Fatigue in risk-on trades as Fed holds the line

Fed commits to low rates and QE at the current pace

- US 2yr swap rates fell 3bp on Wednesday, about 2bp post-FOMC

- 10-year bond yields fell 10bp on Wednesday, about 5.5bp post-FOMC

- The USD was weaker into the FOMC and weakened further afterwards, although moves were volatile and perhaps lack conviction towards further dollar weakness.

- US equities were modestly weaker ahead during the day ahead of the FOMC. They rose initially after, but gave back gains, and fell further towards the end of the day to near session lows. There was significant divergence with High Tech up 1.7%, the S&P500 overall down 0.5%, the Russell 200 small caps down 2.6%.

Overall the Fed lived up to expectations that it would present an outlook for an unchanged commitment to existing extreme policy easing measures.

The dollar and equities moves leading up to this meeting have been relatively rapid and are exhibiting risks of being over-done in the short term. They are starting to exhibit volatile price action, which raises the risk of a more significant correction of the recent run-up in equities and fall in the USD.

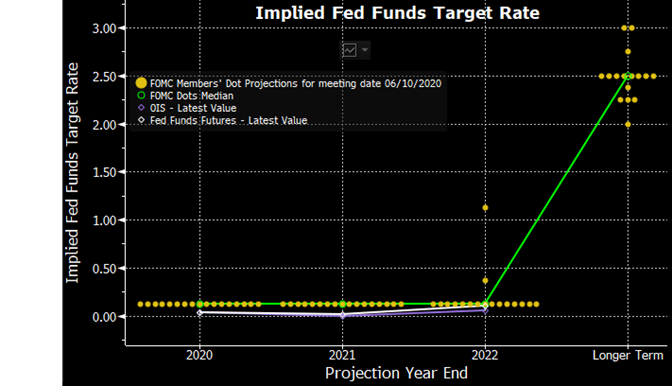

Meeting expectations, the FOMC Summary of Economic Projections, the first since December last year, projected a near-complete consensus that the Fed-Funds target would remain at zero to 25bp for the next two years to 2022 at least. Only two of 17 members had higher rates in 2022. This is consistent with current market pricing.

The FOMC maintained the IOER at 0.10%.

SEP projects rates around zero for two years

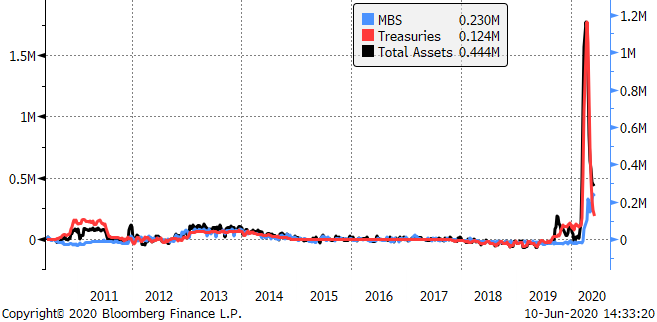

A dovish element (that was largely expected) in the FOMC statement was a change in wording around asset purchases. It had previously said it would purchase Treasuries and MBS in “amounts needed to support smooth market functioning”. Today, it said it will purchase “at least at the current pace to sustain smooth market functioning”.

Separately the New York Fed released a statement clarifying what “the current pace” meant. It said that it was “approximately” $80bn Treasuries per month, $40bn Agency MBS per month, and $250 to $500mn per week of agency CMBS.

This is a relatively rapid rate of purchases. The previous peak monthly rate of purchases in 2013 was around $45bn Treasuries and a similar pace for MBS. The higher pace of purchases of Treasuries might reflect the higher pace of government issuance to fund its massive fiscal spending. In any case, the proposed “current pace” is intended to be a minimum; more will be conducted if considered necessary to maintain smooth functioning.

The FOMC does not state how long this asset purchase plan will remain in place. It says, “The Committee will closely monitor market conditions and is prepared to adjust its plans as appropriate.” This might be regarded as somewhat less dovish than the ECB that places a minimum time frame out to mid-2021.

Four-week change on Fed balance sheet and holdings of Treasuries and MBS

There was considerable discussion in the market about whether the Fed might adopt a yield curve control policy. The announcements today appear aimed at keeping real yields down but fall short of yield curve control. In questioning, Powell said, YCC” remains an open question”.

The Fed may adopt YCC if it thinks current policy settings lack teeth in keeping real rates low. But at this stage, it may see the policy as creating unnecessary confusion when the current agenda is largely delivering the intended monetary conditions.