EUR/JPY downtrend likely to persist if BoJ leave policy unchanged

The market appears to see some risk that the BoJ surprise at tomorrow’s meeting and ease policy. This is not out of the question, but the timing would be very odd. EUR/JPY downtrend appears likely to persist if the BoJ refrains from easing. The market is relatively sure that the Fed will tighten in December and the upside for USD/JPY may be limited if the Fed minutes continue to emphasise a gradual path for rate hikes. The AUD has been surprisingly resilient to weaker commodity prices, but risks remain skewed to the downside.

Surprising stability in AUD in wake of lower commodity prices

One of the more surprising elements of the FX market in recent weeks is the stability of the AUD in the wake of further significant deterioration in key commodity prices and every reason to expect further pressure on iron ore prices and they move to fresh lows.

The wind-back of RBA rate cut expectations and statements from the RBA that it is more confident about the outlook for domestic demand growth have supported the currency. But there is only so much the same statement, repeated in the RBA minutes yesterday, can continue to boost the currency. As we have noted in recent reports, less appreciated is the higher risk the RBA has assigned to China, and that risk appears to be coming more apparent.

AUD and NZD outlooks not so different

Recent developments in New Zealand compared to Australia have been quite similar. Both are experiencing lower inflation outcomes. Both have experienced some improvement in recent domestic economic reports. Some people may note that the most recent employment data in New Zealand were weak, whereas they were strong in Australia. However, the New Zealand job market set-back was Q3 data – a period of significant global market upheaval. A bounce back is likely in Q4.

Both countries are experiencing a weaker outlook for their key commodity exports recently. Both are seeing strong but ebbing housing market indicators as both countries implement prudential and government measures to calm property investment.

However, despite the similarities, interest rates have diverged significantly in the last month as the market moves towards expecting a rate cut in December by the RBNZ and away from expecting a rate cut by the RBA. The 2yr rate spread in favour of the NZD has narrowed to its lowest level since 2013, providing support for the AUD/NZD cross. However, we would caution that the difference between the two countries’ economic outlook is not so large to warrant significant further rates divergence.

Nevertheless, New Zealand 2yr ahead inflation expectations fell in Q4 to 1.85%, remaining below the 2% inflation target and milk prices at the Fonterra biweekly auction fell for a third time in a row, contributing to a weaker NZD outlook.

The market appears to be pricing some risk of a surprise BoJ rate cut

As we approach the BoJ policy meeting tomorrow, no economist surveyed by Bloomberg is expecting further easing in policy at this meeting. Easing would seem odd after the BoJ refrained from doing so at the semi-annual outlook released at end-Oct, at which the BoJ accepted a longer time-frame for achieving its inflation target.

However, the Japanese rates market does appear to be building in some expectation of policy easing; if not tomorrow, then in coming meetings. The 2yr swap rate has fallen below 10bp, the BoJ’s cash rate target, around the low since early-October. This is significantly below levels around 15bp before mid-year. 2 yr government bond yields are also around their lows since May, just below zero.

The BoJ, led by Kuroda, has shocked the market twice by expanding policy easing since 2013, so a surprise cannot be ruled out, but the timing this week would be very odd indeed, especially taken ahead of policy steps expected by the ECB and Fed, seen moving in opposite directions, ahead of the Q4 Tankan report and talk of further fiscal stimulus plans.

A rise in USD/JPY may seem to lessen the urgency for policy easing tomorrow. However, EUR/JPY has been sliding gradually since the October ECB meeting, creating increased competitive pressures on Japanese exporters.

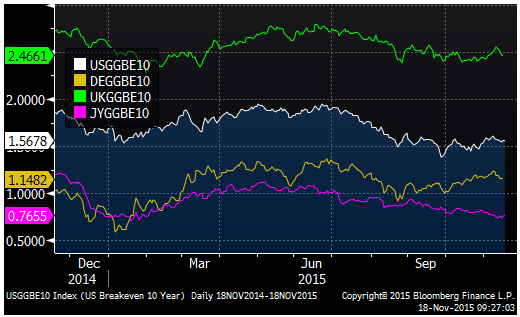

Recent underlying inflation indicators suggest that Japan has achieved progress in raising the rate of inflation. However an indicator that might worry Kuroda is breakeven inflation compensation in government bond markets, suggesting he is losing ground in the battle to raise longer term inflation expectations. Bloomberg analysts pointed out in a story today that while 10 year breakeven inflation compensation has been rising gradually in Europe and the US over recent months, it has been sliding in Japan.

The chart below compares 10 year breakeven inflation compensation from Japan, the USA, Germany and the UK. There has been a noticeable divergence between Japan and the others in the last two months.

There is some risk that the BoJ surprises tomorrow, but the likely outcome is no policy change, and this may further support the recent down-trend in EUR/JPY.

What they said

- ECB Board Member Peter Praet: “It’s key for a central bank to keep inflation expectations anchored, especially in a period of slack in the economy, and we have some signals that these inflation expectations are still fragile.” … “There are risks and this is why we’re considering further action.”

- Westpac Bank analysts lowered their forecast for the current year-ended May Dairy Farmer payout from Fonterra from NZ$5:30 per kgms to $4:50 after the third fall in a row in the biweekly dairy auction. It said this “will leave many NZ farmers facing a second season operating with negative cashflows.” Prolonged negative cashflow is an area of risk highlighted by the RBNZ for financial system stability. (Bloomberg news)

- Bloomberg’s survey of BoJ forecasters taken over the last week to 17 Nov found that 44% of respondents thought the BoJ would not further increase its asset purchases, up from 33% a month earlier (before the 30 Oct semi-annual BoJ outlook). All 41 economists predicted no change on Thursday. The survey also found less confidence in the BoJ’s commitment to achieving its 2% inflation target as soon as possible.

Economic news

- Australia: Wage cost index rose 0.6%q/q in Q3 as expected unchanged from Q2, up from the record low in Q3 of 0.5%. the annual rise was unchanged at the record low of 2.3%y/y as expected.

- New Zealand: 2yr ahead inflation expectations fell from 1.94% to 1.84% in Q4, below the RBNZ 2% inflation target, increasing the risk that the RBNZ further eases monetary policy.

- USA CPI headline inflation was +0.2%y/y in Oct a touch above 0.1% expected. Core 1.9%y/y, as expected, unchanged from Sep.

- USA manufacturing production rose 0.4%m/m in Oct, more than 0.2% expected, after falling 0.1%m/m in each of Aug and Sep. Overall industrial production fell 0.2% dragged down by lower electricity demand and lower oil production. Gains in output were led by construction materials and vehicles. Capacity utilization was 77.5% as expected, down from 77.7% in Sep (revised up from 77.5%), around the lows in May/June, the lows since Feb-2014.

- USA Housing market index was 62 in Nov, below 64 expected, down from 65 in Oct, revised up from 64. It is still at the second highest reading since 2006, well above the 50 neutral line between rising and falling survey responses.

- Eurozone: New car registrations slowed from 9.8%y/y in Sep to 2.9%y/y in Oct, down 0.9%m/m s.a., losing momentum since a recent peak in July.

- UK CPI headline -0.1%y/y in Oct, as expected, unchanged from Sep. Core inflation rose from 1.0%y/y to 1.1%y/y in Oct, above 1.0 expected.

- German ZEW survey of investor confidence current situation dipped from 55.2 to 54.4, a bit below 55.2 expected, to a low since Feb. The expectation component rose from 1.9 to10.4, above 6.0 expected, the first rise since March, still well below its high in March of 54.8.

Markets on the move

- US 2yr swap rates ended unchanged after being up 3bp in early-US trading.

- Eurozone 2r swap rates fell 1.7bp to a new record low -0.086%. More dovish ECB comments.

- Canadian 2yr swap rate rose 1.3bp.

- Japanese 2yr govt yield fell 0.5bp to -0.010% a low since May. 2yr swap rate fell 0.4bp to 0.0975%, around the lows in late-Sep and early-Oct, suggesting some expectation of a surprise BoJ policy easing on Thursday. Prior to July, swap rates were around 0.15%, above the cash rate target of 0.10%. If excess liquidity pushes swap rates much below 0.10%, it implies some risk of a rate cut.

- 2yr swap rates in New Zealand are down 3.8bp in early trading Wednesday from the close on Monday. 3mth OIS are down 1.6bp. Market building in greater odds of a rate cut on 10-Dec. Odds are currently around 50% chance of a 25bp cut.

- Australian 2yr swap rate little changed, around its high since August.

- US equities down1%, reversing earlier moderate gains, well up from the low on Friday last week after the rebound on Monday, but below the neck-line of the head-and-shoulders top made last week.

- Energy sector gave back half its strong rebound on Monday to be down 1.2%. Consumer discretionary stocks that bore the brunt of the selling pressure on Friday last week and recovered somewhat on Monday eked a further 0.2% rise on Tuesday. Metals and mining stocks fell 2.4% making a new low since 2009. Steel sector shares were down 1.8%.

- Copper prices fell sharply on Monday and Tuesday morning in Asia. They recovered from the lows in Asia on Tuesday to be flat in US morning trade, but fell halfway back to the lows in afternoon US trading for a second down day this week; down 0.7% on Tuesday, after a 2.3% fall on Monday, down 9.2% month-to-date to a low since 2009.

- Iron ore futures in China fell 2% on Tuesday to a new low since July. 3mth to 1yr iron ore swap prices fell 1.6 to 2.0% on Tuesday. 12mth forward prices are $38.2 per mt, a new low since contract data available in 2009. Steel price falls have accelerated this month and iron ore inventories have crept higher at Chinese ports from recent lows in June.

- Oil prices fell in the European and US trading session on Tuesday, reversing most of the gains on Monday, to be a little above the low close last week since August. Natural gas prices have been more stable this month.

- Thermal coal futures in China have been stable since Thursday, although at their lows. Coking coal futures have firmed modestly this month from record lows in early-Nov.

- The Fonterra Global Dairy Trade Dairy products price index fell 7.9% in the biweekly auction on Tuesday, in-line with the recent falls in NZ dairy futures. This is the third fall in a row, down 17.3% from the recent peak in October. It is still 34.6% above the low for the year in August, but less than half the levels prevailing near the recent long term peak in early-2014. They are around a third below the average over the last 10 years.

On the Radar over the rest of this week

Australia:

- Friday: RBA Head of Economic Analysis Heath speaks at a government Resources and Energy event in Canberra in the morning.

Japan:

- Thursday: Trade balance; BoJ policy meeting

USA:

- Through the week there are many Fed speakers every day.

- Wednesday: housing starts and permits; FOMC Oct 28 minutes

Canada:

- Friday: Retail sales, CPI

Eurozone:

- There are many ECB board member speaking at conferences through the week and the ECB releases its account of the monetary policy meeting in October at which it put the market on notice for further easing in December. Draghi speaks twice this week. The second at a speech on Friday may be the most significant.

- Thursday: ECB account of the 22 Oct MPC meeting at which the ECB hinted at further policy easing in December; ECB’ Coeure and Prat speak

- Friday: ECB President Draghi speaks in Frankfurt (text will be available)

UK

- Wednesday: Retail Sales; BoE Deputy governor Broadbent speech on the outlook for Britain’s recovery from the financial crisis, followed by Q&A; UK Government committee to hear testimony on the economic and financial costs and benefits of UK membership of the EU from business leaders.