suffering from regulatory pressure

The weakness in European banks has spread to financials in other parts of the world. While there may be some specifics that affect European banks more, the profitability squeeze on banks from increased regulation (including: higher capital ratios, higher liquidity ratios, higher compliance and regulatory scrutiny, related litigation costs, and tougher rules around trading) has reduced bank profitability globally. While banks may be safer in terms of meeting shorter term liquidity requirements, they are just as vulnerable as ever to a deterioration in their asset books that arise when equity and bond markets fall on concerns over global growth and profitability.

Where financials go, so does the broader market

Where financials go, the broader equity market can also go. If banks’ profitability is under pressure they will still tighten their provision of credit to businesses and households. Banks have already reduced their activity significantly in non-bank financing, including their activity in corporate bond and equity markets. As such, stress in these markets may persist for longer without the support of banks’ traders and capital that once were actively employed.

The tougher regulatory environment of banks may mean they survive and the base line for global economic growth is stronger than the pre-crisis era, but the base line can still feel quite weak and contribute to sustained weakness in global equity markets.

Australian resilience but for how long

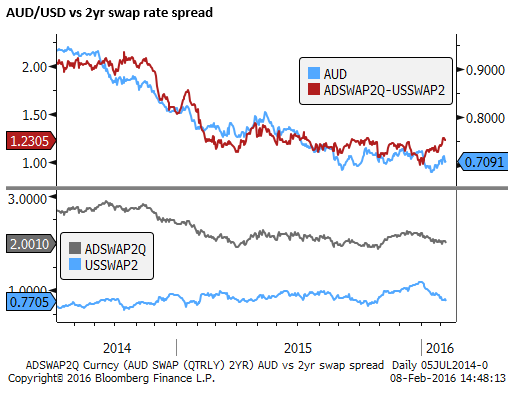

USA 2yr swap rates are 0.77%, down 4bp over the last week (despite the tighter labor market data on Friday), down from a peak of 1.18% on 30-Dec (-41bp).

Australian 2yr swap rates have been much more stable. They peaked a little ahead of the FOMC meeting on 16-Dec at 2.26%, now at 1.99% (-27bp). The AUD/USD yield advantage is around its highs since July-2015 (at 123bp).

In past periods of global risk aversion, the AUD fell more deeply than most other currencies, but in recent weeks, in the context of some broader weakness in the USD, it has strengthened.

In the past it was assumed that weak global economic confidence financial stress, would force the RBA to respond with emergency rate cuts. But in those episodes, Australia had higher interest rates and the AUD exchange rate was much higher supported by a resource sector investment boom.

In the last year, the Australian economy has been resilient to the slowdown in China’s heavy industries and risks related to weaker energy prices. It has appeared advanced in transitioning through the downswing in resource investment. The cash rate is now at record lows (2.0%) and the AUD is already much lower over recent years.

However, the RBA has said it has scope to cut interest rates afforded by low inflation. This scope may soon turn into an obligation if domestic economic confidence starts to falter, which indeed it might in response to weak equities and the potential for tighter financial conditions imposed by Australian banks.

Australian banks feeling the global draft

Australian banks avoided much of the stress experienced by USA and European banks in the crisis era. While in the worst phases of stress they experienced significant problems associated with large offshore funding, the Australian government and RBA stepped in to provide guarantees and collateralized funding. A key point of difference for Australian banks is that their assets were almost exclusively Australian, dominated by mortgages (with a negligible subprime share), allowing the local authorities to accept these as collateral.

However, in the current environment, Australia is feeling some more pressure from the global weakness in financial sector assets. Australian banks are now facing the same scrutiny on the interest rate-fixing mechanism that big banks offshore have experienced since 2012. The Australian Securities and Investments Commission is expected to bring charges against one of the big-four banks (ANZ), and the risk is that this spreads across the other major banks.

Local banks are probably already significantly reviewing their in-house compliance and trading around local interest rates markets. This is likely to be dampening profits and raise the risk of significant litigation costs for Australia banks. As the experience offshore suggests, this may be a long process that spreads scrutiny across the whole business of banking.

ASIC inquiry into bank bill swap rate is one problem but the high rates are also a problem – AFR.com

ASIC’s ANZ probe set to blow up traders’ world – AFR.com

Hedge funds bets against bank credit risk paying off – AFR.com

The exposure of Australian banks to global financial assets is still relatively low, but their recent share market performance has been weaker than the broader Australian equity market.

Australian banks take up a much bigger share of the Australian stock market, relative to other countries, and weak Australian bank share prices can infect the whole equity market and domestic economic and investor confidence more than other countries.

The performance of Australian banks and the overall economy remains highly leveraged to the Australian housing market. The strength in Australian housing has been a major contributing force in the resilience of the Australian economy in the last year. It may well continue to keep the Australian economy underpinned, with demand ongoing from Chinese investors and low rates in Australia still supporting the market. However, housing has thrown off mixed signals in the last six months and the boom in housing construction and prices appears mature. It’s still a stretch to say a housing down-turn may trigger a pervasive and self-perpetuating fall in bank and broader economic confidence, but it remains a consideration that could yet be the factor that drives a much bigger downturn in the AUD.

We see a significant risk that economic confidence capitulates in coming months and the AUD falls back again. (Although again we prefer to sell AUD against gold).