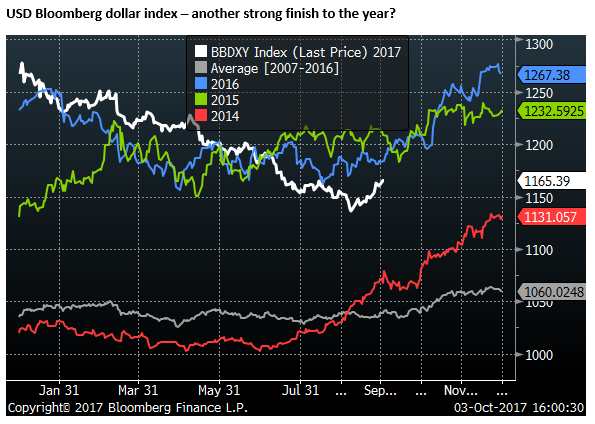

The dollar has made a habit of year-end rallies

The USD has finished each of the last three years with a run higher, and it may again end on a strong note as the market looks forward to tax reform. The market is trading cautiously, facing a number of global uncertainties. There is underlying strength in the US economy that appears to be underappreciated, but may support a strong year-end finish in the dollar. Global growth remains buoyant, and emerging market assets have rebounded in recent sessions. It is possible that they spoil the dollar’s year-end party. However, demand for EM markets is unlikely to spill over to the AUD and NZD; low and diminishing yield advantage, and sluggish equities are likely to weigh on their performance.

Markets facing uncertainties

multiple events have distracted the market in recent weeks: German election uncertainty; Catalan separatist unrest in Spain; US tax plan announcements; speculation over the next Fed Chair; Puerto Rico’s disaster; the latest USA mass shooting; Trump threatening comments on NKorea; Japanese snap election called on 22 October; a rise of a new Japanese political force; and speculation over UK government unity.

The market is also contending with upcoming uncertainty related to China’s 19th National Congress of the Communist Party opening on 18 October, and whether it shifts its priorities towards containing shadow banking risks. How US tax policy progresses, if NKorea decides to up the ante on its war of words with Trump or test missiles, the next general election in Italy (due before 20 May 2018). The ECB is also set to announce its plan for its QE policy next year at its 26 October meeting. The Fed begins its QT in October.

Meanwhile, China and Korean markets are closed this week, making it harder to interpret developments such as a rebound in China’s PMIs to multi-year highs, and surge in Korean exports (+35%y/y in September).

Many of these events are distractions from the underlying trends, but they may be leading to a degree of inertia in investor behaviour. The USD is holding most of its recent gains, but the market appears unsure; drifting and lacking conviction.

Underlying strength in the USA

In the midst of these distractions, the market appears to have paid little attention to stronger US economic data that preceded the hurricanes and in recent sentiment and business surveys.

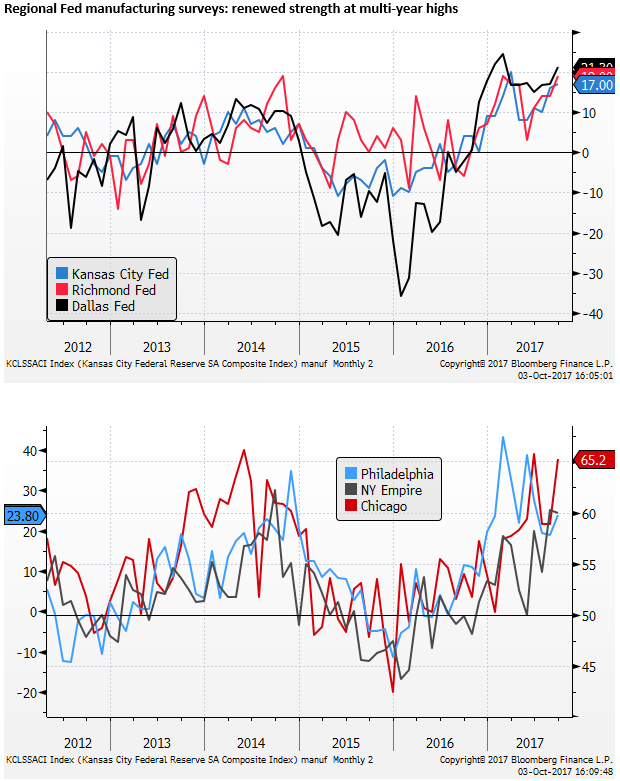

US regional manufacturing surveys were strong in September. Even the Dallas Fed index rose in September, showing little negative impact from the flooding in Houston. In fact, it suggests that businesses in Texas see replacement activity already boosting activity.

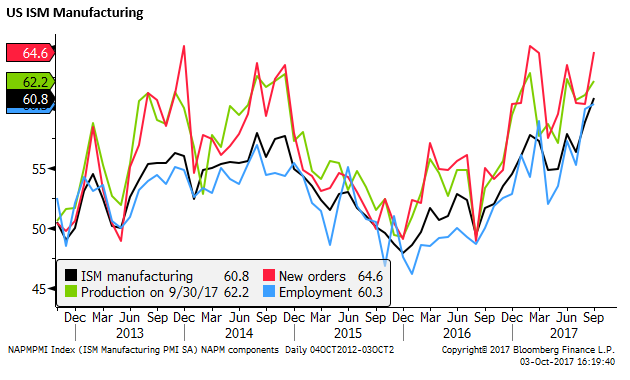

The national ISM manufacturing survey boomed to 60.8 in September, a high since 2004. The employment component rose to 60.3, a high since 2011. New orders rose to 64.6; elevated all year ranging between 57.5 and 65.1.

Fear of weak inflation may be alleviated by a rise in the ISM manufacturing prices component to 71.5, a high since 2011. Higher prices may reflect shortages resulting from hurricane disruption, but they nevertheless suggest inflation will be firmer in coming months.

US employment indicators strong

The market is bracing for a drop in payrolls on Friday on a recent surge in unemployment claims in September related to hurricane disruption. The market is likely to pay little attention to this data (unless it is surprisingly strong).

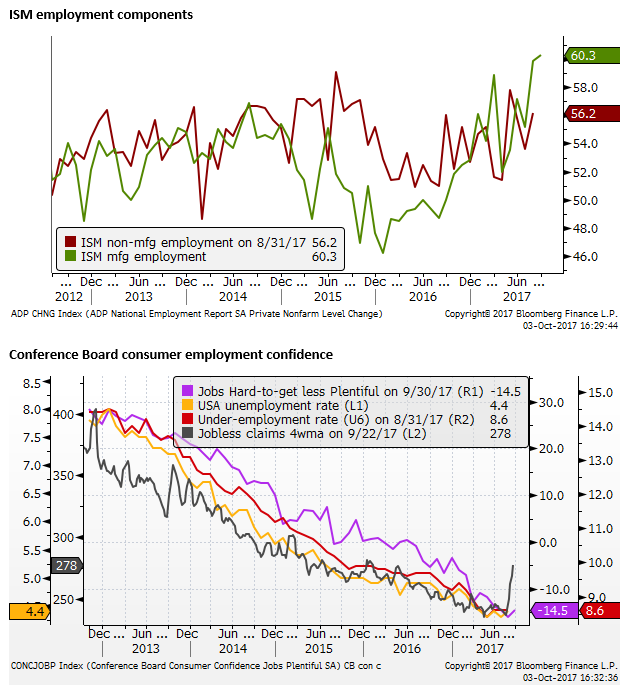

But ahead of the disruption, employment indicators were getting stronger. Unemployment claims were around the low for the year in late-August. ISM employment components were around multi-year highs. The Conference Board consumer survey showed the difference between jobs-hard-to-get and jobs-plentiful at a low since 2001. JOLTS job openings and quits rate was at a cyclical high.

The August jobs report was weaker than expected, but this has been the case for seven years in a row, followed by an upward revision typically in the September report. Another upward revision appears likely this week.

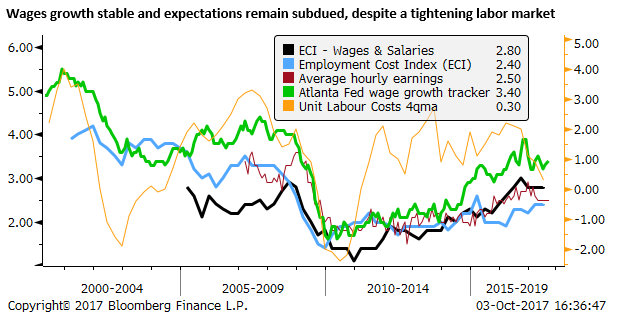

Given the evidence of labor market tightening, we need to watch wages growth; expectations remain subdued.

A habit of strong finishes

The USD has made a habit of year-end rallies over the last three years and on average over the last 10-years. On cue, we may be seeing another strong finish for the USD this year.

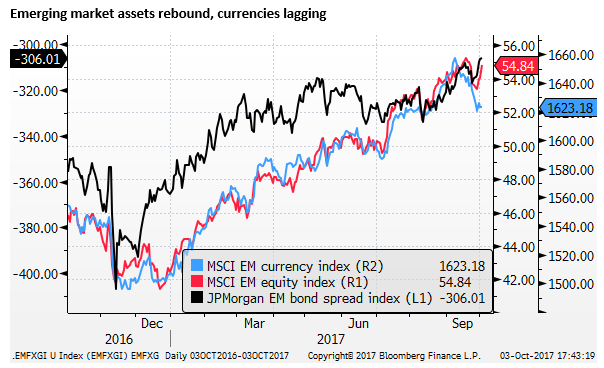

Emerging Markets still attracting demand

The outlook for global growth and emerging markets are still upbeat, and this may be a reason to doubt ongoing strength in the USD.

In recent days we have seen China’s national manufacturing PMI rise to a high since 2012 (52.4 in Sep). (Although this looks at odds with the softer national activity indicators including industrial production and fixed asset investment in August.)

China’s services PMI also rebounded to 55.4 in Sep, a high since 2014. Most Asian countries are showing strong growth in exports and industrial production.

The chart below shows that emerging market equities and bond markets have rebounded in trading this week after a short-lived correction in the last week or two of September. This suggests downside in emerging market currencies may be limited.

AUD and NZD Headwinds

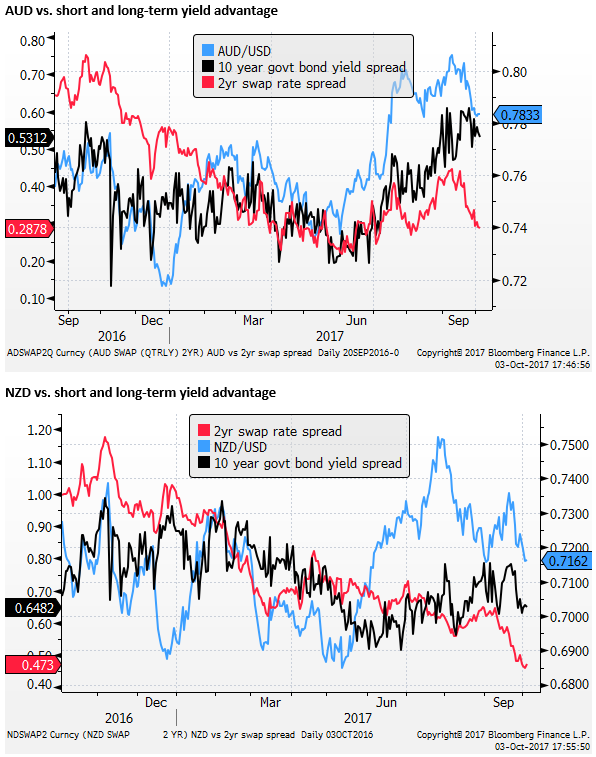

However, we see less reason for Australia and New Zealand currencies to recover. While their economies are likely to benefit from stronger global growth, they appear to be facing greater headwinds.

New Zealand business confidence surveys have deteriorated significantly in September (Both the monthly ANZ and quarterly NZIER survey data fell). In part, this may relate to greater political uncertainty since the national election on 23 September. The make-up of the next government remains in the hands of the populist NZ First Party that holds the balance of power.

The housing market in New Zealand has turned down, and appears to be slowing more clearly in Australia. Both nations are burdened with high levels of household debt, and rate hikes remain unlikely for the foreseeable future. Their yield advantage has diminished. Any updraft from Asian market strength is unlikely to spill over much to these currencies.