FOMC may still be waiting for clear air from abroad

The USD has been weak this year as the Fed has allowed global economic and financial market uncertainty to put its rate hikes on ice. Domestic economic conditions have been resilient to global developments, but not strong enough to demand Fed action. The rebound in US payrolls in June did more to boost US and global equities than to restore US rate hike expectations or boost the USD. The Fed will probably upgrade its view on the economy, but this will do little to support the USD if the rest of its statement is unchanged. If the Fed repeats for a third time that “The Committee continues to closely monitor inflation indicators and global economic and financial developments” the market may see the Fed no closer to hiking and weaken the USD. It is possible that the Fed acknowledges the rebound in global asset markets, providing some support for the USD, but harder to see it sounding more confident on global economic risks in the wake of the Brexit vote.

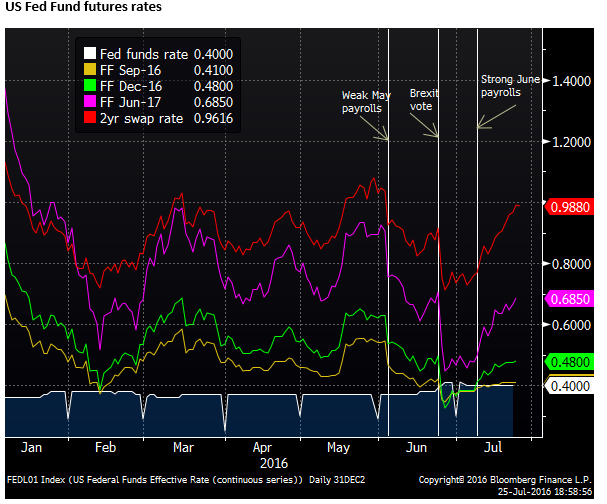

US rate hike expectations slow to recover

The strong rebound in global equity and corporate bond prices in recent weeks and stronger US economic data has restored some of the expectations of Fed rate hikes that had diminished after the weak May payrolls report and UK referendum.

No one appears to think that the Fed will hike this week, although there is a slim probability priced into the futures market. The 21 September FOMC meeting appears to be the next viable option, accompanied by the quarterly FOMC Summary of Economic Projections and Chair press conference.

With the 8 November election soon after the 2 November FOMC meeting, a hike then appears unlikely, leaving the next opportunity the final meeting of the year on 14 December.

However, according to Bloomberg’s World Interest Rate Probability (WIRP) function there is only around 25% chance of a hike by the 21 September FOMC meeting and 50% chance by the 14 December meeting. The OIS market is pricing in around 8bp of hikes by September and 14bp by December less than a standard 25bp hike. A full 25bp is not priced-in until July 2017 (although this embodies a range of possible outcomes from no hike to several hikes).

The chart below shows that rates in the US remain below the levels that were prevailing in late-May, before the weak May payrolls report released on 2 June, when several Fed speakers, including Fed Chair Yellen, indicated that a summer hike (June or July) was probable if the US economy remained on track. Arguably the US economy is back on the forecast track after a hiccup in Q2, but the market is reluctant to believe the Fed is prepared to hike this year at all.

Fed’s credibility gap

It is fair to say that the economic data in the US has not demanded a rate hike with inflation still below target, low global inflation expectations, growth that is overall moderate and considerable global uncertainty.

However, the economic outcomes have been more-or-less in-line with Fed projections, and yet it has hiked only once this cycle, much less than it has forecast over recent years and less than the hike per quarter projected in December last year. There appears to be a disconnect between what the Fed says and what they do.

Former Fed President, Narayana Kocherlakota argues that the Fed needs to provide the market with a better framework for predicting its rate decisions (Janet Yellen Has Some Explaining to Do – newsmax.com). Former Fed Governor Larry Meyers argues that “upside surprises affect the committee less than downside surprises” (Yellen Still Waiting for Overwhelming Evidence to Warrant Hike – Bloomberg.com).

The speech by Fed Chair Yellen at the Kansas City Federal Reserve’s annual Jackson Hole Symposium on 25-27 August will be closely watched for hints on policy direction.

FOMC statement may offer few clues

The FOMC statement tomorrow with a few paragraphs on economic conditions and short cryptic sentences may provide little fresh insight for the market. Presumably it will upgrade its view on the economy after the strong June payrolls report and generally firmer data in recent weeks. However, it should still see market-based measures and surveys of inflation expectations as little changed from low levels.

How the Fed describes the ‘balance of risks’ in the past has appeared to be an indicator of whether the Fed intends to proceed with hikes in a time-frame consistent with its Summary of Economic Projections. However, reflecting greater global uncertainty this year, the Fed has essentially given up commenting on the balance of risks. Instead it has said it is monitoring global economic and financial conditions (a key source of additional risk this year).

The Fed may repeat this oblique statement suggesting it is waiting for clearer air from abroad to be able to hike rates again. If so the market will see little reason to bring forward its rate hike expectations.

It is possible the Fed could comment on the improvement in global financial markets. If so this would be seen as raising the changes of a hike in coming meetings.

It is doubtful that the Fed will suggest the all-clear on global economic risks in the wake of the Brexit vote, and thus unlikely that it will describe risks to its outlook for inflation and growth as “nearly balanced”. If it were to do so this would be seen as a significant hawkish surprise.