Dollar bloc housing market vulnerabilities

Notwithstanding the strength of their banking systems, the CAD and AUD and bank share prices in both countries are exhibiting financial stability risks following the stress experienced by the Canadian mortgage finance company Home Capital Group (HCG). The CAD fell to new lows in over a year in conjunction with a fall in HCG shares, spilling over the broader bank share prices. Mortgage Finance Companies (MFCs) are an important cog in the financial infrastructure of Canada, accounting for around 12% of outstanding residential mortgage credit. The financial stability risks are mitigated significantly by the fact that these mortgages are passed onto banks or the government-backed MBS market, but the MFCs’ business model has been impinged by regulatory action late last year to slow mortgage growth. MFCs must still find short term finance to warehouse loans before origination of MBS or sale to banks. Vulnerabilities lie in their low levels of capital, the lower quality of loans they warehouse, and a high cost and less stable sources of funding. Disruption at one MFC could tighten credit conditions generally in the mortgage market, exacerbate a downturn in the housing market and have broader implications for the economy and financial stability. The non-bank sector appears to have a much smaller footprint in Australia, but it has been growing recently. The RBA estimates that it accounts for around 1% of mortgages. Like MFCs in Canada, Australian non-bank mortgage originators have limited access to short-term finance to warehouse loans prior to securitization. The Australian housing market has shown tentative signs of peaking after another surge in Q1. Regulators have forced banks to ratchet up tightening in credit available for investors. There is an apartment glut developing, of which foreign investors are an important source of demand, and they rely more on non-bank finance. Risks in the housing market have been weighing on the AUD much of the year, and developments in Canada add one more straw to the camel’s back. Adding to the risks for the AUD are credit tightening in China, a sudden 6.6% drop in Chinese iron ore futures prices on Tuesday, and a firmer USD as the Fed reaffirmed its course for gradual policy tightening. Having pushed to a new low, AUD is exhibiting a downtrend, albeit a choppy one, along with CAD and NZD in the last month. However, there are still two-way risks, including an announcement of fiscal expansion expected by the Australian government next week, which may help boost economic confidence.

Dollar Bloc Housing market vulnerabilities

Canada and Australia, and New Zealand for that matter, have a number of similarities in their housing markets and financial systems. All have experienced rapid loan and house price growth, and have high levels of household indebtedness, but all are seen to have strong well-regulated banks that are thought to be prepared for a housing market downturn.

Such a downturn may have broader economic problems and generate an increase in non-performing loans, but the banking system is well capitalized and has low exposure to sub-prime type loans. In recent years, regulators in all three countries have tightened rules on property lending to address increasing housing related financial stability risks.

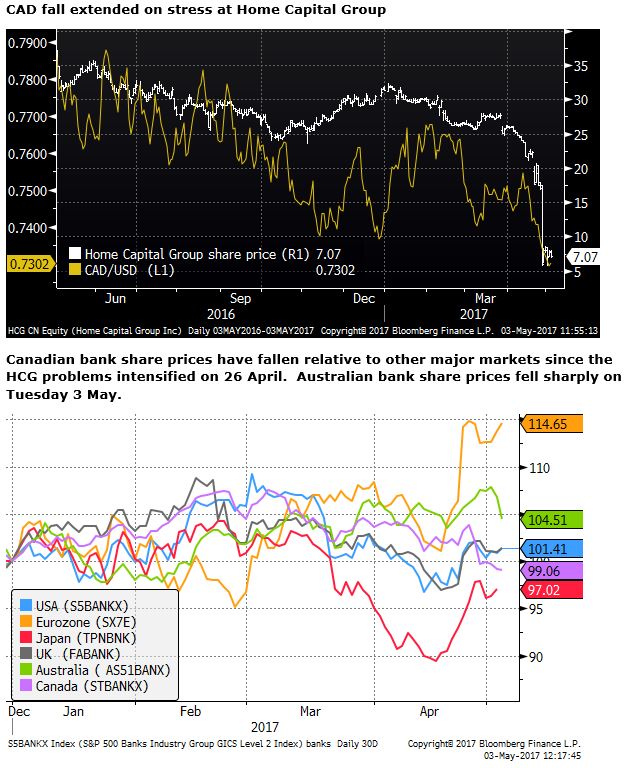

Nevertheless, an area of weakness may be the non-regulated (shadow-banking) sector, and Canada has just experienced a near failure of a Mortgage Finance Company (MFC) called Home Capital Group. As the chart below illustrates, this appears to have contributed to a fall in the CAD exchange rate to a low in over a year.

Canada’s MFCs are an important cog in the mortgage machine

The December 2016 Bank of Canada Financial Stability Review (BoC FSR) said that:

“MFCs are mortgage lenders that, as a group, underwrite and service about $165 billion, or 12 percent, of outstanding residential mortgage credit (as of December 2015).

“MFCs source their mortgages from brokers and either sell the mortgages to a third party, such as a bank, or fund them with government-backed securitizations.”

“The credit exposure of most of the mortgages they originate is therefore passed on to the government or to the regulated sector and not counted in the shadow banking measurement. Only those mortgages that are being warehoused prior to sale or securitization using either ABCP conduits (about $6 billion) or MFCs’ internal resources (about $4 billion) are included in our estimate of shadow banking.”

“Vulnerabilities associated with MFCs primarily relate to their relatively low levels of capital and liquidity and their reliance on funding sources that are potentially unstable during periods of housing market stress”.

The Canadian authorities tightened mortgage insurance rules in October and November last year in order to contain rapid growth in lending and the financial stability risks associated with the housing market. The BoC FSR said that these rule changes had a significantly bigger impact on the business of MFCs than traditional banks.

The risks of financial contagion from a collapse in a MFC is lessened to the extent that most of its mortgages are insured, securitized and passed on to other investors. However, an MFC’s failure could prove significantly disruptive to the availability of mortgage finance in the market, and spillover to a weaker housing market with broader implications for the economy and financial sector.

MFC’s account for a significant share of the overall mortgage originations and are therefore an important cog in the financial infrastructure. If their business model is placed in doubt, it may lead to a significant tightening in overall financial conditions.

The implications are clearly negative for the CAD, as it would force the BoC to consider cutting rates, and in general, could undermine consumer and business confidence.

Financial System Review – December 2016 – bankofcanada.ca

Australia has a smaller non-bank sector

The April 2017 RBA financial Stability Review (FSR) noted that Residential Mortgage Backed Securitization (RMBS) remains well below pre-2008 crisis levels and accounts for less than 2% of banks’ total funding.

The RBA FSR said that non-bank mortgage originators issuance of RMBS picked up in 2016, but were still only around 1% of Australian mortgages.

Overall it appears that Australia has a smaller non-bank sector and smaller MBS market. Nevertheless, like Canada, this portion of the mortgage market is more vulnerable to experiencing funding difficulties, and if one company was to experience difficulties it would have some wider reverberation towards tightening credit conditions and potentially contributing to a weaker housing market.

Like MFCs in Canada, non-bank mortgage originators have limited access to short-term finance to warehouse mortgage loans prior to securitization.

The Australian bank regulator APRA recently emphasized that it would be concerned if banks allowed their warehouse facilities to grow materially faster than their own housing loan portfolios.

Financial Stability Review April 2017 – RBA.gov.au

Australian Housing market may be at a tipping point

The Housing market remains central to the performance of the Australian economy, the strength of its banks and financial system, and the AUD and other Australian financial markets.

Housing affordability has become a major political issue and regulators and the government is acting in measured steps to stem rapid price gains and credit growth significant above income growth.

There is tentative evidence that the housing market in the big east coast cities is starting to cool and recent regulator orders to banks to slow lending for investors, in particular, for interest only loans, and tightening lending criteria, are showing signs of working.

The increased regulatory pressure may be coming at a time when home-buyers are sensing that prices are extended, heeding the increasing volume of news reports and opinions that the property market is peaking. The RBA has been warning for about a year now about the increasing supply of apartments that are coming to market in the next couple of years.

Housing prices to drop 7pc, Citi says, 4 May – TheAustralian.com.au

UBS calls the top of Australia’s housing boom, 25 April – News.com.au

The regulators have steadily ratcheted up pressure on banks since 2014 to improve the quality of their lending, setting speed limits of lending growth to investors, requiring banks to hold more capital, and pay more attention to documentation on borrowers’ financial status. About a year ago this resulted in banks significantly cutting bank lending to foreign investors.

However, on the other side of the coin, demand for housing investment has increased from foreigners, particularly from China, and investors that have ongoing and even increased incentive to borrow to invest. Investors have always had strong incentive to invest in housing due to the combined effect of negative gearing and capital gains concessions. Australians have two main forms of long-term investment for retirement, superannuation funds, and housing investment. And rules around super-funds may have also shifted incentives towards property investment late last year.

The housing market outlook is increasingly complex with factors such as taxes in Canada on foreign investment, tough rhetoric from the Trump administration, Chinese property market curbs and capital controls, and access to finance from foreign banks and non-banks all factors to consider.

Domestically, macroprudential controls on Australian banks, government taxation, retirement saving funds rules, and immigration policy all feature in the mix.

The Federal Government budget is to be delivered on Tuesday 9 May. The Treasurer has said he will not change the tax concessions for investors on negative gearing and capital gains tax. This might be seen as removing a significant downside risk for the housing market. On the other hand, it appears to be making it harder for investors using non-recourse borrowing in the regulated self-managed retirement funds to invest in property. And the Federal government is also expected to lead the way for the states in releasing land available for housing development in Melbourne and Sydney.

Budget 2017: Scott Morrison flags further action if housing market fails to cool, 3 May – SMH.com.au

Another botched job on superannuation emerges, 3 May – TheAustralian.com.au

AUD hit by a Confluence of factors

A confluence of factors appears to have seen a sudden drop in the AUD on Wednesday. It was starting to look expensive relative to CAD and NZD, and the market may have seen some synergies with the banking/mortgage/housing developments in Canada and Australia.

Australian bank share prices fell sharply on Wednesday, it seems in response to the earnings results of ANZ bank, but perhaps also with one eye on the weak bank performance in Canada and evidence of a peaking in the housing market.

Australian mortgage insurer, Genworth reported a jump in delinquencies in its portfolio by 18% in Q1 from a year earlier. It appears that non-performing loans at banks are rising albeit from low levels.

Commodity prices, particularly for metals (copper down 4.5% and iron ore down 6.6%), fell sharply on Wednesday. This may reflect a pullback in China’s manufacturing PMI indicators reported on Sunday and Monday. Chinese interest rates and corporate bond yields have been creeping up to new highs for the year, while Chinese equities and currency have been relatively weak in Asia, suggesting nerves are growing over regulatory efforts to contain credit excesses in China.

The USD was also firmer after the FOMC meeting on Wednesday tended to dismiss recent weakness in Q1 indicators as transitory, suggesting it remains on the same path of policy tightening, largely in place since December last year.

The AUD has fallen to a new low since January, and it may continue to trend lower. However, there are two-way risks with US economic reports mixed, Trump policy agenda facing and uphill battle in Congress, Infrastructure fiscal spending expected to be announced in the Australian budget next week, stronger global growth trends, and the likelihood that China will act to maintain a stable growth outlook ahead of a twice decade leadership shuffle later this year.