Fed seeks to get ahead of the curve

Fed speakers have raised the probability of a 15 March rate hike. They appear to see the next meeting as offering a window of opportunity to get ahead of a three hike agenda this year, allowing the Fed more space to assess conditions through the middle part of the year in an environment of heightened US government policy uncertainty. Dudley highlighted the sharp pick-up in consumer and small business optimism and easier financial conditions generated by the strong stock market and narrower credit spreads. The weaker USD this year may also allow space for Fed policy tightening. While there has been little evidence of the ‘Trump bump’ flowing through to real activity, Dudley still sees the economy operating somewhat above trend and progress towards the Fed’s dual mandate. The Fed’s Williams added that the Fed is close to achieving its dual mandate. In recent months, the USD has responded negatively to USA policy uncertainty and growing doubts over the capacity of the Trump administration to deliver on its initial promise. In fact, the USD appears to have significantly underperformed its improved yield advantage over the last year. We continue to see a topsy-turvy FX market this year, but Fed policy tightening may help boost the USD in the near term.

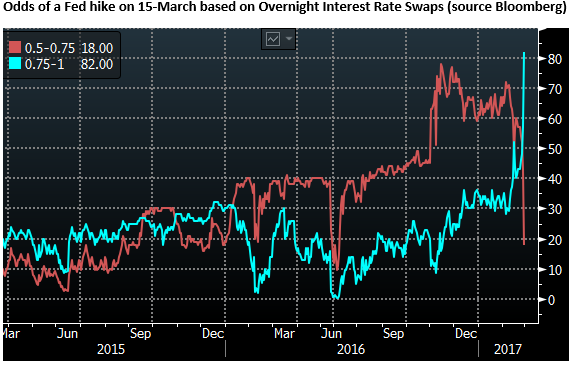

Fed hike expectations surge

Fed-speak had the market hopping on Tuesday, the probability of a Fed hike at its next meeting on 15 March jumped from about a 40% last week to above 50% earlier today after comments by Harker and Williams, and then shot to 80% after New Fed’s Dudley gave an interview to CNN. (Transcript of Dudley’s comments).

The USD bounced on the increasing probability of a Fed hike, but only after it fell earlier in the day on nerves ahead of the Trump speech to Congress later today.

The Trump Paradox

Trump is proving a dead-weight on the USD, even as the stock market has continued to grind higher. This apparent divergence is hard to reconcile – is Trump boosting confidence or undermining confidence?

He has promised big infrastructure spending, tax cuts and less regulation on business, boosting confidence. But he has appeared to get bogged down in health care policy. And his first policy steps have been much tougher border control and immigration policy which undermine confidence – raising fears of turning away skilled workers, tourists, international students, demand for US property, and generating public protests.

Trump talk about ‘economic nationalism’ implies that he will pursue trade protectionism. Indeed he has pulled the US out of the TPP and has criticized NAFTA. He claims to only want one-to-one trade deals, a bad idea in a world of complex global supply chains. This idea of putting “America first”, in a trade sense, may tend to boost demand and inflation in the near term, but threatens growth and productivity over the medium term.

He wants bigger military spending, but cuts to domestic spending programs to fund it. This might tend to undermine economic confidence.

There is considerable doubt that Congress will be able to successful execute radical changes to healthcare and tax policy, under pressure to maintain budget discipline. This could take a lot longer than the market initially expected.

In the meantime, the market must wonder at the stability of the administration that is under investigation for contacts with Russia, attacks all media outlets except FOX news, and appears incapable of taking responsibility for its actions and quick to blame and goad. There seems a high risk that the Trump administration will fall back on stirring up conflict with the Middle East and border control if it finds tax policy and Congress too difficult to deal with.

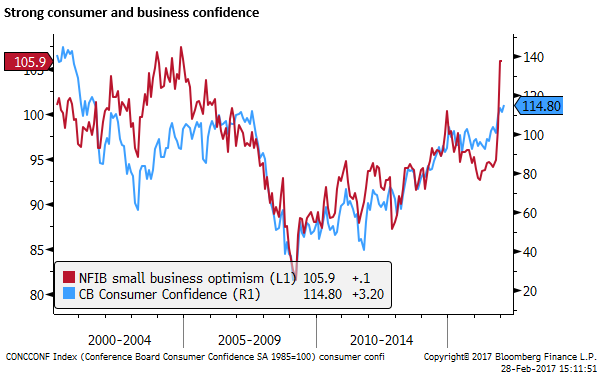

Trump Bump to confidence surveys

The FX market may be expressing Trump doubts, but the New York Fed President Dudley highlighted the boost to consumer and small business confidence since the election of Trump.

In January small business optimism held steady after a surge in Nov/Dec to a high since 2004. The Conference Board consumer confidence index, released on Tuesday, rose to a high in February since 2001. Indeed these indicators would suggest risk to the upside for growth.

A Window of Opportunity

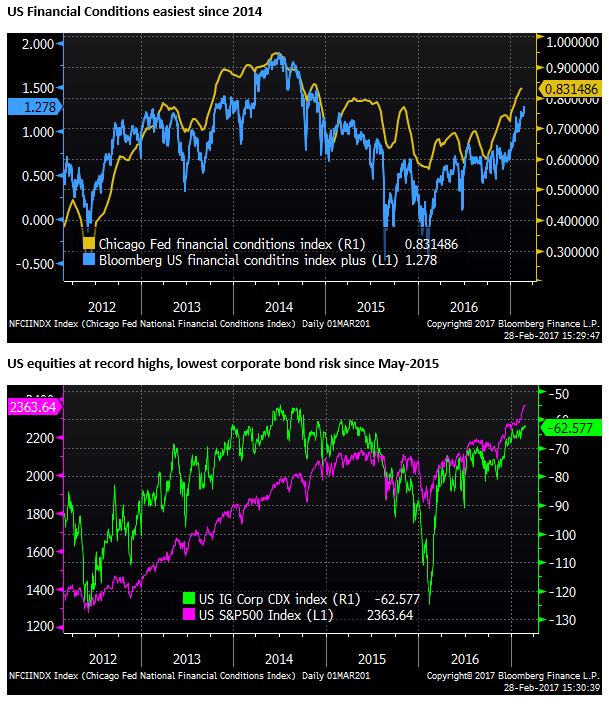

Fed’s Dudley, a core member of the Fed policymaking committee, noted that strong equities and narrow credit spreads implied easier financial conditions. The recent retreat in the USD also helps pave the way for a rate hike. A stronger USD was cited by several Fed participants in the January meeting policy minutes as a risk to growth and inflation, potentially delaying rate hikes.

The 15 March policy meeting might offer a window of opportunity to tighten ahead of French elections and ongoing US policy uncertainty. The Fed has projected three hikes this year and getting one done sooner rather than later might afford the Fed capacity to be more patient before hiking rates a second time this year.

Progress on Dual Mandate

Dudley cautioned that while confidence has lifted, there is little evidence yet that this has boosted real activity in the economy. He noted that it remains to be seen if this will occur, or whether confidence will retreat.

However, he also said that it appears that the economy has been at still is operating somewhat above trend growth and progress continues to be made in the return to full employment and higher inflation.

It does appear that the US is close to full employment and recent inflation readings have been trending higher.

The Fed’s Williams made a similar point, saying, “We’re very close to achieving our dual mandate goals”

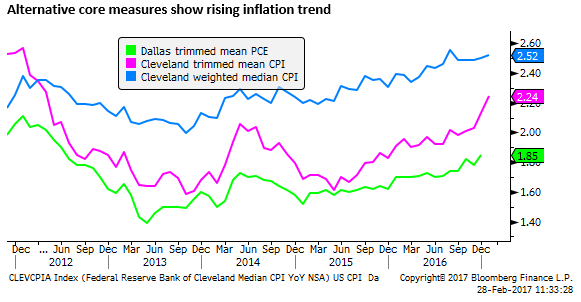

Upside risk for PCE inflation

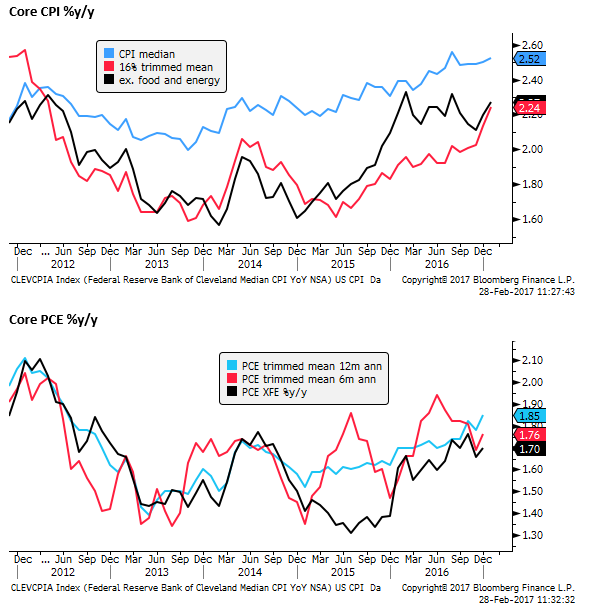

The PCE deflator is due tomorrow. The market expects the core PCE (less food and energy) to remains steady at 1.7%. However, the CPI data for January released earlier in the month rose more than expected, and alternative core measures of CPI and PCE are showing evidence of a rising trend.

The Cleveland Fed trimmed mean CPI rose sharply in the last two months from 2.03 to 2.24% in Jan, a new high since 2012. The Cleveland Fed median CPI was at 2.52 in Jan, averaging above 2.50 since August last year (well above the Fed’s 2% target). The Dallas Fed’s trimmed mean measure of inflation, based on 12 months of data was 1.85% in Dec, a high since 2012.

The Fed has said that is a residual seasonal bias in the CPI and PCE that tends to make inflation readings higher in the first six months of the year. This appears to be born out in the Atlanta Fed 6mth annualized trimmed mean PCE data shown in the chart above that peaked in June-2016. It picked up again in December 2016 (even though lows for this series have tended to be in December in earlier years).