Fed rate pause in view

A Fed pause, if not a peak, may be coming into view. Financial conditions in the US are tightening up, and the Fed Chair and Vice Chair expressed more caution last week. They suggested that rate hikes are no longer on auto-pilot, but are more dependent on data and financial market conditions. With the increased flexibility of a press conference at every FOMC meeting from now on, there is more scope to pause without confusing the market or making a policy mistake. We should not assume that a December hike is a done deal given recent market turmoil spreading to US credit markets. The USD has lost strength since last week and may be more sensitive to prospects of fewer hikes ahead.

Fed shift tone

In interviews last week, Fed Chair Powell and Vice Chair Clarida shifted the Fed’s tone on the path for rates. Both acknowledged evidence of slowing global demand, and that they now have to think more about how far and how fast to raise rates.

Fed Chair Powell said:

“When you look down the road you see challenges ahead that are typical at this point in the cycle. We have to be thinking about how much further to raise rates and the pace at which we raise rates. And the way we will be approaching that is to look at the way the markets, the economy, and business contacts are reacting to our policy.”

Dallas Fed Global Perspectives with Jerome H. Powell – www.youtube.com/user/dallasfed

Fed Vice Chair Clarida said:

“Going forward you have to look at a lot of trends, including the global economy is something that they have to pay attention to, there is some evidence that it is slowing.”

“From my perspective, we are really at a point now where we are data dependent; the economy is doing well, we are looking for signals from the labor market and inflation, to get a sense of both the pace and destination for policy, so this is very much in data-dependent mode right now.”

“As you move into the range of policy that by some estimates is close to neutral, then, with the economy doing well, it is appropriate to shift the emphasis towards being more data-dependent. I think Chair Powell the other day made the analogy in Dallas, that when you are in a dark room, especially without your shoes on, you want to go a bit slower so you don’t stub your toe. So I think data-dependence makes sense right here.”

CNBC’s full interview with Fed vice chairman Richard Clarida – CNBC.com

Both Powell and Clarida were not suggesting a pause in rates was imminent, but they are now much less on auto-pilot. The economic data is clearly important, but they may also be more responsive to financial market conditions.

This is a distinctly different message than Powell gave the market when he said on 3 October that interest rates were still a long way from neutral (Powell says we’re ‘a long way’ from neutral on interest rates, indicating more hikes are coming; 3 Oct – CNBC.com).

Tightening US Financial Conditions

So far this year, the Fed has appeared to downplay equity market weakness and volatility as an influence on rates policy. The correction in equities, after all, has come after multi-year highs, and the recent fall might seem only to unwind an over-valued condition.

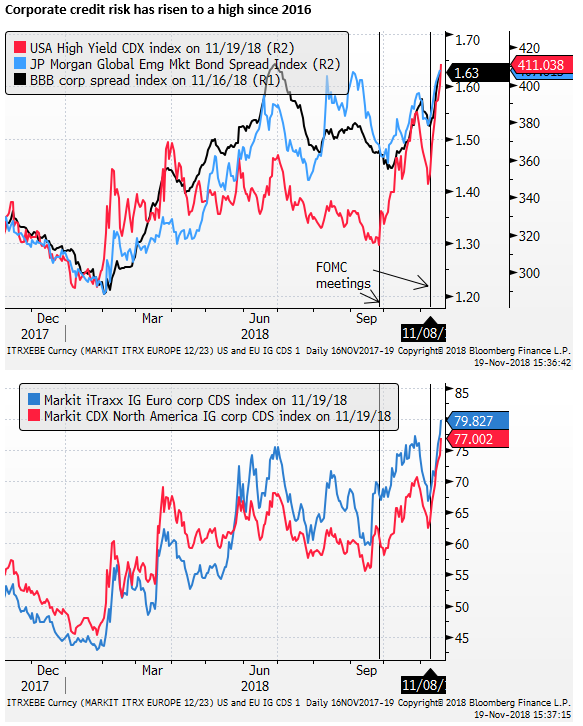

However, in the last month or so, we are starting to see a significant rise in US credit spreads in the bond market. This may well get more attention at the Fed as a sign of a broad tightening in financial conditions.

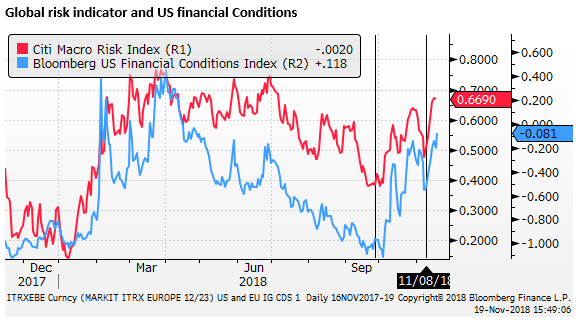

The Bloomberg US financial condition index shows significantly tighter conditions since the September FOMC, although only back to levels in April this year. Money-market spreads are narrower since earlier in the year, although they too have risen in recent months. This suggests that the Fed might not need to hit the pause button yet. However, it has hiked twice more since April, so rates are closer to neutral, and corporate bond credit risk has risen to new highs.

At this stage, the market might be right to presume a hike is coming in December, but it is not in the bag. If market volatility picks up and financial conditions tighten further, then the Fed could decide to pause, or at least use its press conference to suggest further tightening in 2019 might be kept in the bag pending clearer evidence that economic momentum is being maintained despite tighter financial market conditions and increased perceptions of risk in the global and US economy.

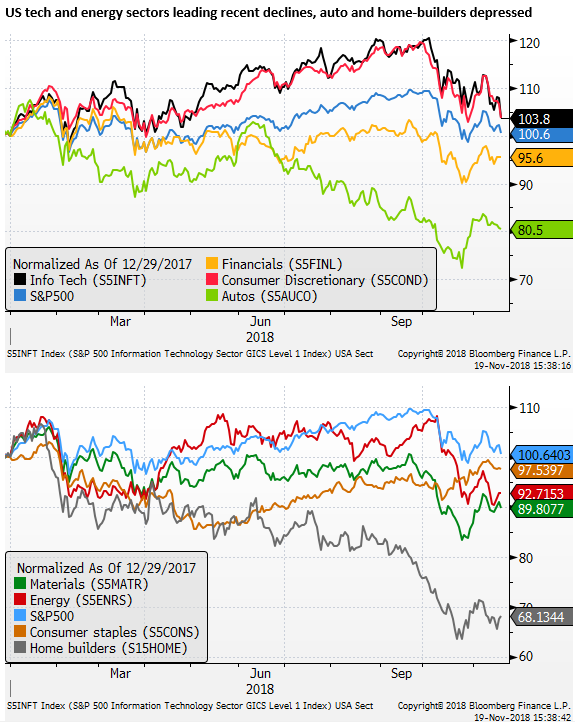

A broader tightening in US credit conditions may reflect increasing market concern over the impact of US trade policy. Weaker international demand for US goods (particularly in China), higher costs for imports and supply chain disruption may be undermining investor confidence in the US industrial sector.

High tech equities have fallen significantly, led by FANG stocks. This reflects pressure on social media to deal with fake news and accounts, moves globally to tax tech giants digital revenue, and weaker demand fears for hardware producers like Apple and semiconductor makers.

Weaker oil prices may have also damaged sentiment in the US energy sector. Auto sales have slowed in several countries, including China, Europe and the USA.

Fed still sees rates below neutral

Underlying US economic data may remain robust, particularly in the labour market, spurring strong consumer spending. We presume the Fed will still project higher rates next year. The Fed funds rate between 2 and 2.25% is still below what the Fed estimates neutral policy.

Fed’s Clarida said:

“As of September, the long run neutral policy rate [projection] by members of the committee was in a range of somewhere between 2.5 and 3.5%, so currently the policy rate is below that range. But you can tell it is getting closer to the vicinity of that range.”

Importance of debt markets

However, a broadening in tighter financial conditions might give cause for more Fed members to countenance a pause in policy, even if they project higher rates.

Powell noted last week the importance in debt markets and thought that they were currently at low levels. However, credit risk indicators have jumped significantly in recent months, and he might be less sanguine when briefed ahead of the December policy meeting.

Powell said:

“We are looking mainly at the real economy; inflation, unemployment and those kind of things. Of course, financial markets and financial market activity matters a lot for that. And it’s not just the equity markets, it’s also, really importantly, the debt markets; levels of interest rates and credit spreads and things like that. They all matter and we monitor that very carefully.

The equity markets get a lot of attention, It is important for the economy, companies can finance their businesses in the equity markets, investors own equities and when equity prices are high, people will spend a little bit of that. It’s not a big change, people would have to think that the increase in equity prices is sustainable before they would spend much out of their wealth, but there is an effect. So when prices go down, or go volatile, we do pick up an effect, but it is one of many many factors that go into a very large economy.

Credit spreads have been very tight. That’s partly because the economy has been so good. When credit spreads are low, they can sometimes move up quickly, and that can have negative effects, but in the meantime, it means that companies can finance at very low rates.”

Weaker housing market conditions

While most economic indicators are still showing a solid growth trend, the strains of tightening financial conditions have shown up in the housing market

The national housing market index fell sharply in data released on Monday from 68.0 to 60.0, a low since August 2016. Still in growth territory, but the fall is the largest in any month since February 2014.

It would not surprise to see some broader peaking in other economic and survey indicators in coming months. The fall in oil prices may slow investment spending and activity in the energy sector. A weaker tech sector and slower demand in global markets may also begin to feedback into real economic data in the coming months.

The potential for gridlock and distraction from by the Mueller inquiry could dampen hopes of further fiscal expansion, while the peak benefit of tax cuts may have passed.

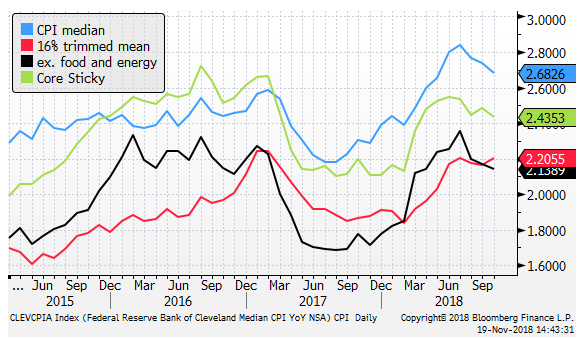

No smoking gun on inflation

The Fed has yet to see a smoking gun on inflation. The CPI release last week showed a tick down in the annual growth in core inflation

Increased Fed flexibility gives more room to pause

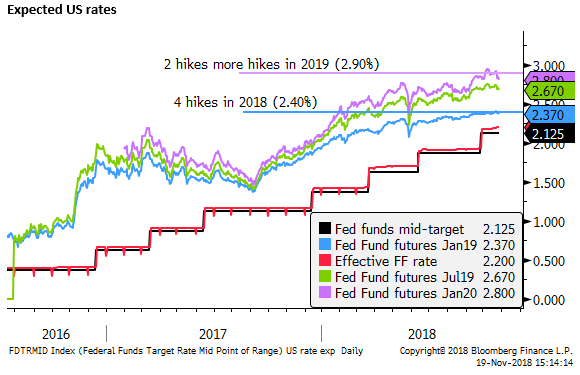

The September FOMC member median projections included a fourth hike this year in December, three further hikes in 2019 and one more in 2020. The Fed fund futures market has largely priced in a hike in December. It is no longer quite pricing two more in 2019.

The market largely sees a hike on 19 December as a done deal. But there has to be some risk that the Fed holds-off in December. They have scheduled press conferences at every meeting next year, and emphasised their capacity to move at every meeting. With this increased flexibility it should be more inclined to pause for more than one meeting to assess market conditions and economic reports. If they did decide uncertainty had increased and financial conditions had tightened significantly in recent months, they could quite conceivably decide to skip a hike in December, knowing that they could hike again six weeks later on 30-January if this uncertainty proved short-lived.