EUR and AUD risks ignored for how long?

The tariff fallout was surprisingly more towards a weaker USD. While this may reveal still underlying bearishness for the USD, other currencies, including EUR and AUD, appear to be more at risk than the USD. USD/JPY may be finding a base after testing significant support near 105. The Fed has turned somewhat more hawkish, the US economy has gained momentum, the Euro economy has lost some momentum and the Italian economy is likely to suffer in the political wilderness.

The Tariff Fallout

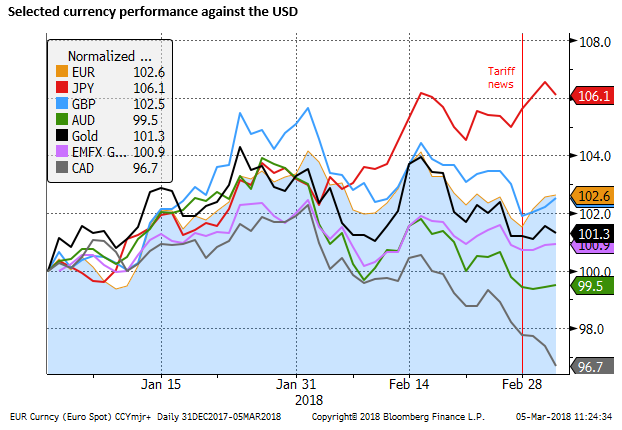

The Tariff news generated a bout of risk aversion in global equity markets. It had a mixed impact on the USD with losses against the EUR and JPY, firmer against most commodity currencies, more so against the CAD, and mixed against EM currencies. Perhaps surprisingly Asian EM currencies are firmer.

Powell over-shadowed by Tariffs

Just before the tariff news, the USD was showing some signs of breaking higher against a broad range of currencies and on the Bloomberg USD index. Hawkish comments by Fed Chair Powell in testimony to the Senate supported the USD.

Powell walked this back a bit in the House testimony two days later, just as the tariff news took over, but the market has now largely priced in three rate hikes this year.

US protectionism may boost USD

The tariff news should pose more risks to EM and commodity currencies than the USD. Arguably it also poses risks to the EUR. A tougher approach to trade by the USA is a threat to the Eurozone as a more export-driven economy with a large surplus.

We remain more constructive on the USD based on a recent acceleration in the US economic performance. We also see the increased focus on trade protectionism as supportive to the USD.

We tend to agree with Trump that the US is in a better position to win a trade war, and thus we doubt there will be serious retaliation to its steel and aluminium tariffs.

Furthermore, the steel tariffs are arguably sensible given the over-production and subsidies in other countries, particularly China. The tariffs create more problems for other steel producers, and the more likely response is that these producers also look to protect their own industries from imports coming largely, ultimately, from China.

US Commerce Secretary Ross pointed out that the US is the largest import market for steel. It thus has significant power to influence the global steel market with these tariffs. As the President of the German Steel Federation, Kerkhoff, pointed out, “If the EU doesn’t act, our steel industry is going to be left footing the bill for American protectionism.” (WSJ.com). Higher tariffs in the US are likely to place downward pressure on global steel prices as producers aim to compete to keep market share after losing competitiveness in the USA. The bigger risk of this tariff is on large steel producers, not the USA.

The real issue is over-production of steel. Other countries may complain loudly and threaten to retaliate, but arguably their attention should turn to China, not the USA. China is not on a strong footing to take the high-ground on free trade. As such, we doubt the US will suffer a global trade war breakout aimed specifically at US companies.

Even if they do, Trump has given notice that he will go tit-for-tat, generating broader risks for export-driven surplus economies’ currencies.

The risk that US companies shift production offshore, to seek lower steel prices, is countered by the lower US company tax structure since the tax cuts last year. US companies also must consider what fallout they might face from the Trump administration if they do threaten to move production offshore.

Underlying weakness in the USD

The underlying weakness in the USD appears to relate more to the forward-looking nature of the market that appears to be attempting to price in a peak in US yields and the end of QE policies in other major economies, and more robust global growth sustaining a recovery in EM assets.

Currency markets send a warning on the US economy – FT.com

It also reflects political risk in the US as the November mid-terms approach, Trump’s net approval rating remains depressed, the sense of chaos generated by the Trump administration, the wide divisions in society and Congress over a range of social issues including immigration and gun control, and the growing tentacles in the Mueller investigation.

However, while the market may be doubting the long-term growth potential in the USA and seeing more political risk, it may not be paying enough attention to the more immediate fundamentals of a wide US yield advantage and an economy accelerating further above potential.

USD/JPY finding a base

USD/JPY, US yields and US equities rebounded on Monday, suggesting that the market is worrying less about a trade war breaking out.

The JPY has diverged significantly this year from US yields and equity markets, It has strengthened despite a rise in US yields and strong equity markets in Dec/Jan. And then strengthened further in early-Feb as equity markets corrected lower, retaining its safe-haven status.

Many analysts, including us, were beginning to wonder what might knock back the JPY. It appears that the market is becoming more forward-looking for the JPY, anticipating the end if its QE well in advance. In many respects, its strength in recent months mirrors the gains in EUR in 2017 as it anticipated the end of QE.

However, USD/JPY may have baulked at falling below 105. It made a stab towards this level on the tariff induce risk aversion, and comments by BoJ Kuroda, who for the first time put a possible date on beginning the end of QE policy, about a year from now. Furthermore, strong Japanese labor data and higher Tokyo inflation supported the JPY last Friday.

Around 105 is a significant technical and psychological level for JPY, and it is noteworthy that it was unable to break below this level despite the significantly more supportive news. This may be a sign that the market sees levels below 105 significantly dampening inflation pressure on Japan, and delaying any QE exit.

In any case, the beginning of QE exit that may occur a year from now is only a maybe and the pace of QE policy exit is likely to be gradual and measured.

EUR risks ignored for how long?

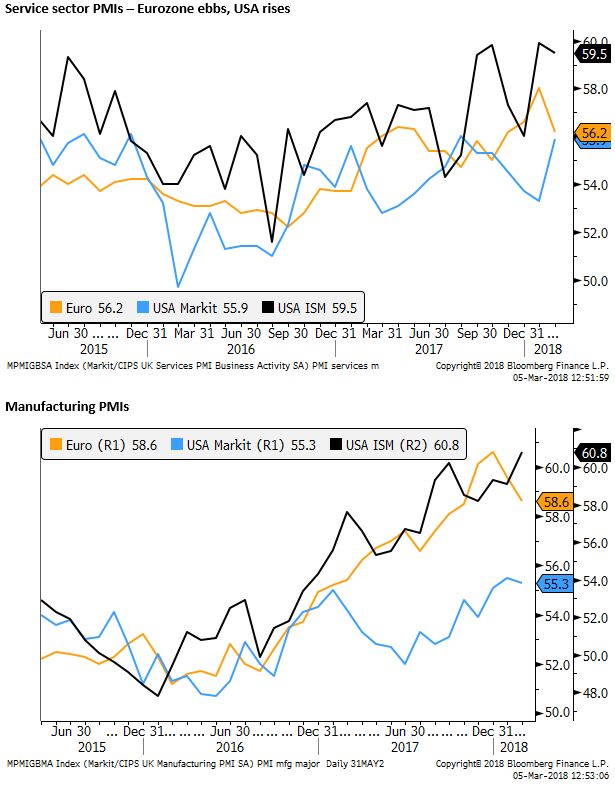

The EUR has rebounded, again, since the tariff news. However, we continue to see downside risks. The Eurozone economy is showing signs of ebbing momentum, at the same time that the US economy appears to have accelerated to a cyclical high, running significantly above trend with the labor market now threatening to generate higher wage growth.

The Italian election is likely to undermine economic confidence in Italy and be a drag on Eurozone growth, albeit potentially a modest one. The protectionist USA policy is a direct threat to the Euro steel industry, and a broader risk for Europe given its large trade surplus and relatively high dependence on export-led growth.

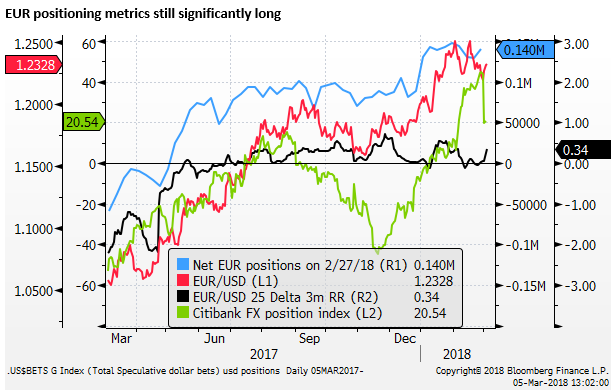

Positioning indicators also continue to suggest a risk of a deeper correction in the EUR.

AUD risks from tariffs

The CAD has weakened significantly in recent weeks, which may reflect some cooling in economic indicators and rate hike expectations in Canada. CAD was one of the more damaged currencies by the tariff news.

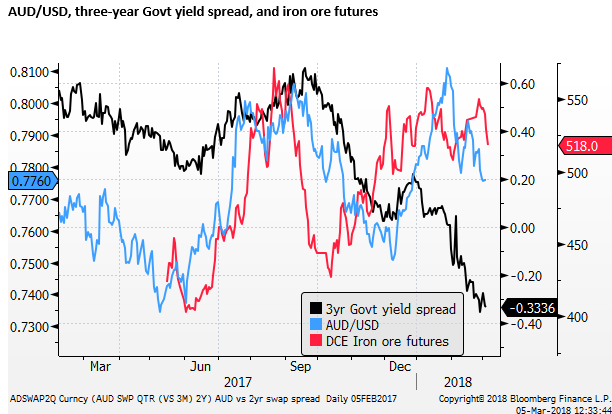

We see risks that AUD comes under additional pressure. As a large provider of steel-making commodities to China and Asia, it faces a more significant risk that steel tariffs undermine confidence in the global steel sector.

Iron ore prices fell on Monday, and maybe a sign of risk building in the China steel sector.

The AUD/USD should also be seeing increased downside pressure from deteriorating yield spreads at the long end both for real and nominal yields.