IMF tells Fed to play it cool, Japan expert sees BoJ policy revamp

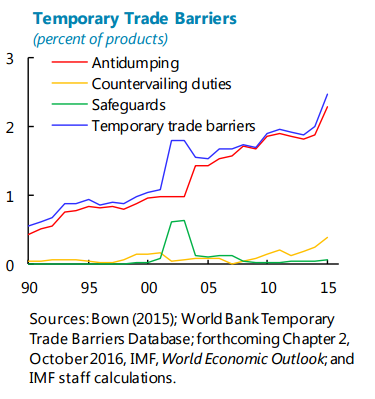

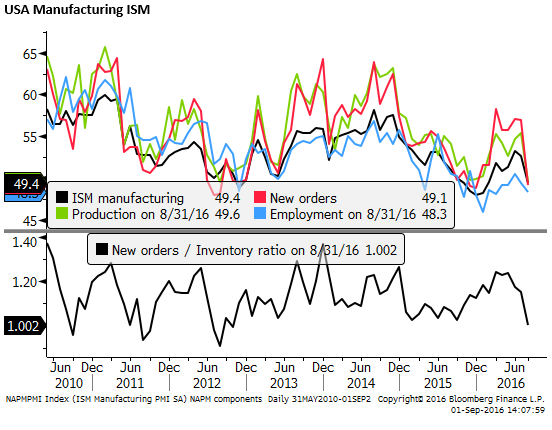

The USA ISM manufacturing survey was surprisingly weak, confirming the trend apparent in regional surveys recently. The data should cause some pause in the debate edging towards a rate hike in the USA. The global PMI fell back somewhat suggesting a stalling in its recent improvement. It remains weak in the low 50s. China’s PMI rose a bit but remains low. Analysts are cautiously optimistic that China’s economy and financial conditions are stable in the near term, but most continue to acknowledge that China’s growth is relying too heavily on easy money conditions and fiscal expansion, and restructuring has a long way to run. On the eve of the G20 leaders meeting this weekend, the IMF released a very pessimistic outlook for the global economy highlight disinflation trends, weak global trade growth, dragging down global investment, and a tough political environment getting in the way of needed reform. A distinguished policy expert in Japan recommends a deeper rate cut by the BoJ and revamp of policy that might help steepen the Japanese yield curve. We continue to see scope for JPY weakness, which may help the USD recovery. But strength in the USD may continue to be halting. Even if the Fed do make another hike in coming months, we can see another prolonged period of rates on hold beyond that. The rebound in the USD could reverse if payrolls fails to deliver at least solid payrolls. The Fed would really like to see clearer evidence that broader indicators of the labor market are improving.

IMF paint a gloomy picture

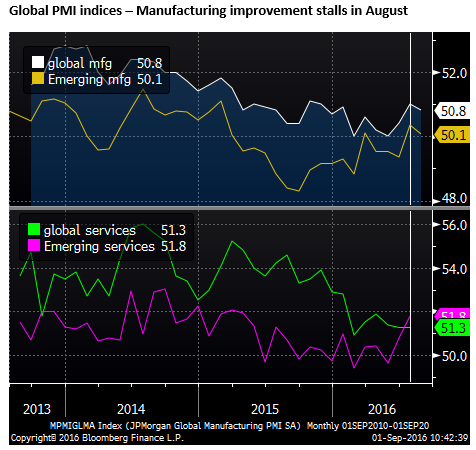

On the eve of the G20 leaders meeting this weekend, the IMF released an update that could hardly have been more pessimistic on the outlook for the global economy. It set out an array of proposals for G20 nations to underpin growth, but political constraints to structural and fiscal reform remain high, suggesting a relative weak growth environment with downside risks will persist for the foreseeable future.

IMF Note on Global Prospects and Policy Challenges – IMF.org

Summary in IMF report for G20 leaders

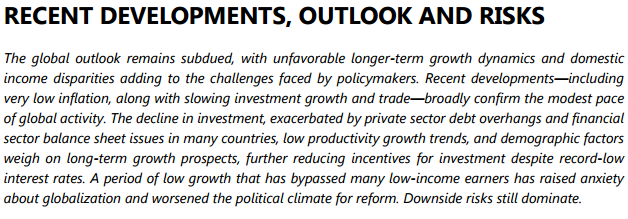

The report highlights dis-inflation as a key risk to growth. It previewed research it plans to release in its forthcoming World Economic Outlook due in October. It blames falling inflation on high cyclical unemployment, falling commodity prices, and excess industrial capacity in large exporters.

It notes that: “A prolonged period of very low inflation could de-anchor inflation expectations and, with the scope for cuts in nominal interest rates limited, raise the real cost of borrowing and weigh on investment.”

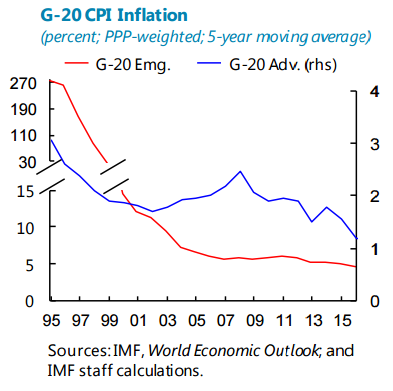

It also highlights the prolonged period of weak global trade growth which accounts for a vicious cycle of weak investment growth, dragging on the global economy and undermining the productivity growth outlook that has already slowed.

It reports that in the past four years, global trade growth barely kept pace with GDP growth. This compares with a pace of more than double GDP growth from the mid-1980s into the 2000s. Since, 2012, trade volumes have risen 3%pa, under half the rate in the two decades before.

Considering the political mood in many countries, including that in the USA presidential campaign, inward looking and protectionist policy trends do not bode well for an improvement in trade growth.

The IMF may be too pessimistic, but they present a sobering back-drop for the market and FOMC policymakers as they approach their policy meeting. The IMF counselled the Fed that, “monetary policy should continue to remain data-dependent, while downside risks to the outlook confirm the case for a very gradual upward path for the federal funds rate.”

No compelling case for the Fed to hike

The focus in recent weeks has been on whether the Fed hikes in Sep or Dec. This may occur, depending on the data making the case for the Fed. But the other message that has been coming from the Fed is that the neutral level of rates has fallen, rates may not rise all that much over the current cycle, and they will continue to raise gradually and cautiously, fearing a stalling in growth and the lack of space to ease policy should the cyclical recovery stall or global risks are realized.

The Fed may be close to hiking again, but this may have more to do with the fact that they have already waited nine-months since the first hike in December and, if they do, it may be another prolonged and halting period before a third hike in the cycle. How the USD responds in such an environment is not clear. It has been on average declining this year gradually. It is possible that this continues over the year ahead.

The outlook for the US economy remains difficult to judge. Recent PMI surveys both for manufacturing and services have been weak to modest. On the other hand, the labour market does appear to be relatively strong and generating some increase in wage growth. Productivity growth has been disappointingly weak in recent years and business investment has also been weak in the last year or two.

Weak productivity growth and modest wage growth may start to generate inflation faster than the very gradual rise forecast by the Fed, (reaching 2% in two years). How would the Fed respond to that? Presumably they would threaten to raise rates a bit faster. However, the prospects of higher rates despite still weak overall economic growth may significantly undermine the equity market.

The Fed would be cautious not to trigger a big correction in equites, and might delay hikes. It might prefer to let inflation rise above target for a lengthy period to compensate for the lack of scope to ease policy should the recovery lose momentum. A big correction in equities would be seen as a risk to the recovery.

However, the Fed is really yet to see the link from a strong labour market to wages to inflation. It sees the Phillip’s curve as very flat and uncertain. It has only seen very early signs that wages are rising, and no evidence that this is flowing through to overall inflation.

Certainly inflation expectations have been falling. And while they are not clearly too low and the Fed continues to say they are anchored, they still pose a risk. They may become unanchored to the downside and argue for more caution in raising rates.

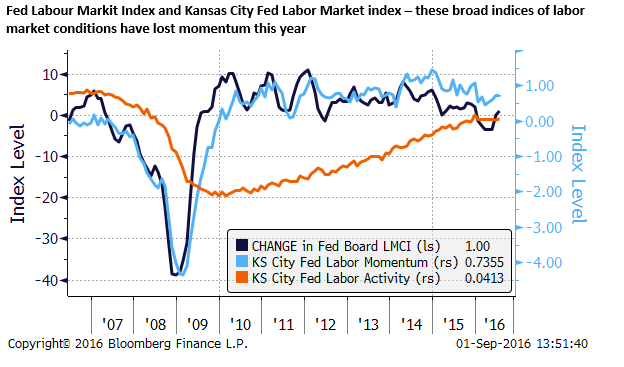

The Fed has acknowledged further tightening in the labor market this year, but the pace of improvement has slowed and key measures such as the unemployment rate have been stable and the participation rate may be rising. The Fed may want to see clearer evidence that the labour market is still tightening in other measures of the labor market (wages, average hours worked, part-time for economic reasons, hires and quits, discouraged workers).

The data is still not compelling the Fed to hike. It might support the case for an incremental policy hike after a prolonged wait. That argument may be made stronger by strong asset prices and concerns over an excessive reach for yield. However, it does not compel the Fed to hike and there are several FOMC members that want compelling reasons to hike. They see more risk of getting ahead of the curve than behind, considering a weak global backdrop, low inflation expectations and limited scope to respond to a cyclical slowdown. The Fed may be close to one more incremental hike before another prolonged wait, but it wants the data to compel them to hike and so far it is not.

At this stage, the USA data overall is not so strong to suggest there will be more than one more incremental hike before another prolonged period of on hold. Will this be sufficient to sustain a rally in the USD? It hasn’t this year, but perhaps it can if yields are falling abroad.

However, that remains to be seen. The trend this year has been more towards a weaker USD, even though yields have been falling abroad as inflation pressure outside of the USA has mainly been declining.

We have argued that a big part of the weaker USD trend this year stems from the surprising strength in the JPY. At least in the last week this has turned around and a weaker JPY combined with renewed focus on the next Fed policy meeting has helped the USD recover more broadly. However, the USD recovery is not convincing. It is mixed and a number of higher yielding EM and commodity currencies may only be correcting from recent stronger trends. This includes the AUD and NZD.

Expectations for BoJ policy revamp

As we have discussed recently, perhaps the most important event on the calendar is the BoJ policy meeting. In the last week, the BoJ has managed to build up significant expectation that it will do something to re-invigorate its policy approach to achieve higher sustainable inflation.

In our view, for BoJ policy and Abenomics to be able to succeed they need to arrest and reverse some of the appreciation of the JPY this year. On the eve of the G20 meeting this week, it seems doubtful that Japan will receive a blessing from other global leaders to conduct FX intervention. But after its 20% rise over the last year, we should watch for any comments that suggest that Japan would be justified in acting in the FX market to avoid further JPY strength that is inconsistent with its fundamentals.

The BoJ has been engaging in a major review of its policy that is to be tabled at its 21 September board meeting. No change in its policy after this review would be a major disappointment and would potentially drive the JPY higher; as has happened after every BoJ meeting this year.

We noted earlier this week that there have been hints that the BoJ may use its review to justify a further cut into negative interest rates.

We note today, an interview on Bloomberg TV of Takatoshi Ito. Ito is the Professor of International and Public Affairs at Columbia University in the USA. He served from 2006 to 2008 as a member of the Prime Minister’s Council on Economic and Fiscal Policy. He also held senior positions in the Japanese Ministry of Finance and at the International Monetary Fund. He is an expert on Japan economics and policy. He may offer salient insights into how to interpret recent comments from Japan policymakers.

He noted that BoJ Governor Kuroda has highlighted that there is considerable room to cut interest rates. He noted that the comprehensive policy review underway by the BoJ is likely to result in an overall reframing of policy and the objectives.

His advice was that the BoJ should cut rates further and adjust policy in a way to allow a steeper yield curve. He noted that the yield curve had flattened more than the BoJ had intended.

This suggests that the quantitative part of the policy might be recalibrated away from a straight volume based policy to one that is more targeted at yield levels.

Takatoshi Ito Interview – Bloomberg.com

How the FX market reacts to this is unclear. It may result in considerable uncertainty. However, a lower cash rate, combined with some yield curve steepening, but with still overall relatively low yields, should encourage investors to sell JPY. It would certainly help if the MoF used intervention policy either verbally or with actual dealing to put a base in for the USD/JPY.