Is inflation rearing its head when least expected?

Rate hike expectations in the USA have been pushed well-out; a full hike is not fully discounted by the market for over a year and a half. However, last week jobless claims were below 270K for a second week in a row, weekly consumer confidence continues to hold up and the core CPI rose further above the Fed’s 2% target to a high since June 2012. Several core measures of inflation in the US have been trending up for the last year, and the risk is that the PCE deflator (the Fed’s preferred inflation measure) will also firm when released on Friday this week. Meanwhile survey and market-based measures of inflation expectations in many parts of the world, including the USA, are at record lows and are likely to see central bank policy remain easy; including keeping the Fed on hold for a while longer. Nevertheless, some stability in commodity prices, more stable global equity markets and evidence of rising actual inflation in the USA may help stabilize inflation expectations and return rate hikes to the agenda, potentially reverting the USD to a stronger trend. Iron ore, steel, base metals and related mining equities have been strengthening or out-performing the broader equity market since around mid-December. The market has tended to ignore this recovery, treating it as a false dawn, but the surge in Chinese loan growth in January reported last week, and recent efforts by the Chinese government to pursue greater financial market stability, suggests China may be reverting, at least for a time, towards boosting growth, including for infrastructure spending. If so, while many will question the motives and capacity of China to generate sustainable growth, the market may fell wrong footed if Chinese data pick up in coming months.

US inflation may be kicking up just when the market least expects

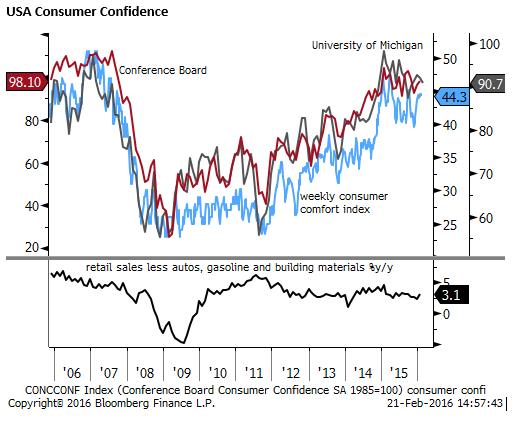

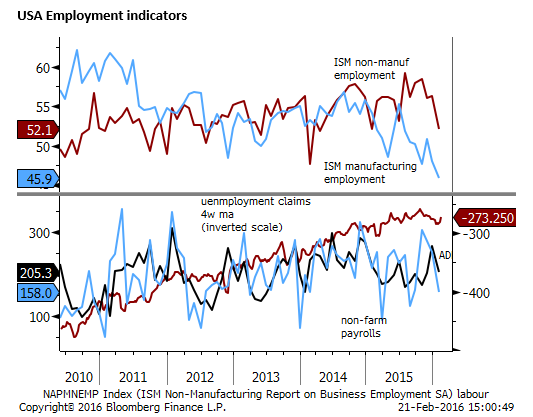

US data has been mixed and inflation expectations lower, but some important indicators suggest it may be premature to think that Fed rate hikes are off the table in the first half of the year. Jobless claims fell back to be below 270K for a second week in a row last week, suggesting that the labour market may remain relatively tight. Weekly US consumer confidence also held up in recent weeks despite global equity market turmoil. And the core CPI rose 2.2%y/y, a high since June-2012, above the Fed’s 2% target.

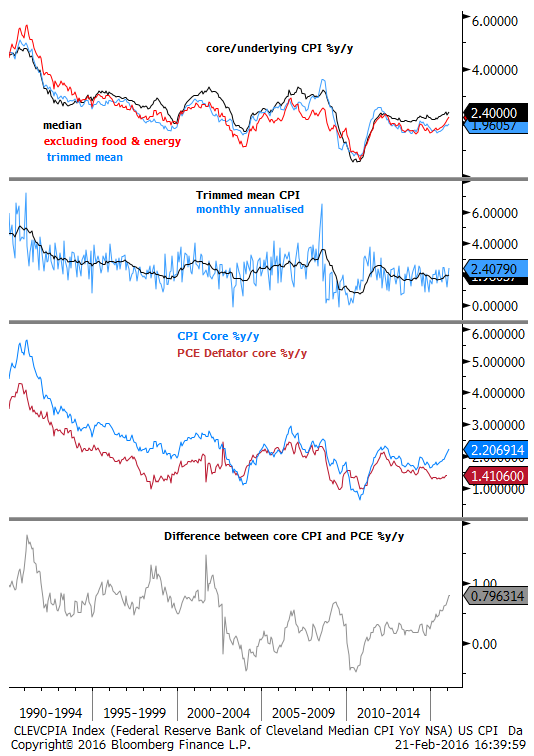

The Fed of course rely mostly on the PCE deflator for its gauge of inflation, due on Friday this week, but is must wonder if the rise in the CPI portends a rise in the PCE, and whether more rapidly rising CPI may influence inflation expectations and wage negotiations.

Already the core PCE is forecast to rise to 1.5%y/y (Bloomberg median estimate) which would be a high since Oct-2014. The Cleveland Federal Reserve Nowcast forecast made as at 19-Feb is for a 1.57%y/y (rounding up to 1.6%), presumably taking in the latest data from the CPI into consideration.

The Cleveland Fed also produces two alternative measures of core inflation (that are well known to Australian readers since they are the primary focus of the RBA) a trimmed mean (1.96%y/y) and weighted median measures of the CPI (2.40%y.y). These are also exhibiting a gently rising trend over the last year and suggest inflation is close to or above the Fed target.

The PCE deflator is typically below the CPI measure of inflation, in part because the PCE is based on actual expenditure, and the CPI basket is updated every two years, such that households can adjust actual spending towards lower priced goods. A good part of the current difference apparently related to a higher weight for housing costs in the CPI. Given most central banks around the world use a CPI measure of inflation, it appears that the US effectively target a higher rate of inflation than many of its peers.

In the last decade the difference between the PCE and CPI inflation measures has not been all that different, however it has blown-out recently to its widest margin since 2002. Back in the 1990s, the difference between the two measures was typically as wide as it is now. As such, perhaps we should not expect the PCE to suddenly catch-up to the higher CPI, but as both have been trending up steadily in the last year, more so core CPI, we should at least be wary that PCE may also be approaching the Fed’s target sooner than expected.

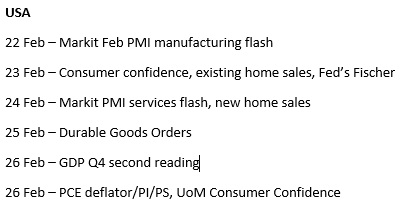

There are a range of other significant data points this week in the US and a several Fed speakers, but with a second hike this cycle now not fully discounted by the Fed Funds futures curve until Q4 of 2017, the risk we need to be thinking more about is what triggers a rate hike sooner. The market may have become too bearish with recent inflation and wage trends still rising and unemployment now at the Fed’s estimate of the long run neutral (NAIRU).

There are a range of other significant data points this week in the US and a several Fed speakers, but with a second hike this cycle now not fully discounted by the Fed Funds futures curve until Q4 of 2017, the risk we need to be thinking more about is what triggers a rate hike sooner. The market may have become too bearish with recent inflation and wage trends still rising and unemployment now at the Fed’s estimate of the long run neutral (NAIRU).

Inflation expectations moving in the opposite direction

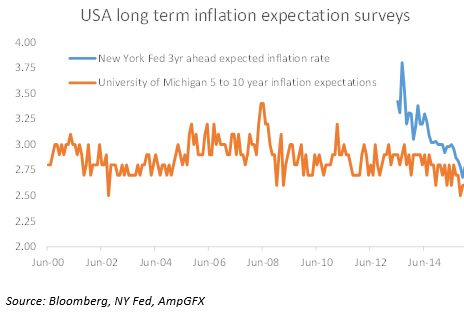

Just at this juncture when US inflation pressure may be rising, long-run inflation expectations have been falling to record lows. Both for market-based measures and surveys.

The University of Michigan preliminary 5 to 10 year ahead inflation expectation fell to a record low of 2.4% (updated on Friday). The New York Federal Reserve Survey fell to 2.5% in Jan, down significantly from above 3.3% before mid-2014.

Market-based measures have also declined sharply to new lows and well below 2% both in the USA and Eurozone. Many officials and commentators have noted the high correlation with long run inflation expectations and the price of oil. While to a significant extent, the deflationary impact of oil should be transitory, and this correlation doesn’t necessarily make good sense, it does highlight the concern the markets may have for the impact of low oil prices on global financial stability, or what they may be saying about global growth.

The Fed’s Bullard expressed his reluctance to hike further until market-based measures of inflation expectations turn up. He said, “I regard it as unwise to continue a normalization strategy in an environment of declining market-based inflation expectations,” One other “pillar” of the Fed’s decision to hike rates in December has also weakened, he said, because falling equity prices and other tightened financial conditions have made the risk of asset bubbles “less of a concern.”

Several, Fed members, including in the recent January FOMC minutes, have expressed more concern over weaker inflation expectations recently, helping account for market expectations of less rate hikes ahead.

Certainly this does suggest that the Fed can wait for longer before hiking rates. But it may also be the case that these inflation expectations start to rise at some point, especially if rising core inflation readings start to get more headlines.

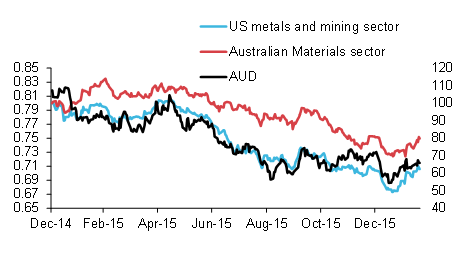

Industrial metals stronger since mid-December

It may be a false dawn and there have been similar periods of recovery during the down-trend in recent years, but it is noteworthy that iron ore, steel and base metals have been firming from long term lows since around mid-December.

The mood around Chinese demand for metals has been bleak in the last year and there is a well-established expectation that Chinese demand for these commodities may have peaked as it restructures its economy away from construction and heavy engineering infrastructure projects. Nevertheless, we must be respectful of the price action and accept the possibility that these markets may be finding a bottom.

Fears around Chinese economic growth may also have been over-blown, driven by widespread discussion over greater volatility in its exchange rate and equity market this year.

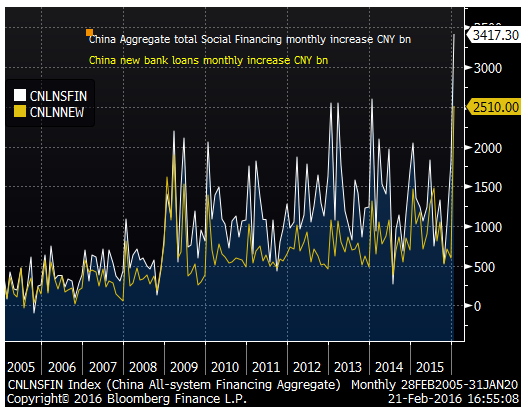

Chinese loan growth may signal faster growth

Chinese bank loan growth surged by a record in January, well above expected. This may have been front-loading associated with the Chinese New Year Holidays in early Feb. However, Market News International (MNI) reported that “bank officials in a number of Chinese cities say February new loans look to be just as strong, even with a week-long holiday in the middle of the month.”

MNI reported that lending to government projects in the first year of 13th Five Year Plan, definitely helped to boost loan growth. (The surge in growth may have been seasonal and boosted by the 5year cycle).

The loan surge may to some extent also reflect a trend towards corporations paying back foreign loans (and replacing these with domestic loans). This might help account for the sharp rise in private sector capital outflow and depreciation of the CNY. To the extent that Chinese companies have reduced foreign loans, they have reduced FX risk and there might be less financial damage from a weaker CNY, and less selling pressure on CNY in coming months.

MNI also reported that despite the ban on local governments from borrowing via bank loans either directly or via investment vehicles, they have been able to open up new channels to borrow via “newly set up industrial funds as well as public-private sector partnership projects.”

This appears to fly in face of central government claims that it is accelerating its structural reforms including cleaning up excessive debt held by local governments and state-owned enterprises. It may indicate that the government is encouraging a return to stronger investment activity at least for a period of time to cushion the overall economy.