Dollar saved by the Fed

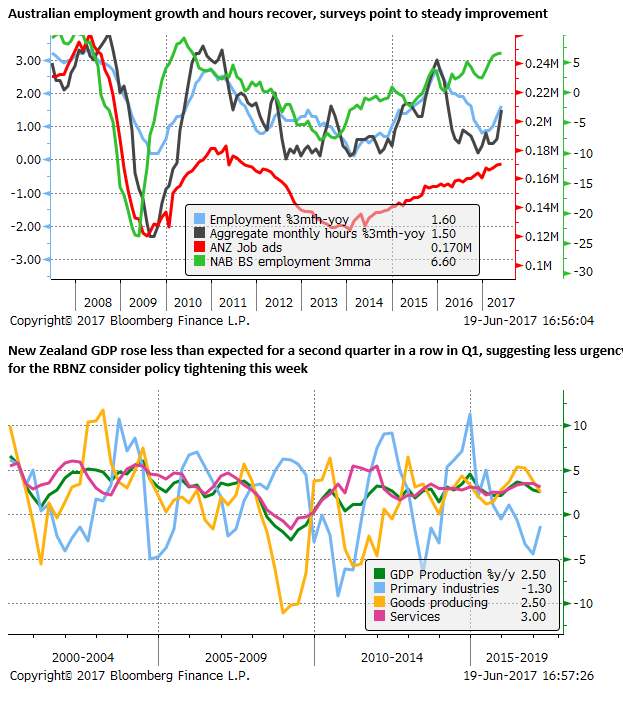

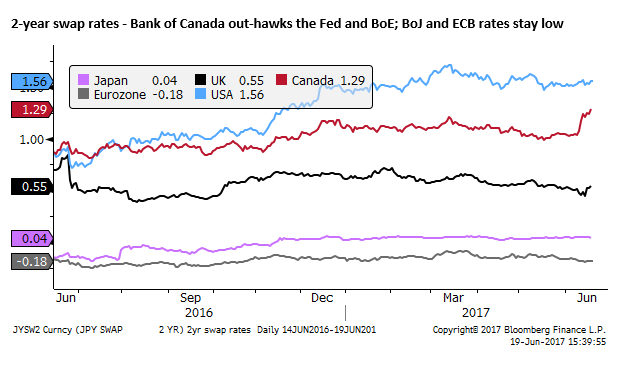

The USD was in crucial danger of being slammed last week after weak CPI inflation data, but has been saved by the Fed sticking to its guns. The USD may be in the process of a technically inspired bounce, but the USA economy lacks oomph, inflation indicators have weakened, including market and surveyed expectations, and political uncertainty remains. So it’s hard to anticipate a sustained rebound. The BoE and BoC turned to a tightening bias last week, while the BoJ joined the ECB in reasserting its current ultra-easy settings. The CAD has bounced sharply, boosted by higher rates, but still faces risks from a renewed slide in oil prices and its housing market. GBP has struggled since the Tories lost their outright parliamentary majority. The UK no longer has a clear plan or common purpose to conduct Brexit negotiations and is facing a period of stagflation (rising inflation and weaker growth). EUR has been surprisingly soft in light of French election results and tightening credit spreads, but it may be consolidating gains in April/May. The EUR has stalled since the ECB downgraded its inflation forecasts at it 8 June policy meeting. USD/JPY and US yields appear to have shifted momentum, at least in the short term, stabilizing and firming in recent sessions. AUD and NZD may have completed their latest swing from oversold levels in May to overbought conditions. Stronger employment data in Australia helped complete AUD’s latest upswing. China’s bond markets have recovered in recent days, suggesting financial stress has eased, but the detention of Chinese insurance company, Anbang’s, chairman suggests financial risks are still present; posing a risk for AUD. We expect little change in the RBNZ policy statement this week and political risk may begin to undermine the NZD as the 23 September election draws nearer. There is a lot of disparate macro developments but no dominant theme.

Saved by the Fed

The USD was in crucial danger of being slammed last week after much weaker than expected CPI inflation data. But it was saved by the Fed, which chose to stay the course with its monetary policy normalization, striking an optimistic tone that the recent slump in inflation may be temporary, economic growth would continue on a moderate path and the labor market was already tight and would tighten further.

The Fed pushed on with its third hike on a quarterly schedule, the fourth hike in this cycle. And it outlined a plan to wind-down its balance sheet expected to begin this year. It stuck to its forecast of three hikes per year for this year and the next two years.

The NY Fed President Dudley reaffirmed the optimistic tone on Monday helping bolster the USD.

The USD has been a bit more volatile in June after breaking below the lows just preceding the Trump election in November last year. In the midst of its fall inspired by the weak CPI report, the dollar appeared vulnerable to slumping further to test lows since 2014. However, in the wake of the Fed’s relatively hawkish tone, the dollar may now experience a technical rebound towards downtrend resistance levels (see chart below).

US Economic reports not exactly working for the dollar

A limiting factor for the USD rebound at this stage is mixed economic data and weaker inflation, including inflation expectations. The market will question the Fed’s resolve to stick to its planned normalization of policy. Faltering confidence in the Trump administration has been weighing on the USD most of this year and this may continue to be a negative factor. At this stage, there is little to suggest that the USD will begin a sustained uptrend.

The Atlanta Fed’s GDPNow forecast has slipped through the second quarter from above 4.0% earlier in the quarter to 2.9% last week. The New York Fed Nowcast concurs; it has slipped from around 3.0% to 1.9% last week. After posting only 1.2% q/q saar growth in Q1, this would be a modest rebound in Q2.

The New York Fed’s survey of consumers, found that 3-year inflation expectations slipped to 2.47% in May (ahead of the latest weak inflation result), returning to lows earlier in the year.

The Citibank economic surprise index for the USA has fallen sharply to -77.5%; if you want to find a positive spin, it may be that rarely does this index fall any lower and the US may be due to show better economic results.

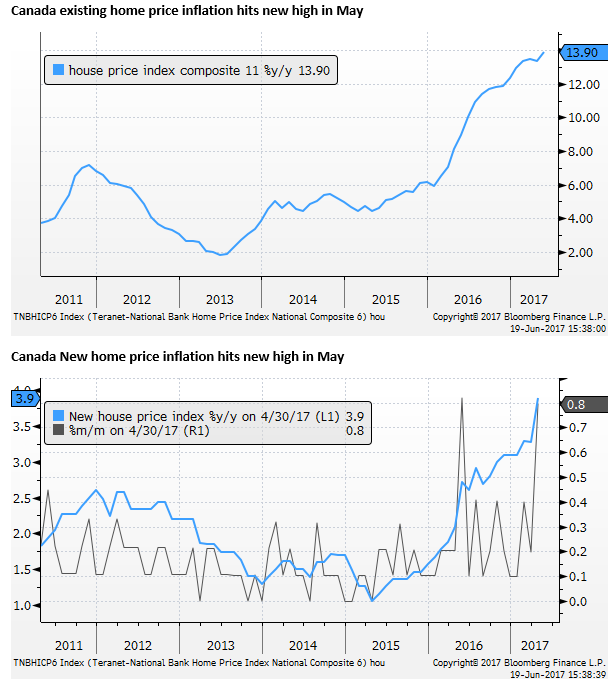

CAD surged on Bank of Canada tightening bias

CAD surged on a shift to a tightening bias by the Bank of Canada on Monday 12 June, catching the market completely wrong-footed with a record short CAD position. The CAD had been relatively weak this year, weighed down by weaker oil prices, a near failure by a mortgage lender, and a rating downgrade of its banks. However, economic reports have been stronger this year and house price growth accelerated in May.

Oil prices slide still a risk to the USD and commodity currencies

On Wednesday 14 June, oil prices dropped to lows for the year on the monthly report from the International Energy Agency (IEA) and weekly report from the US Energy Information Agency (EIA). The IEA point to rising supply despite the OPEC production cut agreement, driven mainly by the US and other non-OPEC producers, but also from OPEC producers (Libya and Nigeria) that are exempt from the production cut agreement. The IEA forecast a longer and more uncertain period before excess inventory is brought back down to more normal levels.

Oil prices may remain under pressure, dragging down global inflation expectations, and increasing risks of deterioration for energy producer currency. This may include the USA which is now a large swing variable in oil production.

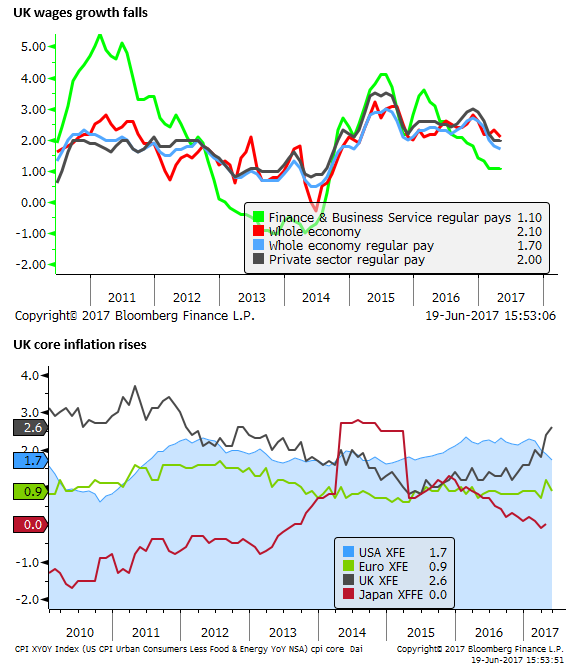

GBP stagflation risk and shift on BoE to tightening bias

On Tuesday, the UK reported sharply higher than expected CPI inflation, rising now well above the 2% inflation target for both headline (2.9%) and core (2.6%). However, on Wednesday, UK employment data was weaker than expected, including weaker wage inflation, pointing to a significant fall in real wages. On Thursday, retail sales were also weaker than expected, raising the specter of stagflation (rising inflation and weaker growth).

On Thursday, the Bank of England responded to the higher inflation trend with a more hawkish policy statement and a 5-3 split vote with three dissenters in favour of a rate hike.

The GBP slumped on 9 June on the election outcome where the Tories surprisingly lost their outright majority and PM May lost her mandate to negotiate a hard Brexit. The GBP is weaker because the UK no longer has a clear plan or common political purpose to conduct Brexit negotiations. Some investors may see a possible shift to a softer Brexit deal as a benefit for the GBP. However, with so much uncertainty, it is hard to see business confidence improving in the UK.

The GBP was buffeted last week by the mixed data and shift to a tightening bias. Also influencing economic confidence may be a serious of terror incidents and the Grenfell apartment tower fire disaster.

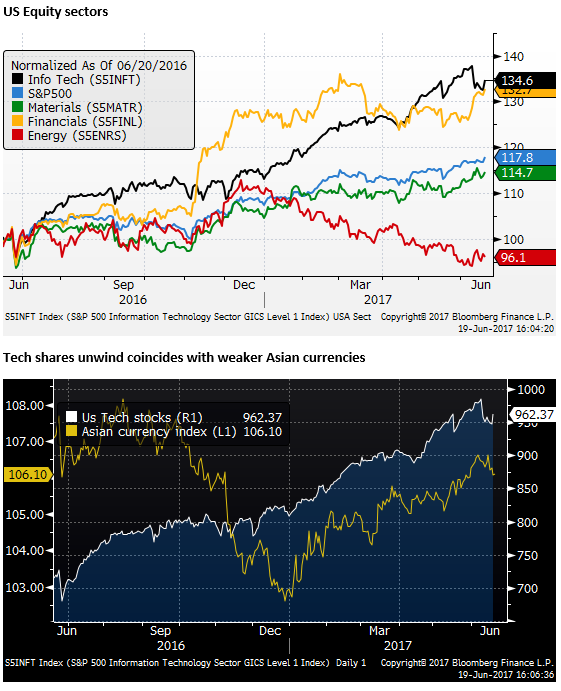

Tech shares correction

9 June was also notable for a sharp correction in high-flying technology equities. These shares remained weaker last week, but have started to recover on Monday this week. Nevertheless, the sector may be exhibiting signs of being overbought. Weaker tech shares may have contributed some recent weakness in Asian equities and currencies.

Amazon deal highlights disinflation pressure

On Friday 16 June, Amazon announced a takeover offer for a large grocery chain Wholefoods in the US. The move sparked renewed market focus on the disruptive nature of Amazon on traditional commerce. While the shares of Amazon have risen, and Wholefoods share prices jumped sharply to near the cash bid price offer, other retailers, globally have experience share price falls.

The market is seeing a greater risk of disruption from Amazons on-line presence, forcing greater competition and margin pressure. While Amazon and Wholefoods may take years to implement strategic change, presuming the deal goes ahead, the takeover highlights the deflationary influence of high-tech disruption in traditional commerce. The downward pressure on prices and margins, now extending more to grocery stores, may be seen as weighing on inflation expectations and global bond yields.

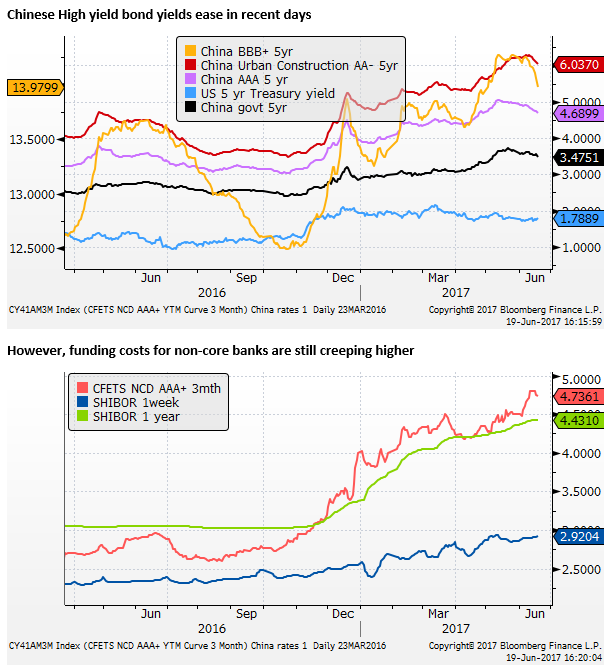

China’s clampdown on unwieldy insurance sector

On Tuesday last week, the Chairman of one of China’s largest insurance companies, Anbang, was detained by authorities for undisclosed reasons. The insurance sectors’ assets in China have surged in recent years. They have expanded investment into a wide range of domestic and global asset funded by high-yielding wealth management products (WMP). The apparent arrest suggests that the central government has increased efforts to control excesses in the industry, a large amount of which may reflect corruption by government officials to enrich themselves without regard to the broader financial risks on the economy.

It is widely presumed that China’s regulators will be careful to ensure financial stability ahead of the 19th National Congress of the Communist Party in October. However, it is evident that authorities are working more towards improving efficacy and stability in the financial sector this year. This threatens to tighten financial conditions in China and expose weakness in the system. Anbang and other insurance companies may find it more difficult to sell WMPS, potentially exposing weakness in their balance sheets (over-leverage and under-performing illiquid assets).

The Anbang Chairman Wu’s arrest adds to financial system risk in China and can act to weaken confidence in Chinese financial markets and spill over to weakness in other Asian markets; including the AUD that continues to perform as a proxy for financial risk in China.

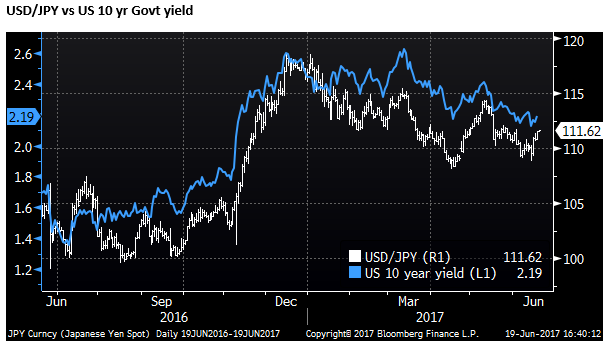

BOJ reaffirms easy monetary policy, JPY momentum swings

On Friday 16 June, the Bank of Japan maintained its ultra-easy monetary policy. This was as expected, although, after a week of more hawkish central bank actions (Bank of Canada, Bank of England, Fed), the market may have been looking for some shift by the BoJ, such as de-emphasizing the size of asset purchases further in deference to yield curve control. The JPY switched from being quite strong, pressing levels near 109 after the US CPI report to falling more rapidly than other currencies after the FOMC statement, rising above 111.

It is hard to say why the JPY swung around so much after the FOMC, especially since US yields were still lower last week, but it may be indicative of a shift in tone for the USD; the USD may have become oversold, and the rebound in USD/JPY may be leading a correction higher.

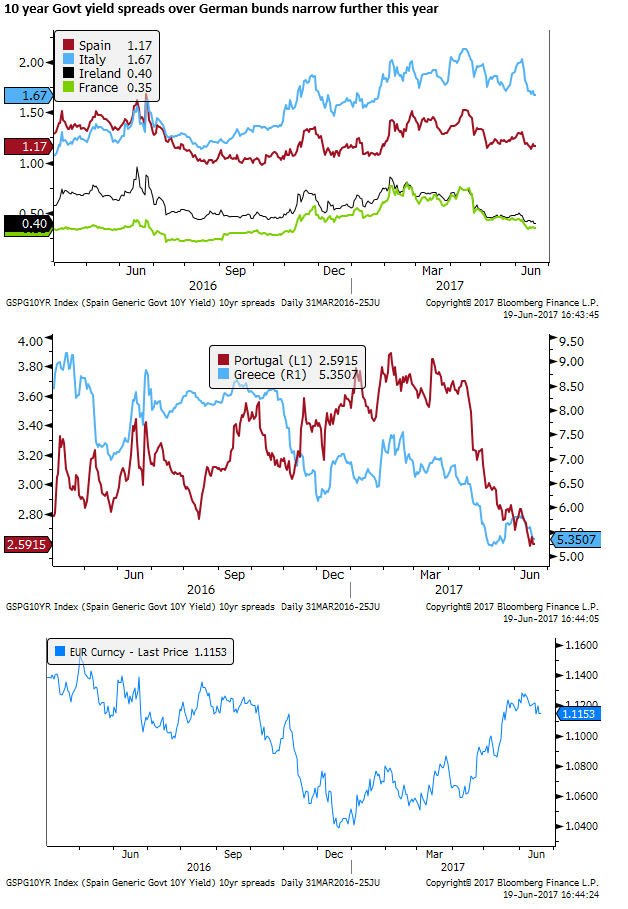

EUR sluggish in recent weeks despite tightening credit spreads

EUR has also been surprisingly soft in light of the convincing win by French President Macron’s new En Marche political movement securing a majority in parliamentary elections; resulting in significant further narrowing in French-German bond spreads, and falling corporate credit spreads in Europe.

It is not clear that we can blame the underperformance of EUR and JPY in the last week on monetary policy, but the ECB, like the BoJ, recommitted to its current QE program and downplayed prospects for more rapid normalization.

The ECB lowered its inflation forecasts for 2018/2019, whereas the Fed maintained its inflation forecast for the next two years. This is despite stable to slightly higher core inflation in the Eurozone in recent months and a sharp fall in US core inflation. EUR, like the JPY, may have become somewhat overbought in recent months, and vulnerable to a period of correction.

Commodity currencies whippy after recent strong run

The AUD and NZD have been surprisingly strong in the last month, including the last week. This may have started as a correction from an oversold position in May, where both currencies and CAD were weak relative to other major and emerging market currencies. However, they have now fully retraced losses in April and May.

In the last week, they have out-performed most other currencies. However, price action has become whippier around resistance levels. On Monday they are down and maybe starting to display signs of peaking again.

The further rise in AUD and NZD last week may have been led by the surprising shift in tone to a tightening bias by the Bank of Canada and surge in CAD.

AUD and NZD have parallels with CAD. All three are affected by high levels of household debt and rapid growth in house prices in recent years. Moody’s downgraded Canadian banks in May due to their exposure to the housing market. Moody’s followed suit in Australia on Monday, cutting ratings of all 12 banks, and their New Zealand subsidiaries. S&P downgraded regional banks in Australia in May.

The market may have become a bit wary that the RBA and RBNZ might emulate the Bank of Canada, and shift to a tightening bias.

It is not likely, but the market is right to be cautious. Australian employment growth has picked up this year. New Zealand data has ebbed recently, but retains a solid trend. NZ PMI surveys for manufacturing and service sectors both rose to robust levels, reported on Friday 16 June and Monday.