A depressing USA election, stronger commodity prices

The hopes of a clean outcome in the dirtiest USA election in recent memory is dampening investor confidence, undermining US assets and the US dollar. It’s not just the possibility of a Trump victory undermining confidence, it is the risk that a narrow Clinton victory is undermined by questions of legitimacy, national division, and a partisan Congress. However, there is more encouraging evidence in global manufacturing surveys and rising commodity prices outside of oil. These suggest that there is an improvement in the USA and global economy. Currency markets have for the most part slipped back into choppy patterns with election uncertainty unraveling some promising trends towards a weaker JPY and EUR. Stronger commodity markets may support AUD and NZD, but they are unlikely to rise much as US election uncertainty rises.

A depressing USA election

USA politics appears more troubling and heading in a farcical direction that offers less hope of a progressive and productive economy. Already it had a worrying undertone with allegations of a rigged system or attempts to steal the election. And there has been a constant assertion that the Clintons are part of some criminal conspiracy. There is little chance that if Clinton wins she will be able to shake off partisan efforts to sully her legitimacy as president. There has been little opportunity for the candidates to campaign on policy and most of the election has been about personal conduct.

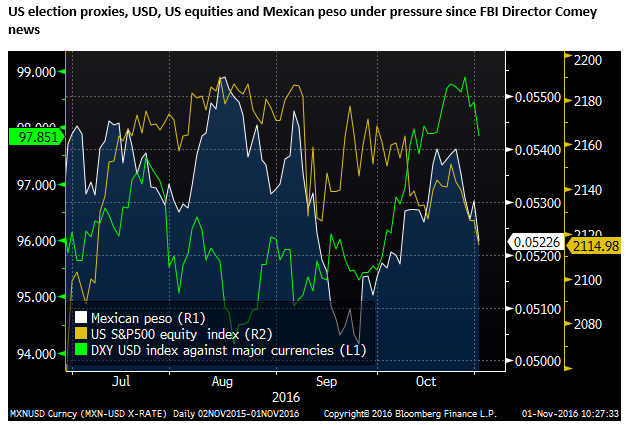

The most bullish election outcome for markets would have been a decisive election win by Clinton and by its size discredit claims of rigging. The market was being buoyed by this prospect up until Friday last week. But that now looks unlikely with the FBI’s insertion into the final days of the campaign providing fuel to the Trump efforts to besmirch Clinton’s legitimacy. The Democrats have resorted to fighting fire with fire by calling on the FBI to investigate Trump links to Russia.

The most likely result appears to be a close outcome with Clinton as President and a large minority of Trump supporters whipped up by the campaign tactics of Trump that will continue to call for legal action against her or worse.

The most recent betting odds have a Clinton victory at 4/11 (around 70% probability) and Trump at 9/4 (around a 30% probability). The latest polls in the USA suggest the outcome has tightened up to be a close call. The odds of a Trump victory have halved from 5/1 (around 15% probability) since last Wednesday.

The state of Congress may also be more divisive with the Alt-right Trump movement gaining power within the Republican Party and making it more difficult for non-partisan compromise throughout the next presidency. Legal action pursued against leaders or previous opponents and ongoing forensic investigations involving government agencies will make the US political system feel like an unstable emerging country and be very distracting, limiting the potential for constructive policy making.

It is hard to understand how far the mood of a nation has sunk into a divisive state. Positions have hardened across grounds of race, income status, and gun violence. There is a widespread loss of faith in the so-called establishment represented by government and big business.

Although Trump is big business, he has been able to paint himself as an outsider from the system to tap into the dissolution of much of the nation and stoke it into a raging fire of contempt and hate. Much of that contempt is leveled at the Clintons, but it is often also directed at moderate Republicans that fail to provide unequivocal support to Trump’s campaign.

It is hard to imagine a more negative campaign with Trump on one hand facing accusations of mistreatment of women among other disrespectful comments towards minority groups or individuals, and fighting back with claims that the media is part of a rigged system and now intensified claims that Clinton is a criminal. The outcome of this election is going to leave deep wounds in the psyche of the nation no matter who wins.

It is hard to imagine this has arisen from an economy that on the surface has largely recovered from the global financial crisis with near full employment, has had relatively few significant terrorist incidents, has avoided significant US troop involvement in an increasingly troubled world and has had a two-term black president. Many have highlighted income disparity as a major cause of the current state of political and social conflict. Perhaps it is part of a natural cycle of a democracy where different interests rise are tested and fall again. But the USA does appear more divided and less capable of progress or global leadership than usual at this time.

It is not surprising then to see the setback in the USD and weaker asset markets. Some of this is likely to be related to increased political uncertainty in the US. This uncertainty may remain a factor beyond the election.

USA economic surveys encouraging

While the US equity market and currency markets are revealing some increased risk aversion, it is somewhat surprising to see global bond yields continue their recent rise (although US yields fall late on Tuesday). Perhaps bond markets are more focused on signs of economic recovery in the global economy, including the USA.

The US ISM manufacturing PMI firmed to 51.9, modest but establishing an improving trend. The Markit manufacturing PMI was more encouraging rising to 53.4, a high since October last year.

Some other less watched survey data are also encouraging; the US IBD/TIPP index of economic optimism built on its strong gain in October rising from 51.3 to 51.4 in November, above its 12-month average of 47.5, and 2.4 points above its all-time average of 49.0. Readings above 50 are supposed to indicate net optimism. It is a telephone survey of 906 adults in the week of 21 to 26 October. Not surprisingly, the survey’s component for confidence in federal politics was only 43.1.

The lift in the overall optimism survey contrasts with the recent retreat in the University of Michigan and Conference Board consumer surveys. It suggests that the election may have been dampening confidence and the prospect of it coming to a conclusion may have lifted spirits. However, the FBI’s Comey statement and the fallout since this survey was taken may dampen spirits again.

U.S. Consumer Confidence Upbeat in November – tipponline.com

Stronger employment component

An encouraging element in the ISM manufacturing report was a lift in the employment component. The chart below shows the employment components from both the mfg and non-mfg surveys. The non-mfg data is due on Friday (the same day as the next non-farm payrolls report). It rose sharply in September to a high since October 2015, so if it maintains much of this gain, the two ISM employment indicators may point to a stronger payrolls report.

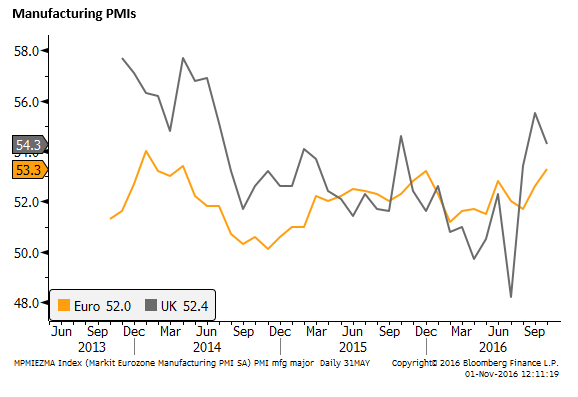

The modest improvement in the USA manufacturing PMI was complimented by improving trends globally. Japan continued its recent PMI manufacturing recovery to 51.4, a high since January. The Eurozone manufacturing PMI rose to a high since April 2014 (53.3) and the UK PMI retained most of its sharp rebound in September (54.3).

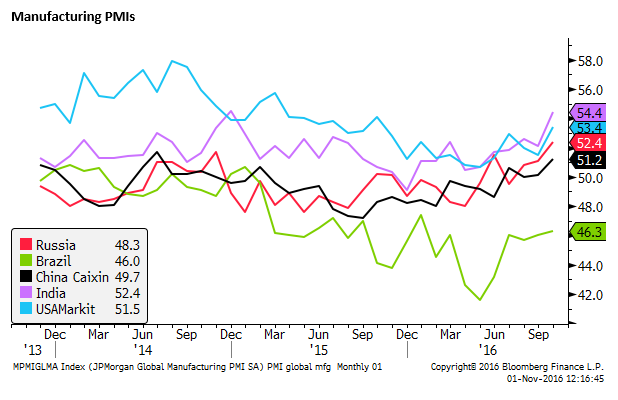

The large emerging market economies all showed improvement, Russia to a new high in at least three years, India revisited its previous high in 2014, China’s two manufacturing indices were both around two-year highs.

Strong commodity prices

Oil prices have retreated recently as the market doubts the capacity of OPEC nations to agree on production cuts at a meeting planned for end-November.

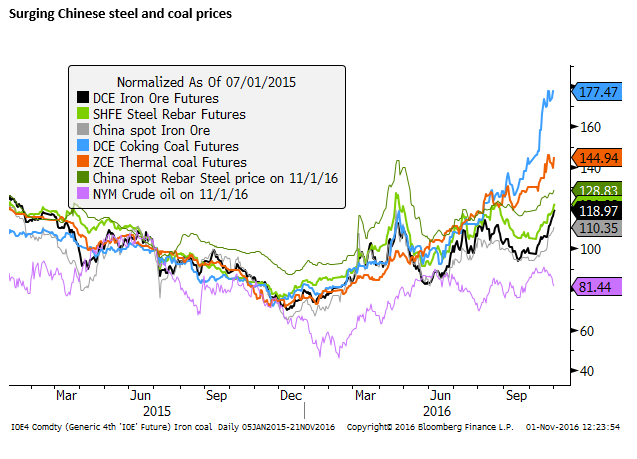

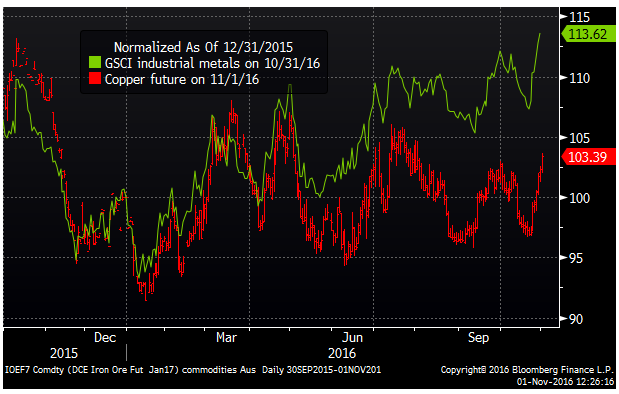

However, outside of oil, other commodity indicators are showing strength consistent with improving indicators of global economic activity.

Chinese steel and coal indicators continue to rise remarkably strongly, raising doubts that the recent surge is not sustainable.

Copper and other industrial metals prices have also rebounded in the last week or so

The NZD also received positive news from a stronger dairy price auction. The overall GDT index rose a strong 11.4% in the latest fortnightly outcome on Tuesday.