Gold may have just started a new bull-market

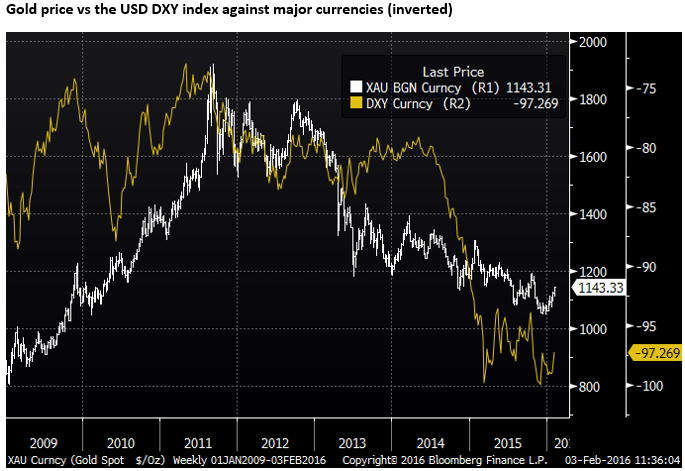

In the current environment of doubts in the value of any currency, doubts in the value of industrial commodities and doubts in financial assets in a relative low growth world facing financial stability risks, gold returns to the fore as an alternative store of value. Gold has been in a downtrend since 2011 in a strong USD environment. We see a risk of a major trend change, but prefer to hold it against a basket of EUR, JPY and USD.

A weaker dollar, but sustained gains hard to see in any other currency

The common element running through markets today is a weaker USD. It has weakened against negative interest rate/risk haven currencies (EUR and JPY), it has weakened against most EM and commodity currencies, and it has weakened against precious metals, industrial metals and energy commodities.

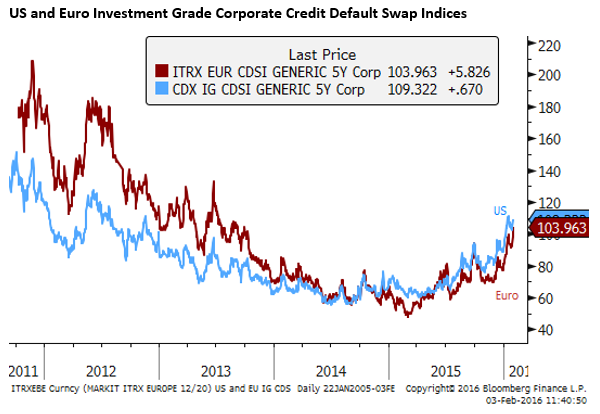

But this has not been a risk positive session. Equites are weaker in major economies and credit risk premia in US and European corporate bonds have risen to new highs since 2013. Constrained or weaker risk appetite should tend to work against the performance on EM and commodities and related currencies.

We might be wary of this feed-back on currencies in coming sessions. Either risk appetite will recover, and we might see some fall-back in EUR and JPY, or investor confidence will remain soft and EM and commodity currencies may fall-back.

It may be natural for the market to sell the USD in light of the weaker economic developments in the US lately, and the likelihood that the Fed reverts to leaving rates on hold for the foreseeable future. But the question is what do you buy? The recovery in dollar alternatives may be limited if the market questions the value of those alternatives. The ECB and BoJ have moved their policy agenda’s more clearly towards accommodation, including negative interest rates in recent weeks. How far will the market go towards buying these currencies even if the Fed revert to policy on hold? It would take a very risk negative environment resulting in a large further global capitulation in equity markets and significant global deleveraging to see a persistent and solid recovery in EUR and JPY. Such an environment would severely weaken EM and commodity markets.

On the other hand, thoughts of global policy easing may stabilize global asset markets, as even modest global growth and investor confidence forces investors to exit cash in EUR and JPY, to at least avoid paying negative rates. This might support further gains in EM and commodity assets, but weaken JPY and EUR.

The most likely and stable candidate to play for USD weakness is in precious metals which act as an alternative store of value in place of any currency and can also act as a haven from weak investor confidence in equities and other risky assets. It is not surprising to see gold rally in this environment.

Negative rate QE currencies are least likely to sustain gains

But the case for gold is not just against the USD. The demand for gold should come perhaps more from those currencies that are pursing quantitative and negative rates policies. The central banks of Japan and the Eurozone are more clearly trying to devalue their currencies. If the market wants to seek an alternative store of value then it certainly should also be to avoid holding these currencies. As such, it may be better to diversify a long gold trade by carrying it against EUR, JPY and USD.

Gold has been in a down-trend since 2011 in a rising USD environment. The bulk of its bull-run occurred from 2009 to 2011 which was dominated by the fixation with QE near zero-rate policy in the USA. The market was bearish USD and feared the tail-risk of debasement in the currency.

The market has gotten used to QE policy and is less fearful of currency debasement, but we are experiencing some of these same elements in the market again, with now the ECB and BoJ pursing even more aggressive QE and negative rates policies than the USA did from 2010 to 2013. There is little doubt that the BoJ and ECB are pursing weak currencies. We might expect both central banks to further ease policy if their currencies strengthen too far.

If the market is questioning owning the USD as an alternative store of value for these currencies, then it might turn to gold.