Emerging economies take lead over languishing majors

USA rate hikes are again slipping out of view. The ISM reports and broad labor market indicators suggest that economic momentum is slipping below potential. A hike in September would appear to be a rash mistake and the risk is swinging towards no hike this year. But just as the USA economy may be stalling, the economic and inflation outlook in the Eurozone, UK and Japan also appears to be weakening. In contrast, several emerging market economies are picking up momentum, led by India, China and Russia. Even though overall growth momentum remains modest and inflation trends are weakening in emerging markets, low yields and non-conventional policy easing in all major economies is set to perpetuate a recovery in emerging and commodity currencies. A weak USD has been a feature of the markets this year, but the tide may be turning towards a relatively weak EUR and JPY. Eurozone inflation indicators are weakening faster than other major countries and Eurozone rates and yields have fallen to the bottom of the pile below those in Japan. The ECB should sound dovish this week and are expected to extend their current quantitative policy easing program beyond March. We see a case for EUR and JPY to languish, if not clearly against the USD, then against emerging markets, commodity currencies and gold.

US Economy momentum wanes placing Fed hikes in doubt

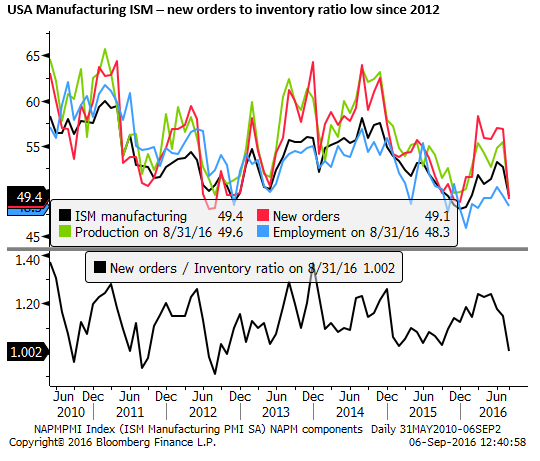

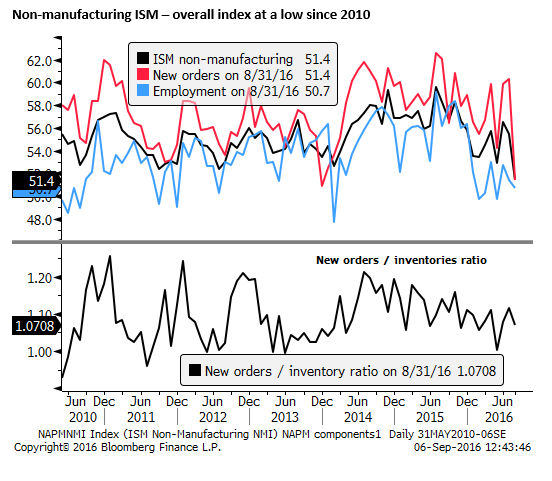

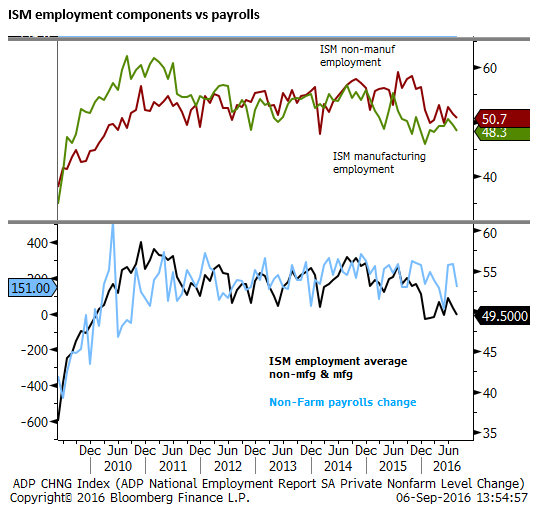

Both ISM surveys for manufacturing and non-manufacturing have weakened to levels that throw into doubt the forecasts of most Fed members looking for a recovery in GDP growth in the second half of the year. This is disconcerting considering the stability in oil prices in recent months, and improved sentiment in global markets in the wake of the Brexit vote.

The fall in the non-manufacturing PMI may seem sudden and thus potentially over-state the softening in this sector. However, the USA Markit services PMI that presumably overlaps significantly with the ISM survey has been around 51 since February this year.

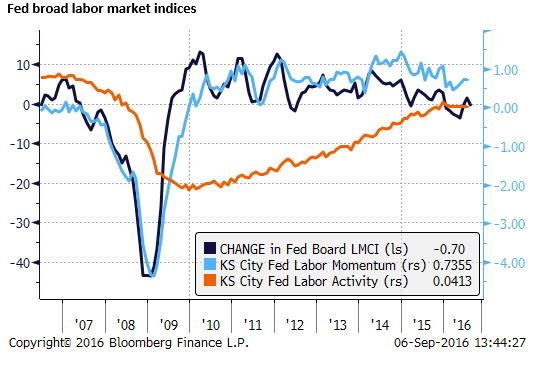

The Fed’s labor Markit Index was negative in August, suggesting that in broad terms the US labor market deteriorated. This index has been negative in all but one month this year, suggesting momentum in the labour market has been weaker for some time. An alternative broad market index produced by the Kansas City Federal Reserve (available up to July) has been flat in its measure of the level of labor market conditions this year. This places a question mark against the recent Fed comments that the labor market is still improving.

Most key indicators the Fed look at for degrees of slack or tightness in the labor market turned weaker in August or were unchanged. This includes weaker wage growth, weaker hours worked, part-time for economic reasons, higher participation, unemployment and under-employment essentially unchanged this year.

Several Fed officials have claimed that the pace of jobs growth is more than sufficient to absorb the growth in the labor force. However, if this is the case, there should have been broader evidence of a tightening labor market. However, it appears that tightening has stalled this year.

The risk is that the pace of payrolls growth slows if the ISM survey reports are any guide. The chart below compares payroll growth with the average of the manufacturing and non-manufacturing ISM employment components. As it stands payrolls growth looks high compared to the ISM over the year-to-date.

The prospect of a September rate hike by the Fed seems slim at best, and the risk is high that the USA economic data does not strengthen enough to push the Fed towards policy tightening in December either.

It will be interesting to see how Fed officials characterize the data over the week ahead, leading off with San Francisco Fed President Williams later today. He has appeared to favor a hike in September at his recent outing. He contributed to a good part of the rebound in US rates in the lead up to the Jackson Hole Symposium. Presumably he will not completely change his tune, but he may start to sound more ambivalent emphasizing the rate decision is data dependent.

All Major Economies stalling, Emerging Markets picking up

Apart from USA economic conditions flattening out, it appears that all the four major economies are showing modest to weak momentum, whereas a number of emerging market economies are showing improvement.

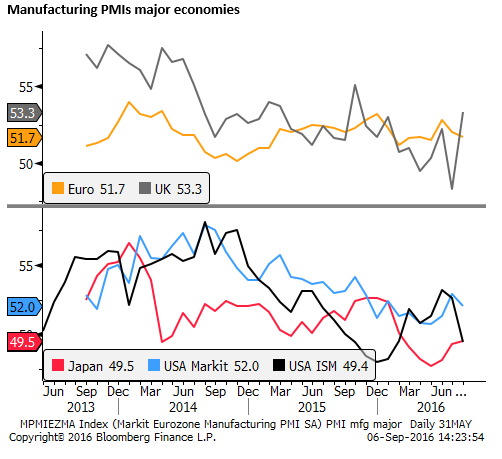

The UK PMIs have rebounded solidly in August from the July slump. However, there is still a declining trend over the last year in the services PMI. The UK manufacturing PMI rebounded more solidly but the jury is still out for this indicator that has averaged a little above the stall rate of 50 this year. Most analysts are worried about the longer term risks to investment and the uncertainty surrounding Brexit negotiations over the coming year.

More focus on Brexit is expected over the next week with a speech by EU Brexit negotiator on Wednesday and EU summit (without the UK for the first time) next week. Carney and his BoJ colleagues are likely to highlight medium term risks to growth in parliamentary testimony on Wednesday.

The Eurozone PMIs have been relatively stable this year in the low 50s, but have still edged lower. Japan’s PMIs for services and manufacturing are both below 50.

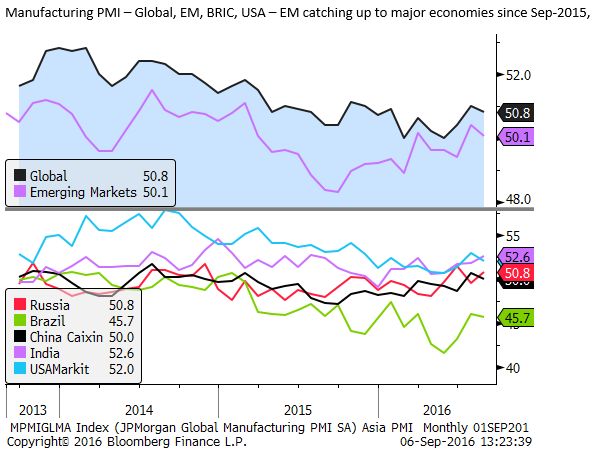

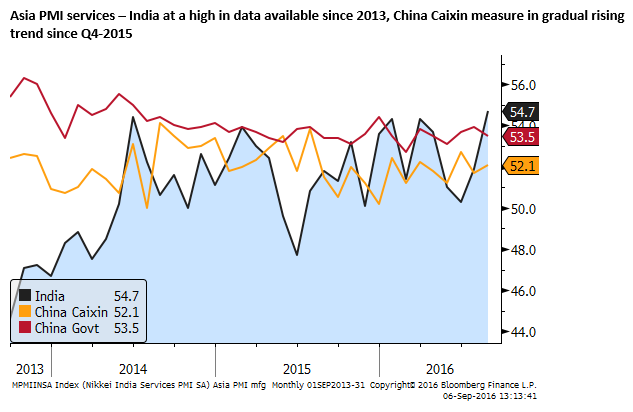

The chart below shows the Global and Emerging Market manufacturing PMIs. Since September 2015, Emerging markets have been catching up to developed market economies. The lower panel of the chart shows the BRIC economy manufacturing PMIs. India has taken the lead, rising to 52.4, a high since August-2015. China and Russia are also showing steady improving trends.

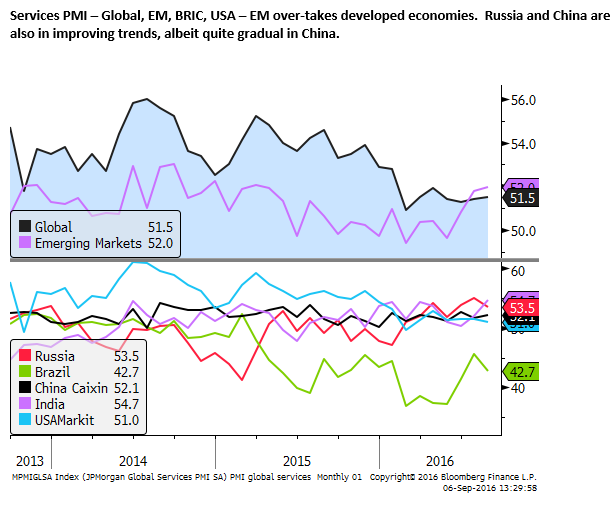

The service sector PMI data shows the emerging market index over-taking the Global index. India at 54.1 is at its highest level in data available since 2013

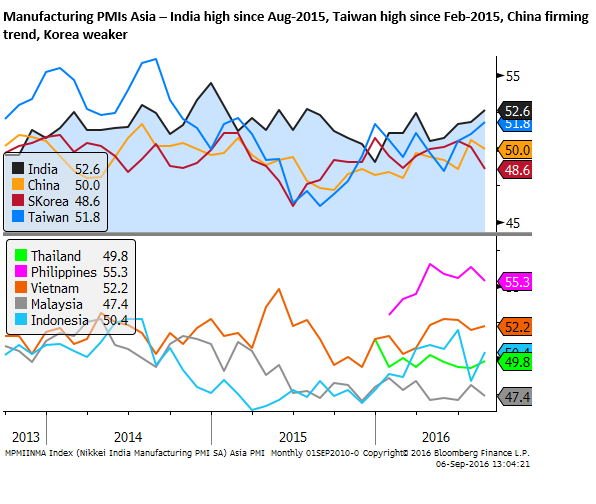

The chart below shows manufacturing PMI data for Asia. It shows that Taiwan is also in an improving trend, in-line with India and China, although Korea is weakening recently. South East Asia is more mixed, but Indonesia may be showing more consistent strength.

Emerging markets should continue to attract capital inflow

The PMI data tend to support the trend this year favoring capital moving back into emerging markets out of the major economies that are struggling to maintain positive momentum.

In the case of Japan, Europe and UK, central banks have recently, or are anticipated to, further expand unconventional monetary policy with negative or near zero rates. The USA so far has hiked once from its record low near zero rates in December last year, and the next hike continues to be elusive.

The low yield environment and stronger momentum in emerging markets in the last year may well perpetuate the uplift in emerging market currencies and asset prices, even if their overall growth outlook is still modest and inflation trends weak.

The same is true for commodity currencies like AUD and NZD. To the extent that AUD is seen as a proxy for China and India, the improving trends in these economies is likely to underpin the AUD. Higher yields and reasonable growth outlook in Australia should support AUD. NZD is higher yielding still and recent economic reports suggest growth has accelerated further above trend.

EUR and JPY may under-perform

For the most part this year, capital flows to emerging market and commodity currencies has appeared to be funding mainly out of the USD with the EUR and JPY surprisingly strong, notwithstanding negative rates and more adventurous quantitative policy.

However, this is contributing to expectations that both the ECB and BoJ may need to prolong their non-conventional monetary policy easing for longer. Increasingly there is a risk that both central banks may respond by taking more extreme policy measures.

Inflation indicators falling in Eurozone

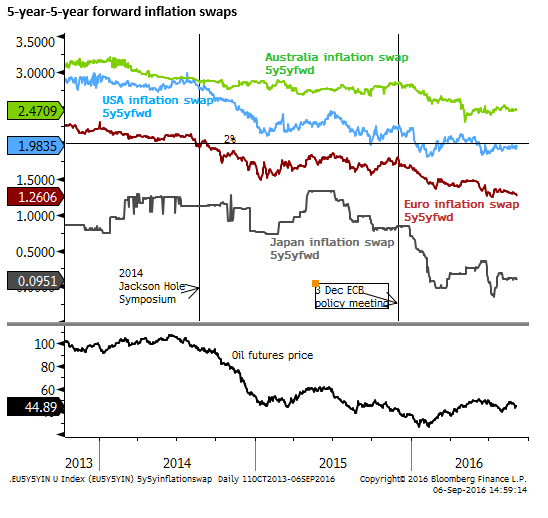

We might expect more dovish commentary from the ECB on Thursday. As the chart below shows, one of its closely watched indicators of long term inflation expectations (5year-5year forward inflation swaps) has sunk to new lows, diverging with the USA.

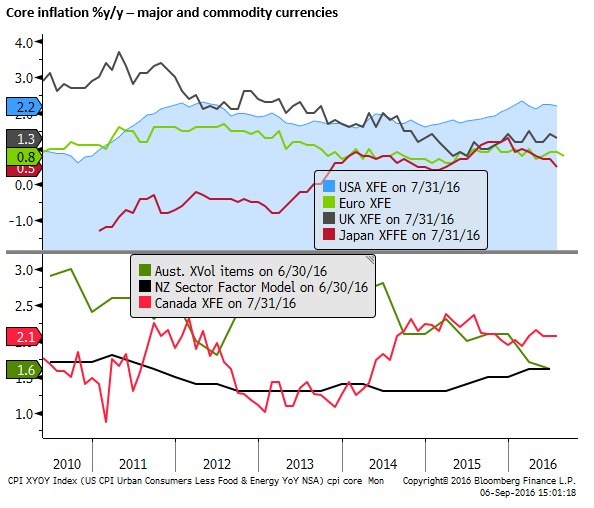

Furthermore preliminary core Eurozone inflation for August was lower than expected slipping to 0.8%y/y, equaling its lows since April 2015.

Concerns over political uncertainty and Europe’s response to the Brexit vote in the UK appear to be detracting from the economic outlook.

Eurozone rates and yields sink to bottom of pile

Many analysts are expecting the ECB to announce an extension of its QE program beyond March next year, changing the parameters to allow it buy a greater share of outstanding bonds, more types of bonds and/or at lower yields, below the -0.4% deposit rate.

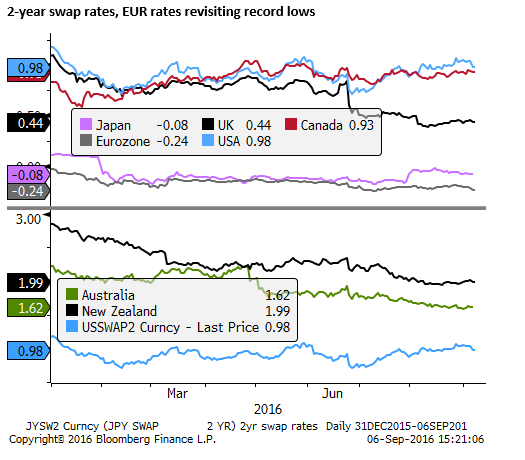

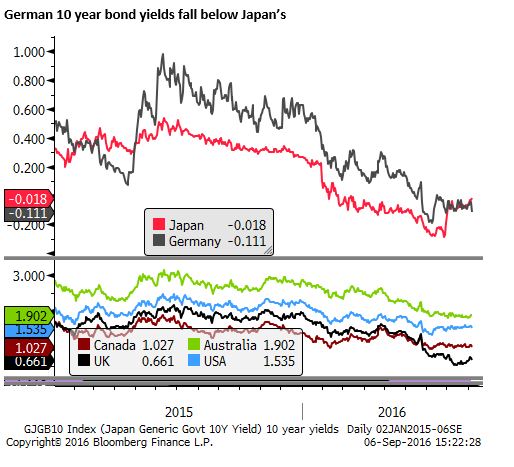

It is not clear that any of these measures should have a negative impact on the EUR exchange rate considering its stability this year. Nevertheless, yields in the Eurozone have edged lower. 10 year bund yields are now below those in Japan (-11bp) and 2year EUR swap rates are considerably lower than Japan’s at -0.24bp.

Selling EUR has not been high on our radar over recent months, but as a foil to commodity currencies, emerging markets and gold, perhaps we should be looking to sell EUR. The ECB should tend to sound dovish based on recent economic and inflation trends.