JPY rock solid and Fed’s dovishness in play, Brexit or not

The Fed FOMC was quite dovish and pessimistic by downgrading the outlook for rates over the medium term to reflect a weaker outlook for US growth potential. This may reinforce the weaker USD trend that has taken hold since early this year. The Fed has proven very sensitive to the payrolls report and even more attention will apply to this report in coming months. JPY is rock solid despite the rising hope of Bremain. The strong JPY is significantly undermining the effectiveness of BoJ policy and keeping downward pressure on global bond yields. Policymakers in Japan appear to have lost the initiative over controlling expectations and financial market outcomes. It is far from clear whether further BoJ or fiscal policy easing anticipated after the 10 July upper house elections will be enough to turn the tide in the JPY. The trend towards a weaker USD/JPY is having broader consequences; it is contributing to very low global bond yields, spilling over to broader weakness in the USD, placing upward pressure on global asset prices, albeit in an environment of low confidence and fear of over-valuation, and contributing to a rising gold price as investors seek an alternative to low yielding bonds and assets and fear more adventurous central bank policy.

JPY rock solid

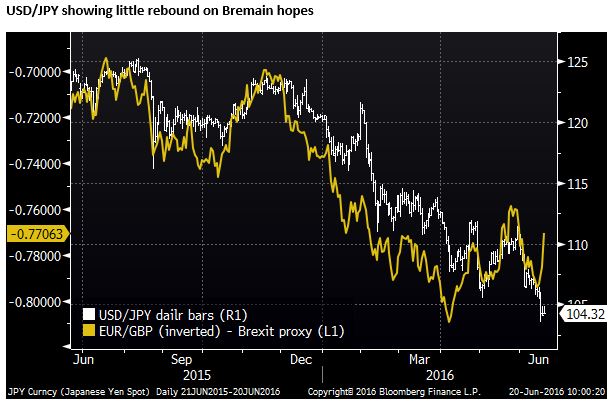

Bremain expectations have surged on Monday driving a large rebound in risk assets, but there is hardly any rebound in USD/JPY. It still appears that there is a powerful underlying down-trend in USD/JPY that is unrelated to the UK vote.

As we discussed in our report last week (AmpGFX – Currency Wars before Helicopter Money, 16 June) the strength in JPY appears to be significantly undermining the effectiveness of the BoJ’s extreme and unconventional monetary policy easing, worsening the unwanted unintended consequences of the policy, and placing considerable downside pressure of bond yields in Japan and globally.

Yields have risen in recent days as hope of Bremain has increased, but the ongoing strength in the JPY, limiting the power of its monetary easing, is likely to limit a recovery in global bond yields that are likely to remain hemmed near record low levels.

Japanese policymakers struggle for answers

A strong JPY continues to put pressure on the BoJ to do more to achieve its inflation target. But if its monetary policy easing already implemented has failed to deliver results, and in fact may have back-fired, the market and the BoJ may wonder if more of the same will fail to turn the tide.

As we discussed last week, the strong JPY reflects the completion of a major asset reallocation through 2014/2015, a return to a significant Japan current account surplus, a lack of clear alternative investments outside of Japan, sluggish global growth in part a result of excessive global debt and geopolitical risks, a weaker USD as the Fed delays rate and, importantly, a reversal of Japan’s preparedness to place a floor under the USD/JPY. They are in a strong position to force their will on the JPY with negative interest rates but have agreed with their G7 counterparts to not engage in competitive devaluation.

Brexaggerated

Even though the market has been heavily distracted by the UK vote and extreme volatility is possible around the vote, the direct impact of the vote, in or out, on global growth in either the long or short term may have been exaggerated.

A Brexit might be a further catalyst towards the trend lower in bond yields with spillover to other markets, but we are less sure that a Bremain will proof to be a circuit breaker.

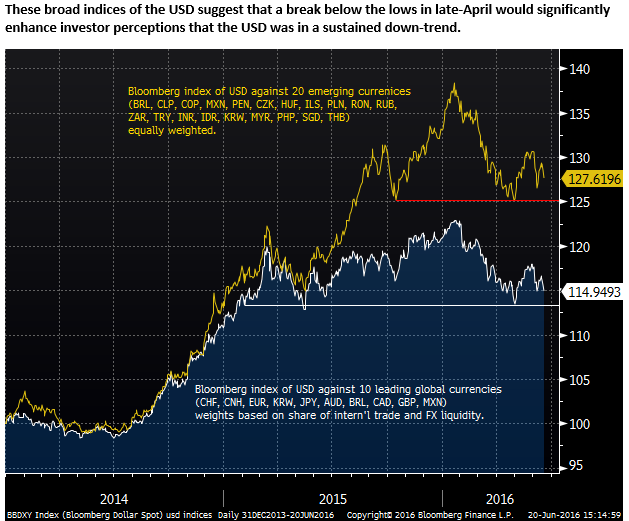

We suspect that once the volatility washes through we will remain on trends that have been in playy much of the year towards a weaker USD, uncomfortable strength in JPY and EUR, downward pressure on yields, unstable assets prices that may continue to rise against a troubled global growth outlook, and a rise in gold as an alternative store of value against low yielding major currencies and worries over more adventurous global monetary policy aimed at boosting inflation.

Dovish Fed displayed waning confidence

Brexit over-shadowed what was another significantly more dovish FOMC policy meeting that supports the trend towards a weaker USD.

The FOMC Summary of Economic Projections significantly lowered their forecasts for interest rates over the next three years and in the long term. The revisions point to a further drop in confidence in the long run growth potential in the USA and globally.

These revisions had very little to do with Brexit. Even though Chair Yellen answered a question on the UK vote at her press conference, it did not feature in her explanation of the Fed’s outlook for the economy and forecasts; the longer run projections ultimately have little to do with the vote.

Yellen emphasized the uncertainty over the longer run outlook for rates but admitted that the lower projections reveal declining confidence in the growth outlook related to the persistence of low productivity growth over recent years in the US and globally that may related to ageing demographics.

If you thought payrolls were important before…

We are set to see an even more intense focus on the monthly payrolls report. This Fed is indeed now quite data dependent. Before the June payrolls report, Chair Yellen and other Fed members said a hike in the summer, meaning in either June or July may be appropriate, resulting in a rise in US yields and the USD. However, this quickly reversed after the weak June payrolls report and the Fed noticeably changed its tune in the June policy meeting last week.

Perhaps the Fed were clinging too tightly to the resilience of the payrolls data to justify the next rate hike that had already been delayed from projections made in December last year. The weak June payrolls outcome, with significant downward revisions to April and May suddenly threw a cloud over the Fed’s outlook.

With the jobs data now not so resilient, more weight was given to other soft indicators including, in particular, weak business investment (Durable Goods orders due on 24 June).

The labor data have not been all bad in recent months, wages growth has picked up, unemployment remained low, unemployment claims and job vacancies were solid. But it has been mixed, along with much of the economic reports this year, creating ambivalence over the case to further tighten policy.

Fed Chair Yellen said, “Although recent labor market data have, on balance, been disappointing, it’s important not to overreact to one or two monthly readings. The Committee continues to expect that the labor market will strengthen further over the next few years. That said, we will be watching the job market carefully.”

As witnessed in the last month, the Fed’s view has swung on one labour report and they are watching the job market carefully.

Hikes may come in the USA because the path is cleared by a weaker USD trend

Our sense is that underlying momentum in the US economy is still there, but it has slowed since 2014/15 and the labor data will remain mixed for a few months; not demanding the Fed hike. This will tend to reinforce the current weaker USD trend. But of course the payrolls data may induce significant volatility and swings in the USD and other markets.

A hike in July seems extremely unlikely and would require a sharp rebound in the jobs report negating the weaker outcomes in Q2. A hike is September is possible but was still require a lift in jobs growth back to near Q1 outcomes and sustained strength in other aspects of the data. The next hike appears now more likely to be held back until after the US election, more probable in December. This picture of two hikes dragged out over two years is consistent with a weaker trend in the USD.

Much depends on the pace of recovery in the USA, but the FOMC’s projections, continuing a pattern of downward revisions in their rates outlook is not projecting confidence. It appears that hikes are now coming only if the USD depreciates and helps improve the US growth and inflation outlook.