Emerging Market Chaos returns

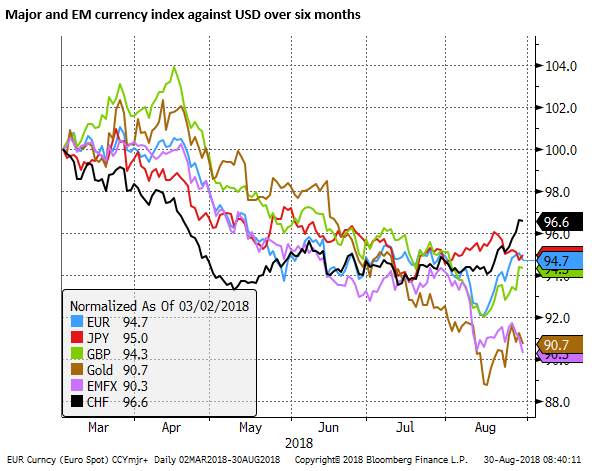

Emerging market chaos has resumed and is spreading to some USD strength against majors. CHF has been the big winner offering the most reliable store of value in a crisis in the last month. There is a remarkable dichotomy between chaos in EM markets and relative stability in the US and some other developed market assets and currencies. Risk of contagion to US equities and bonds is growing. The EUR is softer but is also much more stable than it was in mid-August in response to deteriorating Italian and regional bank shares.

Currency chaos

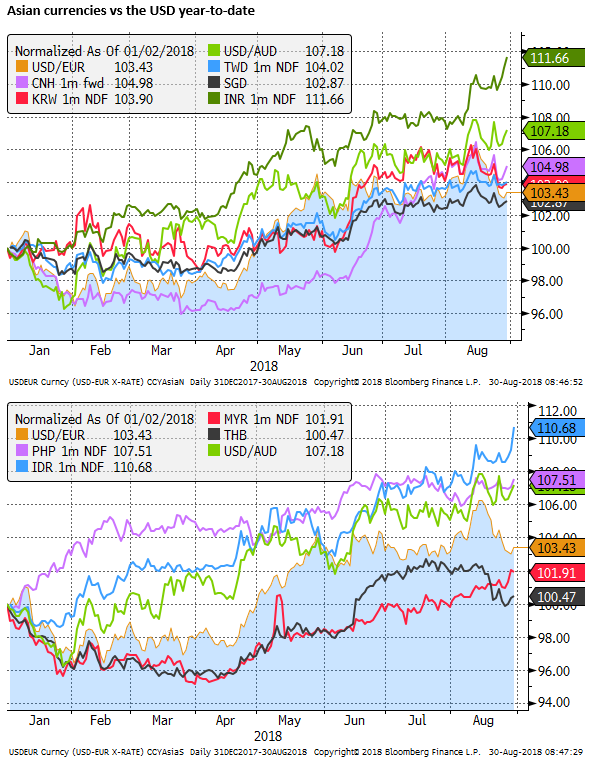

Emerging market pressure has stepped up again in recent days. Deep falls have resumed in ARS, BRL, TRL and ZAR, and most emerging market currencies are weaker against the USD

In the majors, the GBP has rebounded significantly on renewed hopes for a Brexit deal, although its gains have been trimmed a bit in trading on Thursday. EU negotiator Barnier raised hopes for an unprecedented deal on Wednesday, but has walked back optimism saying a no deal Brexit was still possible on Thursday.

The CHF has strengthened significantly over recent weeks. It barely retraced its gains after the first round of weakness in the TRL in mid-August, and has extended those gains over the last two weeks, illustrating that the market has remained on edge even as there has been a modest recovery in emerging market assets in the week up to Monday 27 Aug.

Meanwhile gold and JPY have been dubious safe-haven assets from EM risks in recent months, CHF has been a more reliable store of value in a crisis.

The EUR has weakened modestly so far on Thursday, but has been much more stable and stronger since the first round of the TRL crisis in mid-August, notwithstanding widening Italian yield spreads.

In Asia, INR has fallen significantly (down over 11% in the last six months) to a new low. And the IDR is down over 10%. The CNY had strengthened in the last week since the Chinese government re-introduced its counter-cyclical factor in its daily currency fixing, but it fell a significant 0.5% so far on Thursday.

A dichotomy between EM and US assets

Chinese equities had stabilised and helped Asia ex-Japan equities rebound from their mid-Aust low, but Chinese equities led the falls in the region on Thursday down over 1%.

US equities remain largely above the fray, down modestly in trading so far on Thursday, after reaching a new record high on Wednesday, continuing its record-breaking time in a bull market.

The emerging market weakness has not spread significantly to US high yield corporate bond markets either. At the margin, it has caused US 10 year bond yields to ease back, but yields remain relatively stable.

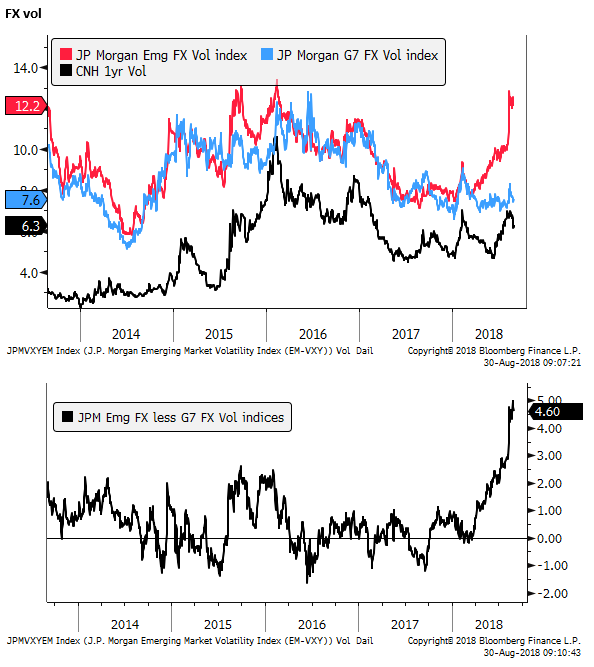

A dichotomy in FX vol

The spread between the JPMorgan FX vol indices for the G7 and Emg Mkts is at its widest level since 2009. The level of Emg Mkt FX vol index is approaching its highs in 2016.

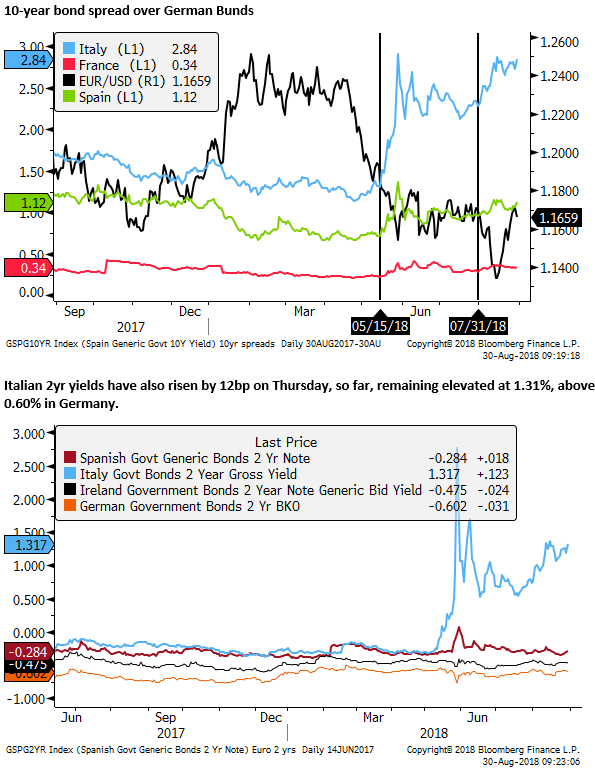

Italian bond risk rising

Italian 10-year bond yields have drifted to new highs near 3.20% (up 7bp on Thursday so far), moving the spread over German bunds to around its widest levels since 2013.

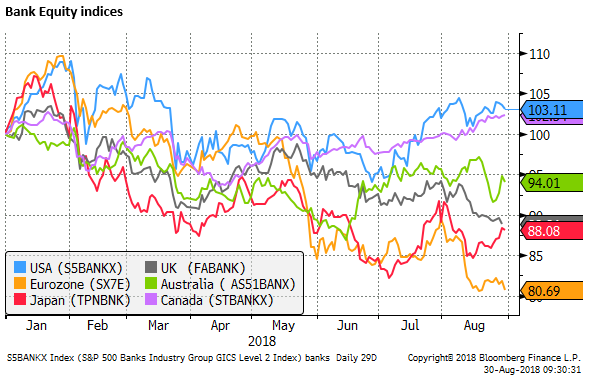

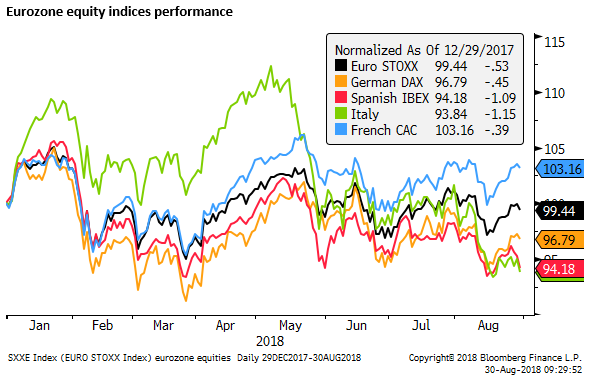

Italian and Spanish equities are leading losses in the Eurozone, reflecting contagion from Turkey and Latam markets and Italian politics and fiscal policy stance.

Italian bank shares are dragging down Eurozone bank shares that have significantly underperformed other developed market bank equities. UK banks shares have also fallen significantly in August which may reflect growing concerns that its banks lose international business as Brexit approaches and the rising risk in Emerging market debt markets.