Eurozone risk aversion building as Italian referendum approaches

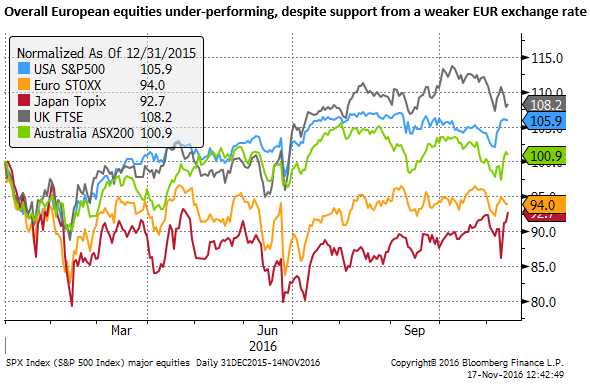

US yields firm back to recent highs as Yellen notes the inflationary risks that may arise from a big infrastructure spend with the economy near full employment. The BoJ illustrate the power of their Yield Curve Control policy in a rising yield environment, sending the USD/JPY higher. Attention may turn more to the Italian constitutional referendum on 4 December. Risk aversion is rising in the Eurozone with peripheral bonds, especially in Italy, underperforming, Bund yields stalling, Eurozone equities and corporate bonds lagging other markets. EUR is down noticeably vs CHF and GBP, indicative of rising fears over Eurozone stability. As investors focus more on the 4 December referendum we may see EUR/JPY come under pressure, helping to cap USD/JPY for the time-being. Given the stronger sentiment for the USD, benefitting from Trump’s policies and recent evidence of stronger activity and inflation in the USA, we may see rising risk aversion in the Eurozone contribute to further weakness in EM and commodity currencies vs the USD. AUD is suffering from evidence that the Australian economy may have stalled below potential just as the USA is making solid progress towards higher inflation, and higher global yields see a retreat in carry trades in riskier currencies, like AUD and NZD.

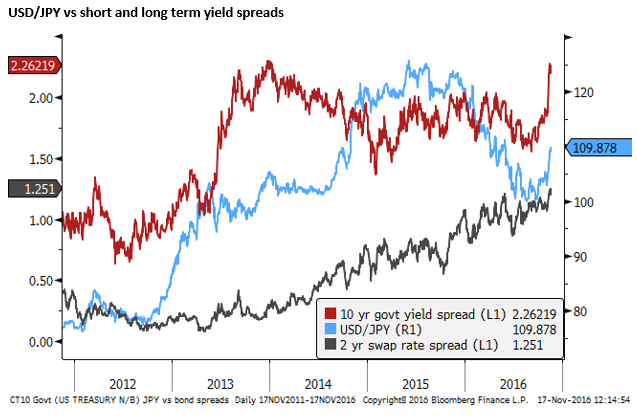

BoJ Yield Curve Control in action

The BoJ illustrated the increased power of its QQE/YCC monetary policy in a rising yield environment on Wednesday. (We discussed this in our report earlier this week: Two currency themes to unwind – ampGFXcapital.com). Simply announcing an unlimited bid for bonds in short and mid-term maturities resulted in no purchases, but yields fell and the USD/JPY jumped back up after experiencing some correction from near the 110 psychological level.

USD/JPY may pause around this level, after rebounding 10% from its lows this year. But the market may start to view the JPY in a sustained weaker trend, this would be a significant shift in mindset from the first three-quarters of the year where most commentators were of the opinion that JPY might strengthen well below 100.

There are risks that USD/JPY does retrace some of its recent gains. We are wary of a return to some risk aversion related to the Italian referendum spilling over to a stronger JPY.

Italian referendum risk aversion

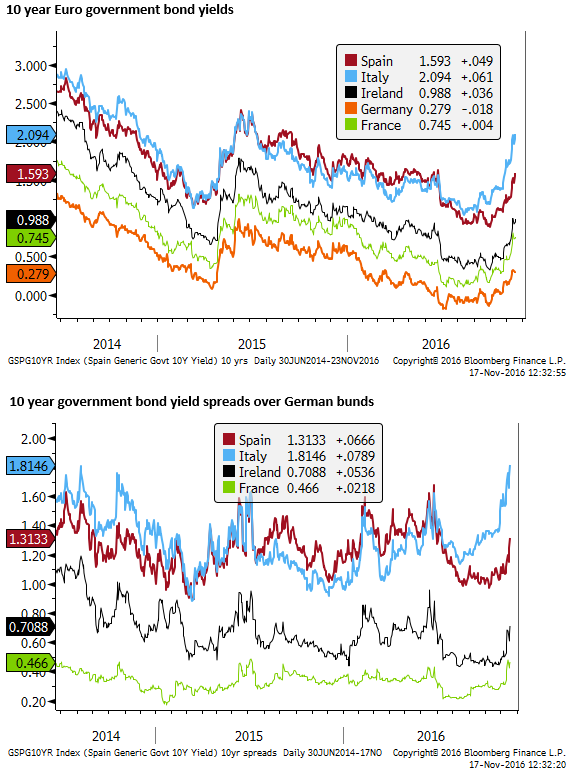

Risk aversion related to the Italian Constitutional referendum is on the rise. The chart below shows 10-year government yields in Europe rising faster in the periphery, particularly Italy, than in Germany. The 10 year spread over German bunds is its highs over the last three years. While this may still be considerably narrower than the heights of the Euro crisis in 2010/13, we are now in an era on ECB QE purchase of government and corporate bonds.

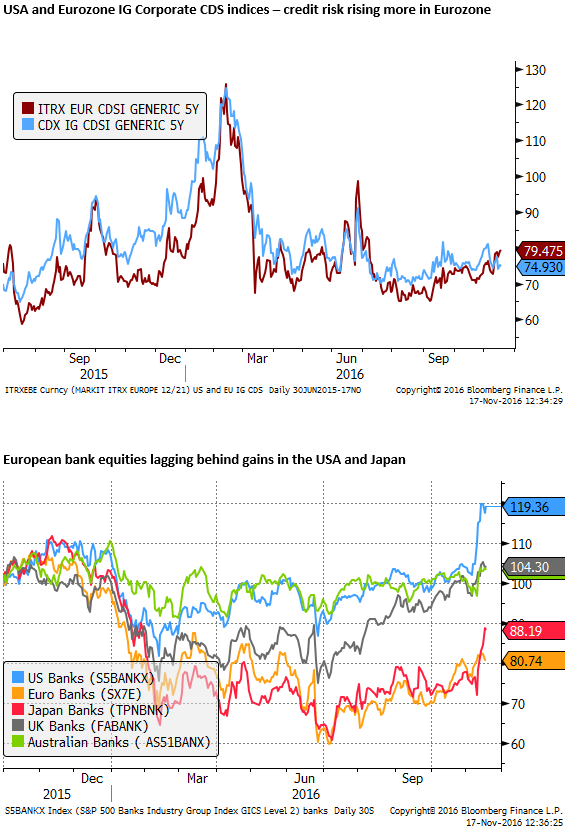

The chart below shows investment grade corporate Credit Default Swap indices for then USA and Eurozone. More recently, credit risk has risen in the Eurozone above that in the USA, despite the support from ECB QE policies.

The Italian constitutional referendum includes a number of electoral reforms including reducing the power of the Senate to reject bills passed in the Chamber of Deputies. The vote is seen by many Italians as a vote of confidence in the government led by PM Renzi. Renzi has encouraged this thinking by saying that he will step down if the No vote wins. The polls are showing the No vote with a narrow lead, although there are a large number of undecided people.

A no vote threatens to see anti-Euro parties take control of the government leading to problems with Italy maintaining the reform agenda and budget constraint needed to meet its obligations to the EU.

The market fears that the Brexit and Trump results point to an anti-establishment trend that raises the odds of a No vote in Italy. It would be a trifecta for populist politics this year that could point to upsets in French and German national elections next year, a shift towards more inward looking populist policies threatening the viability of the Eurozone at a time when it is already dealing with Brexit. A break-up of the Euro is still a long-shot, but this trend reduces confidence in stability in the region, undermining economic and investor confidence.

The Italian referendum may not lead to the same intensity of volatility around the Brexit and US election votes, but the market may again hone its attention in on the 4 December referendum and treat it as another binary event with significant implications for the EUR, European assets and indeed, to some extent, global risk appetite.

EUR has not always responded negatively to increasing risks to Eurozone stability. At times this has driven capital repatriation by its banks looking to shore up their balance sheets, generating support for EUR. At other times capital has shifted from the periphery to the core, mainly Germany, seeing little net selling of the EUR, and in fact, some have postulated that the EUR appears stronger if weaker southern European nations might drop-out. Furthermore, financial instability in Europe could spread to the rest of the world, delay USA Fed rate hikes, or see capital flight from higher risk emerging markets, also tending to support the EUR.

Over time, Euro instability has tended to weaken the EUR since it has undermined economic and investor confidence in the region, leading to easier monetary policy and efforts by the ECB to support liquidity in the banking system. Fears of a break-up in the EUR can then spread to concerns over weaker growth and instability even in the core and lead to broader capital outflow from the region.

As such, the reaction of the EUR to Euro related financial stability is not clear-cut. EUR is weaker vs the CHF, an alternative safe haven in the region. It also weaker vs the GBP, reversing all of its gains over recent months since a hard Brexit became more likely. Considering the risks to cohesion in the Eurozone, Brexit no longer appears to be such a bad idea.

We might expect EUR to be soft relatively to alternative havens. What constitutes an alternative haven has been muddled over the years and depends on degrees of risk and contagion. At times higher yielding emerging market and commodity currencies may seem a viable alternative if developments in Europe do not appear to severely undermine the global economic outlook. Gold may be considered a haven, and so might JPY, especially in situations where developments in Europe appear to delay previously anticipated rate hikes in the USA.

Recently the USD has exhibited a stronger trend; this may be more durable than in the past as the market considers the policy agenda of Trump and recent evidence of improved economic conditions and inflation in the USA that keep the Fed on track to hike in December. As such, the political uncertainty in the Eurozone may be contributing to a more straightforward path towards a weaker EUR/USD.

Considering the strength of the USD, it also appears more likely that rising risk aversion related to Italy may spill over to weaker commodity and EM currencies, probably in an environment of weaker equities and only a modest retracement in the recent recovery in global bond yields.

While the USD/JPY was one of the leaders of the recent rebound in the USD, attention may be turning to the EUR. The rise in USD/JPY may depend more on the rising USD yield advantage and confidence in the global economy. As such, we see a risk that USD/JPY stalls around 110 with potential for some retracement in recent gains, driven by selling in EUR/JPY.

Australian economy falters

The AUD has been further undermined this week by weaker than expected wages data, at a low in the series available since 1998, and mixed labour data. It does appear that the Australian economy that had been transitioning better than most had expected in recent years from a mining investment downturn, has lost momentum this year and facing more disinflationary pressure than its peers.

The slowdown is not too severe, but the economy may now be operating below potential with excess capacity suggesting it may need further policy easing to get it back on track towards sustainable growth and target inflation. The RBA will not be panicking yet and will see benefits from a weaker AUD, but it does appear that it will have an easing bias for some time beyond Fed rate hikes.

The Australian economy should be getting support from higher commodity prices this year. Notwithstanding the correction in recent days in metals and coal, they are still up significantly over the year. However, this does not appear to have lifted business or consumer confidence in mining states in Australia. It might be improving the government budget outlook, offering potential for fiscal stimulus, but it has done little to stabilize the downturn in mining investment.

The mining sector is largely viewing the rebound in Chinese demand for commodities and prices as driven by short-term factors, or subject to considerable risk over the medium term.

There is still additional capacity coming on stream from the most recent mining boom and there is little prospect of a recovery in mining investment in the foreseeable future. As such, rebounding commodity prices are having a relatively limited impact in supporting the AUD.

On the other hand, the recovery in yields globally, led more recently by the USA, is spilling over to some unwind in carry trades or less ‘search for yield’ in higher risk investment, and this is weakening AUD and NZD, realigning these currencies to reflect their rate cuts earlier in the year.