Dollar down-trend becoming entrenched

Weak dollar trend taking hold

An important point to recognise is how broad-based the fall in the USD has been this week, extending across currencies and commodities priced in dollars. A catalyst may have been the EU fiscal package, helping push the next most significant global currency (the EUR) higher, but it’s clear that the USD is the weakest link.

Broad dollar indices have broken below their June lows, extending the USD down-trend since May

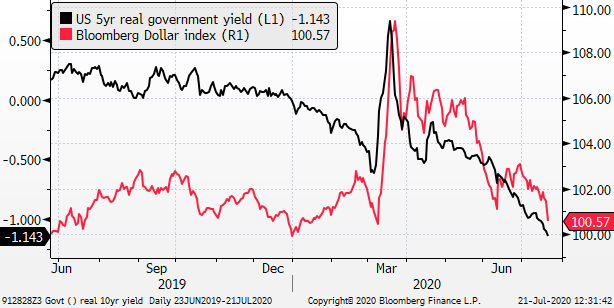

In reviewing the price action for the USD this year, it spiked in March as fear of the global economic fallout from the spread of COVID reached its peak. This was accompanied by a crash in USD term liquidity and a spike in USD borrowing costs. The Fed responded with unprecedented quantitative policies, directly injecting liquidity and supporting credit markets.

The Fed actions dropped what had been relatively high US real yields to very low real yields, crushing the USD yield advantage to levels not seen since the response to the Great Recession. This set the stage for a weaker USD.

A weaker USD has taken time to develop because the USD and US assets are the primary safe haven, and only as global investor risk appetite has improved have conditions become more conducive to a weaker USD.

USA 5-year real yield plunge in recent months to deeply negative levels, to a low since 2013

A catalyst for risk appetite

Importantly, a weaker USD is itself a catalyst for stronger global risk appetite. As the USD weakens it provides a reinforcing virtual circle for stronger global high yield assets, including commodity and emerging-market assets.

A weaker USD drives up commodity prices, and hence commodity assets and currencies. It reduces the cost of finance in emerging market countries that have borrowed in USD. It allows emerging market countries to lower interest rates in their own countries because capital is flowing to their currency and assets.

The argument for stronger EM and commodity assets may be that investors are seeking growth opportunities in non-USD equities and higher-yielding assets. However, the weaker USD may become a theme in its own right, encouraging speculation against the USD, and investors buying EM and commodity currencies to bet against the USD.

Weak USD fundamentals

A weaker USD may then place more focus on weak USD fundamentals. Analysts may start to predict deeper falls in the USD based on political dysfunction, out of control fiscal spending, poor handling of the COVID crisis, and extreme low real interest rates engineered by the Fed.

The Fed has arguably been pushing for a weaker USD to help boost the growth outlook for the US economy and lift inflation expectations. The US administration has frequently called for a weaker USD. The Fed and the administration are more closely aligned on policy than they have been at any time.

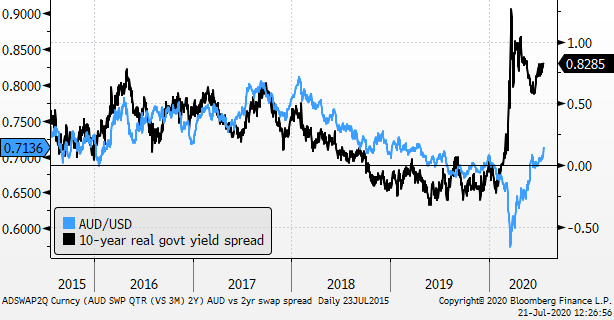

AUD accelerates as it breaks above the June high and 2019 year-end high both around 0.700. This has been a significant pivotal region for the AUD. The AUD appears to have broken out of a downtrend over the last few years since Jan-2018

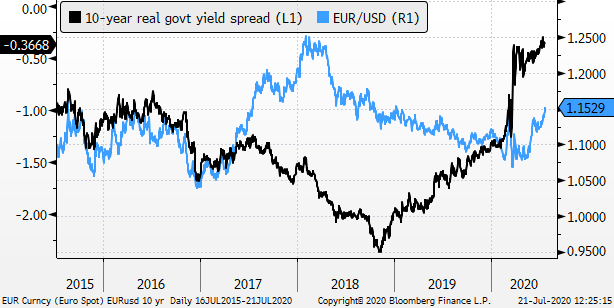

The EUR has broken above the June high and the short-lived spike high in March. It has broken above 1.150, a pivotal level over recent years – around the peak during the early years of the ECB QE and negative rate policy in 2015/2016, and base (neckline) of the 2017/2018 peak. The EUR appears to have broken a downtrend since Jan-2018

The real 10-year yield disadvantage of the EUR has plunged to the low in over 5-years and may argue for significant further rebound in the EUR

The real 10-year yield advantage for the AUD has risen sharply (from negative territory at the beginning of the year) to above the highs of the previous 5-years and could argue for a significant further rebound in the AUD

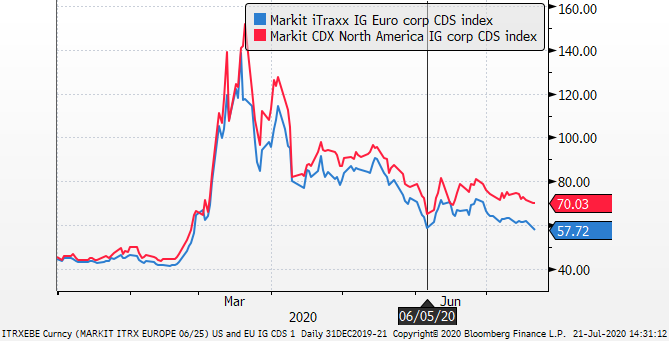

Investment Grade Corporate CDS indices fall to a new low in the Eurozone since Feb, widening the gap below USA indices. This may reflect stronger expectations for the health of Eurozone companies and the relative strength of the central banks’ QE programs targeting private-sector assets

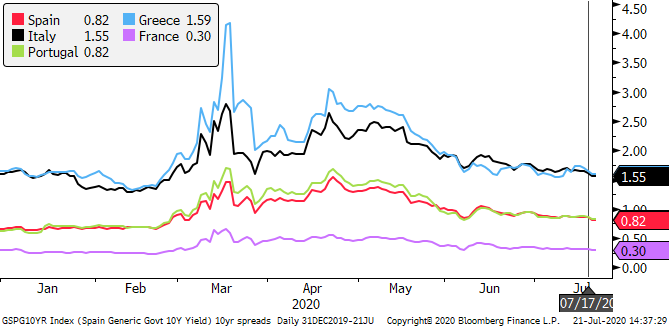

10-year Eurozone periphery yield spreads over German government bonds move to a new low since February

AUD leads the rebound in major currencies

The AUD has been one of the most consistent gainers over recent months, including this week. Key factors supporting the currency are strong gains in iron ore and energy prices in recent months. As Brazil struggles to lift its iron ore output, Australian producers are benefiting from stronger demand from China. Australia has established a solid trade surplus and persistent current account surplus.

The Australian economy is facing severe disruption as are all in the world from the COVID crisis. A renewed surge in cases and restrictions reimposed on social activity in the state of Victoria is causing some setback in the outlook for economic recovery. However, the RBA has indicated that it is in no hurry to expand its policy easing measures which it thinks are effective. While these are significant with cash rates in the low teens and yield curve control centred on a 0.25% 3-year rate target, the RBA has rejected calls to consider negative rates or set a quantitative asset purchase target.

Furthermore, the RBA sees the AUD as consistent with its fundamentals and does not think intervention to cap the AUD or push it lower will be effective.

The Australian government has announced a tapered extension of its key fiscal measures to support the labour market and have proved to be relatively effective, along with state governments, in containing the COVID outbreak and supporting the economy with fiscal policy. The government is in a relatively strong fiscal position and has significant firepower to support the economy.

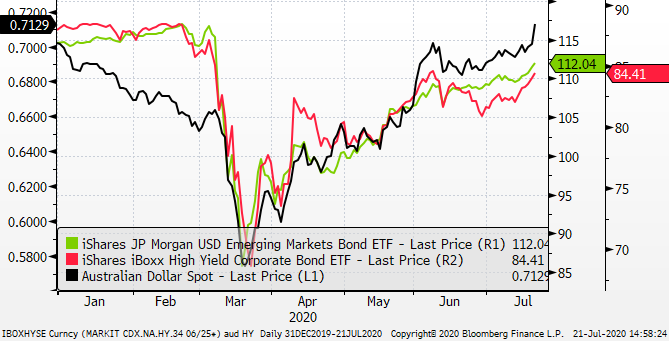

The AUD has been highly correlated with measures of risk appetite such as high yield and emerging market credit spreads. These spreads have narrowed to a low since March. However, the pop in the AUD in the last day may make it seem that it has moved ahead of the rebound in risk appetite

The rise in the AUD in the last day also looks a bit too rapid compared to a more moderate rise in US equities. Nevertheless, US equities are at a high since Feb, and the move up in the AUD may reflect a clearer broad-based fall in the USD