ECB and BoJ policy easing paths diverge

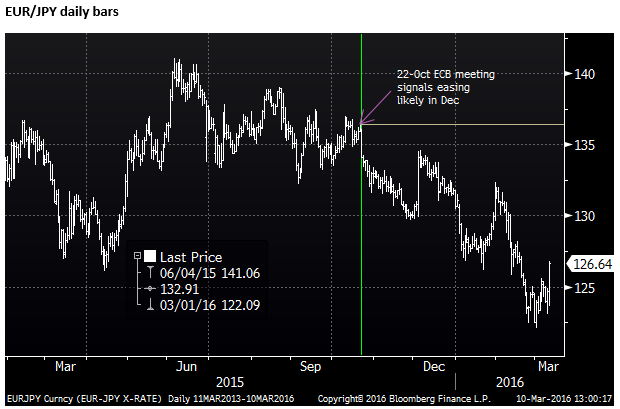

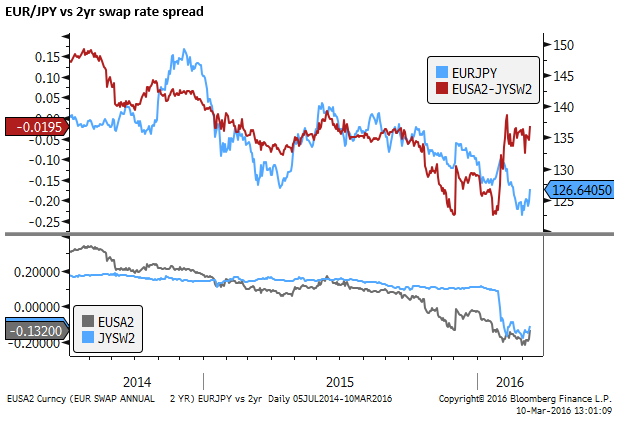

The ECB delivered a comprehensive set of further policy easing measures. But it eschewed the concept of a tiered rate policy, in contrast to the BoJ, and suggested that it was unlikely to target further declines in cash rates. Its policies are more focused on boosting domestic asset prices and domestic bank lending and place less emphasis on a weaker exchange rate policy. Since the ECB set its course to further ease policy at its 22-October 2015 policy meeting, the market has presumed that it favored lower interest rates. It has now signaled it has reached bottom on this path, just as the BoJ has diverted its attention to negative interest rates. As such, we see a case for a recovery in EUR/JPY, potentially retracing the significant fall since October last year.

ECB and BoJ policy easing paths diverge

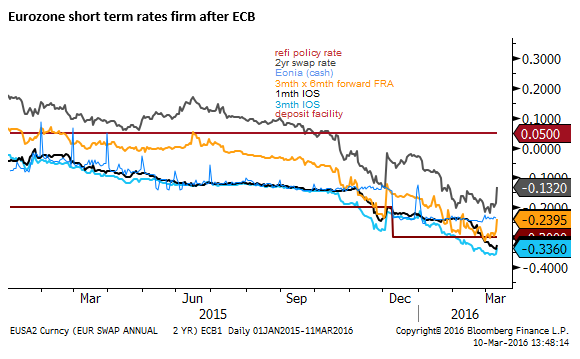

The ECB adopted significant further easing that was dominated by its focus on additional asset purchases and providing medium term funding support for banks. It did lower the key ECB deposit rate by 10bp to -0.40%, in line with market expectations. But it eschewed the idea of tiered interest rates such as that employed by the BoJ in January, and hinted that the ECB is reluctant to cut the deposit rate further.

The EUR fell initially as the overall package met or exceeded expectations in each type of policy measure, and introduced a few surprise elements. However, the EUR rebounded as Draghi suggested policy rate cuts may be done. He said, “The bottom line of this is that basically more and more of the emphasis would shift from rates instrument to other low conventional instruments.”

The policy measures employed are significant but are directed at lowering medium to longer term rates, lowering corporate credit spreads and incentivizing banks to lend more to the private sector, by linking ECB negative rate funding support to the amount of new bank lending over the next few years.

Overall, this might be quite effective in supporting asset prices in the Eurozone, but it does so in a way that tends focus on boosting domestic asset prices without weakening the exchange rate.

It maintains down-side pressure on the exchange rate by lowering the deposit rate to -40bp, but this was already anticipated. By reducing the probability that this rate might fall further and adopting policies that tend to boost equity prices and longer term bonds, including corporate bonds, it might in fact support the currency somewhat by attracting capital inflow to the region.

It would still be advantageous to fund carry trades in EUR, and ultimately this might limit upside in the EUR, but the market needs to adjust to the shift in focus away from further rate cuts by the ECB, and this might keep EUR on a rising trend in the near term.

In choosing this approach, the ECB now appears less focused on weakening its exchange rate compared to the BoJ. In contrast, the BoJ’s step down the path of a tiered interest rate structure suggests that it may yet pursue still lower cash rates that are aimed more clearly at a weaker exchange rate.

The recent backlash in Japan against the negative cash rate decision by the BoJ on 28 January has recently supported the JPY by appearing to discourage deeper cuts into negative territory. And the decision on Thursday by the ECB may make it still harder for the BoJ to cut deeper.

However, it has chosen its tiered path, and the ECB has now chosen its alternate unconventional policy route. As such, we may see the EUR/JPY rally further to unwind its significant fall over recent months. It would seem, the BoJ has more potential to lower its rates further at the front of its rates curve than the ECB.

ECB rates cut largely as expected

Policy rates were lowered. The key rate that essentially sets the effective market cash rate, the ECB deposit rate was cut from -30bp to -40bp (as was widely expected by the market). The ECB also lowered its other two policy rates by 5bp. The MRO that applies to the LTROs, was cut from +5bp to zero. And the MLF, which is more symbolic in this time of excess bank liquidity was cut from +30bp to +25bp. (neither of these two cuts were expected).

New TLTRO operations with potential for negative rates

The ECB introduced 4 new targeted longer-term refinancing operations (TLTROs) with 4-year maturities. The last will mature in March 2021, thus extending the downward pressure on medium to longer term yields, allowing banks to lock in low cost funding against their portfolio of loan assets.

The TLTROs begin in June and occur quarterly.

Importantly, the maximum rate of interest banks’ pay on these loans is the ECB’s MRO policy rate set at zero (lowered from +5bp), but banks may actually get paid (i.e. negative rates may apply) if they lend more than a certain benchmark. That rate may be as low as the ECB deposit rate of -40bp (lowered from -30bp).

The aim of these new TLTROs is to alleviate the downward pressure on banks’ profits, a key concern that has increased since market interest rates turned negative, and encourage banks to lend more, to take advantage of the negative interest rates than may apply to the TLTROs.

Banks will be able to borrow via the TLTROs up to 30% of their total eligible loans (loans to euro area non-financial corporations and households excluding loans to households for house purchase).

The benchmark threshold banks must exceed to achieve negative rates on the TLTROs (get paid by the ECB to take their money) is complicated, and I am not sure I fully understand it.

But it appears to go like this. If a bank’s net lending (the increase in loans) in the period from Feb-2016 to Jan-2018 (over two years) exceeds a certain benchmark threshold, then the bank is eligible to receive a discount on its TLTRO borrowed amount (get paid by the ECB) as much as 40bp.

The benchmark is based on net lending (the increase in loans) in the year-ended Jan-2016. If banks increase lending over this period, the benchmark is zero. If net lending falls over this period, the benchmark is “equal to the eligible net lending in that period”.

That doesn’t make sense to me but it appears to on one hand incentivize banks to at least achieve net positive net lending over this year, and incentivize them to lend more in the next two years.

I will wait for banks closer to the ECB to provide their analysis on the details as I fail to make full sense of their press release (my time is better spent elsewhere).

ECB announces new series of targeted longer-term refinancing operations (TLTRO II) – ecb.europa.eu

More asset purchases, and corporate bonds now included

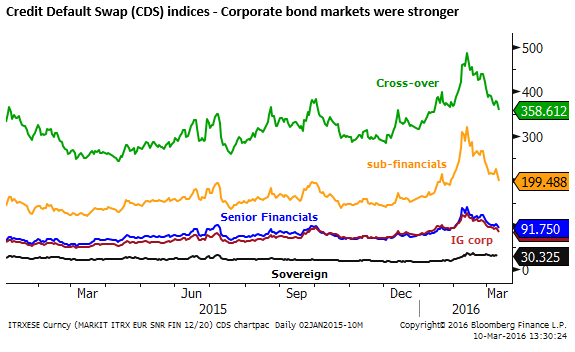

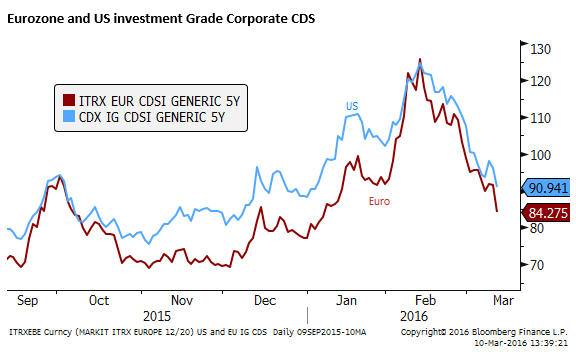

The asset purchase program was increased in size from EUR60bn per month to EUR80bn per month, and includes for the first time non-bank investment grade corporate bonds.

It doesn’t specify what amount of corporate bonds will be purchased, but this should tighten spreads in the corporate bond market and support company share prices.

It should increase borrowing opportunities directly for corporates. By displacing demand to other bonds and assets, including bank issued bonds, it should also make it easier for banks to raise capital to help repair their balance sheet and provide capacity to lend more to the private sector (and take advantage of the TLTRO negative rates on offer).

Draghi also noted that the TLTROs will help banks in an environment of large upcoming bank bond redemptions “in an environment where the price of bank debt is volatile and uncertain”. His words suggest that the combined policies were in part designed to help boost bank profitability.

The Asset purchases are intended to run until end-March 2017 (unchanged since the 6mth extension made in December). The ECB continues to say it will be extended if necessary, until the ECB “sees a sustained adjustment in the path of inflation”.

Tiered rate policy rejected

The ECB has effectively rejected the idea of tiered interest rates on banks’ excess reserves on deposit at the ECB (as was recently adopted by the BoJ), and this is seen as limiting the scope to cut effective cash rates further.

The tiered rate system adopted by the BoJ was designed to protect banks’ profitability as the marginal (lowest tier) rate was cut into negative territory. The ECB has adopted an alternative method of protecting bank profitability, but introducing negative rates on TLTROs (if banks lend enough to the private sector).

The ECB’s method emphasizes lower medium to long term funding costs for banks and specifically encourages them to lend more. In this sense it appears to be more targeted at lifting domestic demand in the economy. However, it also appears to lessen the capacity of the ECB to cut its deposit rate much further.

Draghi stumbled on his words quite a bit when discussing the potential for rates to be cut further; probably because he was aware that the EUR might rally if he didn’t choose his words carefully. Indeed it did rally and the meaning taken by the market was that the ECB can see more problems than before with rates that are cut too far below zero, and it is pretty much done on this front.

Draghi said, “We’re also aware that — by the way, here, there are different views about whether negative rates have affected or how they affect the profitability of the banking system. We can discuss this later. But let me ask you — let me tell you — does it mean that any negative rate will be posited? Doesn’t mean that we can go as negative as we want without having any consequence on the banking system?”

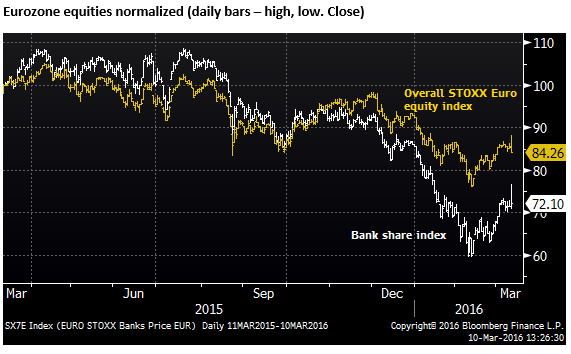

Eurozone Asset markets response

Given the emphasis on supporting bank profitability, it is surprising to see European share for banks reverse most of the gains made on the ECB announcement; although bank shares did finish up 0.9%, better than the 1.4% fall in overall Eurozone equites.

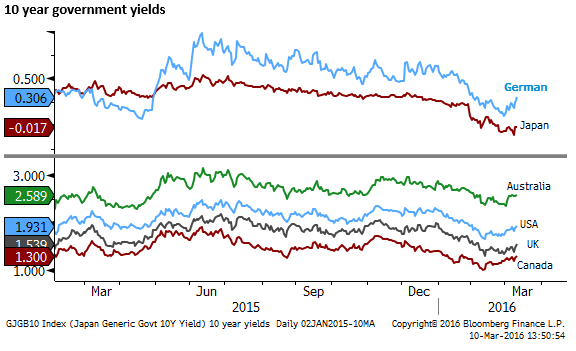

German government yields also rose on the day, notwithstanding an announcement of more ECB asset purchases. This might be regarded as a sign that the ECB policy has encouraged investors to sell Bunds in favour of higher yielding assets; including corporate bonds. Yields in other countries also rose