Improved backdrop for AUD and NZD

While waiting for this week’s big central bank policy meetings, BoJ and FOMC later today, we look at the set-up for the RBNZ policy meeting that follows on Thursday and recent trends in Australia. Commodity price support has increased for both. Recent New Zealand economic reports have been better than expected, suggesting the economy is running solidly above trend. The Australian economy is operating close to trend and is well advanced in working through the downturn in mining investment. In light of recent signs of modest recovery in China and improving trends in India and other emerging markets, both NZD and AUD may out-perform major currencies, such as GBP, dealing with the Brexit fallout, and EUR, working through weak economic momentum, banking sector problems and political uncertainty. After putting all their chips down in their August policy statement, the RBNZ will struggle to sound as dovish this time. The risk of significant volatility around the BoJ and Fed meetings suggests caution, but conditions have improved for AUD and NZD recently. A peaking in the Australian property market may be a negative that comes into view, more likely, next year.

RBNZ will struggle to sound as dovish as last time

In its 11 August Monetary Policy Statement, the RBNZ cut rates by 25bp (some had thought they may cut by 50bp at that time), and released a dovish statement with a clear bias to ease. It said, “Our current projections and assumptions indicate that further policy easing will be required”.

The Monetary Policy Statement (MPS) released at that time, confirmed in a speech by Governor Wheeler on 23 August, forecast the Official Cash Rate to fall by a further 35bp from 2.00% (one or two more 25bp cuts), essentially by the middle of next year.

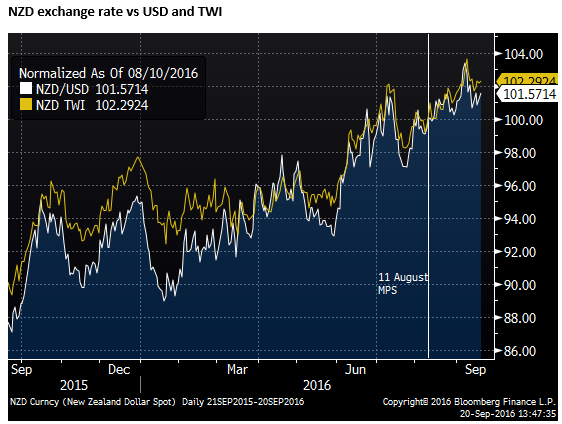

The August policy statement also said that “A decline in the exchange rate is needed.” A step up in the dovish rhetoric on the exchange rate from earlier in the year.

More pointedly, the August MPS presented an alternative scenario for rates policy that forecast two or three rate cuts by mid-2017 and four or five cuts to below 1% over the next two years if the trade-weighted exchange rate remained unchanged and did not fall from a TWI of around 76.5 to 73 over the two to three year horizon.

However, oddly, the more dovish rhetoric and forecasts related to the exchange rate in the MPS did not feature in the press conference led by Governor Wheeler after the August policy meeting, nor did he make any reference to it in his 23 August speech. Similarly, in press statements after the August MPS, Assistant Governor McDermott suggested that the RBNZ would be reluctant to change policy at review dates between the release of quarterly MPS, and also made no reference to the more strident language and forecasts related to the exchange rate.

As such, the market has come to see the RBNZ less reactive to the strength in its exchange rate than it suggested in the MPS. Since the 11 August MPS, the NZD has strengthened by 1.6% against the USD and by 2.3% against the RBNZ TWI.

There is no expectation that the RBNZ will cut rates on Thursday this week, but the market will be watching to see if the RBNZ repeats its view that, “A decline in the exchange rate is needed”. And continues to project that, “further policy easing will be required”.

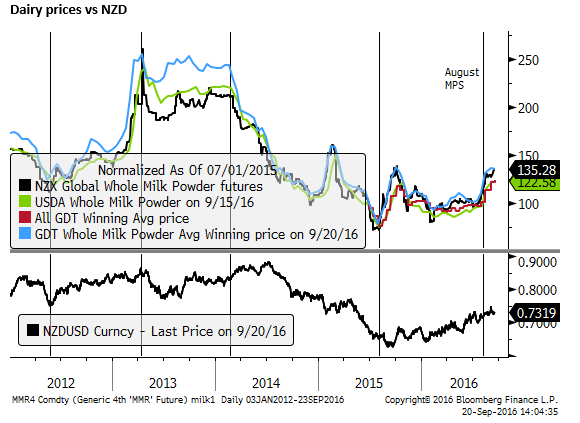

There is some risk that the RBNZ walks back these dovish views. Economic data have broadly surprised on the strong side and dairy prices have rebounded significantly, suggesting that the economy is coping well with the current level of the exchange rate and rate cuts are not needed with recent economic growth well above trend.

Dairy prices are up solidly from recent lows in July by around 20%, The Rabobank survey of New Zealand farmer confidence rose to a three-year high. A Net 35% of farmers see improvement in the rural economy over the year ahead, up from 3% in July.

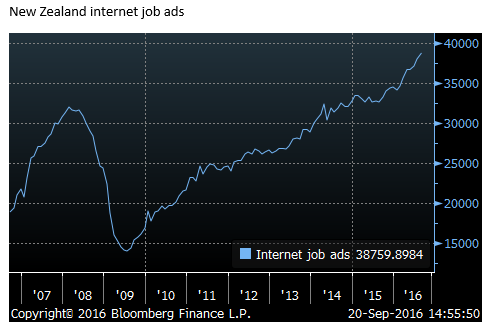

The broad sweep of New Zealand economic data suggests that the economy is growing solidly above trend (around 2.5% to 3%). Q2 GDP rose 0.9%q/q and 3.1%y/y. This was above the RBNZ forecast in its August MPS of 0.8%q/q, and with an upward revision to Q1, the annual growth rate was 0.3ppt above the RBNZ forecast.

Other more forward-looking activity indicators suggest growth continues to operate significantly above trend. Business surveys remain in a moderate to strong range. Job advertisements have re-accelerated this year, internet ads were up 18.8%y/y in August, returning to the previous high growth rate in 2014.

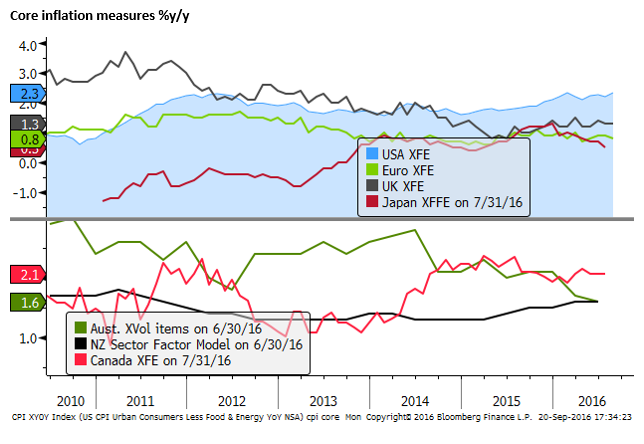

However, while growth clearly does not need a boost, the RBNZ shifted its focus more clearly to lifting inflation from a prolonged period below target (since Q4-2011). The RBNZ MPS exhibited more urgency to lift inflation, concerned that prolonged sub-target outcomes were seeping into longer-term inflation expectations and becoming more entrenched.

To get inflation higher, it was aiming for a sustained period of above-trend growth, tightening capacity constraints, to push up inflation pressure. On 23 August, Governor Wheeler said, “The forecasts contained in the August Monetary Policy Statement have the economy’s output gap currently at zero and rising to around 1.2 percent of GDP in 2018.”

The most recent GDP data suggest that the RBNZ is closer to achieving its higher output gap already, and thus it will be less inclined to cut rates. But presumably, it will still suggest a further rate cut is more likely. It is also likely to note that the higher NZD my place more unwanted downward pressure on tradable inflation.

The RBNZ can use its macroprudential policy measures to help justify its bias to cut rates. These measures are set to be implemented on 1 October, and might be expected to help keep a lid on the buoyant property market.

Reserve Bank confirms nationwide restrictions on loans to property investors – RBNZ.govt.nz

Unfortunately for the RBNZ, if they would like to avoid further gains in the RBNZ, there is nowhere to go with its policy statement. They went ‘all-in’ with the August policy statement, the best they can do is make the same dovish statements on the exchange rate needing to fall, and say rate cuts are required. Anything less will seem like they are less eager to cut rates and are not as concerned by currency strength.

We expect the RBNZ to keep these key phrases, but the risk is that they tone both down. The stronger dairy prices and solid pace of growth make it less clear that a weaker currency is needed and additional rate cuts are less urgent.

Overall, the underlying conditions have improved for the NZD since the August policy statement, and the outlook for the currency remains robust. Barring outside influences, the NZD might be expected to retain a rising trend.

Conditions more supportive for the AUD

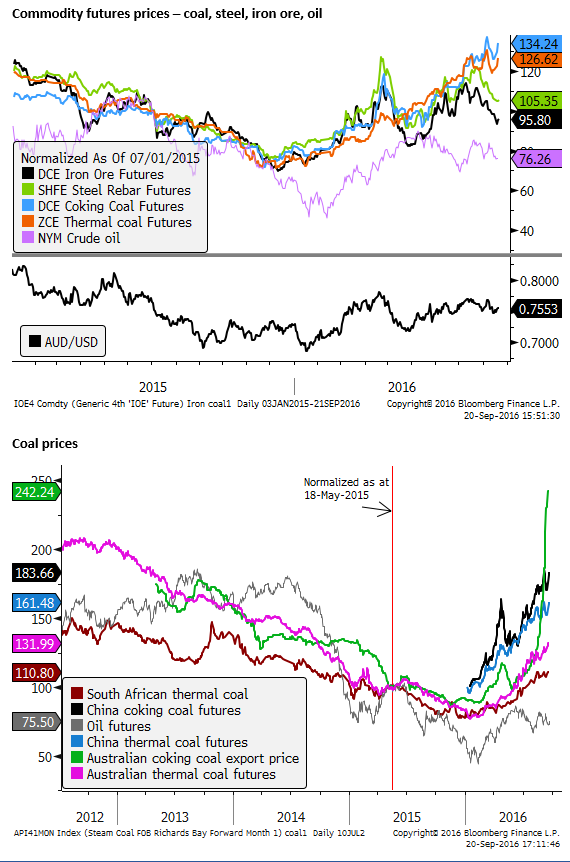

Commodity prices have also increased solidly for the AUD since lows around January. The RBA minutes said, “Prices of Australia’s commodity exports had increased since the previous meeting and were around 30 per cent above the lows of early this year.”

Iron ore prices have been weaker in the last month or so, but coal prices have continued to trend higher. In fact, metallurgic coal prices have surged by more than double since around mid-year to levels consistent with the peak years (4 to 5 years ago). This may be a spike above longer-term sustainable levels related to production disruptions in China. However, China has also been closing down less efficient mines, and the rise in coal prices are generating a surprise lift to income from Australian producers.

The RBA minutes said, “Members noted that there had been some signs of an improvement in sentiment in parts of the mining industry.”

The emphasis of recent speeches by RBA Assistant Governor for Economic, Kent, and the RBA minutes is one of stabilization in the economy that is well advanced in working through the mining investment down-turn and growing at around trend. There appears to be little urgency to cut rates further.

Like New Zealand, if there was to be a rate cut it might be to lift inflation from levels that are below the target band. But the RBA cut rates twice this year to deal with the lower inflation outcomes and appears willing now to take an extended period of time to assess domestic and global conditions; potentially well into next year.

At issue for Australia is a potential turning point in the housing market in the next year or two as a developing over-supply of apartments spills over to weaker house prices, a peak in housing construction, and potential for negative fallout for the financial system and household confidence.

However, at this point residential construction is still rising to a peak, house prices, overall nationally, are still rising moderately. As such, it does not appear to be on the radar for AUD at this point.