EUR facing big test as Fed reaffirms guidance on December

EUR sits just above key supports (the lows in May and July) and may be setting itself for phase two of its big downswing that began in 2014. The Fed has reaffirmed its guidance on December (conditional on the economy and financial conditions remaining relatively stable). RBA Governor Stevens also reaffirmed his new easing bias, but is likely to wait out the Fed. It would not surprise if the RBA leant on its easing bias to jaw-bone the AUD down should it have any significant uptick.

Steven’s re-affirms easing bias

RBA Governor Stevens’ speech this morning helped put a bit more context around the policy statement on Tuesday where rates were left on hold and the market stepped further back from expecting a rate cut.

Stevens is exuding a sense of calm over global and domestic developments accentuating the progress the country is making in transitioning through its mining sector investment down-turn. He is not in a mind to over-react to recent events and is prepared to give it time to see how the economy unfolds. The most likely scenario is that rates are held steady through the rest of this year.

He may see a high probability of a hike by the Fed on 16 December and more policy easing by the ECB ahead of that on 3 December. These events may have a competing influence of external conditions for Australia and thus it would seem sensible to wait for these events to unfold.

However, while calm and seeing some positive trends in non-mining business, he has made it clear that he is thinking about another cut in rates. He said, “Were a change to monetary policy to be required in the near term, it would almost certainly be an easing, not a tightening.” This is a clear affirmation of the easing bias that was implied in the policy statement on Tuesday. It is important that Steven’s felt it worth re-emphasizing this message.

While encouraged by the progress Australia is making in economic rebalancing, it does not change the fact that headwinds from the terms-of-trade and mining down-turn are not abating and may be intensifying.

Stevens highlighted the challenges arising from weaker steel demand in China. He said, “The current rate of growth of the Chinese economy is uncertain, as is its future growth rate. Chinese policymakers are attempting a profound transition in the growth model while dealing with some legacy issues (such as a substantial debt build-up) arising from the previous model. It is likely that the marginal steel intensity of China’s growth will be lower in future than in the past. Some suggest that Chinese steel consumption, which has fallen this year, may continue to do so.”

Steven’s highlighted that Australia is benefiting from greater demand for its services from China, helping offset the drag on the resources sector. However, it is still important to recognise the bigger risk and challenge for Australia is the impact of weaker resources sector activity and income. Many countries (and their currencies) benefit from firmer Chinese consumer demand, but none are dampened as much as Australia by its retreat in steel demand.

Stevens helped put in context the recent tightening in credit conditions for mortgage borrowing. The bottom line is that “Measuring across the total loan book, the recent actions are the equivalent of roughly half of one 25 basis point monetary policy change”, Stevens said.

Stevens highlights that policy is accommodative and the recent steps, “take back perhaps a quarter of the extent of interest rate easing seen since the start of this year, and a smaller proportion of the total easing in lending costs seen over the past two years.” Nevertheless, if the RBA thought policy was appropriate around mid-year, steps by banks to tighten lending to investors since mid-year and raise their standard variable rates announced in recent weeks, have made policy a bit tighter than may be preferred.

Steven’s said, “At this point, then, my preliminary assessment is that the macroeconomic effect of these actions [banks’ tightening mortgage lending conditions] in themselves may not be large. It is one part of a much bigger and evolving landscape. Nonetheless, the Reserve Bank Board will keep this matter, and that broader landscape, under careful review.”

Stevens is keeping a rate cut up his sleeve and will be watching to see the impact of tighter mortgage lending, among other things. As such, the performance of the housing market and mortgage lending activity will be important. Recent tentative evidence suggests a cooling is underway.

If the housing market does cool and commodity prices continue to be fall then a lower exchange rate will probably be required to keep those green-shoots of recovery moving in the non-resource sectors in the right direction. The RBA may well be prepared to cut rates again to keep the AUD lower.

One thing that Stevens and the RBA has not said much about in its policy statements this week is the exchange rate. They appear pretty content with it trading around .70. It would not surprise me, however, to see the RBA attempt to use its easing bias and jaw-boning to cap any significant up-ticks in the currency.

Fed re-affirm plans for December

As discussed yesterday, the USD’s interest rate support has risen significantly in the last week as the Fed has reaffirmed the message that it is currently on track to hike on 16 December, and will need to be knocked off track by surprising weakness in economic reports or global market uncertainty. Economic reports since last week are mixed, but enough to keep building the case for a hike. Fed’s Yellen and Dudley reaffirmed that message overnight and gave the USD a further lift.

Druckenmiller is back in

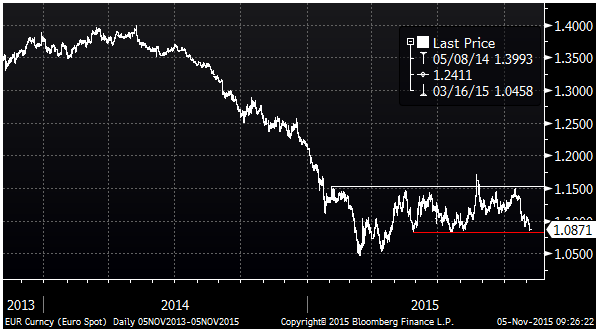

As discussed yesterday, combined with the dovish ECB, EUR/USD rate spreads have moved to new lows since 2007 and are helping re-establish a EUR/USD down-turn.

Bloomberg has run a story that influential hedge-fund manager Stan Druckenmiller has established a short EUR positon. Some of the quotes ring true and are worth highlighting in understanding the psychological and technical nature of the market. He said currency moves tend to last two or three years. He is referring to the big cyclical swings that people like him with a medium term outlook try to take advantage off. He also said they tend to have a long pause in the middle.

In the case of EUR it is about one and a half years into a big cyclical down-swing and has been moving through a long pause between May and Oct. There is every chance now that it is beginning another phase of a major down-turn.

Psychologically it will increase the bearish mood for EUR if it breaks below its lows in May (1.0819) and July (1.0809). These have formed a base in the range since May. It would also break a series of higher lows since March this year, after the currency pair essentially failed to break back above the levels that prevailed pre-ECB QE implementation in January, although it did briefly in the height of the August global markets upheaval.

What they said

- USA Fed chair Yellen: “the economy will continue to grow at a pace that’s sufficient to generate further improvements in the labor market and to return inflation to our 2% target over the medium term, and if the incoming information supports that expectation, then…December would be a live possibility,”

- She said, the U.S. economy as “pretty strong and growing at a solid pace” despite some weakness “spilling over to us from the global economy.” She repeated that raising rates soon would allow the Fed to tighten monetary policy at a gradual pace

- USA Fed NY President Dudley: December as a “live possibility” for a rate increase and added, “but let’s see what the data shows.” (Fed’s Yellen: December Is ‘Live Possibility’ for First Rate Increase – WSJ.com)

- Stan Druckenmiller (Famous hedge fund manager): said he is betting against the EUR. “The nice thing about currency moves, they tend to last two or three years”….the moves tend to take a “time out” somewhere in the middle. He said that ECB’s Draghi has “pretty much pre-announced step two”, while “heavy breathing” at the Fed points towards a potential interest rate increase. On equities he said, “I could see myself getting bearish, and I can’t see myself getting bullish.” (Druckenmiller Says He’s Short the Euro, Stocks Could Be Next – Bloomberg.com)

- Reserve Bank of India Governor Raghuram Rajan: “There are lots of people elsewhere who want to buy rupee bonds because of higher rupee interest rates and greater confidence in Indian inflation prospects, bolstered by our new inflation targeting framework”…. “I think that the rupee will become more attractive as an investment currency,” adding that the central bank is trying to encourage corporate borrowing abroad in rupees. Rajan expressed confidence he can reach a 5 percent inflation target by March 2017, calling the current monetary stance “just right.” ….“External corporate borrowing has come down significantly this year” ….. “And maybe people are now less convinced that borrowing in dollars is a one way bet.” (Rajan Sees Rupee as Investment Currency; Dollar Debt Curbed – Bloomberg.com)

Markets on the Move

- Oil prices retreat on the weekly report from the US EIA showing a higher than expected increase in crude oil inventories. Prices were down around $1.5, reversing the gains the previous day. Energy equites reversed about half of the previous day’s rise to their highs since July, down 1.0% on the day.

- Copper prices fell alongside the significant set-back in oil prices in US trading, also reversing its gains the previous day. Metals and mining equities in the US were down 1.6% and steel sector equites were down 2.1%, more than the broader market that was down 0.4%