Euro inflation, US economy and Canada rates still on track

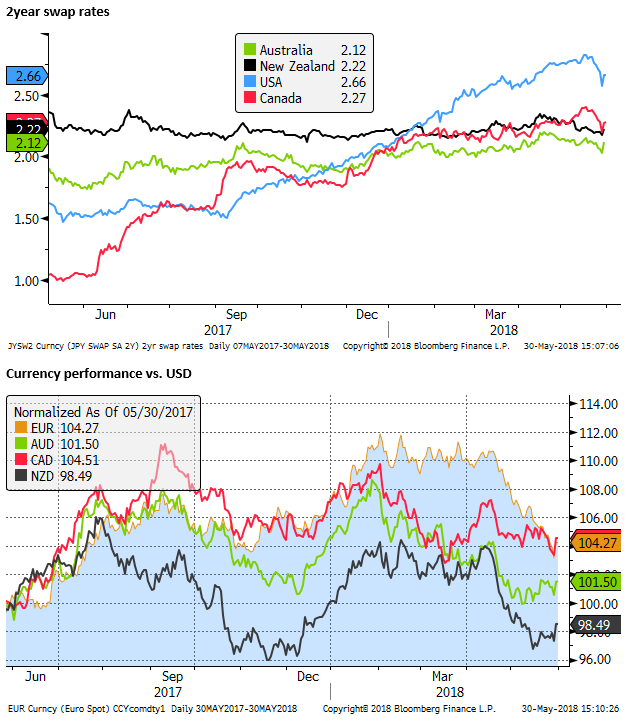

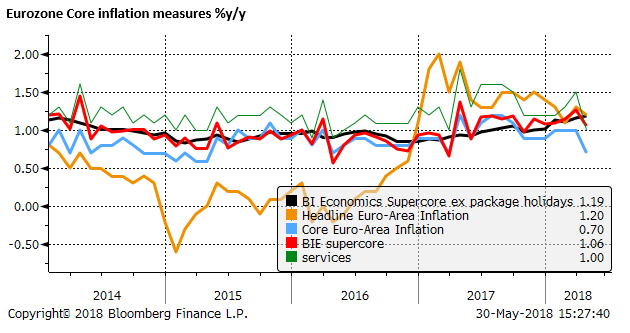

Individual country preliminary inflation data for May suggest that Eurozone headline and core measures will rebound more than expected. Without the political upheaval in Italy, the data might signal a clearer path to exiting QE and support a sizeable recovery in EUR. Political uncertainty eased somewhat on Tuesday and EUR has rebounded, but the situation remains fluid. US economic reports were mixed with a downward revision in Q1 PCE inflation, and softer ADP employment. However, the Beige Book pointed to somewhat more wage and inflation pressure. The Bank of Canada suggested that a hike at its next meeting in July would be consistent with their gradual normalisation in rates policy, necessary with inflation on target and the economy operating near capacity. They see risks from trade policy and global stresses, but not enough to derail plans to hike soon.

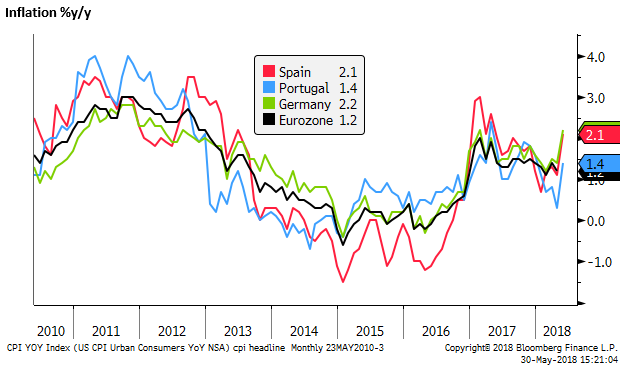

Euro inflation may be back on a higher track

The existential threat posed by Italy to the euro was replaced today by much stronger than expected inflation data from several Eurozone countries, including Germany, Spain and Portugal. Other economic data from the region, including stronger labour market data from Germany, suggest economic activity is likely to stabilise and strengthen from a period of weakness in the first four months of the year.

If not for the lingering fear of a crisis in Italy and some political uncertainty in Spain, the CPI data on Wednesday might argue for a significant further rebound in the EUR. Without the political crisis, the data would support the end of ECB QE in September.

The dip in Eurozone core CPI in April is likely to be revealed as an aberration from the trend in the May data released on Thursday.

Of course, it is difficult to disentangle the politics from the latest economic data. The EUR has bounced sharply as the temperature in Italy was turned down. Italian asset markets also rebounded, probably with some help from ongoing support from the ECB’s Asset Purchase Plan

The latest political news provides a path to a less dramatic outcome, although still with heightened and prolonged uncertainty. At this stage, it is best not to comment too extensively given the fluidity of the situation.

US economy on track

US economic reports were mixed to a bit weaker than expected, but probably don’t move the needle much on the US outlook. The Fed Beige book sounded more upbeat in May than April. It pointed to some tightening in labour market conditions and firmer price pressures. Although certainly not ringing any alarm bells that inflation pressure is picking up too much.

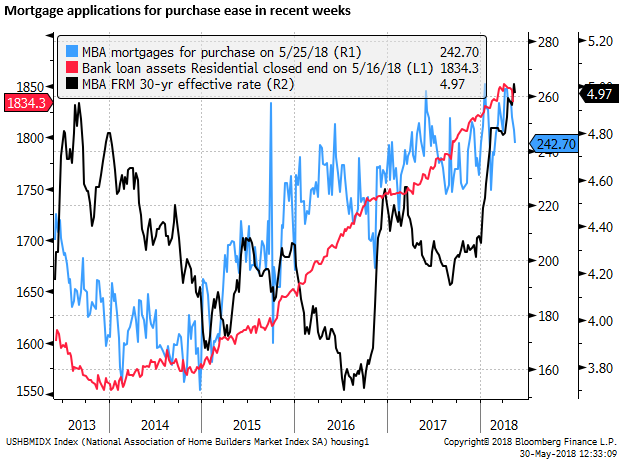

Weekly mortgage applications have eased for 5-weeks in a row, perhaps indicative of rising mortgage rates, although the series is still broadly in a rising trend.

The ADP employment report rose 178K, less than 190K expected, and revised down from 204K to 163K in April. The three-month average for ADP employment growth is 180K in May

The market median forecast for Friday’s non-farm payrolls report is for an increase of 190K in May (after a rise of 168K in April).

At the margin, the ADP report may dampen expectations for Friday’s payrolls. But the market may presume any slowing in jobs growth may be more indicative of tightening supply of available workers, and the focus will be on the unemployment rate and wages, along with other metrics on available workers, including broader U6-underutilization rate.

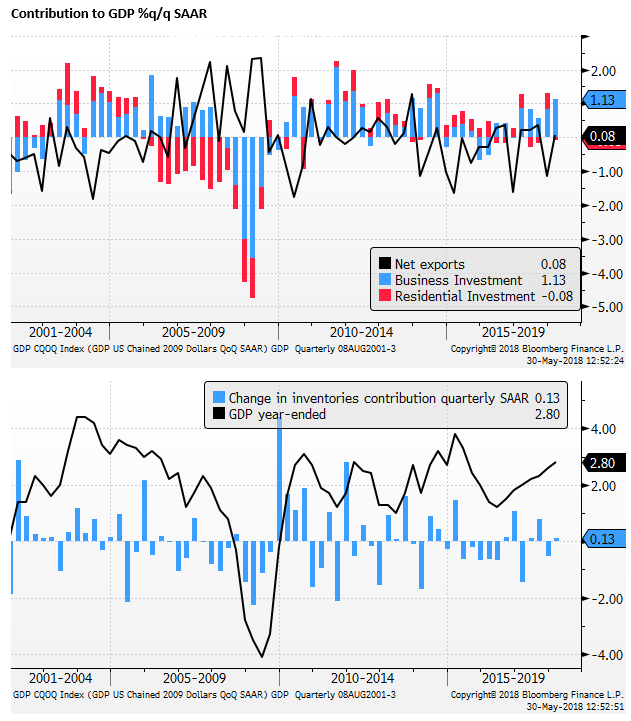

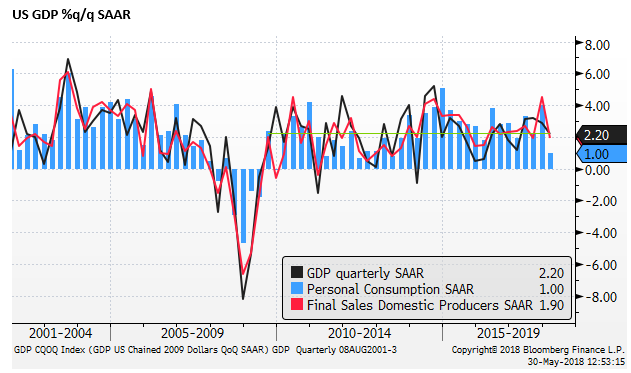

The US GDP Q1 was revised down to 2.2%q/q SAAR from 2.3%, although the mix in the data was more encouraging with stronger business investment and lower inventory accumulation.

Business investment contributed 1.1% q/q SAAR to GDP growth in Q1, the largest amount since Q3-2014, continuing a strong pattern for a 5th quarter in a row.

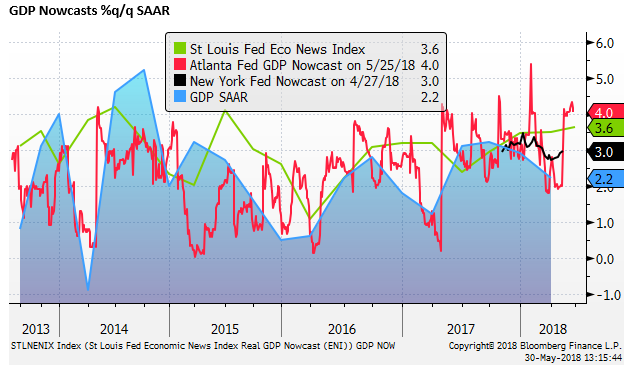

After a weaker than average Q1, continuing a pattern of low Q1 outcomes over recent years, partial indicators are pointing to much stronger GDP growth in Q2. The Atlanta Fed Nowcast is at 4.0%. The New York Fed Nowcast is at 3.0%, and St Louis Fed Eco News index is projecting a 3.6%.

However, The core PCE in the GDP report was revised down from 2.5% to 2.3% q/q SAAR in Q1. The April PCE inflation data is due tomorrow, and should reflect some downward revision in recent data. The market is looking for a 1.8%y/y result for core PCE in April.

Beige Book sounds more upbeat

The Fed’s Beige Book sounded more upbeat than in the previous report in April. It said, “Economic activity expanded moderately in late April and early May with few shifts in the pattern of growth. The Dallas District was an exception, where overall economic activity sped up to a solid pace. Manufacturing shifted into higher gear with more than half of the Districts reporting a pickup in industrial activity and a third of the Districts classifying activity as “strong.””

Labour and wages

“Labor market conditions remained tight across the country, and contacts continued to report difficulty filling positions across skill levels.”

“Many firms responded to talent shortages by increasing wages as well as the generosity of their compensation packages. In the aggregate, however, wage increases remained modest in most Districts. Contacts in some Districts expected similar employment and wage gains in the coming months.”

Prices

“Input cost increases, along with labor shortages in some sectors and strengthening demand, put upward pressure on prices in the transportation, construction, and manufacturing sectors. Some Districts also noted that their retail contacts were more able to pass along price increases to their customers than in the recent past.”

Beige Book – May 30, 2018 – FederalReserve.gov

Bank of Canada on track

The Bank of Canada removed from its statement “some monetary policy accommodation will still be needed”, suggesting to the market that a rate hike is back on the table for the next meeting in July.

The probability of a 25bp hike from 1.25% to 1.50% on 11-July rose from 53% to 77% after the BoC statement.

The Bank reiterated that “higher interest rates will be warranted to keep inflation near target”, and added that it “will take a gradual approach to policy adjustments”.

It appears to be gearing up for some further normalisation in interest rates in July at what might be regarded as a gradual pace, after pausing for two policy meetings.

This would be the fourth hike in the current cycle, after back-to-back Jul & Sep hikes last year, and a third in January.

The statement was much shorter and indicated that the outlook was on track with its April MPR forecasts, with core inflation “near 2 per cent, consistent with an economy operating close to potential.”

They continue to see growth running around 2%, modestly above potential.

The statement continued to say it would be “guided by incoming data” and “The Bank will continue to assess the economy’s sensitivity to interest rate movements and the evolution of economic capacity.”

It reiterated risks from “ongoing uncertainty about trade policies”, and noted, “stresses are developing in some emerging market economies.” But it seems that recent events have not yet knocked the BoC view off course.

Bank of Canada maintains overnight rate target at 1¼ per cent – BankofCanada.ca

The statement helped CAD catch a bid, in-line with the broad rebound in commodity, EM, and European currencies.