Glass half-full so far on Trumpnomics, but risks are lurking

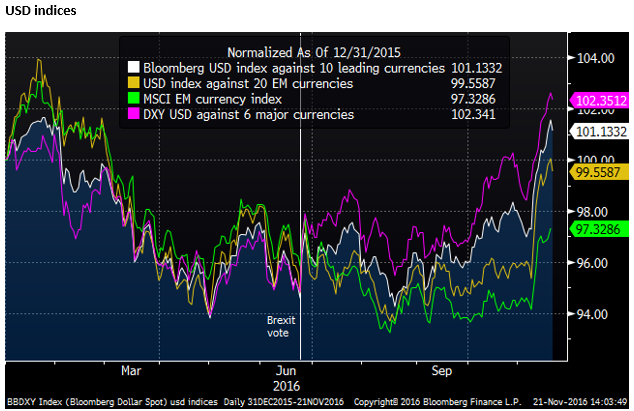

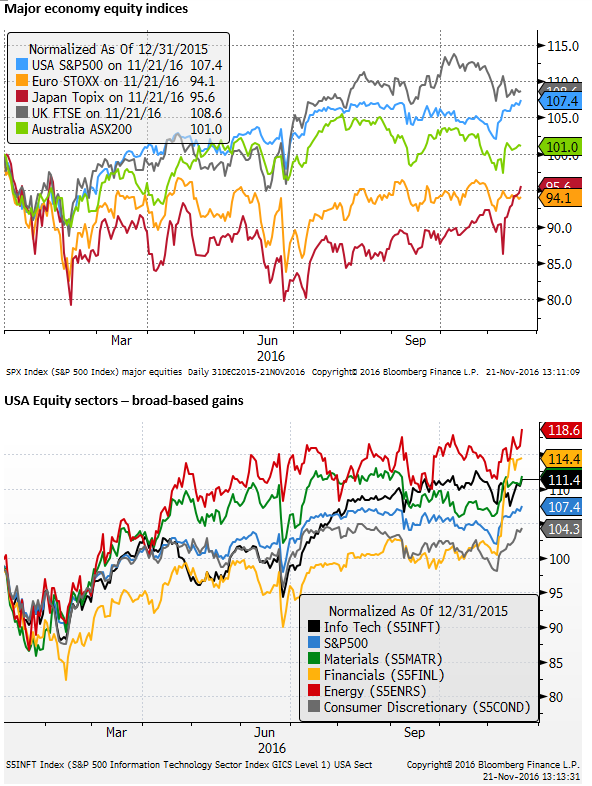

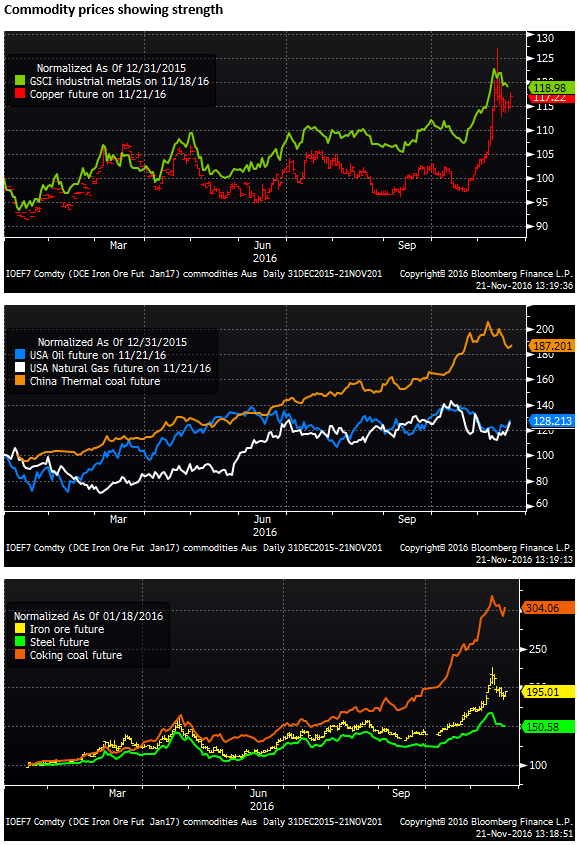

The market views Trumpnomics as a glass half full at the moment. The rise in global yields and surge in USD has not spilled over to weaker equities. The US stock market has moved to new highs in a broad-based rally notwithstanding potential headwinds from a strong USD and risks to trading relations and immigrant labor that may arise as Trump fills key roles in his administration with hardline loyalists. Other major equity markets and global commodity prices are also strong. The USD has started the week retracing some of its rapid gains over the last two weeks since the USA election. Commodity and EM currencies have taken heart from strong asset markets, EUR has firmed on some better news on German and French politics. The GBP rose solidly reaffirming a rising trend since the USA election as PM May shows deft management of Brexit expectations and excessive pessimism in Q3 is unwound. The JPY has been one of the more consistently weaker currencies since the USA election as sentiment and positioning have swung more abruptly from bullish JPY to bearish. However, news of an earthquake in Japan has boosted the JPY. We see potential risks to the sanguine view for global markets. The Italian referendum threatens confidence in Europe, higher US yields, and higher inflation expectations may spill over to weaker equity markets. Fears over protectionist US policies may also undermine US and global investor confidence. The broader trend remains in favour of the USD, but we see the market getting ahead of itself on equities and this may threaten EM and commodity currencies, while bringing support back for JPY, at least for a time, as investors consider the threat from higher inflation expectations on asset prices.

Glass half full

The market starts the week holding a glass half-full. Equities are on the rise, despite the rise in global bond yields, potential for political upheaval in Italy as the 4-December referendum looms, and risks to international trade and international cooperation arising from Trumpnomics.

Commodity prices are also firmer after some correction last week, and oil prices are joining the rising trend as OPEC remains on track to ratify an agreement to cap production on 30 November next week.

A number of higher yielding commodity and EM currencies are firmer on Monday after two weeks of declines against the USD, basically since the USA Trump election victory. The gains come as the rise in US and global bond yields stalls.

The good news for these currencies is that stronger commodity prices and equity markets suggest global growth optimism related to the hope of more infrastructure spending in a number of countries is supporting investor confidence.

But it is also likely to be the case that after a strong run-up in the USD, the market may simply be consolidating and back-filling, awaiting new impetus.

EUR has recovered more modestly, taking heart from news that German Chancellor Merkel plans to run again in elections next year, and a decisive performance by French Presidential hopeful Francois Fillon in a first round center-right primary election. These potential leaders offer hope that the EU can navigate the pressures from disillusioned electorates.

GBP has rebounded more solidly, reaffirming a rising trend since the USA election. The only currency to make gains against the USD in recent weeks. UK PM May continues to manage expectations on the timetable for and what might be achieved with respect to Brexit, notwithstanding ongoing uncertainty, relatively well. The GBP still appears to be recovering from excessive pessimism in Sep/Oct.

JPY, on the other hand, as failed as yet to pull-out of its steady and rapid fall since the USA election (although it rebounded on first reports of an earthquake in Japan). The further decline on Monday, despite a retracement in USD gains against most other currencies, may reflect in part the strong equity market performance and improving global risk appetite.

A number of commentators are now espousing much more bearish longer term views for JPY and the market is still trying to escape its long JPY position established during the first three-quarters of the year. The USD/JPY crashed up through the 110 psychological resistance with hardly a pause. This may have triggered more urgent short-covering.

With limited new developments to consider, after a rapid rise in the last two weeks, the pullback in the USD appears to be largely about corrective price action. Short term technical may suggest that the USD has become overbought.