JPY has scope to fall further on rising global inflation indicators

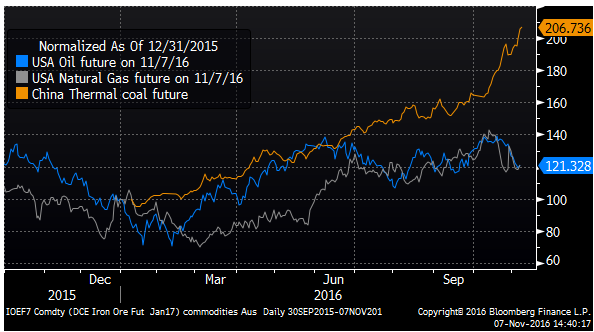

The increased prospect of a Clinton victory in the USA election is allowing the market to start to look beyond the risk of policy and social upheaval in the USA. The reduced risk of legal action against Clinton over her use of emails (following the latest FBI release) also improves the prospect for stability post-election. Global growth indicators have generally improved over recent months and commodity prices have continued to build on gains earlier in the year (with the exception of oil prices). US employment data were stronger than expected, including higher wages growth. This is supporting rising global bond yields from still very low levels. As global bond yields rise, while they remain largely stagnant in Japan, the JPY is likely to weaken against most currencies. We expect this trend to continue unless there is a surprise Trump victory. We see scope for JPY to unwind a good deal of its significant gains this year. The RBNZ are expected to cut rates this week, but they will do so reluctantly and are likely to move to a neutral bias, supporting the case for a stronger NZD/JPY. AUD is pressing against resistance supported by resurgent coal and iron ore prices, but recent economic reports suggest domestic growth may be losing momentum. CAD has significantly underperformed AUD and NZD, undermined by lower oil prices, dovish Bank of Canada statements, and fears over the US election. More stable oil prices and a solid Clinton victory may see CAD recover lost ground.

RBNZ to cut reluctantly

In New Zealand, there is a virtually unanimous agreement by forecasters that the RBNZ will cut rates this week on Thursday morning. The rates market is pricing in 19.5bp of cuts, about a 78% probability of a 25bp cut to 1.75%.

However, analysts are also largely in agreement that this will be the last cut in the cycle for New Zealand, and the rates market pricing has no more than 23bp of cuts priced in from here. As such, the market should not be surprised if the RBNZ move to a neutral bias after one more rate cut this week. However, many will be still looking for a mild easing bias as part of an attempt to keep a lid on the NZD exchange rate.

The recent economic activity and inflation data do not make a case for further easing at this time. As such, there is a risk that the RBNZ decides not to cut further this week. However, they have strongly signaled that a further rate cut is expected. In recent meetings, it has said, “Our current projections and assumptions indicate that further policy easing will be required”. As such, the market thinks it has painted itself into a corner.

A key concern of the RBNZ has been the strength of the NZD exchange rate. It has made the exchange rate a key determinant of its rates policy, blaming the currency’s strength for the persistent undershooting of its inflation target and dampening long-term inflation expectations. It has said that it aiming for significantly above trend growth to boost domestic inflation pressure to offset the deflationary forces coming from the strong exchange rate and weak global inflation pressure combining to depress tradables inflation.

As such, the RBNZ may fear a surge in the NZD if it does not follow through with its predicted rate cut. However, the most recent inflation data, trends towards higher commodity prices and recent evidence of some lift in global inflation expectations suggests that the case for a further cut this week has diminished.

We think that the recent improvement in the inflation outlook has not been so large to prevent the RBNZ from cutting rates this week, and we expect them to follow through, but the tone of their policy statement is likely to be neutral. We think they will remove any comment in their opening statement that says rates are likely to, or even, may need to be cut further.

The risk is then that the NZD firms in the wake of the statement. However, NZD is already relatedly strong against other commodity currencies and the USD is likely to receive some boost from a Clinton victory. As such, we are not expecting a significant uplift in NZD/USD, but can see significant gains against the JPY.

New Zealand inflation revised higher

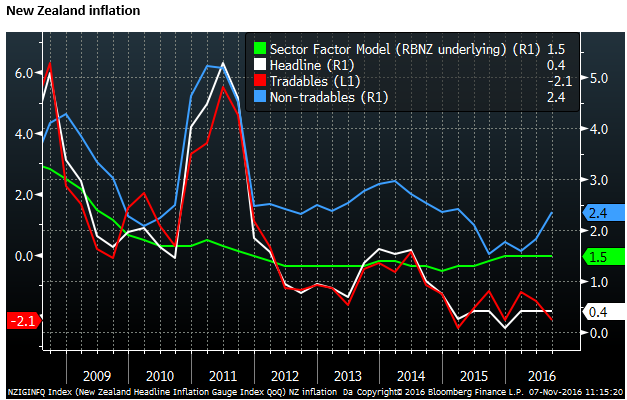

Statistics New Zealand (SNZ) announced on Monday that it had made an error in its initial release of its Q3 CPI (released on 17 October) and were making the unusual decision to revise the data higher. CPI was revised up from 0.2% q/q to 0.3% q/q and from 0.2% y/y to 0.4% y/y. The correction related to government relicensing fees for vehicles, and thus lifted non-tradables inflation from 2.1%y/y to 2.4%y/y

The chart below shows that non-tradables inflation has risen for the last two quarters to a high since Q1-2015. The RBNZ favoured underlying measure (Sector Factor Model) has been stable for three-quarters, but up from lows in 2014/15.

The recent uplift in global commodity prices is likely to reduce the deflationary impact from tradables inflation and should further dampen the case for rate cuts.

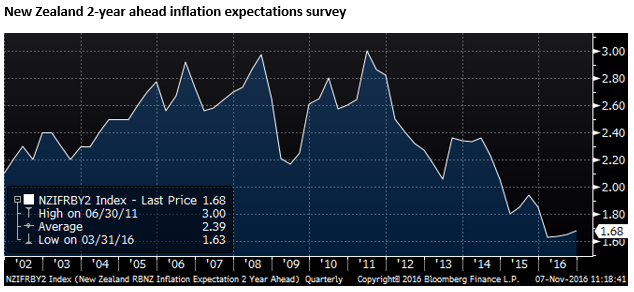

Last week, the 2-year inflation expectation survey also firmed for a third quarter to 1.68%, albeit still near historical lows set in Q1 at 1.63%. Still too low, but at least moving in the right direction.

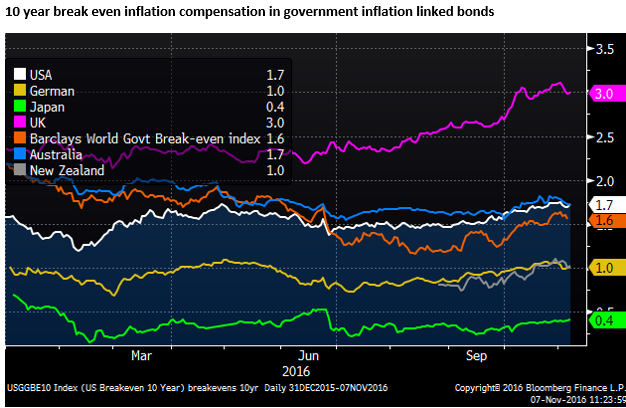

Breakeven inflation expectations based on 10-year government inflation-linked bonds have firmed in New Zealand in recent months, in-line with the global trend.

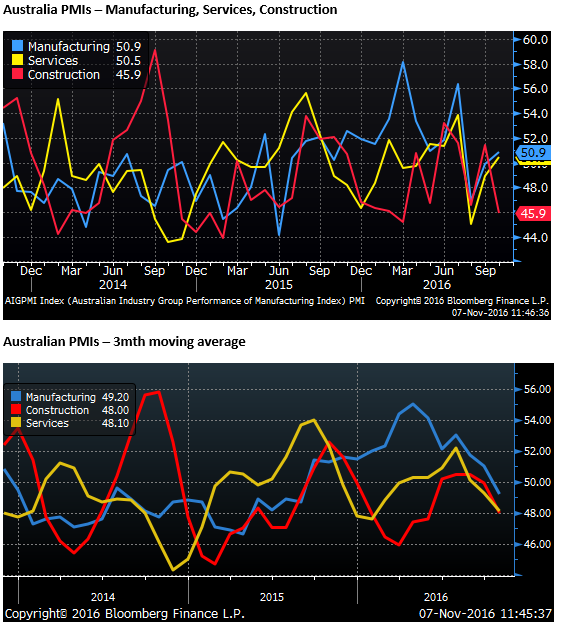

Australian construction PMI weak

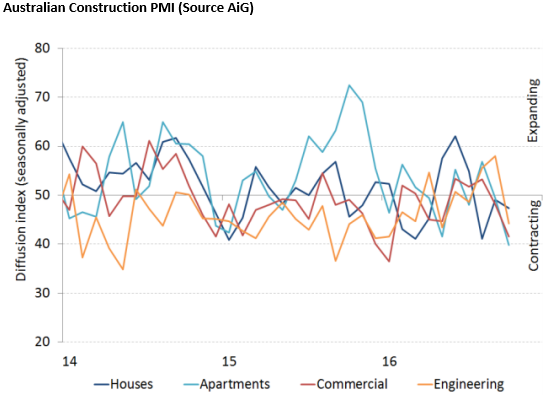

Australia may be starting to see the effects of a peaking in its apartment building cycle. The PMI for construction fell 5.5pts to 45.9, a 20-month low. The apartments component fell to a 39-month low. The other three components (houses, commercial and engineering were also in contraction

Construction slips back in October – cdn.aigroup.com.au

The PMI data can be volatile from month to month, but the 3mth moving average suggests that the economy has lost momentum since the middle of the year.

The RBA look at a range of surveys supplemented by their liaison; it noted in its quarterly Statement on Monetary Policy release on Friday 4 November that “Survey measures of business conditions in the non-mining sectors have been above average for some time.” The PMI data suggest that this assessment is on the optimistic side.

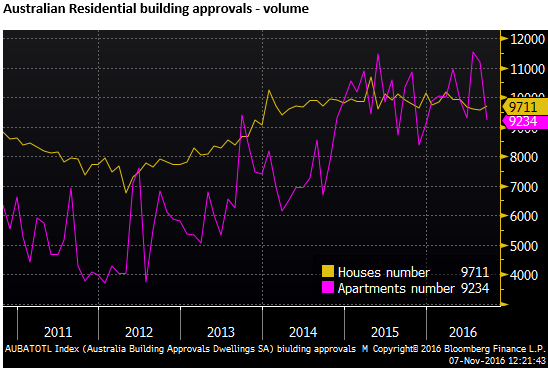

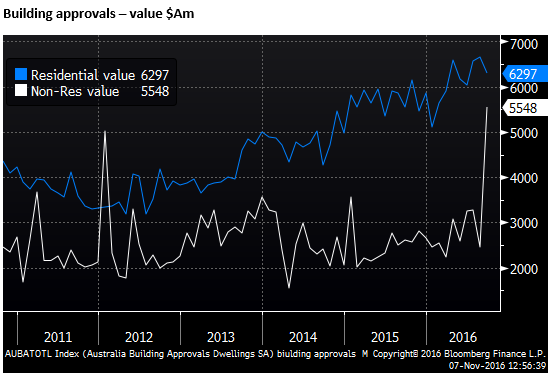

The most recent building approvals data released on 31-October for September showed a sharp fall in the number of apartment approvals, albeit from around record levels. As the chart below shows, approvals have been running around record levels for around two-years. A key concern in Australia is an excess supply of apartments over the next few years with a potentially dampening impact on the economy, generating some risk of negative fallout through related financial stress and lower prices.

However, the approvals data showed a sharp jump in non-residential approvals. It remains to be seen if this is a one-off or a pick-up from what has been weak growth over recent years for non-residential approvals.

Australian retailing weak

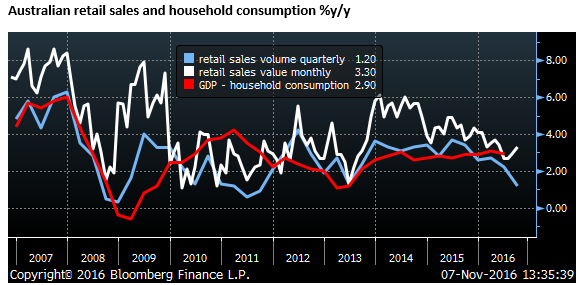

Australian retail sales data for Q3 were significantly weaker than expected, falling in volume terms by 0.1% q/q s.a., below +0.2% expected. The chart below shows that the volume of sales over the last year rose 1.2%y/y, a low rate since 2011. The value data were above expected in September and rose 3.3%y/y.

The data point to some downside risks to the RBA growth forecasts presented on Friday. It is looking for household consumption to contribute at around its long-run average trend rate over the year ahead (around 3%), but retailing has dropped well below that rate in the last two quarters.

The RBA noted some downside risk to their consumption outlook. It said, “There is some uncertainty about the likely strength of consumption growth over the period ahead. If weak growth in household income persists, households may restrain growth in future consumption, which would imply a more modest decline in the household saving ratio than has been observed in the past few years.”

Australian job ads decent

The ANZ internet job advertisements data was more encouraging rising 1.1%m/m in October after a flat result in Sep, up 6.1%y/y, continuing a fairly steady growth rate over the last few years from a low 2013. The data help balance the recent decline in skilled vacancy data (up to September) since June. Perhaps the divergence in these indicators is indicative of the shift in employment from the mining sector to the less skilled service sector, and the disparity in full-time and part-time job growth with the former falling and the later accounting for all the job growth in the last year.

Resurgent commodity prices

There are signs that the Australian economy has lost some momentum and may be facing headwinds from a peaking in residential construction. However, the AUD is pressing the high end of its range for the year, supported by resurgent Australian commodity prices (coal and iron ore), lifted by improved demand and supply cuts in China

Industrial commodity prices, in general, have been strengthening recently, including base-metals. Apart from China, there has been a broader modest improvement in global demand indicators.

The exception is oil prices that have been undermined by high levels of supply and new capacity that may come on stream quickly if prices rise only modestly. Focus remains on OPEC’s meeting on 30 November where they plan to agree on caps on production. Oil prices stabilized today on reports that Russia (outside of OPEC) may join with OPEC in controlling supply to help keep the market in balance.

The lift in commodity prices will boost mining company profits and in turn Australian government tax collection. However, the trickle-down to new mining jobs and salary increases is likely to be limited. The RBA said in its Monetary Policy Statement that, “The increase in commodity prices over 2016 to date represents a marked change from previous years. If sustained, higher commodity prices will provide some support to growth in nominal income, but are not expected to lead to much additional mining investment over the next couple of years.”