Improving growth outside the USA and political instability inside

The USD is weaker as the US election takes on deeply disturbing characteristics that may have long-lived implications for political stability and leadership. There may be a modest relief rally on a Clinton victory, but fears that her opponents will seek to have her impeached throughout her term in office will keep confidence in check. The USA economy has been growing modestly and lacks clear momentum. It remains to be seen if it can shake off the political malaise and drive the case for higher interest rates. Outside of the USA, there have been signs of improvement in economic growth in several large emerging economies and Europe. Industrial and agricultural commodity prices, with the exception of oil, also appear to support the notion of a more favorable supply and demand balance and rising inflation pressure. This improves the outlook for emerging market and commodity currencies, the EUR and GBP. The outlook for the USD is less clear, and JPY may weaken as yields tend to rise in other countries. However, uncertainty remains high on several fronts including, Brexit, oil prices, USA election, and Chinese financial stability.

USA political troubles

Election uncertainty in the USA has knocked the USD back on its heels. As discussed earlier this week, it is not just that the race has tightened, it is that after the election the loser is likely to cry foul loudly and persistently, damaging the legitimacy of the President and confidence in key institutions; including the FBI and DoJ.

Political stability may remain permanently damaged. If Clinton wins we cannot be sure that Republicans in Congress and their supporters within the FBI and other institutions do not attempt to bring on impeachment proceedings against the President. Even if these were to fail they would undermine the capacity of the administration to guide any positive legislation and the prospect of any compromise across party lines in Congress will seem very low. This may well act as a persistent weight on economic confidence in the USA.

Some additional political uncertainty is now priced into the USD in the last week, and we may see some relief rally if Clinton were to perform well in the 8 November election. Even if she were to win narrowly, there may be an initial relief rally in the USD as investors fear most a Trump victory given the greater potential for policy upheaval with uncertain consequences.

However, the market is not yet focused on the damage that appears to have been done to confidence in the stability of the system where political opponents attempt to undermine the winner through investigative and legal institutions. Attention will turn to how magnanimous is the loser. Will Trump call for unity? Will Clinton blame the FBI and will her supporters call for investigations into Trump’s connections to Russia or past actions of his business empire? Only through gritted teeth at best, I suspect. Any recovery in confidence following the election may be limited and fragile.

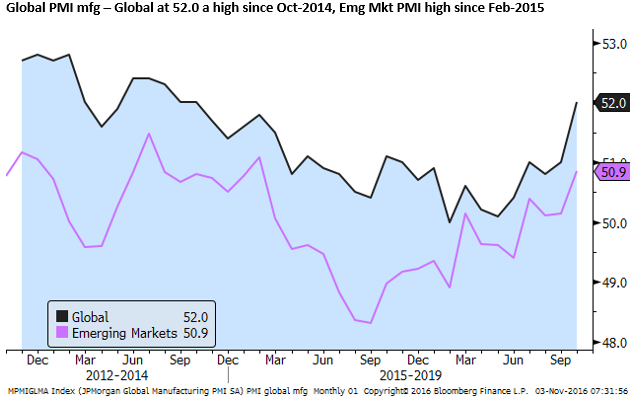

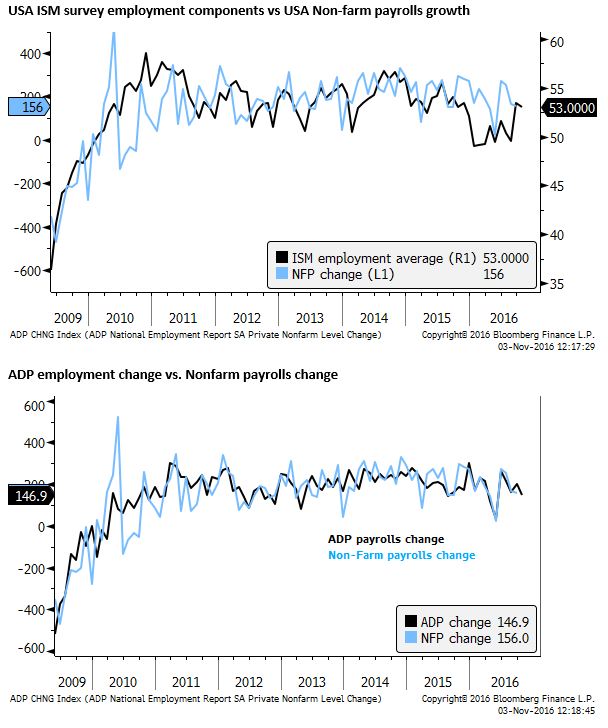

US growth outlook ho-hum, improvement abroad

However, while the US election may appear to have hurt the USD, it may also be the case that the USD is weaker due to stronger economic performance abroad. Recent US economic reports are mixed and some fear the economy has lost momentum, reducing the prospect for higher rates in the USA.

Perhaps the USA election has dampened economic activity in the USA, delaying investment and employment, but whether it is the election or not, it does not appear that the USA economy is the clear growth leader at this time. Investors may increasingly look to emerging market currencies seeking exposure to their improving growth outlook. From a political stability point of view, they may seem no worse than the USA.

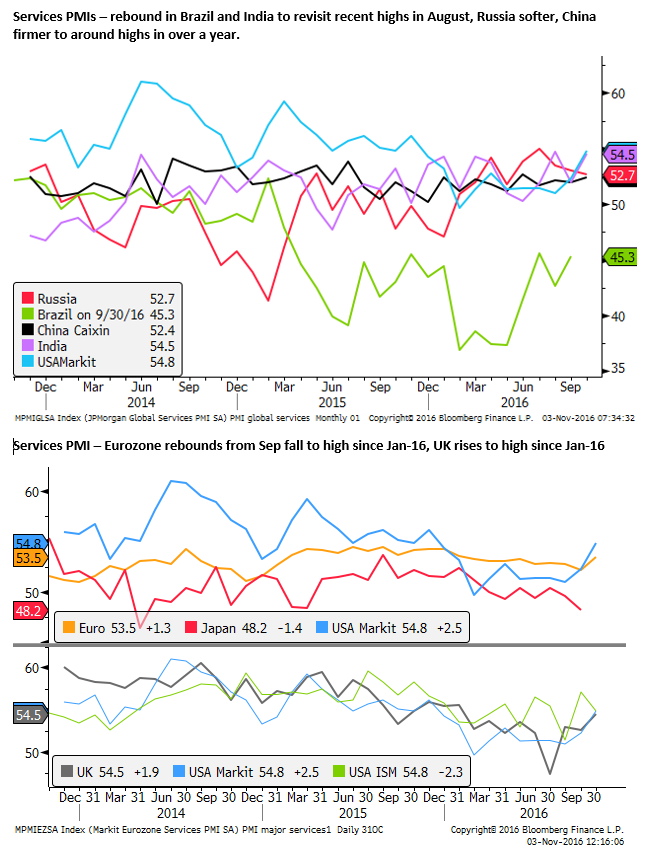

European outlook improved

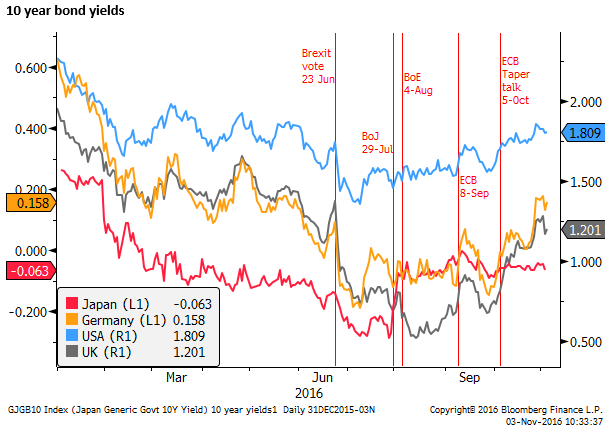

Recent European and UK economic reports have beaten expectations showing improving momentum. Notwithstanding the intense uncertainty related to Brexit, political stability has improved significantly in the UK with the strong leadership by UK PM May. This includes recently backing the head of the Bank of England, Carney, to remain at his post for longer. Political deadlock in Spain has been resolved with Rajoy forming a minority government.

No doubt major risks remain in Europe and the UK related to Brexit, the financial stability of several banks, an Italian constitutional reform referendum on 4 Dec. However, the UK and Eurozone yields have risen significantly in the last month or so, tending to lead the gains in US yields and rising significantly against flat Japanese yields, in part on improved economic performance and higher inflation expectations. Higher yields and a sense that political uncertainty is more clearly priced-in may attract capital inflow to EUR from the USD and JPY.

New Zealand rates approaching low

A sense that rates are approaching lows in New Zealand and Australia are supporting the AUD and NZD. Both have also been supported by resurgent commodity prices for milk, coal, and iron ore. Considering the increased political uncertainty in the USA and improved global growth indicators over recent months, it is easy to construct a positive outlook for both currencies. Uncertainty over housing markets and debt levels in both countries are the main factors holding them back.

New Zealand may be closer to turning around its inflation outlook with the economy close to full employment and very strong labour market momentum. Its most recent Q3 employment report showed the fastest annual pace of growth in aggregate hours worked (6.7%y/y) since 1993 and the fastest employment growth (6.1%y/y) in data available on Bloomberg since 1992.

Preventing this pace of employment growth spilling over to higher wages has been rapid, immigration and record participation (70.1%). But the unemployment rate has fallen to 4.9%, a low since 2008, and maybe in the zone that is consistent with NAIRU. Although there remains scant evidence of a pick-up in wage growth from low levels (around 1.6%y/y).

The case for the RBNZ to deliver a widely expected rate cut next week has sharply diminished. But if they do not, the NZD may be set to surge significantly. Even if they do cut, it will be difficult to sound significantly dovish to keep a lid on NZD.

The RBNZ would be hoping that the Fed proceeds to hike rates in December and growth in the USA and globally picks up to take appreciation pressure off the NZD.