Fundamentals battle positioning, real yields support the USD

In the FX market, fundamentals are battling excessive positioning in several currencies, including the AUD and NZD where positioning data suggest that the market is near record net shorts. After around six months of exodus, funds may also be looking to rebuild positions in emerging markets. Asia has lagged other regions recently as the market continues to worry about the economic outlook in China and headwinds from sour trade relations with the US. Nevertheless, it is participating in a recovery in risk assets in the last week. The capacity for a sustained retreat in the USD against other major and EM currencies may be limited by the recent strong gains in real long-term yields in the US. This may be limiting the recovery in EUR and GBP.

Extreme short positions in AUD and NZD

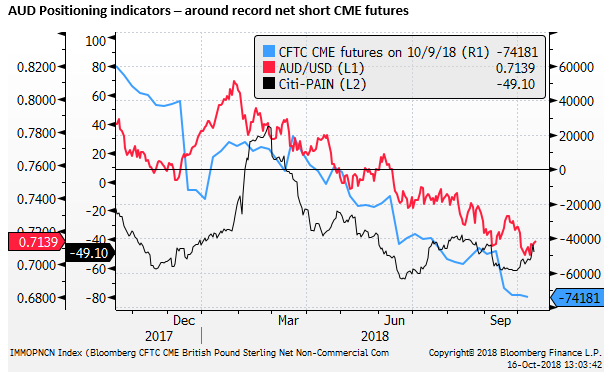

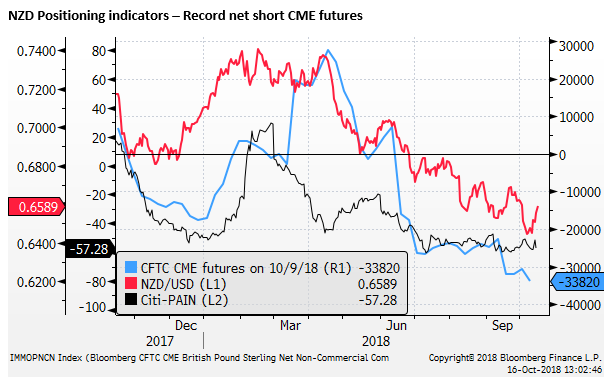

One of the biggest impediments to potential downside in the AUD and NZD appears to be excessive short market positions.

The CFTC data on speculator positions in the currency futures market shows the market is around record net shorts in the AUD, and at a significant new peak in net shorts for the NZD.

The Citibank FX Positioning Alert Indicators (PAIN), which estimate the positions of currency managers from their reported returns, also suggests that this market segment is significantly net short both AUD and NZD. The PAIN data is daily, as opposed to weekly for the CFTC data, and it shows only modest squaring of short positions in AUD and NZD in recent sessions.

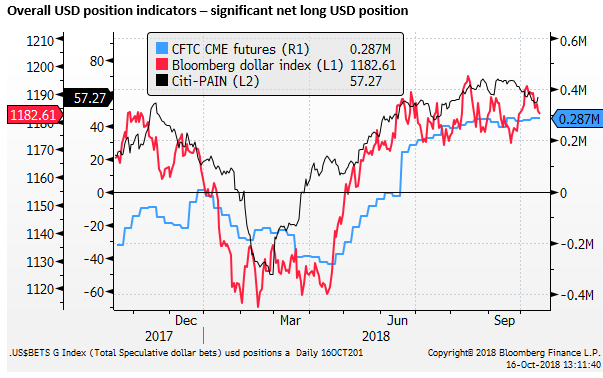

Overall long USD position

More broadly, CFTC CME futures positions data suggests that speculators are significantly long the USD. Net-long USD positions, summing the short positions across all other currency futures, are at a high for the year, albeit below extremes in 2015 and 2016. The Citibank PAIN index also suggests the market remains significantly long USD.

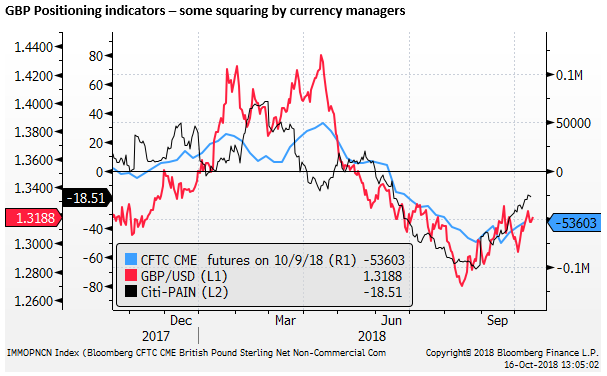

Apart from the AUD and NZD, the futures market appears significantly short GBP, although the Citi-PAIN index suggests more dynamic currency managers are no longer excessively short GBP.

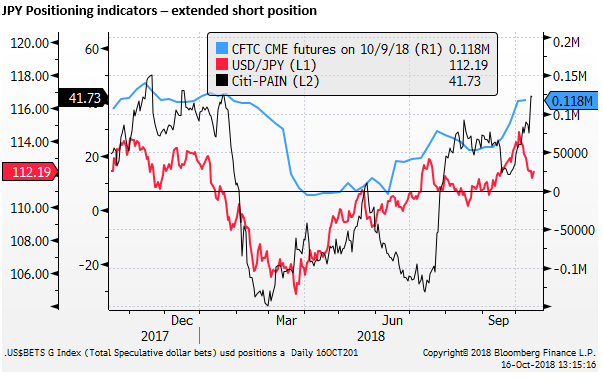

The market also appears to have moved into a significant net short JPY position. The PAIN index suggests that the faster moving currency manager market has further extended short positions in recent sessions.

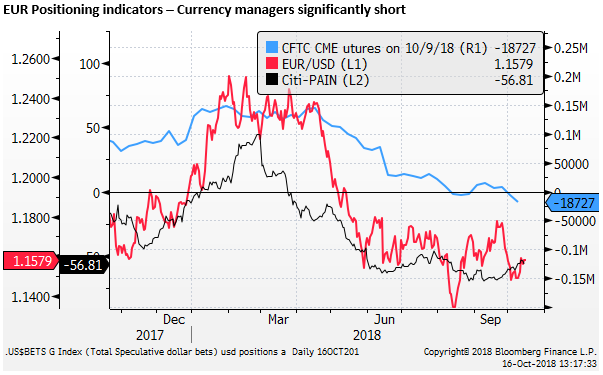

Futures positions in the EUR have only recently and marginally moved into a net short position. This contrasts with the PAIN index which suggests currency managers retain a significant net short EUR position that has moderated somewhat in recent weeks.

However, the market appears relatively square in the CAD. The futures position is somewhat short, while the PAIN index has moved to a slightly long position.

Mean-reversion in emerging markets

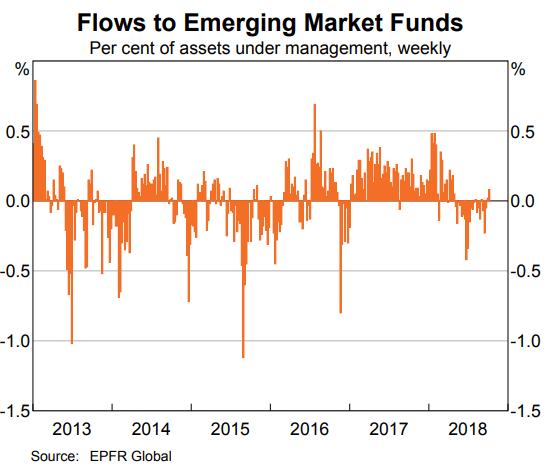

The recent recovery in emerging market assets may also reflect light, underweight or net short positioning. A chart from the RBA Financial Stability Review released last week, incorporating data up to 10 October, shows a significant and persistent retreat in capital from emerging markets investment funds from around April, until a modest inflow to EM funds in the last week or so. The outflow over a roughly six-month period may have left investors with an underweight position.

Source: RBA FSR – RBA.gov.au

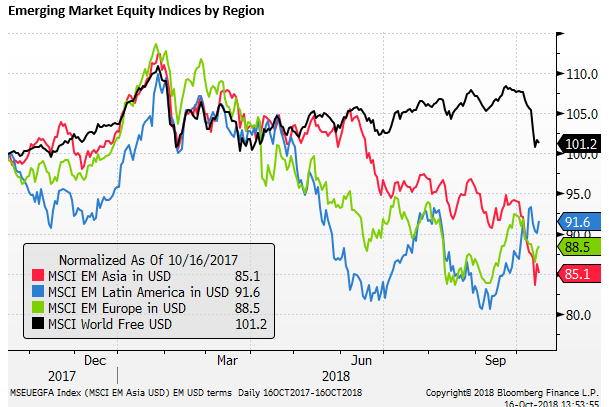

Divergence in emerging markets

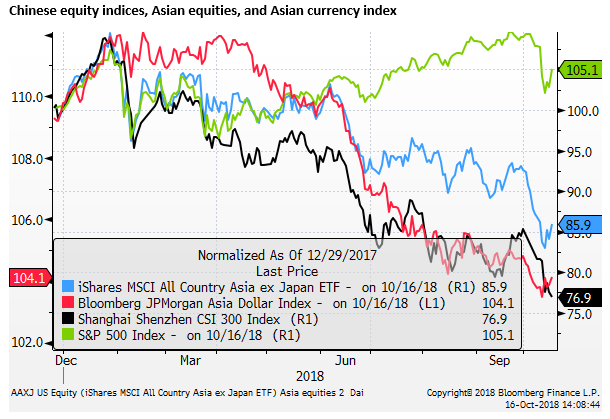

There has been a significant divergence in EM markets in the last month. Latin American assets have recovered significantly, led primarily by a rebound in Brazilian markets on improved investor sentiment towards the likely government. European emerging markets have been weaker in recent weeks, but are well up from September lows, while Asian equities fell sharply to new lows in October.

The fall in Asian stocks may reflect the ongoing concern over the strains between China and the US over trade and other issues, a sharp correction in the IT sector, and higher energy prices. However, Asian currencies and equities are also rebounding in the last week.

Our indices of emerging currencies by region also show American EM currencies have rebounded more decisively than other regions since September, while Asian currencies made news lows in October; although have recovered somewhat in the last week.

Positioning and mean-reversion after deep falls in emerging market assets may tend to support a number of currencies in the near term. This may include Asian currencies, spilling over to the AUD. However, we continue to see risks at elevated levels for the region. Risks include US and China trade relations, stress related to excesses in Chinese credit markets that may limit the government’s capacity to stimulate the economy, the housing market downturn in Australia, and a rising trend in US yields.

Higher long-term real yields in the US may return to support the USD

The rise in longer-term real yields in the US may be a significant impediment to a sustained recovery in other currencies. Higher real yields in the US should be a more potent support for the USD than a rise in nominal yields.

Higher real yields might point to a more sustainable growth outlook in the US. Alternatively, it might indicate that the run-down in the Fed’s balance is generating some upward pressure on longer-term yields, tightening monetary conditions.

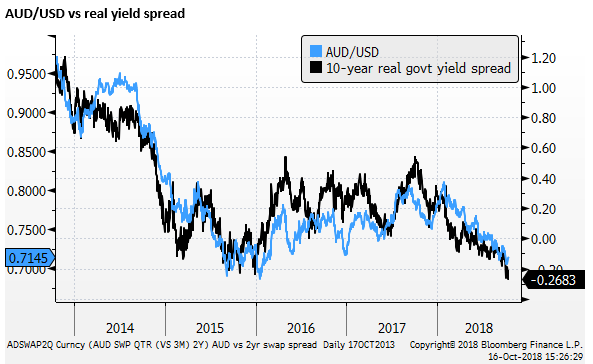

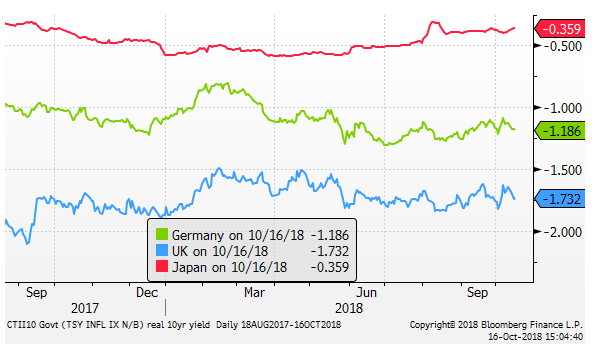

The chart below shows that real long-term yields in the US, reflected in inflation-linked government bonds, have risen significantly to new cyclical highs in recent months (by over 25bp since mid-year). They are also significantly higher in Canada. However, they are little changed in Australia.

Real 10-year yields are little changed and remain deeply negative in the UK and Germany. They have risen somewhat in Japan.

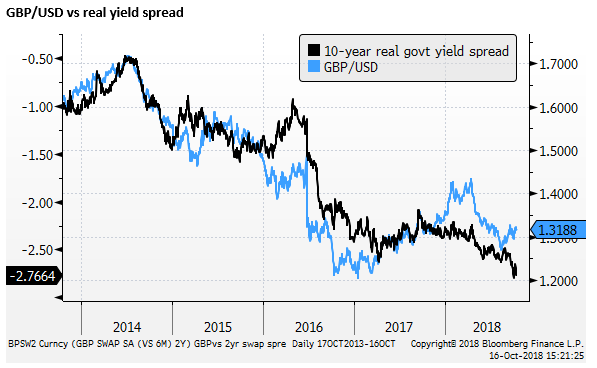

The charts below compare EUR, GBP, JPY and AUD to 10-year real government yield spreads. The EUR has out-performed real, and nominal yield spreads in recent years. Although its fall this year in more in-line with real yields. The real yield spread has fallen significantly to new lows in the last month and may yet drag down the EUR.

GBP has been bouncing it seems on some improved confidence that a Brexit deal between the UK and EU governments will be agreed soon. However, confidence in a deal has not been reflected in UK real yields. Any deal will still leave many doubts; not only over whether it will be ratified by the UK parliament, but also over the ultimate relationship between the EU and the UK that must be worked out over a two year transition period.

The USD/JPY had a tight relationship with yields in 2016/2017, but has diverged significantly this year. USD/JPY may be finding support from the higher yield spread, but the connection has been tenuous.

The Australian economy has grown significantly above trend in the last year, and is finding support from stronger commodity prices. However, this has not shown up in higher real yields in Australia, suggesting that the market is not convinced the recovery will be sustained over the longer term. This may reflect risks apparent from China and a weaker Australian property market. The AU-US real yield spread has fallen in recent weeks to a low since 2008, and suggests that the recovery in the AUD in recent weeks may again run out of steam.