Elevated and rising risk factors for AUD

Elevated and rising risk factors for AUD

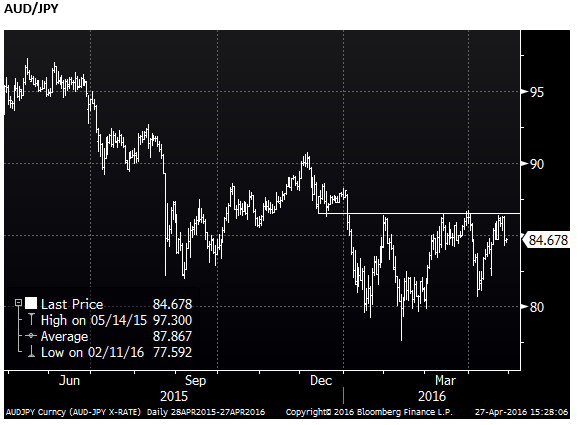

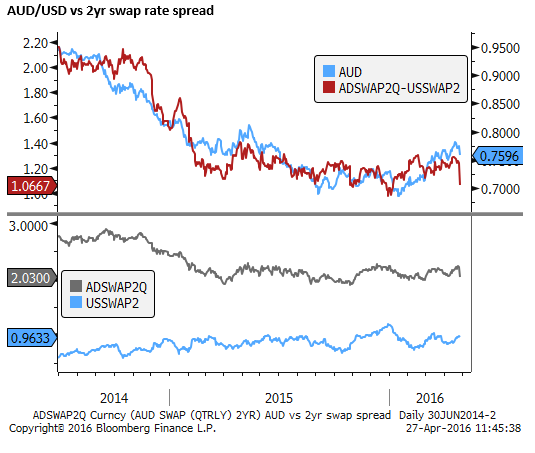

The much lower than expected underlying inflation measures in Australia, evidence of an ebbing housing market and rapidly approaching national election on 2 July make the case for a rate cut by the RBA next week. This is likely to keep the AUD on a weak footing. The AUD had already started to look toppy ahead of the inflation data, facing significant resistance around 0.78 and perhaps starting to respond to evidence of financial stress in China. The rebound in USD/JPY also appears to have spilled over into profit-taking sales in AUD against JPY. We have noted several significant risk factors for the AUD this year; including a tightening election race, opposition policy to significantly cut tax breaks for property investors, bank share prices struggling, banks tightening credit for housing, and a looming over-supply in apartments at the same time as banks are specifically tightening credit for this sector. Low rate policies abroad are providing some support for the AUD, but in consideration of its elevated and rising risk factors we see further upside in Gold/AUD.

From Chocolates to Boiled Lollies

A 2% drop in the AUD/USD on a day where almost everything else didn’t move? – As my ma used to say it went from chocolates to boiled lollies,

Since pushing above the 0.75 level in March the AUD has been relatively volatile but it has retained a rising trend. However, that looks perilously in danger with its slide below 0.76 the biggest correction to-date.

The Inflation data was a big deal

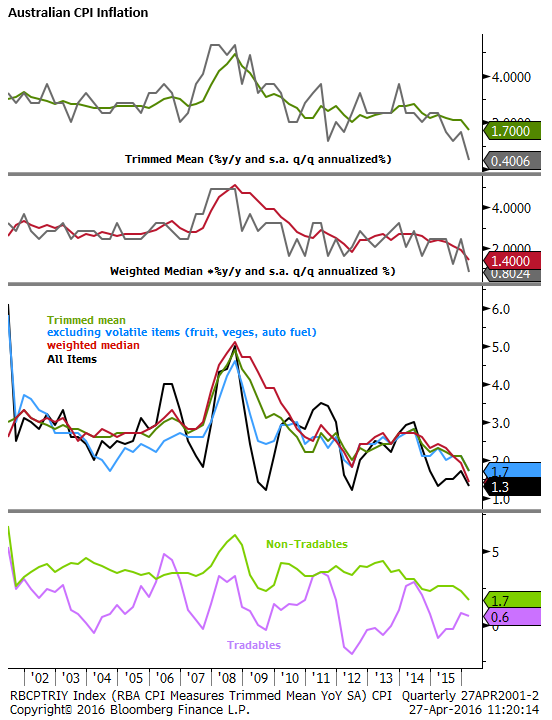

The low inflation figure was a big miss and does matter. It raises the question that was already being muttered under the market’s breath that the RBA is outside its mandate of achieving a 2-3% inflation target over the medium term.

Ahead of this inflation report the RBA had been saying since last year that, “Inflation Is quite low…..is likely to remain low for the next year or two”. And that, “low inflation would provide scope for easier policy, should that be appropriate to lend support to demand.”

In its February quarterly Statement on Monetary Policy it forecast underlying inflation at 2% (the bottom of its target range) for June-2016 and obliquely in the 2-3% range at the end of 2016 and each year in its forecast horizon of three years. In other words, the forecast was consistent with its mandate.

However, it is evident that the RBA thought inflation would tend to be in the lower half of its forecast for much of this horizon, and thus it might be taking more risk that it misses its target to the downside than would be strictly justified by its mandate.

- Australian CPI Inflation All Items fell from 1.7% to 1.3%y/y

- Weighted Median fell from 1.9% to 1.4%y/y (s.a. annualized at 0.4%q/q in Q1-16)

- Trimmed Mean fell from 2.1% to 1.7%y/y (s.a. annualized at 0.8%q/q in Q1-16)

- Excluding volatile items fell from 2.1% to 1.7%y/y

- Non-Tradables fell from 2.3% to 1.7%y/y

The Q1 inflation report places annual inflation on all underlying measures below the 2% base in the RBA mandate, but more disconcerting is that the recent trend is weak and suggests the annual measures of underlying inflation will fall further below target in coming quarters.

The RBA were in part counting on pass-through from a weaker exchange rate over the last two years to lift inflation, but the recent rebound in the AUD diminishes this prospect. It may count on some recovery in the oil price to lift inflation, but this will take considerable time with uncertainty before it might feed through to underlying measures. As such, the scope to cut rates may now seem a necessity to bring the inflation outlook into the mandated target over the medium term.

In response to the data, NAB changed its RBA interest rate call from on hold to a 25bp cut at the next meeting on 2 May (The same day as the government announces its annual budget and economic projections). It said RBA remains an inflation targeting central bank.

Macquarie Bank reinstated a rate cut call for May that it had pushed out to August.

JP Morgan added a rate cut to its call in May and sees a second in August. Its economist said the inflation data should convince the RBA that the disinflation trend is genuine, moreover, has not stabilized. It further said question marks over domestic growth in the second half of the year due to a peak in housing activity and a 10% appreciation of the AUD since Q3-2015 make it harder for the RBA to withstand downside surprises on inflation.

AFR Economic columnist and RBA watcher Alan Mitchell wrote that, “If the Reserve Bank is inclined to cut interest rates but is hesitant because of the election campaign, it now has the perfect excuse.” And, “if the RBA concludes that it is very likely to want to cut the cash rate between now and the election, now might be a good time to do it.”

Low inflation gives RBA a green light for a pre-election rate cut – AFR.com

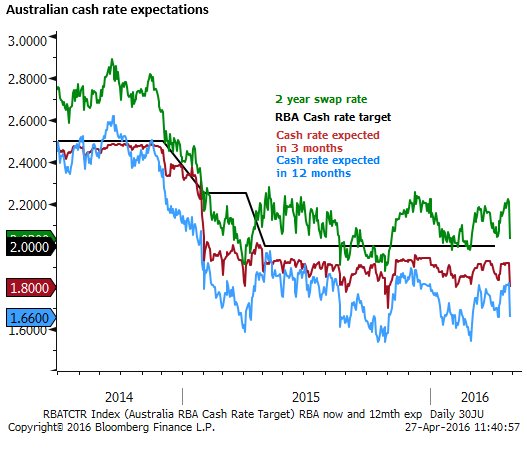

The probability of a 25bp cut on 2 May implied by OIS has risen from 15% to 52% in response to the inflation data. This will probably rise close to a done deal in the next week.

Over 12 months, the market is pricing in 34bp of cuts, up from 18bp ahead of the inflation data.

AUD fall may reflect several other risks, including financial stability in China

The inflation data is a big deal and sharply raises the odds that the RBA cuts rates as soon as next week, and is thus likely to keep the AUD looking heavy.

But there are several other risk factors for the AUD that we have discussed in other reports this year. The election slated for 2 July, the housing market risks, high levels of household debt, bank exposure to the housing market and other pressures on bank stocks that make up a dis-proportionally large share of the Australian stock market, and increasing evidence of risks in China.

AmpGFX – AUD in no man’s land, political and economic risks remain elevated (6 April)

Most of these risks appear to have been pushed into the background by the market focusing more recently on a rebound in oil and iron ore prices, a weaker USD and solid economic reports in Australia including stronger employment growth and business confidence.

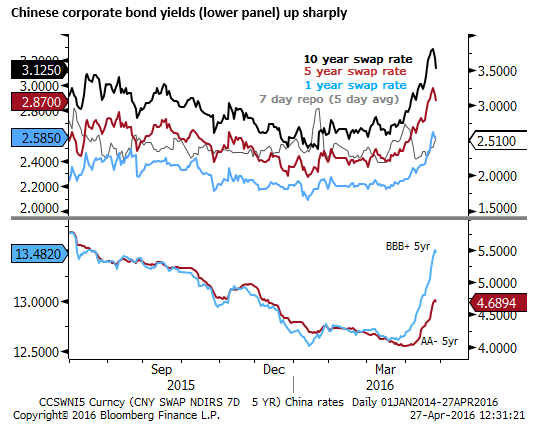

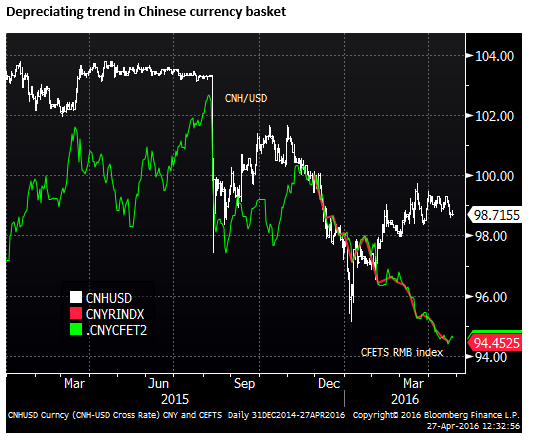

However, even before this inflation report, the AUD was starting to look toppy. It had retreated from .78 even as oil and iron ore prices were still rising. It appeared to be the case that the AUD may be looking over its shoulder again at financial stability concerns in China. As we discussed in our report AmpGFX – Signs of Stress in Chinese equites and bonds (21 April), Chinese corporate bond yields have risen sharply, its equity market has significantly lagged other markets, and the CNY has continued to depreciate on a trade-weighted basis. The rapid run up in Chinese credit in Q1 has been featured in a number news reports recently as unsustainable.

China debt load reaches record high as risk to economy mounts – FT.com (24 April)

China’s Debt Bomb – Bloomberg.com (25 April)

AUD may be the canary in the coal mine again

There is not broad evidence that global markets are returning to a cautious footing on China. Certainly the FOMC statement today removed its sentence that “global economic and financial developments continue to pose risk.” Nevertheless, the AUD has often been the ‘canary in the coal mine’ with respect to financial and economic developments in China, and it might be one of the first markets to respond to increased risks and concerns related to China.

The AUD, having risen to 0.78, 10 cents off its lows in January, reaching technical resistance, and dragging speculators into significantly net long positions, may have built in much of the good news and thus had started to become more responsive to the risks that had been pushed to the back-ground, including weak financial market developments in China.

Surging Chinese metals prices were supporting the AUD, rebounding rapidly this year. However, in the last few sessions both iron ore and steel have retreated, lending some weight to the view that their rise has been partly driven by short term speculation and prices are excessive in the context of longer term fundamentals. The AUD peaked several days ahead of the peak in Chinese iron ore futures, suggesting that global investors were beginning to see metals futures in China as over-exuberant (not dissimilar to the Chinese stock market rally that ended in June 2015).

A Life Expectancy Under 4 Hours Shows China Commodity Frenzy – Bloomberg.com (25 April)

Oil prices on the other hand have continued to rise to new highs. This might tend to support the AUD, improving the outlook for its gas exports. But global markets are starting to lose their tight correlation with oil prices, the AUD included.

RBA may feel easing housing market increases scope to cut rates

The fact that the RBA has not already cut rates in a low inflation environment reflects the substantial risks it is seeing in housing and excessive household debt. The RBA is concerned by financial stability should it cut rates and further fuel household borrowing from already high levels. It fears further pushing house prices up, such that if/when they fall it may generate a bigger and more prolonged contraction in the Australian economy.

While at 2%, cash rates in Australia might still be relatively high compared to other developed nations, the relative ease with which banks have lent for housing has meant Australia has not needed to cut rates as far as might have been the case to boost its economy. But equally it has relied heavily on a resurgent housing market to carry it through the down-turn in its mining sector.

The weaker AUD over the last year has helped lift business activity, a welcome development for the RBA that is clearly reluctant to cut rates further.

The RBA had become much more patient with low inflation over the last six months, encouraged by improving business activity and solid employment growth, steadily bringing the labour market back towards full-employment.

The recent evidence of some peaking in the housing market and tightening in bank lending conditions will help the RBA come to the conclusion that a further rate cut may do less harm to financial stability.

Apartment risks

The AUD may now start to build in more of the risks that if anything are looming larger. One of those is a growing supply of apartments, and tightening lending conditions for apartment both for domestic and foreign buyers. Apartments in the major cities have been put up at a rapid rate chasing Chinese buyers. However, the market is starting to look saturated with reports of price falls on recent developments.

Banks have noticed and have specifically started tightening lending standards for this segment and for foreign buyers that the banks know are drawn to these developments.

According to the Australian Financial Review in an article quoting Harry Triguboff, the founder of Australia’s largest apartment developer, Meriton, most of Meriton’s apartment buyers come from China and most fund their purchases locally. Triguboff said, “The banks had a very good name with the Chinese but now they cannot trust them,”… “The problem is they don’t know how much the banks will give till the end.”

Since these comments were reported on 21 April, Westpac have announced they will virtually stop lending to foreign buyers without local income.

Below are a series of articles that have increased in number in the last month discussing to the risks in the Australian apartment sector.

ANZ Banking Group cracks down on dubious offshore mortgage funding from Asia – AFR.com (5 April)

CBA joins crackdown on foreign property buyers – AFR.com (19 April)

Westpac calls time on lending to foreign residential property buyers – AFR.com (27 April)

Westpac Bank and all banks in the Westpac group, including St George Bank, Bank of Melbourne and BankSA, have ceased lending to all foreign residential property buyers.

The bank joins ANZ Banking Group and the Commonwealth Bank of Australia in the latest round of foreign lending tightening.

The group will no longer accept mortgage applications from non-residents, home buyers with foreign self-employed income and those who hold temporary visas in Australia.

“In line with Westpac Group’s responsible lending practices, we have strengthened our policies regarding non-residents lending and foreign income, which represent a very small component of our loan book,” a Westpac spokesman said.

Local applications that include foreign income will be given a lower loan-to-value ratio of 70 per cent, down from 80 per cent.

The new policy started on April 26 and will also apply to pre-approved loans that have not been issued or activated within 90 days of pre-approval, Westpac confirmed.

Property industry warns of failures as wave of apartment settlements looms – AFR.com (6 Mar)

The number of apartments due for settlement is ballooning and, despite the soothing words from Lendlease and Mirvac at the half-year results, concern is rising about whether buyers will be able to pay for them.

An estimated 44,784 apartments are due for completion and settlement this calendar year across Sydney, Melbourne and Brisbane, up almost a quarter on last year’s 36,486, according to figures from planning consultancy MacroPlan Dimasi.

Apartment glut a threat to financial stability, warns RBA – AFR.com (15 April)

In its most extensive warning yet of the “indirect” risks facing the property market, the Reserve Bank’s Financial Stability Review warned that the supply of new apartments in major metropolitan cities could “weigh on prices and rents,” which could reduce the income of property investors and make it harder for them to sell.

“With the demand for apartments softening in some areas … and households facing tighter access to credit, settlement failures might increase,” the RBA said.

The warning comes as banks are being forced by the Australian Prudential Regulation Authority to curtail lending to property speculators, a move that has lessened the risk of a housing bubble but may have created “challenges” in the apartment construction market given the volume of building undertaken.

The Reserve Bank raised concerns about the “significant and increasing” role of Chinese investors in the Australian property market, which is said presented “indirect risks” to the financial sector.

While the bank’s exposure to Chinese investors and developers was small “if Chinese demand were to decline significantly, that could weigh on domestic property prices and so lead to losses on the banks’ broader property-related exposures”.

Chinese buying was concentrated in “off-the-plan” apartments in Sydney and Melbourne with Foreign Investment Review Board data suggesting a “substantial” increase of late.

Lawyers sharpen their pencils as apartment market turns – AFR.com (17 April)

Lawyers are sharpening their pencils before a rise in disputes between buyers and developers, as record numbers of off-the-plan apartments are due to settle in a slowing market.

Arguments between off-the-plan buyers and developers due to differences in the final product and the expected purchase happen regularly. But an estimated 44,784 apartments are due for completion and settlement this calendar year across Sydney, Melbourne and Brisbane, up almost a quarter on last year. This is as values fall and lenders, pulling back on their exposure to the sector, are putting buyers under pressure to stump up more equity when they settle. The Reserve Bank of Australia is worried.

Developers warn RBA over apartment scaremongering – AFR.com (18 April)

Developers have warned the Reserve Bank that the more it talks up fears of an oversupply of apartments, the more banks will withdraw their lending to buyers, leading to a possible self-fulfilling fear of “apartment collapse”.

The developer, who is in the midst of settling her apartments, did not want to be named but said an increasing number of her clients, who have strong borrowing credentials, were being turned away from banks, even though they were pre-approved to buy apartments.

What worries billionaire developer Harry Triguboff – AFR.com (21 April)

Most of Meriton’s apartment buyers come from China and most fund their purchases locally. But local borrowing has become more difficult as the banks, prodded by APRA, seek the security of more documentation and higher deposits.

Many are already locked into off-the-plan contracts to buy apartments and may struggle to settle the purchases.

“The banks had a very good name with the Chinese but now they cannot trust them,” says Triguboff.

“The problem is they don’t know how much the banks will give till the end.”

Triguboff says the banks now ask Chinese buyers to produce their tax statements. “Lets see how that goes,” he smiles.

Melbourne CBD apartment values fall 30pc, settlement fears rise – AFR.com (29 April)

Apartments in central Melbourne are being resold at up to 30 per cent less than their off-the-plan purchase price, sales data shows.

Not all apartments have fallen in value – some have risen – but analysis of a handful of transactions shows many apartments have failed to hold their value between original purchase and resale, typically a few years later.

The figures are the clearest sign the apartment boom in the Victorian capital is running out of steam and could show more widespread falls if owners elected to sell.

Record low rental yields in Sydney and Melbourne a risky sign, Moody’s warns – AFR.com (11 April)

Rental yields on residential properties in Sydney and Melbourne have fallen to record lows posing risks for property investors and residential mortgage-backed securities, ratings agency Moody’s warns.

Increased net costs in servicing a housing investment relative to household incomes make investment properties less affordable, according to Moody’s Investor Services residential report.

“The gap between the interest costs for investors on high home values less rental earnings is bigger than it has ever been,” Moody’s assistant vice-president John Paul Truijens said.

“The deteriorating affordability of servicing investment properties makes residential property investors more vulnerable to risks such as loss of income, interest-rate increases, vacancies or rent reductions, and therefore increases their probability of default.

NAB survey shows foreign home buying falls to two-year low in first quarter – AFR.com (20 April)

Foreign purchases of residential property fell to a 2 ½-year low in the first quarter as banks tightened lending restrictions to offshore buyers, the National Australia Bank said.

Foreign buyers of new homes accounted for just 11.8 per cent of total new property sales – down from a peak of 16.8 per cent in September 2014, the Quarterly Australian Residential Property Survey showed.

There was also a shift in investment, however, as big falls in purchases of new properties in Victoria – to 10.7 per cent from 32.5 per cent in December 2014 – and in NSW (to 11.1 per cent from 21 per cent a year earlier) were partly offset by a jump in Queensland.

The share of foreign buyers in new property markets in Queensland rose for a third, straight quarter, to 21.9 per cent in January-March from 20.9 per cent in the three months ended December 31. Almost half of the apartments purchased by foreign citizens in Queensland were in the $500,000 – $1 million range, compared with just 34 per cent in Victoria.