ECB and BoJ buckle in for the long haul

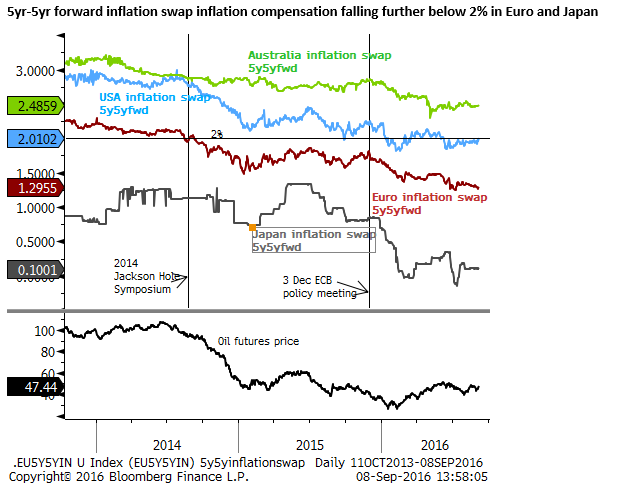

Policy inertia at the major central banks may be contributing to a low degree of commitment in FX and rates markets leaving them subject to flights of fancy of short-term speculators. The greatest uncertainty appears to relate to Japanese financial markets and intentions of Japanese policymakers. While there has been much discussion in the market over the timing of Fed policy hikes contributing to volatility, the odd angry swing in the JPY appears to be setting the tone in FX markets and to some extent rates and equities. On Thursday, after the ECB displayed its inertia, an initial rise in EUR was wiped out by a sharp rise in USD/JPY reversing part of its equally confusing sharp fall earlier this week. The rebounding USD/JPY spilled over to a broader rally in the USD and some risk aversion and correction in equities and commodity currencies. Oil shot higher after US inventories fell on what appeared largely related to US storms rather than any fundamental shift. This also contributed to some broader risk aversion and emphasized the skittishness in the market. The BoJ policy meeting on 21 September may help resolve uncertain and trendless asset markets. Recent speeches by BoJ Governor Kuroda and his deputy Nakaso suggest that the BoJ is looking to reset policy to make it more sustainable for a long haul battle to lift inflation, insistent that they will not reduce the “level” of easing. This appears to mean raising longer-term yields to take the pressure off financial institutions’ profits and a deeper NIRP to lower short-term yields and even out the overall impact on the yield curve. A reverse of the Fed’s 2011/12 operation twist. The Japanese rates market appears less convinced that short-term rates will fall, with yields overall higher since the 29 July BoJ policy meeting. As such a deeper NIRP may still be seen as a shock to a skittish market. This may end up being negative for JPY and spark a rally in the USD, but you couldn’t bet the house on it given the way JPY has traded this year.

ECB and BoJ buckle in for the long haul

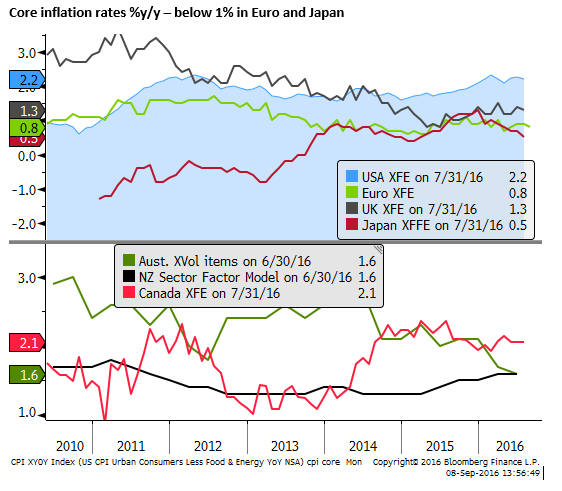

Central bankers are reluctant to come out and say it, but reading between the lines and their lack of action in the face of declining inflation outlooks this year, suggest that they see limited scope for further policy easing.

ECB president Draghi said no new measures (buying equities, helicopter money) were discussed. The Governing Council didn’t even discuss extending the current end-date of the QE purchase program beyond March next year, even though it is widely expected that they will. Draghi only offered glibly that the current policy settings are working in lowering borrowing costs and generating growth (weak to modest) in credit aggregates. Meanwhile, it edged lower its inflation forecast next year from 1.3% to 1.2%y/y, leaving unchanged its 2018 forecast at 1.8%.

Similarly, the BoJ has made marginal changes in its policy since it cut its cash rate target 20bp to -0.1% on 29 January despite clearly falling actual and expected core inflation, more than 1.5% below its 2% target. In the last week it has emphasized that it needs to look more closely at the costs of this policy in comparison to the benefits, highlighted the drawbacks of QQE with NIRP, leant on the idea that Japan has ‘adaptive’ rather than ‘forward-looking’ expectations formation to justify extending the horizon for achieving its inflation target to a now unspecified “as soon as possible”.

It appears that the current set of policy options have been pushed close to their limits. Further expanding purchases of bonds is difficult when they already own a large share of outstandings and yields are already so low, below negative across a large share of the market. Cutting rates further when they are already negative risks further undermining financial institutions’ profits to the point where it might impair credit creation going forward and undermine confidence.

Alternative easing options such as helicopter money or FX intervention appear to be outside their legally allowable policy options and are too controversial at this stage to consider.

Central bankers appear to be tweaking their current policy settings to prepare for a sustainable period of implementation, acknowledging that the battle to generate higher inflation may take a lot longer. But they are reluctant to push these policies harder or try new measures.

They are now crossing their fingers and hoping that current policy will do the job if given enough time. They are putting faith in higher oil prices helping lift those adaptive inflation expectations next year.

Part of this acceptance that policy is near its limits is apparent in more vocal appeals by central bankers to governments to speed up structural reform and expand fiscal policy (in a politically-correct manner of course; i.e. in ways that are sustainable and productive).

Fiscal policy support is being implemented in China, Japan, UK, Canada and a few other countries. However, political impediments and a lack of fiscal space are restricting overall fiscal expansion, particularly in the Eurozone.

This inertia in central bank policy is contributing to complicated and uncertain financial markets, especially FX markets.

BoJ may implement operation twist

At the top of this list of uncertainty is Japanese financial markets. They appear to be spilling over to volatility in other markets and there is a risk that this spills over to broad global risk aversion and sharp correction in asset prices.

The rapid appreciation in the JPY this year is not easy to explain considering that Japanese rates and yields fell increasingly into negative territory. Conventional thinking would suggest that negative rates and yields should weaken the exchange rate.

But the rising JPY itself helped drive Japanese yields lower, undermining corporate profits and inflation expectations. In turn, undermining bank profits and their stock prices as the yield curve flattened. And reinforcing a home bias in Japan to avoid foreign currency exposure (even though they were buying more foreign bonds).

The obvious solution was FX intervention to break this doom loop, but the rising JPY revealed a political reluctance to use intervention policy to stabilize the JPY and a hamstrung BoJ that was equally incapable of stabilizing the currency. The BoJ may have had room to cut its negative interest rate further, but this failed spectacularly to halt the JPY rise in January and appeared to be part of the problem by undermining bank profits.

While the BoJ appears to have run out of willingness or scope to further significantly expand monetary policy easing (even though they claim otherwise), the severe flattening in its yield curve, resulting in weaker financial institutions’ profits, detracting from economic confidence, appears to have convinced them to rejig existing policy to allow longer term rates to rise.

However, this would not be an easing in policy. Conventional thinking suggests that higher yields long or short term is a tightening of monetary policy. Although there seems to be some confusion over what is and isn’t policy easing when yield curves are low, flat and largely negative.

The BoJ claims that it has no intention of reducing the “level” of monetary policy easing. As such, if it would like higher longer term yields then it might be planning to lower short-term yields. This suggests that it may edge lower its cash rate target below -0.1%.

They seem to argue against a major change in the level of policy, but want to reset policy to be more sustainable for a long fight against deflation. The most sensible approach may be a modest further cut in NIRP, pushing down short-term yields and less buying of longer-term bonds to target somewhat higher longer-term yields. The Japan version of operation twist.

But market commentary appears quite confused over what the BoJ plans on 21 September. BoJ watchers emphasise a diversion of opinion on the BoJ MP board, suggesting there is a range of possible outcomes ranging from some adjustment in QE purchase targets and/or some cut in the cash rate target, or no change. Some argue the BoJ will wait for the outcome of the 21 September FOMC meeting, suggesting no change in BoJ policy until at least 1 November (but of course this would also be just ahead of the next FOMC meeting, although few see an FOMC policy shift days before the US election).

The BoJ has pointedly refused to say almost anything about the strength in the JPY this year, despite it being the elephant in the room.

Since mid-year, the JPY has strengthened to critical levels near 100 such that the market is now wondering if intervention will be considered. Short-term speculators are now also long JPY and global investors that were under-weight JPY in 2013/2015 have been forced to square-up. As such, there now appears more two-way risk in the JPY.

As such, an operation twist (with a deeper NIRP) might be expected to weaken the JPY; since it would further increase the cost to Japanese investors of hedging foreign currency exposure, or the running cost of a long JPY exposure in general.

However, JPY has been in a rising trend all year. It has surged after each BoJ policy meeting this year, including soon after the BoJ introduced NIRP for the first time on 29 January. The BoJ and government have not attempted to stabilize the JPY. Volatility in the JPY in the lead up to and after recent BoJ meetings has become increasingly intense. As such, it is difficult to bet on a weaker JPY.

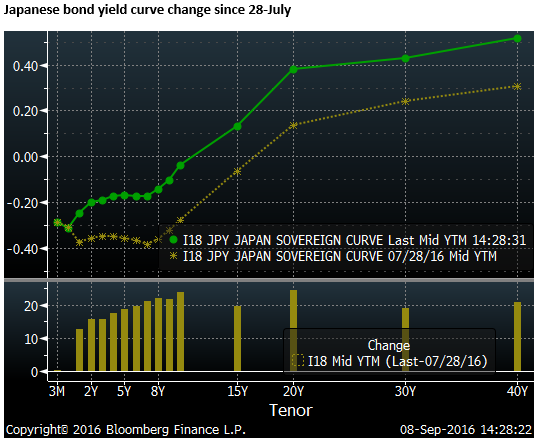

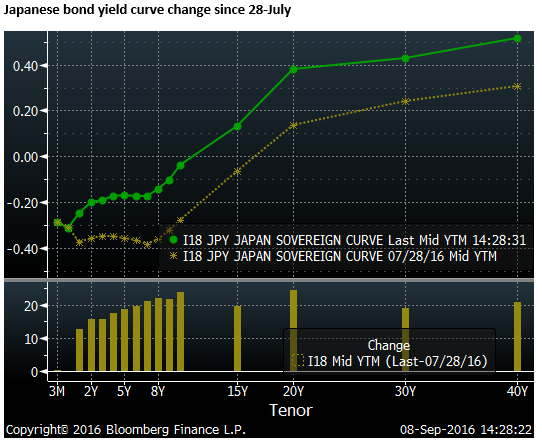

Japanese bond markets appear to be betting on a reduction in long-term bond purchases more than they are betting on a deeper NIRP. The chart below shows that the yield curve has steepened somewhat but mainly it has experienced an overall rise in yields since the day before the 29 July policy meeting.

Nevertheless, 10-year JGB yields are still below zero, so presumably the BoJ might like these and super long-term yields to rise further yet.

While there has been a modest fall in 2yr and shorter term rates recently, they remain relatively steady and only very modestly below zero, suggesting the market is doubting the BoJ will lower the NIRP much if at all. As such, there still seems to be considerable scope for market upheaval if the BoJ adopts a deeper NIRP.