Fed gradual and cautious, JPY sets tone

Chair Yellen signaled an incremental improvement in the outlook for rate increases, but she left out a lot of possible comments that might have narrowed the view on the timing of the next hike. She appears to be keeping her options open.

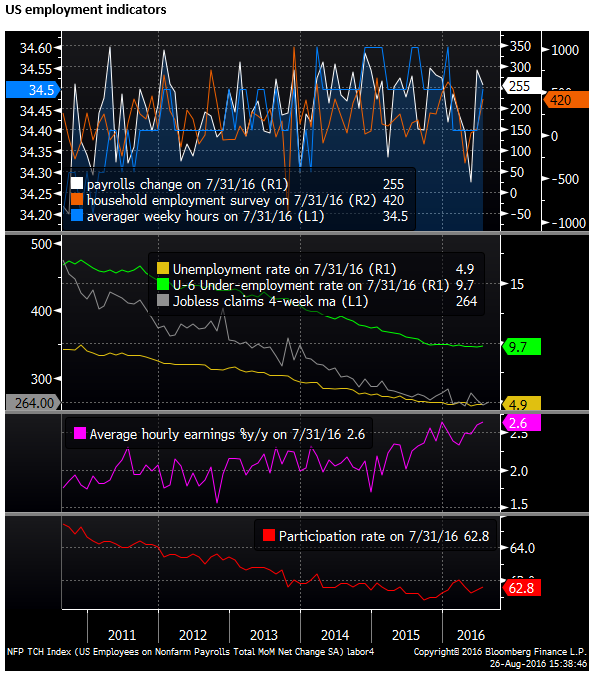

To more clearly move the needle in favor of a rate hike, the Fed would like to see clearer evidence that stronger payrolls is coinciding with other measures of a tightening/improving labor market; including lower unemployment, under-employment, part-time for economic reasons, higher hours worked and wages.

US yields rose on Friday after Vice Chair Fischer comments. When asked, he agreed to the question, that “we should remain on the edge of our seats” for a possible hike in September and even two hikes by year end. But Fischer also emphasized it depends on the data.

Looking through the framework on how Yellen sees monetary policy, her speech suggests she may not be convinced yet that the Fed should hike in coming months, and if they do, it will be a long gap before hike three in the cycle.

A key point to take out of all the Fed commentary over the last month is that there is increasing willingness to get another hike done this year, but there is also increasing wariness about hiking through the cycle. The clearest take away is that the Fed is espousing a gradual and cautious approach. This suggests that future hikes are more likely to be delayed on any evidence of stalling in growth and less likely to be accelerated on strength.

The jump in USD/JPY on Friday after its repeated attempts to move below 100 in recent weeks may be a sign that the tide is turning for the USD/JPY. Certainty there is a much lower bar for the BoJ to jump at the 21 September meeting. The BoJ may only need to reassert its current policy agenda of targeting 80tn of net asset purchases per year and a negative cash rate target of -0.1% to sustain USD/JPY above 100.

The next big market event will be the US payrolls report next week. The Fed comments in recent weeks and at Jackson Hole have resumed intense focus on this report. It is far from clear that this report will be strong enough to make the case for a 21 September hike. Recent US economy data have been mixed.

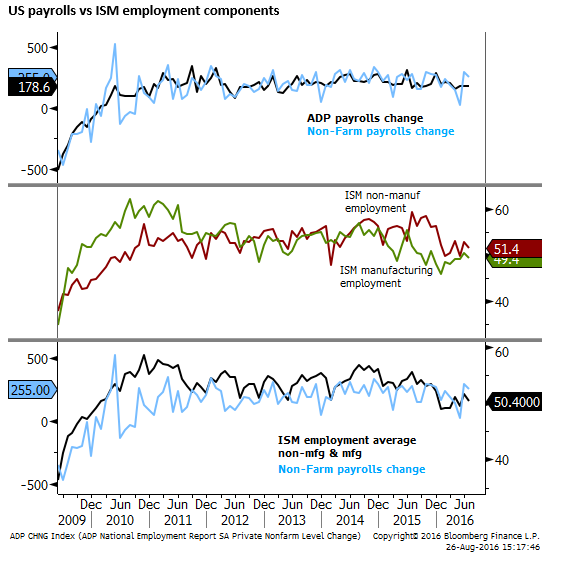

We see a risk that payrolls loses momentum again after two months of strong outcomes. This would be consistent with a weaker PMI employment components that averaged 50.4 for the manufacturing and non-manufacturing indices in July.

This continues to be a difficult and complex period in markets. The prospect of a gradual and cautious Fed is supporting higher yielding emerging market and commodity currencies. But USD/JPY has been setting the tone for markets this year and is showing some signs of basing, which could restore broader support for in the USD.

Chair Yellen non-comital on rates

Chair Yellen signaled an incremental improvement in the outlook for rate increases, but she left out a lot of possible comments that might have narrowed the view on the timing of the next hike. She appears to be keeping her options open.

Unlike the more hawkish Williams, Yellen gave no indication on the rate of payrolls gains that is consistent with a tightening labor market and she said nothing about the remaining slack in the labor market.

Overall the outlook for growth remains moderate and emphasis is on a gradual policy tightening. Such that the next hike, should it come this year, may not be followed quickly by a third this cycle and the Fed will remain cautious and closely watching for ongoing evidence of labor market tightening and higher inflation.

The Fed requires the labor market data, in particular, to remain solid and show evidence of tightening. Should this stall or soften, rate hikes will immediately be pushed off the agenda. As such there is an asymmetry in how the market may respond to USA data. The USD will probably respond more decisively and bearishly if the data improvement stalls again. If payrolls remain on the recent trend (190K average over the last three months) with limited evidence of further tightening in the labor market, then the Fed will be divided and the cautious gradual attitude of most FOMC members may incline the Fed to inaction.

To more clearly move the needle in favor of a rate hike the Fed would like to see clearer evidence that stronger payrolls is coinciding with other measures of a tightening/improving labor market; including lower unemployment, under-employment, part-time for economic reasons, higher hours worked and wages.

On the current policy outlook, Yellen said:

“U.S. economic activity continues to expand, led by solid growth in household spending. But business investment remains soft and subdued foreign demand and the appreciation of the dollar since mid-2014 continue to restrain exports. While economic growth has not been rapid, it has been sufficient to generate further improvement in the labor market. Smoothing through the monthly ups and downs, job gains averaged 190,000 per month over the past three months. Although the unemployment rate has remained fairly steady this year, near 5 percent, broader measures of labor utilization have improved. Inflation has continued to run below the FOMC’s objective of 2 percent, reflecting in part the transitory effects of earlier declines in energy and import prices.

“Looking ahead, the FOMC expects moderate growth in real gross domestic product (GDP), additional strengthening in the labor market, and inflation rising to 2 percent over the next few years. Based on this economic outlook, the FOMC continues to anticipate that gradual increases in the federal funds rate will be appropriate over time to achieve and sustain employment and inflation near our statutory objectives. Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months. Of course, our decisions always depend on the degree to which incoming data continues to confirm the Committee’s outlook.”

The market reaction to this speech was indicative of the non-committal nature of these comments. Yields and the USD rose, fell, then rose again to close higher. She said, “The case for an increase in the federal funds rate has strengthened in recent months.”

So a hike has become more likely, but how likely? In May, Fed members including Yellen said a hike was “likely” in the summer. Recent Fed comments still fall short of this clear guidance. Of course the summer hike did not happen and the probability collapsed after the weak May payrolls report.

One might conclude that there is still a wide range of opinion at the FOMC and Fed members are unwilling to commit until at least they see one more jobs report.

Vice Chair Fischer pressing the case for another hike

The higher rates response on the day on Friday owes more to how Vice Chair Fischer interpreted Yellen’s speech.

Fischer was asked on CNBC whether people should “be on the edge of our seat” for a rate hike in September, and for more than one policy tightening before year end. He answered: “I think what the Chair said today was consistent with answering yes to both of your questions, but these are not things we know until we see the data.”

This appeared to warn us that a hike in September is on the table, and another in December is possible. However, it is very hard to assess how Fischer interpreted “on the edge of your seat” and he continued to note it depends on the data.

In the past, Fischer has been more inclined than his peers to say we can’t give clear guidance and it depends in the data. So he may have meant we cannot dismiss the possibility of a hike in September or two this year as negligible and we will respond to the data.

Fischer did note that jobs growth over the last three months (averaging 190K) were strong, and the Fed will have another payrolls report next week to consider ahead of the 21 September. It does appear that he will be siding with the case for another hike if this data were consistent with this stronger trend, especially if there were some supporting elements in the report suggesting that the labor market had tightened.

However, as to the prospect of two hikes this year? This would seem a stretch given every Fed member is emphasizing a gradual and cautious policy approach. It is hard to imagine this would occur.

Fed’s Fischer interview – CNBC.com

Yellen’s tool-kit analysis argues for more caution than normal

Yellen’s speech was mainly about the how monetary policy toolkit has changed since the Global Financial Crisis in 2007/08 and how it may work in the future.

She outlined the main challenge going forward will be the lower outlook for the neutral interest rate, implying there will be less space to use conventional rate cuts to address future economic down-turns.

She anticipates that the Fed may again in future have to rely on the “non-traditional” tools established since the GFC, once rates hit zero. The first line of defense will be asset purchases (probably Treasuries and Government mortgage backed securities) and forward guidance (saying they will keep rates at zero until at least unemployment falls below 5% or inflation rises above some threshold).

Yellen used a model to argue that these tools could be quite effective and give the Fed sufficient scope to guide the economy (unemployment and inflation) back to normality after “a set of highly adverse shocks.”

However, she also noted concerns that the model may be optimistic, implying the policymakers should consider and be open to widening the toolkit.

Some of these concerns relate to current situation; such as, “an environment where long-term interest rates are also likely to be unusually low.” Or where short term rates were low to start with; in this context she noted that, “By some calculations, the real neutral rate is currently close to zero, and it could remain at this low level if we were to continue to see slow productivity growth and high global saving.”

She also acknowledged a short coming with “non-traditional tools” is that “they might inadvertently encourage excessive risk-taking and so undermine financial stability.”

She made it clear that, “the simulation analysis certainly overstates the FOMC’s current ability to respond to a recession, given that there is little scope to cut the federal funds rate at the moment.”

While she did not specifically state it in this speech, the current limited space to cut rates, and the short-comings with relying on non-traditional tools, suggest the Fed should raise rates more cautiously.

There are asymmetric risks to being behind or ahead of the curve. The negative consequences of being ahead of the curve (tightening too quickly) are greater than being behind the curve. This supports the notion that the Fed should delay hikes until, as some have described it, it sees the whites of inflation’s eyes.

Looking through the framework on how Yellen sees monetary policy, this speech suggests she may not be convinced yet that the Fed should hike in coming months, and if they do, it will be a long gap before hike three in the cycle.

Cautious and gradual

A key point to take out of all the Fed commentary over the last month is that there is increasing willingness to get another hike done this year, but there is also increasing wariness about hiking through the cycle. The clearest take away is that the Fed is espousing a gradual and cautious approach. This suggests that future hikes are more likely to be delayed on any evidence of stalling in growth and less likely to be accelerated on strength.

JPY sets the tone

The biggest response to the Jackson Hole events came in the JPY. We suspect that the sharp fall in JPY may be coloring the broader market response from currency to bond markets.

USD/JPY has been weak since the BoJ disappointed market expectations for more significant policy easing at the 29 July policy meeting. In uneasy calm over the last two weeks after extreme volatility into and after the 29 July policy meeting, USD/JPY has been testing the key psychological 100 level, but generally it has closed above this level. It briefly test this level post the Yellen speech, but rebounded and rose sharply above the 100.50 to 101.00 levels that had capped it for the last two weeks.

The outlook for BoJ policy on 21 September also remains very uncertain, but the BoJ at the least must try and convince the market that it is committed to extreme policy easing, even if the market doubts the effectiveness of its current policy measures, that are under review.

Japan CPI weak

The Japanese CPI inflation outcome released on Friday was weaker than expected and raises the pressure on the BoJ to do more to ease policy (whatever that may be).

The BoJ’s preferred measure of underlying inflation, its own CPI less Fresh Food and Energy fell from 0.7%y/y in June to 0.5%y/y in July. This is down from its high of 1.1% in November 2015, at a low since April 2015; clearly moving further and well below its 2% inflation target.

The trimmed mean inflation fell from 0.2%y/y to 0.1%y/y in July, and the BoJ’s diffusion index of rising prices less falling prices has also been declining for several months.

Measure of Underlying Inflation – BoJ.or.jp

BoJ Governor Kuroda is to appear in a panel discussion at the Jackson Hole Symposium that overviews the event on Saturday along with the ECB’s Coeure and the Bank of Mexico Governor Carstens. It may not be an occasion where he will provide more hints on BoJ policy measures, but the market will be closely attuned to his comments.

The jump in USD/JPY on Friday after its repeated attempts to move below 100 in recent weeks may be a sign that the tide is turning for the USD/JPY. Certainty there is a much lower bar for the BoJ to jump at the 21 September meeting. The BoJ may only need to reassert its current policy agenda of targeting 80tn of net asset purchases per year and a negative cash rate target of -0.1% to sustain USD/JPY above 100.

US data may fail to impress

The next big market event will be the US payrolls report next week. The Fed comments in recent week and at Jackson Hole have resumed intense focus on this report. It is far from clear that this report will be strong enough to make the case for a 21 September hike. Recent US economy data have been mixed.

This week, several regional manufacturing surveys were softer and the Markit preliminary USA PMI was down from 52.9 to 52.1 in August, below 52.6 expected. The Markit services PMI was only 50.9 in August, down from 51.4 in July.

Durable goods orders were modestly firmer than expected. Underlying core capital goods orders rose for a second month in a row in July (up 1.6%m/m after rising 0.5%m/m in June). However, they are still around the weakest level since 2011, and thus do not yet show enough recent strength to much support the case for a Fed hike.

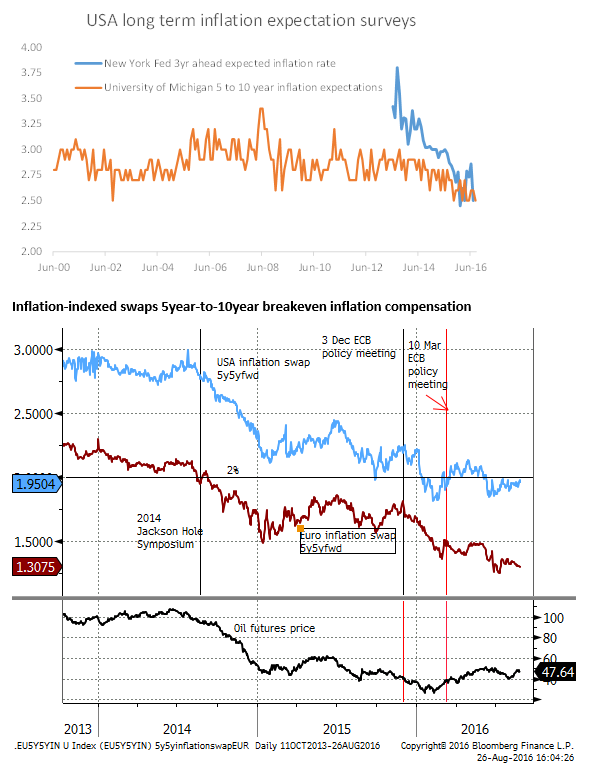

The Michigan Consumer survey of long term inflation expectations were revised down to 2.5%, equaling the record low seen several times since October last year. This concurs with the most recent reading in the New York Federal Reserve forecast of three-year ahead inflation expectations that fell back to 2.5% in July, revisiting lows in Q1 this year. Market-based measures of inflation expectations have been stable since mid-year, but are still near their lows. As such, low inflation expectations remain a restraint of Fed policy tightening.

Next week kicks off with the PCE deflator on Monday; the Fed’s main inflation gauge. Fed members have argued the core is near 1.6% at the moment, gradually on a path to make it to 2% over two years. The market is expecting core PCE to slip to 1.5%y/y in July.

On Thursday the ISM manufacturing survey is released, based on recent regional and Markit data this may be unimpressive and is forecast by the median economist to dip from 52.6 to 52.0.

Payrolls are due on Friday and are expected to rise 180K, unemployment is forecast to fall from 4.9% to 4.8%.

We see a risk that payrolls loses momentum again after two months of strong outcomes. This would be consistent with a weaker PMI employment components that averaged 50.4 for the manufacturing and non-manufacturing indices in July.