In a risk recovery it is hard to look past the AUD

The market has become remarkably correlated with oil prices, and has lost sight of broader economic and policy developments that may occur. Policy makers are likely to step into the fray to offset the negative market action and bolster confidence. At this same time it can be argued that the market has over-reacted to an incremental shift in actual economic trends. The ECB was emphatic on Thursday, leaving a clear impression that it intends to counter the fall in inflation expectations with more policy easing at its next meeting in March. The pressure on the BoJ to step-up its QE measures has intensified. In the context of a recovery of risk-appetite, it is hard to look past the AUD. Australia is considerably more advanced in moving through its down-turn in resource sector investment than Canada. Its services sector (education, tourism, and property) has received higher demand than previous cycles and many other economies from China. It is receiving a high share of the private sector capital outflow from China. Its overall economic momentum has picked up over the course of the last year and it is one of the better performing economies in the Asia region notwithstanding a bigger drag from commodity prices.

Policy action may generate a sizable risk-rebound

My sense is that we are more likely to experience a period of recovery in risk appetite. The year-to-date has already seen a significant fall in global equity markets and rise in risk premia. The market has become remarkably correlated with oil prices, and has lost sight of broader economic and policy developments that may occur.

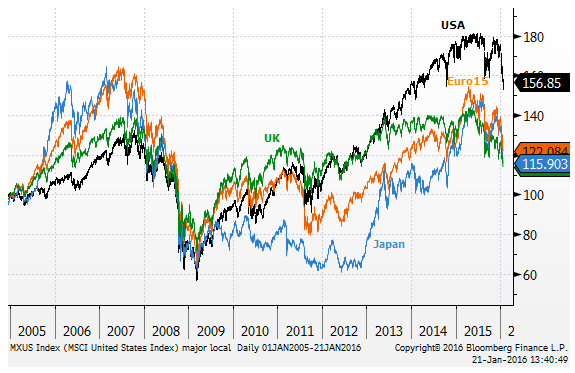

There is no doubt that the fall in equites this year will have a sustained impact on global economic and investor confidence. The technical indicators for equity indices across the world have established down-trends. All the major country equity markets have broken below the lows last year set in August, and their peak levels were generally in the first half of last year.

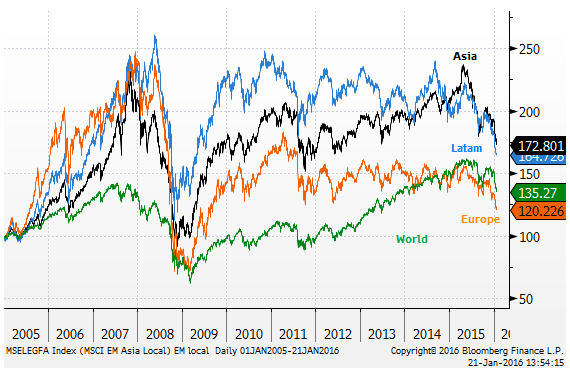

Emerging market equity indices, appear more bearish. The MSCI emerging Europe and Latin American local currency indices are at a low since 2009, Asia is at a low since 2012.

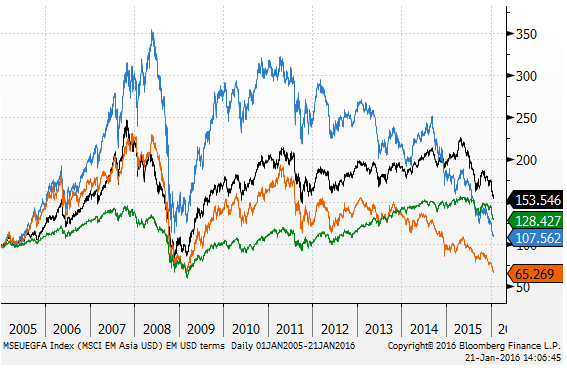

In USD terms, both the major and EM equity market performances are much worse. Taking account of a strong USD and weak European and Latam currencies shows persistent down-trends in those regional equites since 2011.

There are reasons to be more circumspect on the global economy; Chinese growth has continued to slow gradually, emerging market growth generally still appears challenged, the US economy appears to have lost some momentum. The market has been adjusting to the prospect of higher US interest rates. The deep further fall in oil prices has raised the risk of more widespread defaults in the energy sector, weaker emerging economies, and a related fall in energy sector investment.

However, in the to-and-fro nature of markets, policy makers are likely to step into the fray to offset the negative market action and bolster confidence. At this same time it can be argued that the market has over-reacted to an incremental shift in actual economic trends. It is still more likely that global economic growth proceeds at a moderate pace this year and next; supported by easy global monetary conditions.

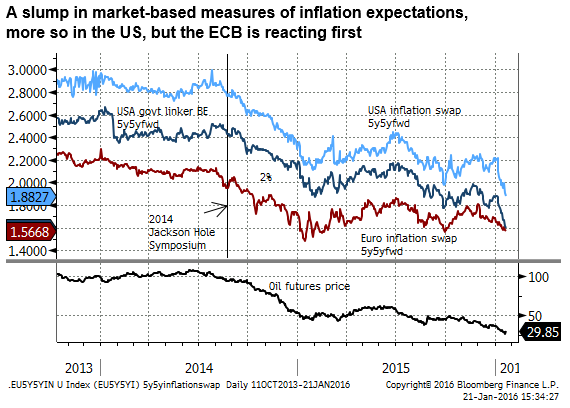

US Fed policy makers have highlighted the fall in various measures of inflation expectations over the last week. They may be shifting to a longer period of wait and see on further policy tightening.

The ECB was much more emphatic today, leaving a clear impression that they intend to counter the fall in inflation expectations (that are highly correlated with the oil prices) with more policy easing at its next meeting in March.

After the rapid rise in the JPY and concurrent fall in Japanese equities this year, the pressure on the BoJ to step-up its QE measures has intensified. It didn’t follow the ECB lead to ease policy in December, but the same may not be true if the ECB eases again in March.

Chinese policymakers have been more effective in stabilizing its currency and equity markets in recent weeks. They have used a considerable amount of FX reserves to maintain stability. While this may be alarming, they still have a formidable FX reserves war-chest to call on, so presumably they will continue to help restore some confidence the global asset markets.

While a large amount of capital may have been pulled out of global equities of late, the market will be left wondering what to do with cash balances that yield little to nothing, and less in the Eurozone with negative rates. The enduring question of what is a viable safe harbor for savings persists, and this can easily set in motion a recovery in asset markets, even if for a short period.

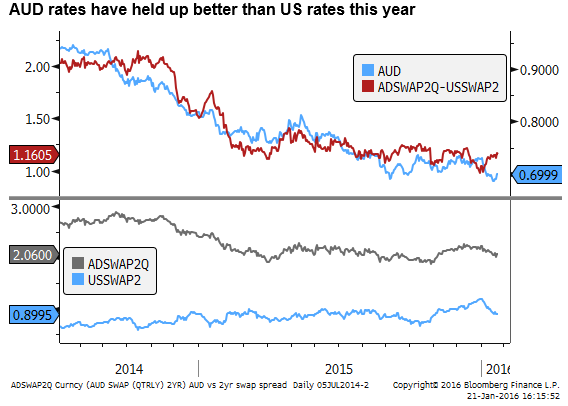

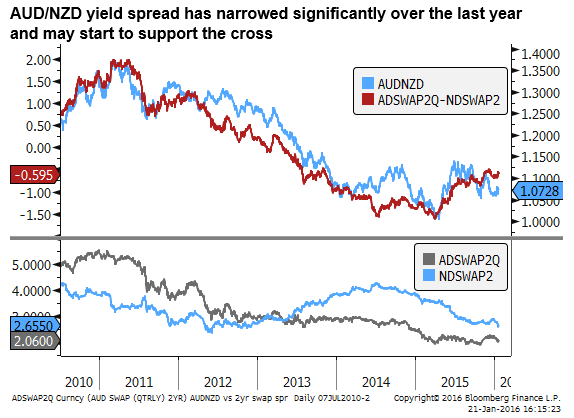

AUD has proven resilient, and may rebound

In the context of a recovery of risk-appetite, it is hard to look past the AUD. While the AUD has recently made a new long term low, it only just surpassed the previous low in September, in the context of much lower commodity prices, much higher risk attached to possible financial and economic crisis in China, significantly higher global risk aversion, and its increasing exposure to the energy sector

It does not appear to be the case that the AUD wants to move much below .70. The reasons are that the Australia is considerably more advanced in moving through its down-turn in resource sector investment than Canada. Its services sector (education, tourism, and property) has received higher demand than previous cycles and many other economies from China. It is receiving a high share of the private sector capital outflow from China. Its overall economic momentum has picked up over the course of the last year and it is one of the better performing economies in the Asia region notwithstanding a bigger drag from commodity prices.

The result of these factors is that the RBA has not been moved to consider emergency rate cuts, and the currency is losing its appeal as a proxy for China fears.

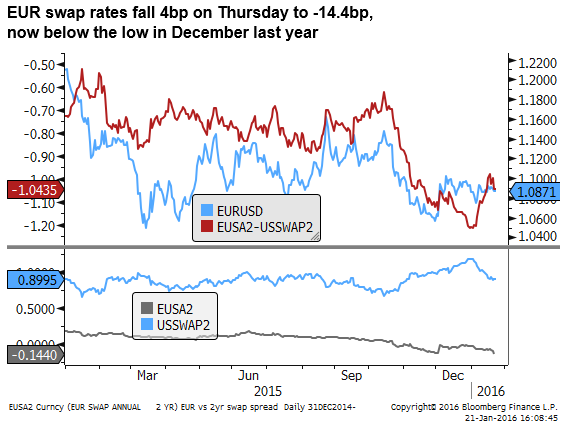

ECB action likely to sink EUR

One of the more surprising developments on Thursday is the bounce-back in the EUR in the face of very dovish performance by the ECB. Draghi has again forewarned the market to expect further policy easing at the next meeting.

The market is naturally wary of believing the ECB after it under-delivered on expectations in its December policy easing. Once bitten twice shy.

However, we must recall that the ECB still eased policy by a reasonable clip in December, and Draghi, in his press conference, made a number of comments to suggest he has dealt with much of the push-back for additional action he encountered in December. He emphasized that the Governing Council was unanimous in its agreement on how to describe the guidance after Thursday’s meeting.

The ECB is currently, much more dovish and reactive to oil prices that any other central bank. It is pushing much harder to achieve its inflation goals. If it eases again in March, as is now the central case, it will set a pattern of responding quickly and decisively to global developments, including weaker commodity prices.

EUR has only moved sideways in the recent period of risk aversion. Should risk appetite show some recovery, EUR should fall significantly.

What they said

President of the ECB, Mario Draghi

From the introductory statement:

“As we start the new year, downside risks have increased again amid heightened uncertainty about emerging market economies’ growth prospects, volatility in financial and commodity markets, and geopolitical risks. In this environment, euro area inflation dynamics also continue to be weaker than expected. It will therefore be necessary to review and possibly reconsider our monetary policy stance at our next meeting in early March, when the new staff macroeconomic projections become available which will also cover the year 2018. In the meantime, work will be carried out to ensure that all the technical conditions are in place to make the full range of policy options available for implementation, if needed.” (Emphasis mine: Although Draghi repeated the underlined section many times in the Q&A)

“On the basis of current oil futures prices, which are well below the level observed a few weeks ago, the expected path of annual HICP inflation in 2016 is now significantly lower compared with the outlook in early December. Inflation rates are currently expected to remain at very low or negative levels in the coming months and to pick up only later in 2016. Thereafter, supported by our monetary policy measures and the expected economic recovery, inflation rates should continue to recover, but risks of second-round effects should be monitored closely. A more comprehensive picture of the impact of oil prices and other external and domestic factors on the outlook for HICP inflation will become available in the March 2016 ECB staff macroeconomic projections, which will also cover the year 2018.”

From the Q&A (Paraphrasing)

Recall my speech in New York….It was quoted at our discussion today…that we have the power, willingness and determination to act.

There are no limits to how far we are willing to deploy our instruments with in our mandate.

Conditions have changed since the December policy meeting, the ECB needs to act to maintain its credibility. Oil prices are 40% lower, the exchange rate in effective terms has strengthened, geopolitical risks have increased.

The governing council was unanimous in committing to this line of communication.

In response to recent events in China….The outlook for the Euro area has been revised downward and the effects on the commodity markets has been quite visible.

When looking at the effect of oil prices in inflation … We look at three things:

- Persistence of these changes…. over the last two years at least

- The materiality … since last meeting 40% in December

- We look at second round effects, whether low oil prices feed into other prices, it could generate what we want to avoid, a spiraling downward phenomenon.

We have to be very vigilant about second round effects….Looking at the non-energy core inflation…. we don’t have many reasons to be optimistic… when we look at wages we don’t have reasons to be optimistic.

All inflation expectation measures have declined….More worryingly they’re correlation with occurring inflation, and therefore their correlation with oil prices, has also increased.

This is why second round effects are especially important.