JPY funded carry trades may be coming back, Yellen thrusts gold back into the lime-light

Surprising strength in NZD and AUD today, before the dovish Yellen speech, despite weaker oil prices, weak Australian bank share prices, and negative news related to China in recent days, may reflect renewed interest in carry trades, particularly funded out of the JPY. The JPY has been relatively weak in the last two weeks and USD/JPY volatility measures suggest downside fears have diminished significantly since early-February. The dovish speech by Yellen today is only likely to reinforce this trend. Yellen reasserted the message from the 16 March FOMC meeting and fleshed out more clearly a case for raising rates cautiously. She endorsed the lower market expectations for Fed rate hikes, spoke extensively about global risks, implied a weaker USD is preferred and made it seem she was prepared to look through higher inflation readings in the near term. With negative rates in Europe and Japan, rates potentially on hold for longer in the US and a range of concerns that are likely to keep the market wondering about the scope for upside in global asset prices, gold is stepping back into the lime-light.

Surprising strength in AUD

To my surprise this morning (in Breckenridge, Co.) AUD and more so NZD were up sharply on a lack of information at least from my perusal of news (before the dovish Yellen speech). These gains are surprising in light of weaker oil prices that appear more solidly founded in rising oil inventory and approach of a 17 April meeting of producers in Doha that is unlikely to deliver a surprise and is only expected to freeze output at current high levels, while Iran and Libya are still set to increase output.

The strength in the AUD is also at odds with weak Australian bank stocks (crucial to the health of the Australian stock market and the confidence of many retirees relying on their dividends that are under threat of falling). Furthermore, recent news out of China is less supportive (China Beige Book, property curbs).

A return of the JPY funded Carry Trade

But what may be happening is a return to carry trades and demand for higher yielders funded out of the negative yielding JPY in particular that has been grinding weaker over the last two weeks.

The fact that NZD is leading the AUD higher, highlights that the gains are probably being driven by offshore developments.

A fall in AUD/NZD from recent highs probably makes sense in light of the weaker Australian banks, China growth risks and political risks in Australia as an election looms.

If the move is being driven by Japanese investors, they are likely to prefer the NZD since it is coming off a recent base vs. the JPY, as Japanese investors much prefer to buy around recent lows than chase a rising market.

Furthermore, if there is broad-based buying of both currencies, NZD can rise faster as the less liquid currency.

JPY cross charts have been showing rising trends of late, reinforcing the case for carry trades funded out of JPY.

Needless to say negative rates in Japan that feature across the government curve out to at least 10-year maturities are an incentive to Japanese investors to renew offshore investment, both at the retail and wholesale level.

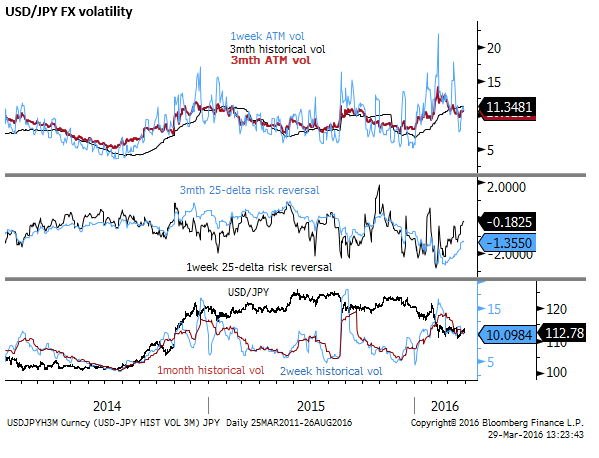

The main factor holding them back from carry trades has been elevated FX volatility. However, while some currencies appear more risky, such as GBP, JPY has been trading in a range since early-Feb, implied JPY vol has been declining, and risk-reversals have been rising, reducing the premium for USD/JPY puts. As such it appears there is less downside risk for USD/JPY than in early-Feb.

Dovish comments by Fed’s Yellen, underpinning global asset markets is also likely to support the case for carry trades.

As we discussed in our report AmpGFX – Anatomy of a Weaker Dollar, 22 Mar, a sense that G20 policy makers may be cooperating more and calling an implied truce in the so-called currency war, is likely to boost the case for carry trades. This sentiment may be starting to take hold.

My search of news and commentary has failed to show up any anecdotes of Japanese carry trade activity, so it may be the case that I am wrong. Alternatively, it may be early in the trend. In any case it is best to respect the technicals and they favor JPY crosses extending gains.

Yellen Reaffirms dovish message from March FOMC

Yellen has delivered a dovish speech that fits with the dovish message delivered in the 16 March FOMC statements. This returns the market firmly towards the mindset that the Fed will be in no hurry to raise rates. Yellen has powerfully countered the more hawkish tones that had come from Fed President’s Bullard and Williams in the last week that appeared to boost the USD somewhat.

Yellen has endorsed the fall in market yields predicting less rate hikes this year, highlighting this as valid development to counter the risks to growth arising from a weaker global economic outlook.

Yellen highlighted that while the base-line outlook for GDP growth, unemployment and inflation have not changed much since December (although they were revised somewhat lower), this is only because the market is now projecting a lower trajectory for Fed rate rises (and she also pointed out that the FOMC has responded to weaker global trends by lowering its projected rate hikes in the March policy statement).

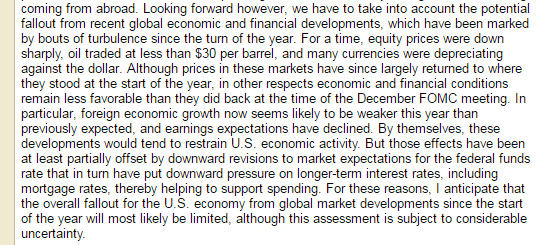

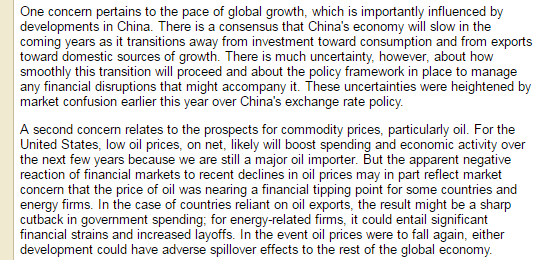

Yellen spoke extensively about the global risks to USA growth

In particular she spoke of the risks related to China and oil prices that the market appears to have been especially fearful of this year.

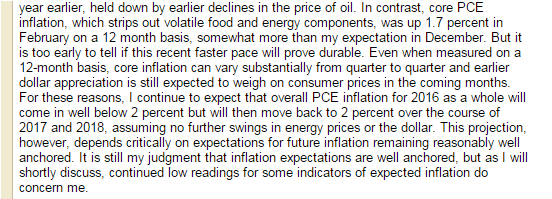

Yellen also helped us understand why the Fed has remained so benign in its inflation forecasts in the face of the recent pick-up in core inflation readings over the last six to 12 months. She expressed some doubts that this rise would prove durable.

She noted that “earlier dollar appreciation is still expected to weigh on consumer prices”. As we have noted in recent commentary, Yellen and key Fed members appear to have taken note of Fed research that suggests that inflation tends to be over-estimated by official data early in the year. She did not specifically mention that here but obliquely said, “core inflation can vary substantially from quarter to quarter”. It appears that key Fed members are looking through recent and perhaps even upcoming inflation readings, suggesting less reason to expect them to move rates in coming months.

Yellen also spoke extensively on inflation expectations. The comments were relatively balanced, explaining why she still sees these as “well anchored”. But she is leaning towards keeping rates lower for longer to account for lower survey and market measures of inflation expectations. Yet another reason why the Fed may be reticent to raise rates.

It is probably not fair to say that Yellen was playing currency war games, but she also appeared to endorse the benefits of a lower US dollar, and imply that the recent strength of the dollar (in the last two years) had lowered the Fed’s path for rate hikes.

Yellen also made mention of the asymmetry in possible policy responses to shocks. Because the Fed has less scope to ease, it should be more cautious and hence slower to react to evidence that it may need to hike. Another reason to see the Fed’s reaction function as dovish and provide support for inflation hedges.

The one somewhat hawkish aspect of the speech was that Yellen mentioned several times that the outlook is uncertain and the Fed will react to data and events and is not wedded to its forecasts for rates.

Furthermore, while acknowledging risks associated with low inflation expectations she said “it would not be all that surprising if inflation rose more quickly than expected” and she is monitoring closely incoming wages and prices data. As discussed in my report on Monday, wages data on Friday need watching even more closely than inflation data at this juncture.

The Outlook, Uncertainty, and Monetary Policy – Fed Chari Yellen, 29 March – federalreserve.gov