IT disruption driving up Asia EM currencies, GBP risk builds, AUD yield advantage gone

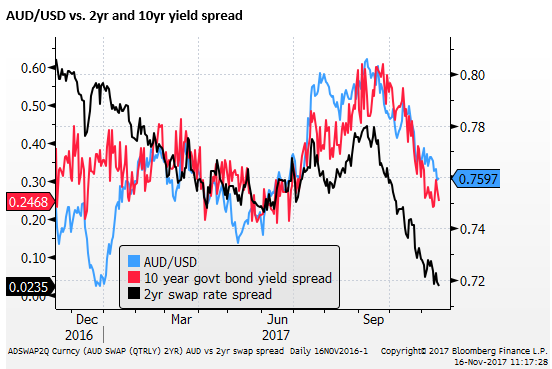

Investors are pursuing gains in equity markets; in particular, EM markets that are big exporters of IT goods. These capital flows are tending to drive currencies; Asian EM currencies are out-performing other EM regions. The USD is tending to weaken as the US growth outlook is moderate and no more special than other economies. The Fed may be raising rates faster than other countries, but not so fast to upset domestic or global growth expectations. Commodity currencies are under-performing. There appears to be excess supply of commodities, and while some commodity prices have strengthened this year, performance has been mixed. Chinese construction demand may be slowing, weakening demand for steel-making commodities. Yield curve flattening may reflect good disinflation trends related to technological disruption and globalization that support global asset markets; albeit with winners and losers along the lines of disruption. Comprehensive US tax reform may upset recent trends of a softer USD and strong EM markets. GBP has firmed this week despite evidence that its economy is suffering from Brexit uncertainty, UK government instability, and growing time pressure on Brexit negotiations. The AUD/USD 2yr swap spread is close to flipping into negative territory for the first time since 2001.

FX caught in equities’ web

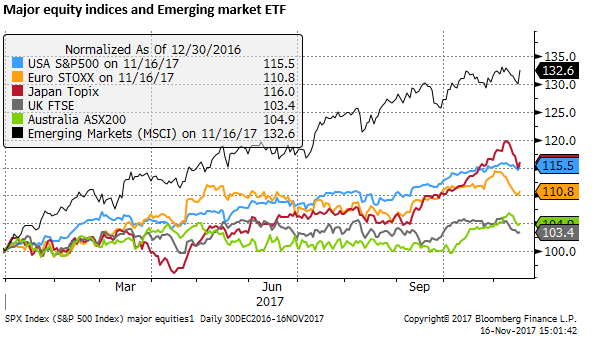

Equity markets bounced back on Thursday. Emerging market ETFs out-paced major equity markets; up around 2%, trading close to recent highs.

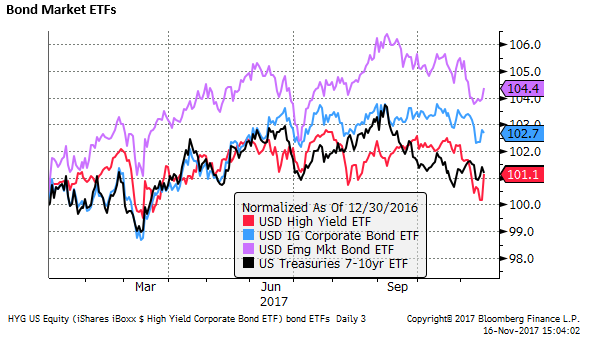

High yield corporate bond markets that led the asset market correction recently have also bounced back sharply.

The FX market is struggling to find a consistent theme, and government bond markets remain relatively stable. It appears that investors are more focused on pursuing rising trends in global equities, confident that global growth remains buoyant, inflation subdued, and central banks will pursue only gradual and cautious policy tightening.

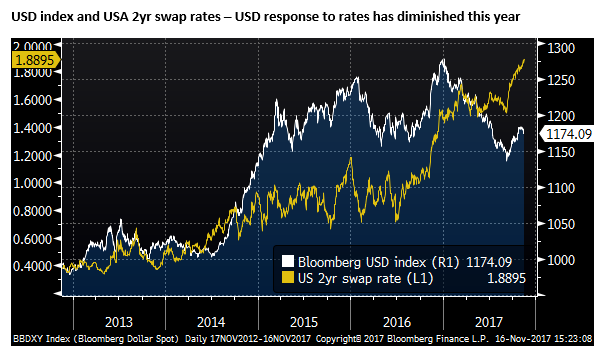

FX markets, as a result, are in drift mode, losing their historical connection to interest rate differentials, and responding more to equity capital flows.

The USD is tending to weaken as the US growth outlook is moderate and no more special than other economies. The Fed may be raising rates faster than other countries, but not so fast to upset domestic or global growth expectations.

Asia equities and currencies out-perform

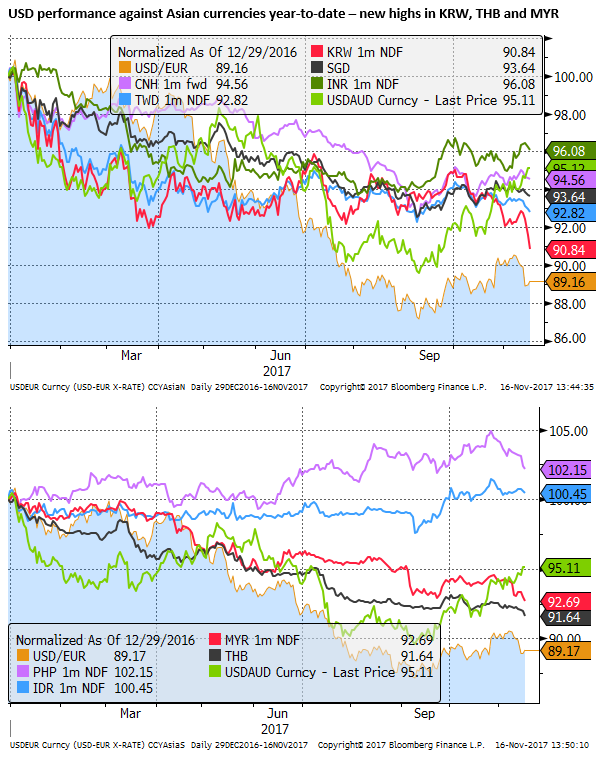

Investors are pursuing gains in equity markets; in particular, EM markets that are big exporters of IT goods. These capital flows are tending to drive currencies; Asian EM currencies are out-performing other EM regions. Several Asian currencies are at highs for the year against the USD.

The KRW has surged in recent days since breaking to new highs (USD/KRW lows) for the year. It has rallied in part on rate hike expectations in S.Korea; since September, 1-year Korean swap rates are up over 30bp.

PHP has strengthened significantly in recent weeks from one of the weakest positions for the year-to-date in the region. The THB reached a new high for the year, as has the MYR.

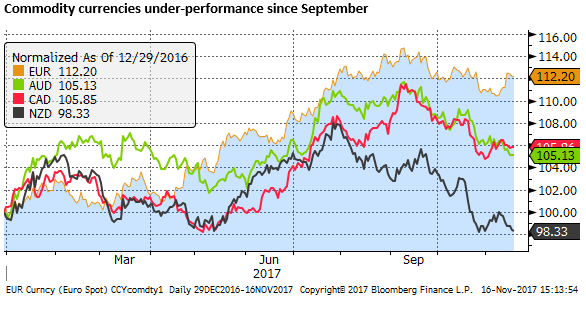

Commodity currencies under-perform

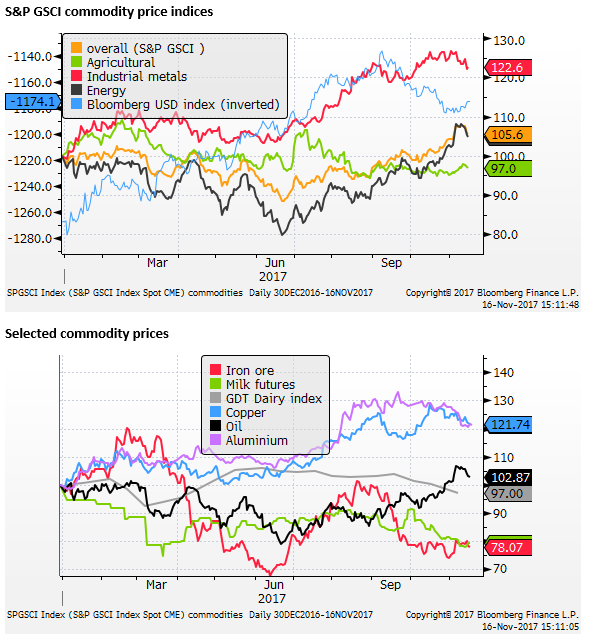

Commodity currencies are under-performing. There appears to be excess supply of commodities, and while some commodity prices have strengthened this year, performance in commodities has been mixed. Chinese construction demand may be slowing, weakening demand for steel-making materials.

Curve flattening good for equities

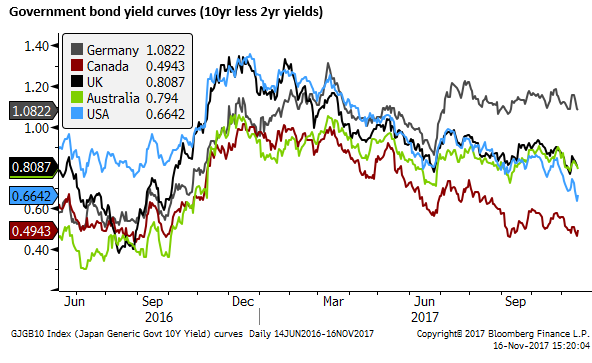

The US and global government yield curves are flattening. Some may fear that this is a warning that global growth expectations are slowing and monetary policy is tightening. However, that does not ring true with the performance of equity markets and the buoyant outlook for the global economy expressed by many analysts and central bank reports.

It may reflect the low/stable inflation expectations related to globalization and technological disruption; increasing competition and depressing wages even as labour markets tighten.

This might be regarded as good dis-inflation, representing improving productivity (even if measured productivity in major economies remains low). If so, it should boost demand for equities; although with winners and losers along the pathway of disruption.

It may reflect the ongoing QE by the ECB and BoJ holding down long-term bond yields. As capital flows to EM markets, and FX reserves growth picks up, this may add to demand for reserve currency bond markets. In essence, global monetary policy remains easy and is depressing bond yields.

What could go wrong?

What could go wrong? For one, the market appears to be still giving little consideration to a comprehensive tax reform bill in the US. This could become inflationary and drive capital back to the US, to the detriment of EM capital markets.

EM markets may benefit from strong US growth, but if US growth becomes inflationary it will place upward pressure on US yields across the curve and may force investors in EM markets to take more seriously the risk of currency losses. A tax reform bill is also expected to encourage capital repatriation by multinational companies, which may reinforce a stronger USD.

China’s economic growth appears to be bucking the global trend and slowing. China is grappling with high and rapid growth in domestic debt. Its policymakers are pivoting toward controlling excessive debt growth. China is a large economy, and significant disruption to its growth or financial market stability remains a risk to global capital markets.

The US Fed is now reversing QE. The ECB is set to halve QE purchases in January and may end them in September next year. This may be a factor in lessening downward pressure on global bond yields next year.

Time pressure creeping up on GBP

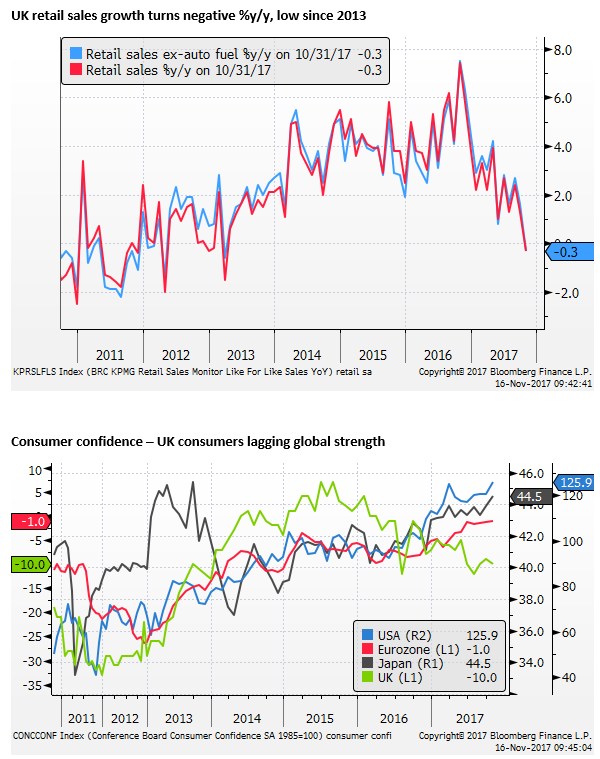

The UK has delivered soft data this week; retail sales, employment, and CPI. And yet GBP has firmed. The market is closely watching the political news and prospects for Brexit negotiations. A number of analysts are looking for progress on the divorce bill ahead on a 14/15 December EU summit so that negotiations can get onto what everyone is most concerned about – the trading relationship and transition period after Brexit scheduled for March 2019. This appears to be providing GBP some support.

However, much concern remains over the stability of the UK government. The lack of consensus within the UK parliament on the preferred legal and trading relationship post-Brexit makes it hard for business to be confident that it can stick to a negotiating strategy and deliver some certainty around the outcome. Time is an issue. Businesses do not want to wait until the 11th hour to plan operations post-Brexit. Unfortunately, the history of the Eurozone crisis suggests that dealing with EU countries does tend to get dragged out to the deadlines and then often beyond.

There are a number of potential pitfalls in negotiations that will come up over the year ahead. And it is far from clear that the Tory party and its partner Democratic Ulster Party will be able to hold together and agree on any deal that its negotiators may be able to cobble together with their EU counterparties. If party leadership changes, or a new election is called midway through, it could be a major setback in deal-making.

Risk of a significant further fall in GBP increases the closer we get to March 2019 deadline. Businesses have already given the UK government a softer but much sooner deadline to show significant progress. Companies want to some idea of how Brexit will look early next year. Already they are deep in contingency planning in case there is no deal, and this may be dragging on the UK economy.

Nevertheless, the GBP may bounce a bit if the May government survives through year-end and makes progress on the divorce bill.

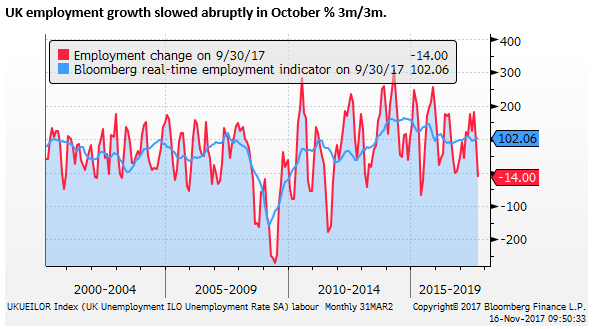

The UK unemployment rate remained at a 42 year low at 4.3% as expected (steady since July), but employment growth fell 14K %3m/3m in September, below an increase of 52K expected. Wages growth remained stable, as expected, and subdued at 2.2%y/y for regular pay.

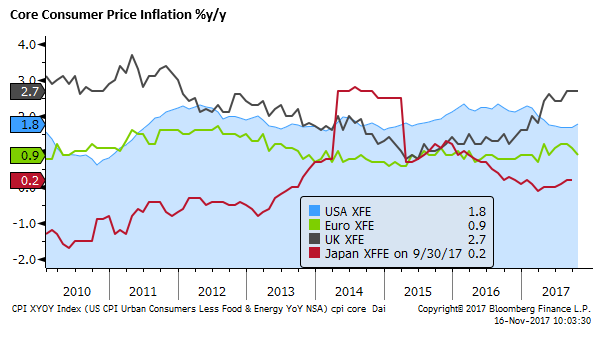

UK headline inflation was steady a 3.0% y/y in October, below 3.1% expected by the market, and below the BoE’s prediction in their 2-Nov Inflation Report, that headline inflation would rise to a peak of 3.2% in October. Core inflation, excluding food and energy, steady at 2.7%y/y, below 2.8% expected.

AUD yield advantage gone

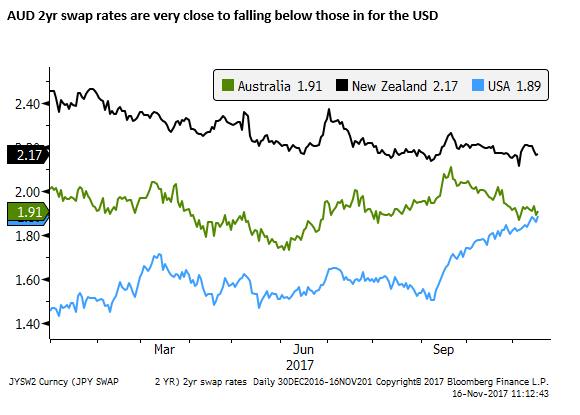

Rate differentials have played a lesser role in USD direction this year. However, they cannot be ignored entirely, and may matter more for the AUD since its equity market does not offer the same attraction to global investors pursuing IT exposure. AUD is also a proxy for China where growth is bucking the global trend, and commodity demand may be slowing.

It is noteworthy that the 2yr swap spread for the AUD/USD is close to flipping over to negative for the first time since 2001. The AUD is likely to encounter some technical support in the 0.75s, but buyers may not be all that keen, and downside risk remains

RBA on hold for the foreseeable future

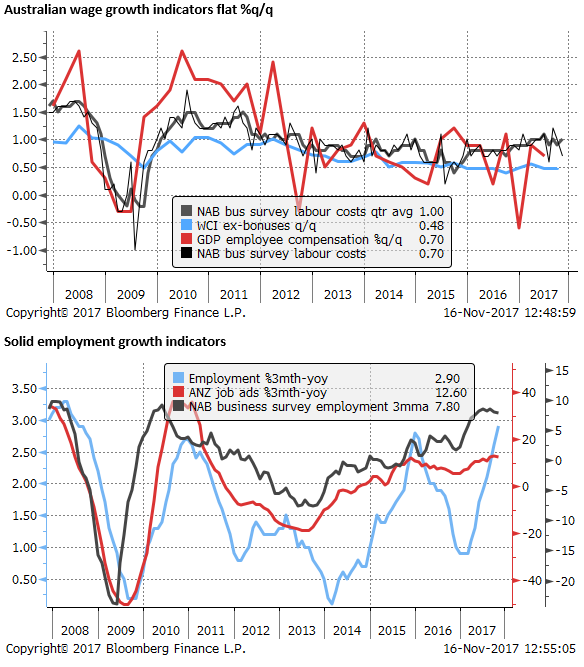

The main data point that has weighed on Australian rates this week was lower than expected wage growth on Wednesday. Some other data points were more positive; the labour report showed a fall in the unemployment rate to 5.4% on Thursday, a low since 2013. And the NAB business survey showed a sharp rise in current conditions to 21, a record in the series since 1997; (although other survey components were largely unchanged).

One of the key developments for Australian rates was the RBA quarterly Statement on Monetary Policy, released last Friday, forecast underlying inflation at the bottom of its 2 to 3% target band at the end of its forecast horizon in December 2019. This suggests they are not expecting to raise rates through the next two years, and a cut is not out of the question.

These forecasts are made based on the current market pricing for rates and no change in the exchange rate, and normally the RBA would signal it agrees with market pricing by forecasting inflation within the inflation target by the end of its forecast horizon. In the past, when the RBA was less concerned about financial stability issues related to high household debt, a forecast of inflation below target in the medium term might signal an intention to cut rates very soon.

However, preventing a deeper fall in Australian rates and the AUD since the RBA SoMP was a more upbeat view on private sector investment and government infrastructure spending. The RBA has expressed considerable patience over the last year in allowing inflation return to its target, to avoid cutting rates and risking a further build-up in already relatively high levels of household debt.