JPY feeling the unintended consequences of QE

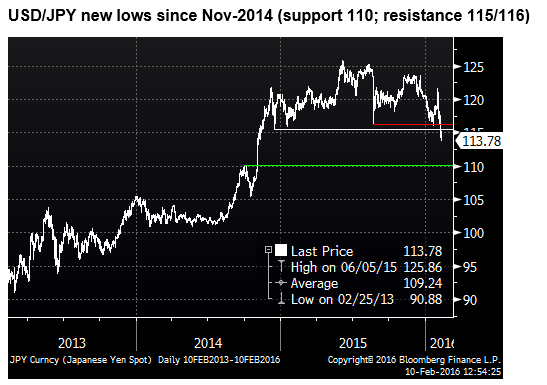

The USD/JPY has plunged below its previous lows since November 2014. The next major support is the levels preceding the Oct-2014 BoJ QQE phase two policy easing (USD/JPY around 110). The fall comes despite the short term yield advantage for the USD/JPY rising to its widest margin in many years. The key driver is higher global market uncertainty sharply reducing yield-seeking behavior. The effectiveness of unconventional QE/negative rate policies appears to have sharply diminished over the last year. We may even be witnessing the undesirable unintended consequences of prolonged global QE coming home to roost and dampening market confidence. Nevertheless it is hard to see any other path for the BoJ and ECB, suggesting both may opt for more negative rates and play the intervention card if currencies strength persist. We note that in the most recent bout of global market uncertainty this year, intensifying since the BoJ opted for negative rates on 29-Jan, JPY has not strengthened more than gold.

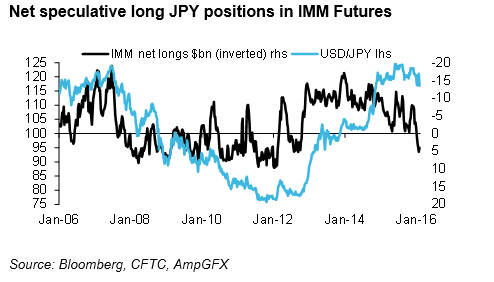

Speculators long JPY for the first time in the QQE era

Since the first week of this year, the IMM futures market reported that non-commercial (speculative) traders have had a net long JPY position for the first time since before so-called Abenomics was implemented at the end of 2012, including the “Quantitative and Qualitative Expansion (QQE)” monetary policy under BoJ Governor Kuroda. The net long position increased to a peak in the last week of January of a significant $5.2bn worth of net long JPY futures positions (around 50% of previous peaks in 2008 and 2010).

It would not surprise to see the net JPY long position rise further in the data to be reported later this week, given the further rise in the JPY and global market risk aversion, notwithstanding the introduction of negative rates policy as at the previous BoJ policy meeting on 29 January.

USD/JPY breaks key support around 115

In recent days, USD/JPY has fallen below the previous lows since November 2014. Several previous lows were in the 115s, including in Dec-2014, Jan-2015, and earlier this year in Jan-2016. It also reached a low just above 116 in Aug-2015. So it is significant for chart followers that the USD/JPY has breached these lows, and the psychological 115 level, after essentially 15 months of a wide side-ways range between 115/125. Chartists are likely to view the 115/116 level as a key resistance range for the currency pair.

The next key support for USD/JPY is around 110. This was the peak in the lead up to the historic second wave of BoJ QQE set on 30-October 2014.

Where did the Yield seeking behavior go?

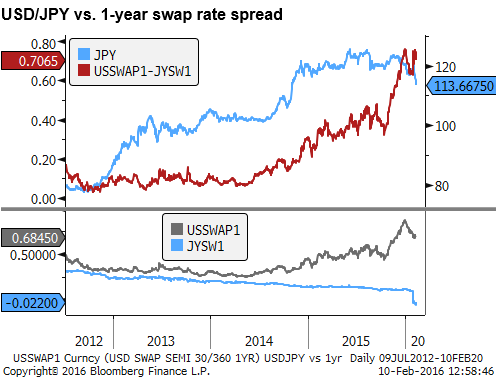

It is surprising from a fundamental perspective to see sentiment turn so negative for the USD/JPY after the Fed has implemented its first rate hike and is no longer expanding its balance sheet since late-2014, while the BoJ continues to expand its balance sheet at an historic rate of 80tn JPY per year and has recently pushed its marginal cash rate to record lows, below zero

As the chart below indicates, the recent fall in USD/JPY has little to do with the short term yield advantage. Despite the recent fall back in US rate hike expectations, the 1-yr yield advantage for the USD over the JPY is around its high since the election of PM Abe in 2012.

Quantitative policy aint what it used to be

It appears that the effectiveness of quantitative monetary policy to influence currency and other markets has diminished. At the height of QE policy, volatility in global markets was very low and yield seeking behavior often dominated, resulting in stronger asset prices and narrower credit spreads. Many currency analysts used the relative growth of central bank balance sheets (money bases) to model their exchange rate fair-values.

However, over the last 18 months, global markets and exchange rate volatility has increased sharply from record lows in the first half of 2014.

It may be the case that USA Fed QE was the most powerful type of QE given the role the USD plays as the denominator for much of the global financial and commodity markets. It may be the case that a rate rise in the US has contributed to greater global market uncertainty. As such, perversely, higher rates are no longer supporting the USD, but are doing more to raise volatility, reduce yield-seeking behavior and weaken the USD against lower (negative) yielding currencies.

Inherently more volatile markets, QE’s unintended consequences

It may also be the case that markets have become more inherently volatile and nervous due to tougher regulatory measures on banks, limiting their capital and trading capacity, more so in the most credit sensitive and higher risk markets. The market has witnessed several flash-crashes in bond and currency markets over recent years, and investors, market-makers and traders perceive much fatter tails in the probability distributions for financial markets. As such, they are less inclined to fight market trends that may appear contrary fundamental analysis.

In the last six months the market has experienced much higher volatility and weakness in global asset markets that few claim to fully understand.

Many see this volatility related to greater uncertainty over the state of the Chinese economy and stability in its financial system as it grapples with high national debt, while at the same time attempting to modernize its economy and financial system and integrate with global financial markets. It has certainly unsettled market confidence to see increasing and persistent private sector capital outflow from China, notwithstanding the nation’s large holdings of foreign exchange reserves and relatively low levels of foreign debt.

There is also significant credit problems related to the energy sector. Over-supply in several commodity markets has developed in part because of earlier optimism over the path of growth in China and other emerging markets and the low cost and easy availability of credit in the era of QE policy since 2009, encouraging rapid expansion in energy and other commodity production capacity. The lower than expected global demand for these commodities and excess supply has caused prices to fall sharply. While this is supporting consumption growth, prices have fallen so far now that they have generated credit problems in the sector. These problems have in turn spilled over to a weaker financial sector in the last year.

In a manner of speaking, the unintended consequences of QE is that it has helped regenerate credit problems, such that its effectiveness is now diminished.

It may be argued that, to some extent, QE policy became part of the problem and world policy makers relied on it too much to spur global economic growth and higher inflation. The question may be asked – if QE has had some detrimental unintended consequences, should central banks try to solve the current problems by implementing even more QE, negative rates and other unconventional monetary policy measures?

Without attempting to answer that question, the doubts in the effectiveness of QE to alleviate the current ills of the global economy are contributing to an inherently more volatile global financial market environment.

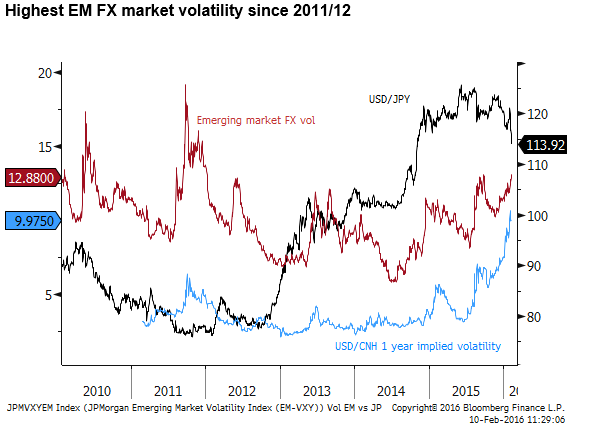

The chart below compares the USD/JPY to the JPMorgan Emerging Market FX implied volatility index and the USD/CNH 1-year implied volatility. Various measures of implied volatility in financial markets have lifted to the highest levels in a number of years. Both these FX vol measures in this chart are not directly affected by the JPY exchange rate, but provide a sense of the greater financial market risk and uncertainty that has diminished yield seeking behavior and contributed to a stronger JPY, despite its lowest relatively yields in many years.

Many moving parts in the JPY outlook

There are a number of moving parts that make it difficult to pick the USD/JPY direction. Increased global market volatility and uncertainty support the JPY, discouraging yield-seekers from selling/borrowing-in the JPY to fund higher yielding investments, and discouraging Japanese investors from investing offshore, bringing Japan’s current account surplus into play as a potential source of net demand for the JPY.

However, a stronger JPY at some point is likely to bring the BoJ/MoF and Japanese government into play to use rhetoric and policy to weaken the currency. With negative interest rates, intervention to weaken the JPY actually generates net interest income for the Japanese government. Threats of intervention have not arisen yet, but should be taken seriously by the market.

Volatility in the global financial markets may also calm down. While the markets may appear more inherently volatile, more QE and lower rates policies may still be effective in regenerating some confidence. Yield-seeking behavior may not need much of a push to get going again since there are arguably no safe harbors for savings. Japanese and European investors pay an outright interest rate penalty for benefit of avoiding exchange rate risk in their home currencies.

To make a fundamental case for a significantly stronger JPY we have to presume that either confidence will build that Japan can achieve sustainable inflation above 2%, or the US economy will falter and need to cut rates with the possibility that the Fed too might revert to unconventional monetary policy, including introducing negative rates and QE.

Perhaps at some level the market can see some risk of these two things occurring, perhaps more so the latter given current bearish global market sentiment. However, the case for either in the foreseeable future appears very slim.

Several FX analysts are predicting that Japanese officials will soon begin to warn the market that they are watching and concerned by the appreciation of the JPY. This would naturally be the first step in the battle to prevent further gains in the JPY.

Furthermore, as mentioned already, speculative futures traders are net long JPY for the first time in the BoJ QQE era. This suggests potential for a squeeze of these positons if the BoJ/MoF/Government start to hint they are warming up the intervention motor.

The higher level of global market volatility that is probably here to stay should tend to cap the rebound in the USD/JPY, but government and central bank action by Japan is also likely to limit the downside. Fundamentally the case for a sustained gain in the JPY is weak.

The same is true for most currencies, but Japan and the ECB have proven to be the most dovish QE and negative rate responsive central banks. As such, it remains particularly difficult to see sustained gains in these currencies. Accordingly our strategy includes selling JPY against Gold. Gold can act as the alternative store of value when no other currency is viewed as sufficiently stable.

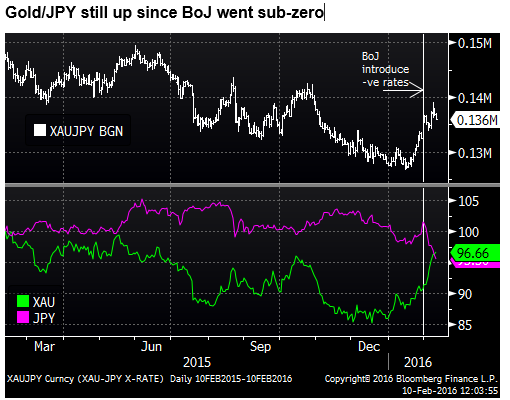

JPY has not matched Gold since negative rates were introduced

As the chart below of Gold/JPY and its components shows, gold (XAU) has rebounded more than the JPY over the most recent bout of global market uncertainty since the BoJ introduced negative interest rates.