Forget bitcoin; the real bubble is global equities

There is something of a disconnect between US equities, firing up on tax reform, and the USD and US bond yields struggling to gain traction. Some of the recent weakness in the USD appears to be related to political uncertainty, embodied in a sinking Trump approval rating, despite tax reform. Trump’s net approval rating hit a new low last week, but the latest polls hint at an improvement. Notwithstanding tax reform and risk that the US economy overheats in 2017, the market has more bearish calls for the USD next year. These calls are not unreasonable, but the market may be relying too much on convenient explanations for a weaker USD in 2017 and assuming these will hold up in 2018. We see more to the Trump tax reform bill than many left-wing commentators that are hoping Trump will fail. The 21% corporate tax rate and nationalist economic policies have other government’s worried and may drive companies to book more revenue in the USA, even before you add in a potential real boost to growth. This may make the tax policy look much better than modest market expectations. The taper in global QE is too slow as we head into 2018, and may pump more air into frothy asset markets, creating a more dangerous bubble than bitcoin (which we see as still under-valued as it grows into a store of value asset). As we head into 2018, we suggest taking FX forecasts with a grain of salt. In this environment, it may pay to adopt a patient and contrary stance, waiting for fleeting trends to crack and the fickle market to switch focus to the next spurious correlation. Beware unforeseen strength in the US economy related to the massive corporate tax cut and upside risk to inflation. This may result in surprising strength in the USD in 2018 and a correction on global asset markets.

US equities fire-up on tax reform, USD not so much

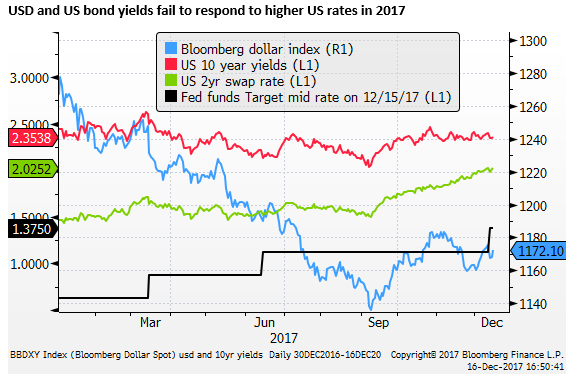

The USD has struggled to gain traction despite the improved prospect of a significant tax reform likely to be enacted before year-end, three rate hikes by the Fed, and a rise in 2yr swap rates by over half of one percent to a new high since 2008. Likewise, US 10 year yields have struggled to move up.

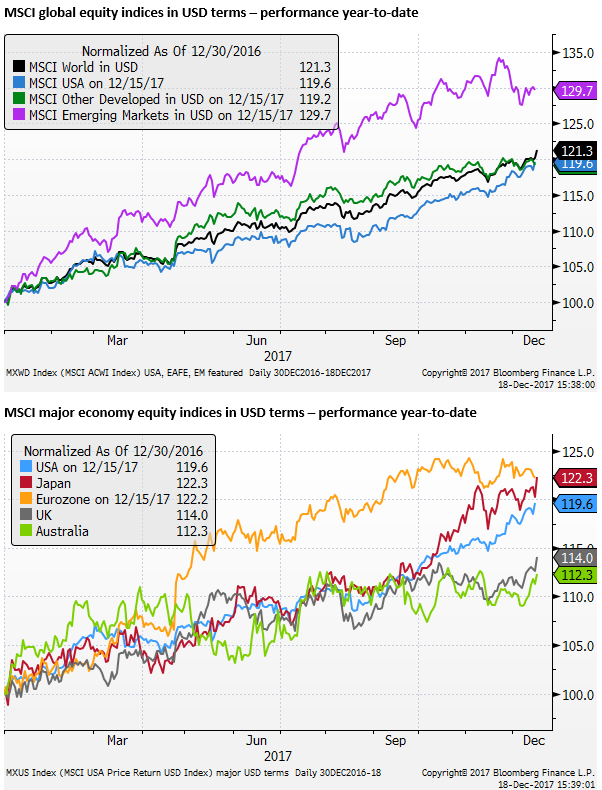

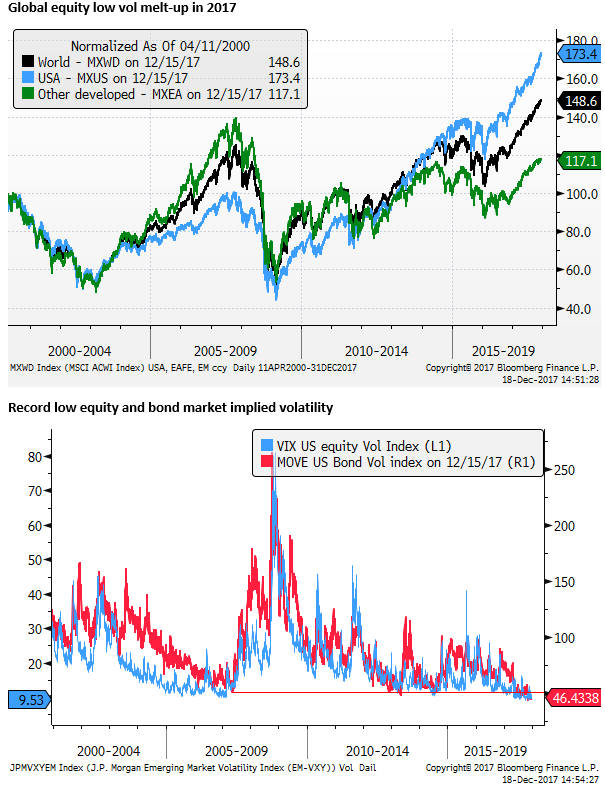

On the other hand, US and global equities have had a powerful and steady rally in 2017.

US equities have modestly under-performed Eurozone and Japanese equities this year (in USD terms), although they have caught up significantly in recent months as the tax reform bill has come to fruition and the US economy appeared to gain more momentum.

US equities proxy for tax reform / USD proxy for political risk

It is perhaps surprising that tax reform progress has not done more to revive the USD and US yields in recent months; whereas it does appear to have given US equities a boost outright and relative to offshore equity markets.

The chart below shows that US equities accelerated after the House passed its first version of the tax bill on 16-Nov, with the Deutchebank high tax index (an index of equities that have the most to gain from lower corporate taxes) leading the gains from this date.

On the other hand, the USD and 10-year US bond yields are weaker in recent months. We also place in this chart the date of the Paul Manafort indictment that coincided with a plea deal by Trump campaign foreign policy advisor Papadopolus on 30-Nov. The Flynn plea deal followed on 2 December and coincided with the Senate’s passage of the first version of its tax bill. We might conclude that the controversy surrounding the Mueller investigation has been a drag on US yields and the USD despite the boost the tax bill has given to US equities.

It is something of an anomaly that the US equity market has drawn strength from the tax reform bill and paid little attention to the Mueller investigation and broader US political uncertainty, while the USD and US bond yields appear to be paying more attention to political uncertainty and less to the positive tax reform news.

Political Uncertainty embodied in slipping Trump approval rating

There has been a lot going on that is contributing to political uncertainty; including the Alabama Senate election race, the sexual harassment claims, the Mueller investigation, and the battle inside the Republican movement between Alt-right and traditional conservatives. All of this and more is feeding into the mid-term elections in November next year. Needless to say that Trump has been a polarizing and uniquely agitating figure that adds to the sense of political instability domestically and in foreign policy.

The tax reform policy is a big win for Republicans and Trump and may prove to be a stabilizing influence for confidence in government. But it is very difficult to know if this will be sustained. We should certainly expect more from the Mueller investigation and counterattacks from Trump and Republicans against the integrity of Mueller, the FBI, DoJ, Clintons and Democrats.

No one can say with clarity what pressures will build in Washington next year and whether this will continue to be a drag on the USD.

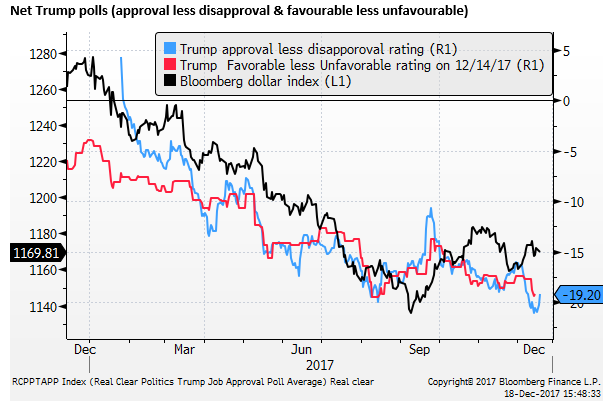

Trump’s approval rating appears to have been correlated with the performance of the USD. If this approval rating is any guide to the performance of the Republican’s in the mid-terms, then it may continue to grab attention. If Democrats take control of both houses of Congress after November 2018, the risk of impeachment rises significantly. It is not even clear that the Republican movement will rally around Trump if it senses that he has become an election liability.

It would not surprise to see Trump’s approval rating improve at least temporarily after the tax reform bill success. This could help support the USD in the near term.

However, the chart below shows the Real Clear Politics index of survey results (approval-less-disapproval and favourable-less-unfavourable) net percentage readings. The most recent readings place Trump’s approval at a new net low. This may be a factor preventing a more positive response in the USD to rapid momentum in recent months towards a tax reform bill.

There is just a hint of an improvement (from a low for the year) in the latest Trump poll.

The market has a bearish USD view next year and beyond

We have struggled to understand why the USD has been so weak this year. Notwithstanding the political uncertainty, the Fed has delivered three hikes, the US economy has retained its momentum, picking up strength in the second half of the year, and the labor market is now relatively tight.

The prospect of a massive corporate tax cut thrown on top of an economy near full-employment generates a significant risk of economic overheating in the year ahead.

The tax reform bill also includes a tax break for multinational corporations that is expected to generate a one-time surge in capital inflow that may trigger significant demand for the USD; even if only a small portion of this repatriation generates actual foreign exchange conversion into the USD.

The USD yield advantage has improved against most currencies, but this appears to have done little to support the USD.

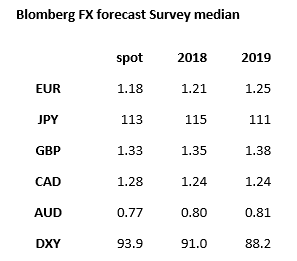

Looking at the year ahead, notwithstanding the tax reform bill, many banks are now forecasting further significant declines in the USD next year and beyond. This is born out in the Bloomberg survey data.

Rationalizing a weaker USD outlook

In looking at the some of the reasoning for these bearish USD forecasts, it seems the main theme is that many perceive the US rate tightening cycle as mature or largely priced in, while they are looking for policy tightening to develop in other countries. Many see the rally in EUR in 2017 as evidence that even a modest shift towards less policy accommodation in other countries may cause a big rebound in their currencies.

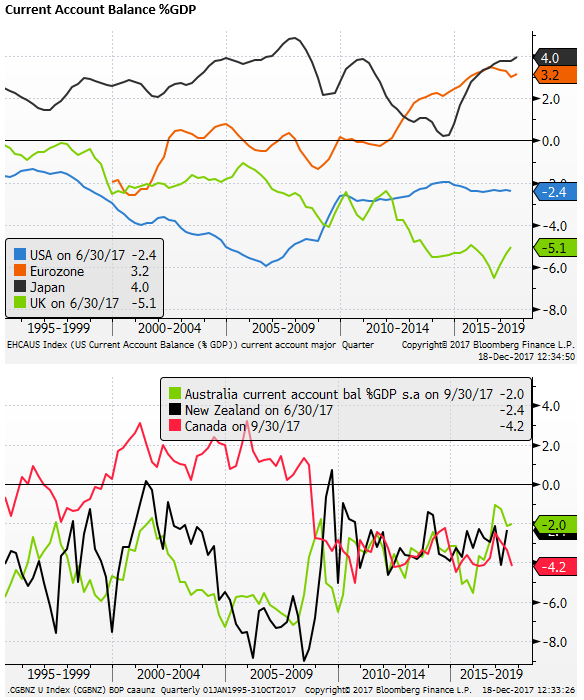

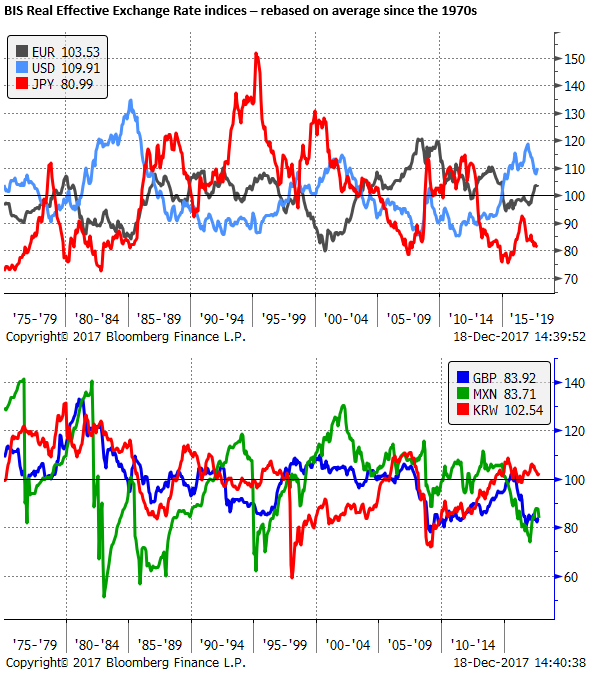

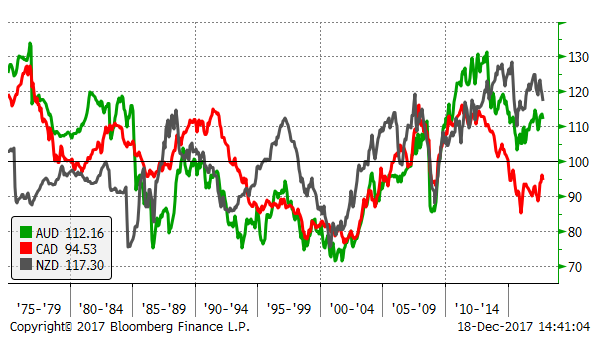

An accompanying argument is that the USD is relatively expensive after its sharp rise in 2014/2015, and a number of other currencies are considered relatively cheap. Embodied in this value assessment, is the observation that the US retains a significant current account deficit, but a number of other countries have improved and stronger external balances.

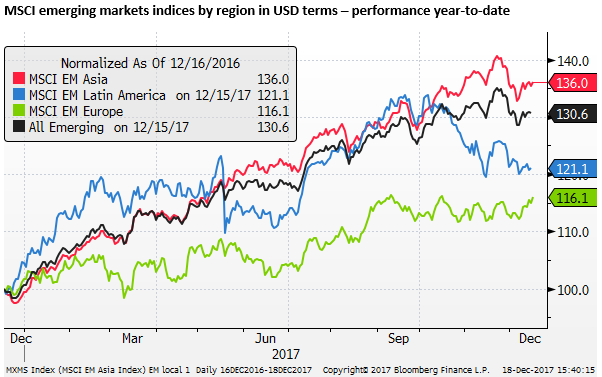

Another argument used to support a bearish view for the USD is the notion that global growth has accelerated and become synchronized. this is driving up demand for a wide variety of global assets. In particular, this is supporting emerging market assets and currencies, many of which are viewed as high-beta plays on global growth and rising investor risk appetite.

The market appears to be non-plussed by US rate rises and more attuned to stronger growth indicators outside the USA.

An alternative USD bullish case

We have some sympathies with these views, and certainly, do not want to swim against the tide, but are wary of the market falling behind convenient explanations for the weaker dollar trend in 2017 and drawing too much confidence that this will just continue into 2018.

Our concern is that the rise in the US yield advantage in 2017 comes back to support the USD in 2018. Already the USD yield advantage has increased, and from our perspective, we see upside risk for medium-term and longer-term yields in the US relative to most other countries in 2018.

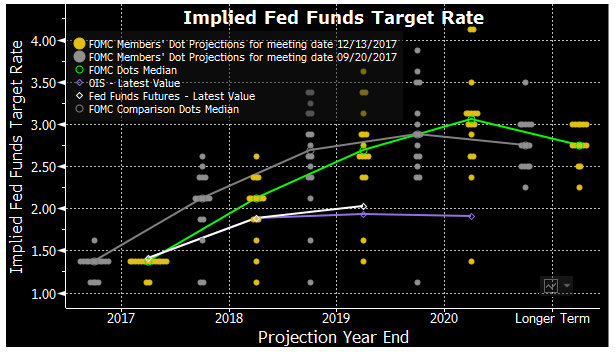

As it stands, the market is still well below the Fed’s dot-plot (rate forecasts for the next view years). While growth may be rising globally, the US economy is closer to fully employed than most, and therefore its central bank still has more reason to tighten monetary policy.

A related risk is that inflation and wages do start to rise in the US. This is something that the market is currently not prepared for. The presumption in the market, underpinning low US bond yields and a slow pace of policy tightening, is that inflation will remain persistently low, held down by long-term secular trends.

The perception that the USD is expensive and many other currencies are cheap is also over-blown. The BIS real effective exchange rate indices suggest that the USD is moderately expensive, and much of this reflects a few case of excessively cheap other currencies, such as the JPY, GBP, and MXN, rather than broad-based strength in the USD. The EUR actually comes out as somewhat above its long-run real-effective average using the BIS narrow indices.

There is perhaps more to the idea that stronger more synchronized global growth can help emerging market currencies that have a high share of exports in their GDP and strong external balance. These currencies tend to be more driven by capital flows to their equity and bond markets.

However, the risk to this view is that yields in the US rise more than expected and trigger some correction in global equities in the next year. This might arise if the tax reform bill triggers some over-heating in the US economy and forces faster than expected US rate hikes.

The other risk is that the Trump’s economic nationalism policy agenda moves further in the direction protectionist trade policy. The NAFTA negotiations are ongoing and Trump has adopted a tougher line on trading relations with a number of Asian countries in recent months. Such concerns have been forgotten in 2017, but remain a risk in 2018.

The Trump tax cuts may actually pay for themselves

We also assign more weight to the recent tax reform in supporting the USD than the market. Many commentators do not believe the tax cuts will generate significant demand in the US and doubt that is will generate much additional policy tightening.

However, the most significant aspect of this tax reform is the large cut in corporate tax that is designed to make the US ultra competitive in the global marketplace. This is very much in line with the Trump administration’s view on economic nationalism. It is designed to entice multinational corporations to bring more of their activity onshore to the USA.

The Trump administration is moving the US into a highly competitive position as part of its shift in attitude to treat the rest of the world as adversaries in trade. It is providing rewards to those that produce and book revenue in the USA, and punishing those that do not.

There is reason to believe that this strategy will be far more effective than left-leaning commentators such as Larry Summers would have you believe.

The tax changes certainly appear to have foreign governments scrambling to address what they see as a significant competitive risk.

Europeans issue warning to Trump on tax overhaul – FT.com

Chinese alarm as US cuts taxes, hikes interest rates – AFR.com

If foreign countries see a competitive risk, the implication is that the tax reform, part of the “America First” strategy, may boost USA growth at the expense of other major countries. If so it should tend to boost the USD.

The following article in the WSJ, argues that multinational companies may reverse a trend in intra-company transfer payments from booking revenue in tax havens like Ireland to booking them in the USA. While the article argues that this does not generate jobs or higher salaries, it would boost the trade balance. It follows that this would boost GDP and measured productivity and the government will also generate higher revenue than it would otherwise. This is before any real impact that might also arise from the incentive to invest and produce more in the USA. It suggests that the Trump administration may not be too far off the mark when it argues that tax cuts will boost GDP growth and pay for themselves.

This One Weird Tax Trick Could Raise GDP, Shrink the Trade Deficit – WSJ.com

The US administration has spent much of its energy on economic nationalism, and we should not dismiss the possibility that this may actually work to boost growth in the USA at the expense of its trading partners, creating upward pressure on the USD.

Many people have become so negative on the Trump administration that they are unable to perceive that his economic policies might significantly boost growth. His calls for 3% plus growth are often derided and dismissed as unrealistic. However, his massive corporate tax cut and combative trade policies may at least set the US on a course to achieve these goals. If he fails it may be because the US economy overheats rather than falls short on demand. Either way, this presents an upside risk for the USD.

Global asset melt-up in 2017

FX analysts may also have placed too much faith in their views of what is driving currencies. FX has not been the main focus for investors in 2017, and thus FX trends may have been more random and driven by sentiment that fundamentals in the last year.

We sense that investors have been more focused on asset prices, jumping on low volatility rising trends in a number of high yield and growth assets, seeing little alpha opportunities in currency markets.

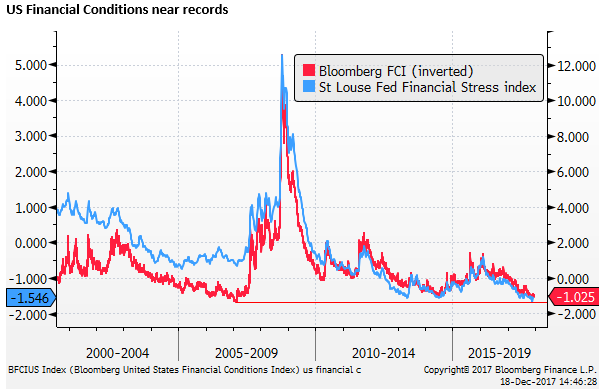

This is consistent with excessive global monetary policy easing that appears to be pumping up asset prices across the globe. Notwithstanding the faster pace of Fed policy tightening in the last year, indices of financial conditions suggest monetary conditions have become easier, not tighter.

Easy monetary conditions have been justified by low inflation. Inflation has indeed been sticky below central bank targets, and this has, for the most part, allowed central banks to continue to pursue quantitative and low rate policies.

In the meantime, global growth has picked up to its most buoyant levels since before the 2008 global financial crisis. The result is that risk appetite has lifted, real return expectations have lifted and asset prices have been rising more rapidly in a low vol manner.

Picking currency winners and losers in this environment has been a mug’s game. You have been better rewarded getting long and invested in high beta assets, equities, leveraged loans, high yielding EM and corporate bonds.

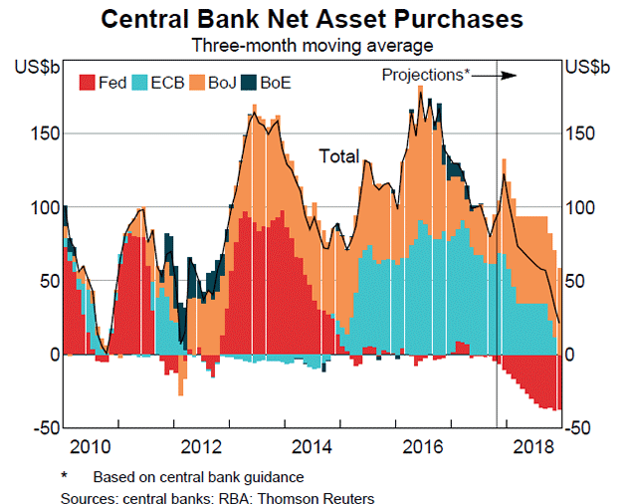

Global policy easing may continue in 2018

Global monetary policy may be turning the corner towards becoming less accommodative, but it is hard to say if this will begin to curtail the bullish asset market trend in the next year.

Since October, The Fed has started reducing its balance sheet (quantitatively tightening) at a pace of $10bn per month. It intends to raise this to $20 per month in January to March. The ECB is set to cut the pace of its asset purchases from EUR 60bn per month to 30 bn per month (after it was cut from EUR80 bn to 60 bn in March this year). Japan is still pursuing asset purchases at a pace of JPY 80tn per year; although has moderated this amount since it has adopted a concurrent yield curve control policy, targeting 10-year yields at “around zero %” that in practice appears to be below 10bp.

Source:RBA.gov.au

As such, while the flow of total central bank asset purchases will slow next year, the stock of central bank holdings will continue to grow at a significant rate for most of next year. Perhaps the reduced flow of purchases will begin to matter to global asset markets. However, as the bull global asset market heads into 2018 with strong momentum, it appears that the rising stock of central bank assets is depressing real long-term government bond yields and boosting global asset prices.

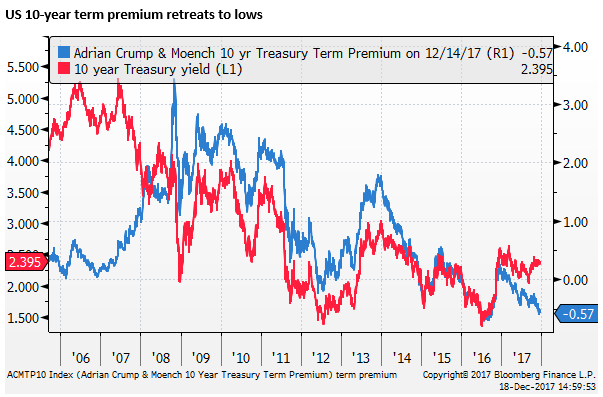

Evidence that Global QE is having a more depressing impact on long-term bond yields, and boosting global asset prices, is the fall to revisit record lows in an estimate of the US Treasury term premium.

A measure devised by Fed researchers shown below estimates that this premium is negative 57bp. This is supposed to be the additional yield investors require to lock in their capital for 10 years, rather than keeping assets liquid and rolling them over on a short-term basis. Theoretically, this should be positive, but it has become more negative in the USA through 2017, despite policy tightening, including now quantitative tightening, by the Fed. This speaks to the global influence of total global policy easing.

Improved global risk appetite, driving capital towards emerging markets may have had a self-reinforcing element, tending to boost EM central bank reserves that are recycled to FX reserve currency bond markets.

Forget Bitcoin; the real bubble worry is global equities

Market commentators are scrambling over themselves to declare bitcoin a financial bubble of worrying proportions. Instead, they should be expressing concern that excessively easy global monetary policy is fueling a potential bubble in mainstream asset markets. Many of these same analysts are happy to project rising asset equity markets as fundamentally sound.

The low global inflation outcomes, in major economies, notably the USA, is allowing some, including two dissenting FOMC members, to justify easy monetary policy. However, if there are secular forces at work that are flattening the Phillip’s curve, then policymakers should be worried that their easy policy is spilling over to artificial gains in global asset markets that will prove unsustainable once cyclical forces over-power secular trends in inflation.

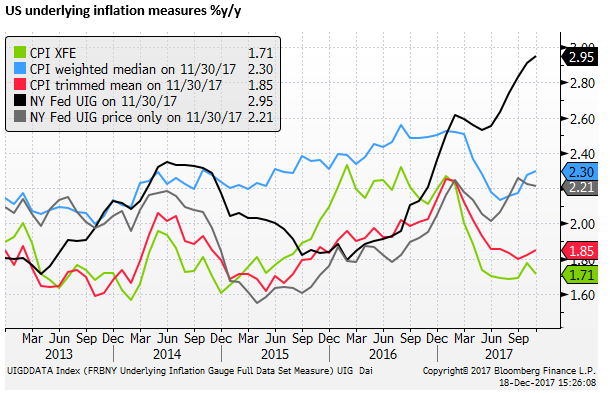

One index that appears to be picking up this risk of excessively easy Fed and global monetary policy is the New York’s Fed measure of underlying inflation. This index incorporates a wide array of financial data in addition to standard price data to estimate the underlying inflation trend.

While the standard core CPI measure, excluding food and energy, dipped in November to 1.71%y/y, revisiting recent lows in 2017, the NY Fed’s underlying inflation gauge rose to 2.95%y/y, a high since 2006; well above the Fed’s 2% target.

This index is picking up the risk arising from the low vol rapid growth in asset markets and suggests that the Fed needs to keep tightening policy, and is in fact well behind the curve.

Take FX forecasts with a grain of salt

As we head into 2018, we suggest taking FX forecasts with a grain of salt. The market is not really paying attention to FX fundamentals, and they will be apt to attach themselves to whatever theme justifies the current trend. In this environment, it may pay to adopt a patient and contrary stance waiting for fleeting tends to crack and the fickle market to switch focus to the next spurious correlation.

Secondly, beware of unforeseen strength in the US economy related to the massive corporate tax cut and upside risk to inflation. This may result in surprising strength in the USD in 2018 and a correction on global asset markets.