ECB’s stepped up plans to end QE may not be good news for the EUR

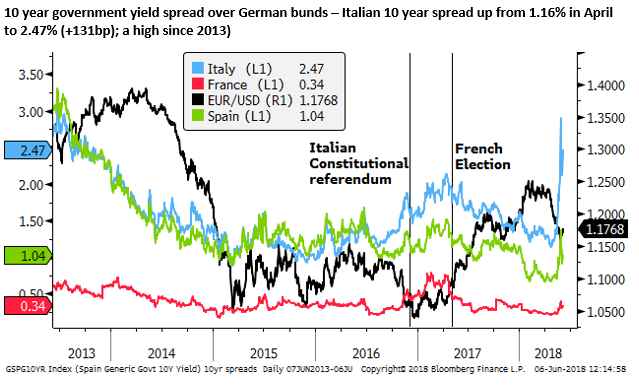

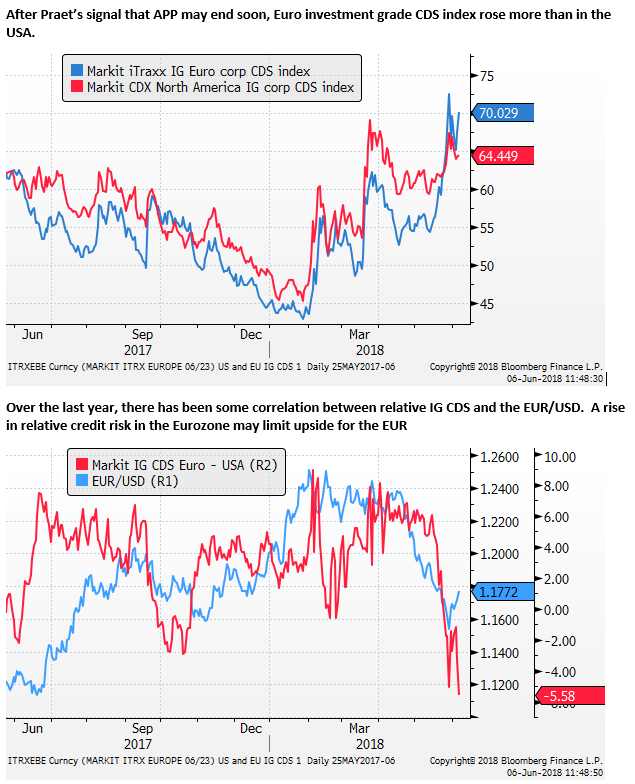

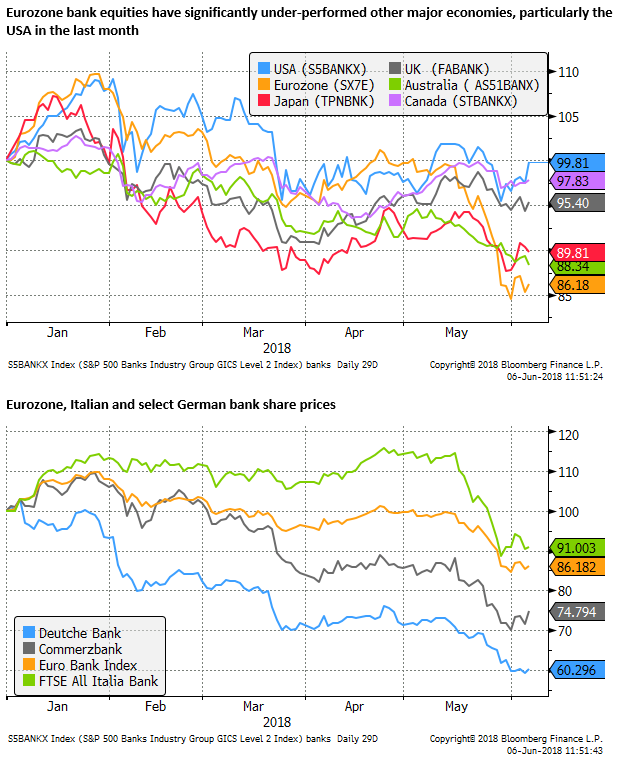

ECB’s Praet signalled that the ECB is thinking about withdrawing from net asset purchases soon. We should expect a plan at the next Governing Council meeting on 14-June for the APP beyond its current completion date in September. Praet’s upbeat view on the Eurozone’s growth and progress on convergence to the ECB’s inflation target made no mention of the political upheaval in Italy and contagion to Eurozone financial markets, or the threat from US trade policy. A key question is how would Italian credit spreads cope with the threat of fiscal expansion in Italy that defies EU rules in an environment where the ECB is no longer buying Italian assets. EUR has lifted on Praet’s comments, bringing forward rate hike expectations more clearly into next year. However wider credit spreads in the Eurozone have probably limited the upside for EUR. A weakening ECB commitment to QE will not necessarily be good news for the EUR as the year progresses.

Praet tests the waters

ECB Chief Economist Peter Praet tested the waters on Tuesday for the temperature on ECB withdrawing its QE (Asset Purchase Plan) later this year. He said, “Next week the Governing Council will have to assess whether the progress so far has been sufficient to warrant a gradual unwinding of our net purchases.”

Praet’s upbeat view on economic growth and inflation converging to its target (that made no mention of Italy’s recent political upheaval), make it clear that he favours at least further reduction in the APP beyond September, if not ending it.

Given the recent economic and political uncertainty in the Eurozone, many had thought that the ECB would delay making a statement on the APP until 26 July (the last meeting before September). However, Praet’s speech suggests an announcement on APP plans beyond September is likely to be made next week on 14 June.

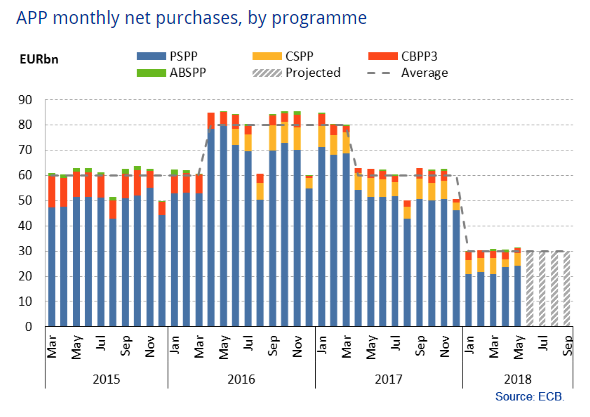

The ECB has been reducing the size of purchases in steps since it reached a peak in 2016 of 80bn EUR per month. It was reduced to 60bn in April 2017, and the 30bn in January this year.

Earlier in the year, the EUR was strong as the market speculated purchases would end in September, and the ECB would begin raising rates sometime next year. However, market sentiment appears to have shifted to expecting one further but shorter duration taper that may extend the APP until the end of this year.

Praet’s wording “sufficient to warrant a gradual unwinding” also suggests the ECB GC may be thinking about a further reduction in the APP, rather than ending it in September. But the tone of his assessment on the economic outlook was quite upbeat and there is a risk that the ECB GC votes to halt new purchases beyond September.

Asset purchase programmes – ECB.Europa.eu

Bringing forward ECB rate hike expectations

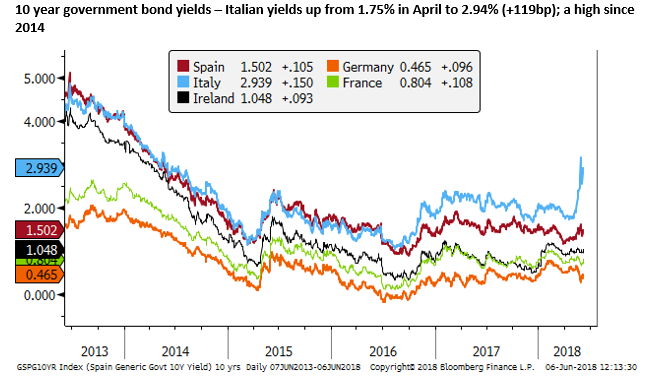

In response to Praet’s speech, 10-year German bund yields rose 9.6bp to 0.465%, and 5-year bund yields rose 5.1bp to -0.60%. The EUR rose by around 0.5% to the high 1.17s.

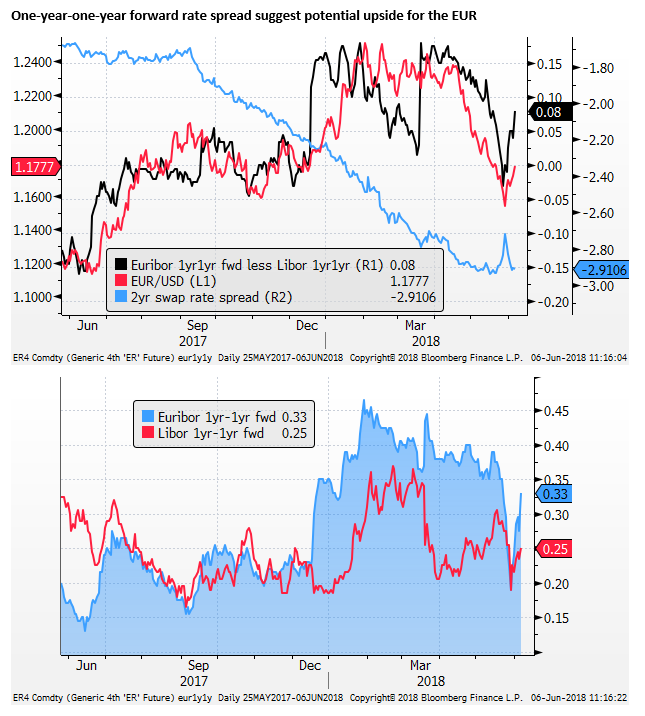

A chart we have used a few times in discussing the EUR is the rate spread differential between the Eurozone and USA one-year-one-year forward. This tends to suggest that the market has factored in rate hikes expected in the USA in the relatively near term (over the coming year), and is more focused on the rates outlook beyond that. In particular, it is focused on the timing of rate hikes in the Eurozone that will come sometime after the end of the ECB’s APP.

We can see that this differential has mapped the EUR/USD exchange rate relatively closely over the last year, even as the EUR has tended to largely ignore the 2yr rate spread.

Praet’s speech has raised the rate hike expectations by the ECB a year-out. On this basis, it is possible to see a further appreciation of the EUR.

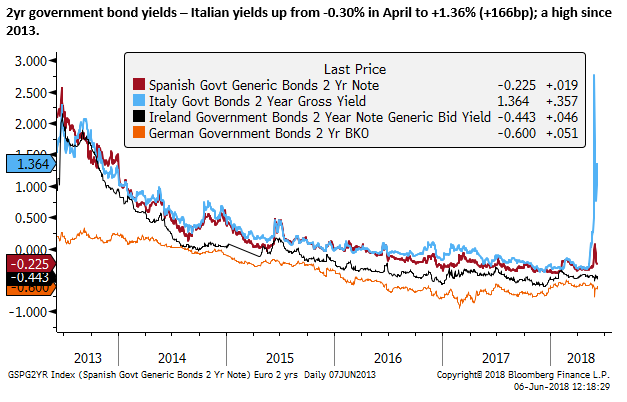

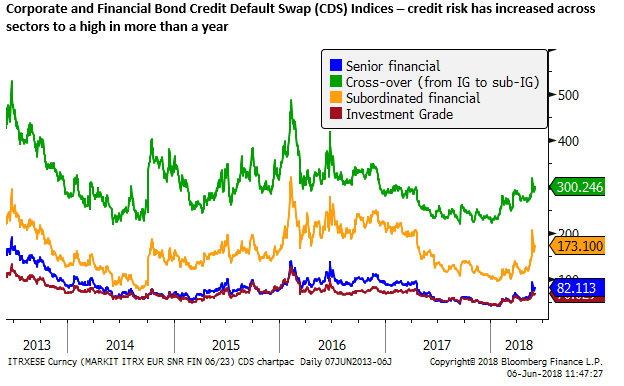

Credit spreads widen

However, much of the economic evidence that Praet has leant on pre-dates the recent upheaval in Italian financial markets. A key issue for the EUR will be how will financial condition change as the ECB pulls back from QE.

There is a stock vs. flow factor in play. The diminishing new asset purchases have probably been more effective in compressing risk spreads in the Eurozone, given the stock of asset purchased by the ECB has continued to grow.

This is a point made by Praet; he said, “The stock of long-duration assets held in our portfolio will continue to put downward pressure on longer-term interest rates well beyond the end of our net purchases.” Even when the APP ends, the ECB forward guidance is that it “will reinvest the principal payments from maturing securities purchased under the APP for an extended period of time after the end of its net asset purchases.”

Nevertheless, the approaching end of APP is likely to place some upward pressure on credit spreads and potentially tighten financial conditions in the Eurozone.

If it were not for the recent political upheaval in Italy, the market might presume that an end to the APP might have limited and gradual impact on credit spreads, that would continue to support Eurozone recovery.

However, there is now a clearer risk that Italian credit spreads will blowout significantly as the ECB moves forward with withdrawing its APP, this could have contagion to other European countries and weaken economic performance in the Eurozone.

Draghi’s departure may further undermine EUR assets

Furthermore, Draghi’s term ends in October. He has been instrumental, since taking over as ECB President in 2011, in corralling often reluctant colleagues towards accepting the responsibility of holding the EUR together by extending increasingly aggressive and inclusive monetary policy to cover all countries, as long as they stuck within EU’s Growth and Stability Pact. He famously declared in July 2012, “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro.”

Draghi no doubt leaves a legacy with the ECB that will allow it to take wide-ranging measures in the future. However, the taste for QE is likely to be significantly diminished when he departs. Investors must consider the prospect that in the next crisis, the ECB may not be as quick to act under new leadership.

Praet’s upbeat assessment (key quotes below)

“The underlying strength of the euro area economy persists, with growth above potential and sentiment indicators still well above long-term averages for most sectors and countries.”

“The unemployment rate is at its lowest level for nearly nine years, despite an increase in the labour force of more than 2%.”

“The European Commission’s biannual investment survey, released on 27 April, shows expectations of a strong increase in real industrial investment of 7% in 2018.”

“The heterogeneity of lending rates across countries has also fallen sharply, with the pass-through of our measures becoming more even. Loans to NFCs have continued to grow and reached an annual growth rate of 3.3% in April 2017.”

“PMI survey indicators signal continued employment creation ahead across sectors as well as across major countries in the euro area. Measures of labour market tightness, such as the vacancies-to-unemployment ratio or survey indicators of labour shortages, show an upward trend for the euro area that has steepened over the past year. Measures of slack, such as the U6 measure of unemployment, also show improvement.”

“Annual growth in negotiated wages in the euro area increased to 1.9% in the first quarter of 2018, from 1.6% in the fourth quarter of 2017. The upsurge was primarily due to Germany, where negotiated wages increased by 2.3% in first quarter of 2018 up from 1.9% in the fourth quarter of 2017, driven by major wage agreements in the German metal and engineering industry, the public sector and the construction sector.”

Praet guides on APP withdrawal (key quotes)

“The Governing Council has three criteria for assessing whether there is a sustained adjustment in the path of inflation towards levels below, but close to, 2% over the medium term: first, the convergence of the projected headline inflation to our medium-term aim; second, confidence in the realisation of this convergence path; and third, the resilience of inflation convergence even after the end of our net asset purchases.”

“Signals showing the convergence of inflation towards our aim have been improving, and both the underlying strength in the euro area economy and the fact that such strength is increasingly affecting wage formation supports our confidence that inflation will reach a level of below, but close to, 2% over the medium term. As for our third criterion, resilience, waning market expectations of sizeable further expansions of our programme have been accompanied by inflation expectations that are increasingly consistent with our aim.”

“At the end, any decision concerning the termination or further extension of our net purchases will hinge on the ultimate judgement of the Governing Council. Once the Governing Council judges that the three criteria have been met, net asset purchases will expire, in line with our guidance. From that point in time, inflation developments will remain conditional on reinvestments continuing for an extended period of time and on policy rates remaining at their present levels well past the end of our net asset purchases. Our forward guidance on policy rates will then have to be further specified and calibrated as appropriate for inflation to remain on the sustained adjustment path to levels below, but close to, 2% over the medium term. The stock of long-duration assets held in our portfolio will continue to put downward pressure on longer-term interest rates well beyond the end of our net purchases.”

Monetary policy in a low interest rate environment; Peter Praet; 6 June 2018 – ECB.Europa.eu