Knock-ons from rising bond yields

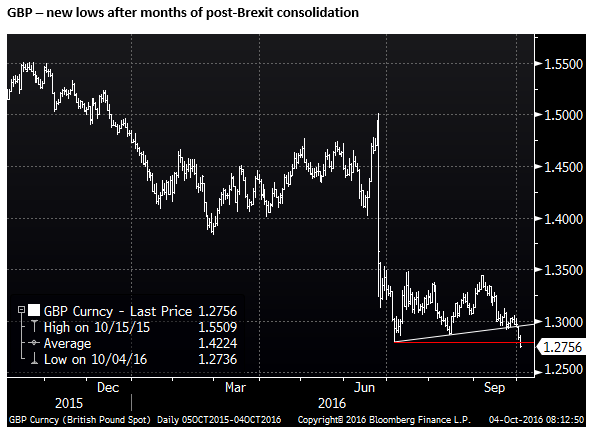

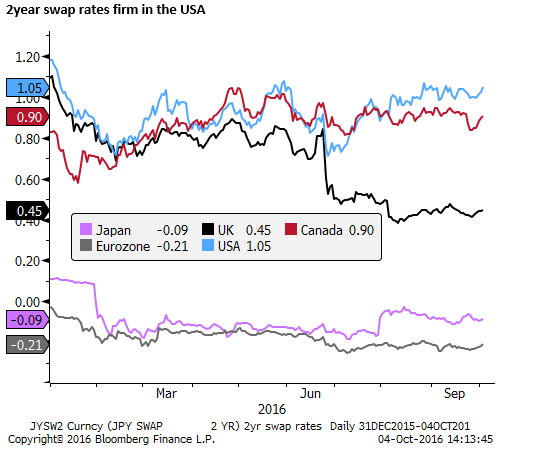

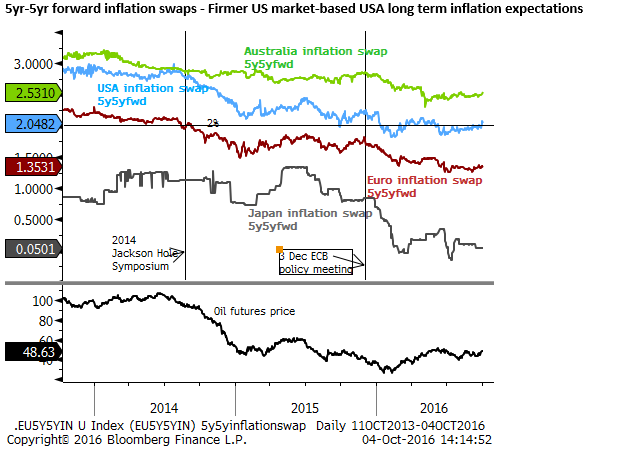

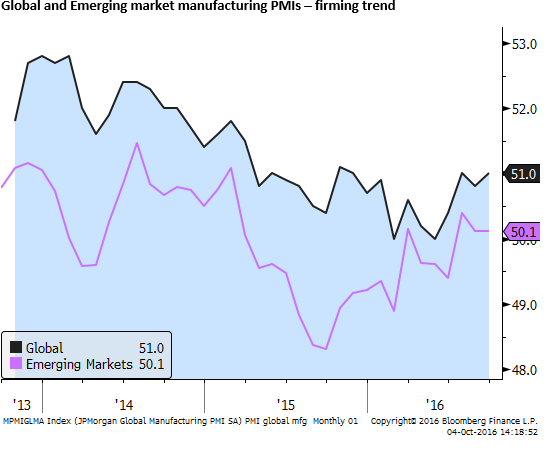

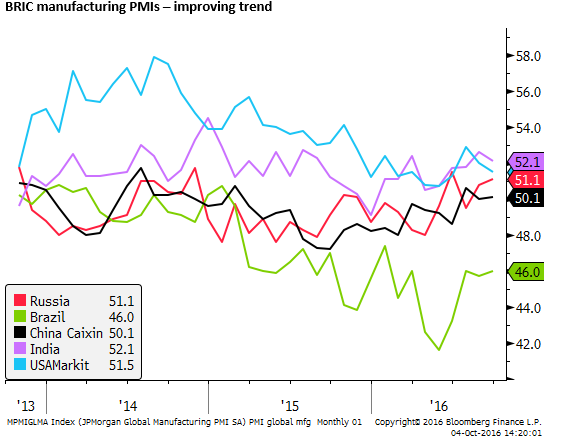

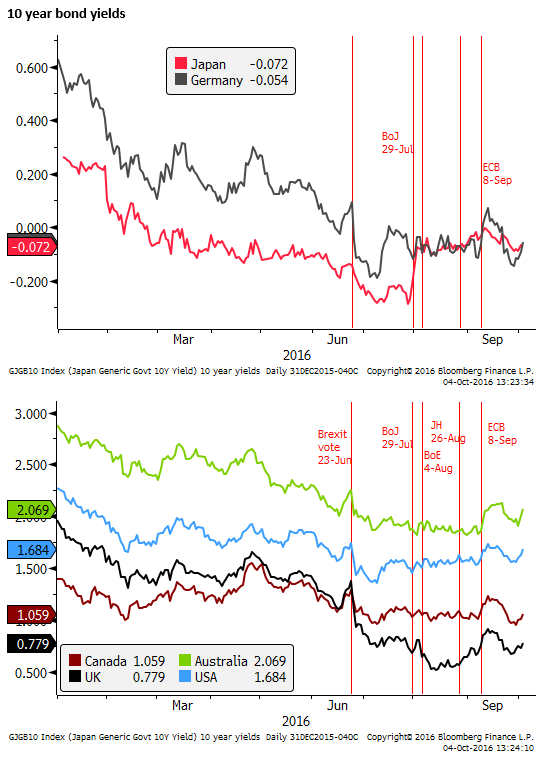

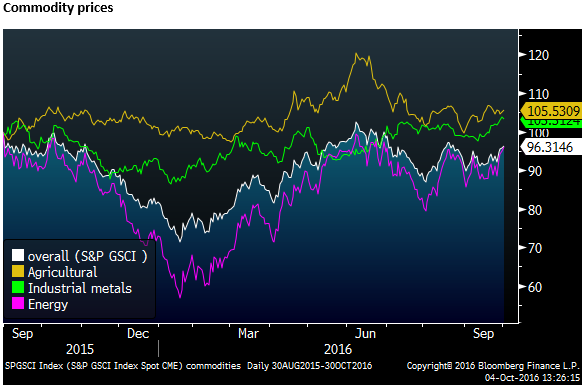

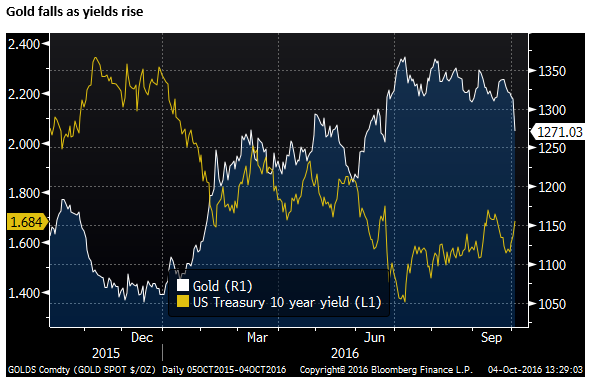

GBP has finally and belatedly responded to the heightened and prolonged Brexit uncertainty, notwithstanding a resilient UK economy and prospects of significant UK fiscal stimulus. The outlook remains negative, but it is risky to jump on the selling bandwagon. Bond yields may have resumed a fledgling rising trend, supported by the BoJ’s ‘Yield Curve Control’ and notions of ECB tapering that stem from the same concern that flat yield curves are bad for the financial sector and may be counter-productive. Higher yields are also supported by increasing expectations of more fiscal stimulus and firming commodity prices related to modest improvement in global economic activity. Yields may be rebounding from extraordinary lows generated by fear of a shortage of bonds to feed QE programs, and depressed views on inflation and secular stagnation. Gold has broken key support, weighed down by rising bond yields and firming confidence in global growth. JPY has also broken a year-long downtrend and combined with weaker trends in gold and GBP is spilling over to broader gains in the USD, even though US economic data has been mixed. Vague ECB taper talk has added uncertainty. It may tend to reinforce a rise in yields, but threatens to turn what was a constructive market to one that is more risk-averse.

There is this thing called Brexit

The GBP is weaker; apparently, there is this uncertainty about Brexit. The press is spinning this as emanating from a speech and press comments from PM May. But I fail to see what new information has come to light. PM May and the UK government have been saying they would proceed with triggering article 50 in early 2016 for some time. They have said that they will pursue Brexit in the spirit of the prevailing no vote to EU membership, making controlling immigration a key priority. EU leaders have warned the UK for months that they will play hardball and access to the single market was not an option without free movement of people. EU leaders have said they would make an example of the UK to discourage other nations from thinking they can exit the EU and retain benefits.

Bloomberg has run a story saying that the Theresa May led government is unlikely to give priority to preserving the trading status of the UK financial sector, but it has no facts and quotes some unnamed industry insider opinions. This is largely just a manifestation of existing risks. The negotiations on trading relationships with the EU have not started and the fact is that there is a long period of uncertainty ahead.

Banks to Miss Out on Special Favors in May’s Brexit Plans – Bloomberg.com

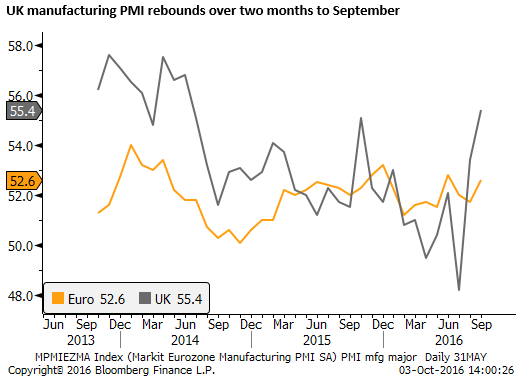

Stronger UK PMI and fiscal stimulus talk

At the same time as the GBP broke down through the bottom of its recent trading range, the UK manufacturing PMI jumped surprisingly to a two-year high and the UK Chancellor of the Exchequer Hammond said that the government had jettisoned its long pursued objective of fiscal consolidation. He suggested that fiscal policy will be loosened to help support the UK economy through Brexit, and the government plans to spend on upgrading the UK’s creaking rail, road, and other infrastructure. This news could have been bullish for the GBP. The probability of further BoE policy easing has diminished as the economy has proved more resilient than expected and fiscal policy may take over the reins in underpinning confidence and growth.

Random timing

The fall in GBP makes sense, the timing of it is a bit random. The slow response to Brexit uncertainty is more about positioning than anything else. The speculative trading market has been near record shorts since July and this has delayed the response in the GBP to building evidence of a hard Brexit.

While speculative traders are short, a lot of investors and individuals have long-held GBP assets that they had never really thought about divesting from and were shocked by the Brexit vote. These people may be belatedly biting the bullet and repatriating these assets away from the UK, or hedging their GBP exposure. Furthermore, the UK has one of the largest current account surpluses as a percentage of GDP in the world, weighing on the GBP now that the medium-term outlook is so uncertain.

Key break-outs

FX markets have been trading in choppy ranges for some months. It is fair to say that inertia in major central bank policies has been a contributing factor. The Fed has had an on-and-off attitude to rate hikes contributing to a lot of noise but little direction. The BoJ has been losing credibility as it failed to do much even as the JPY rebounded in the first half of the year and Japanese inflation expectations collapsed. The ECB has moved policy at the fringes, but, like the BoJ, seem largely all-in on QE and is watching and praying for the Eurozone to weather the storm of political uncertainty.

Most currencies remain in choppy ranges, but there have been a few key break-outs. GBP has dropped to a new low and Gold has dropped sharply below is range since mid-year. The USD/JPY also appears to be threatening a break-out to the topside, breaching a year-long down-trend line.

These breaks have helped boost the USD more broadly. Like the timing of the GBP/USD slide, it is hard to see a specific trigger for a rebounding USD. The US data has been mixed at best. The Atlanta Fed ‘GDPNow’ forecast for the current quarter has been consistently revised lower. There have been a mixture of dovish and hawkish Fed member comments.

It is true that US 2-year yields have firmed recently suggesting there are some increased expectations for higher US rates, but this is as random as the recovering USD.

Perhaps the fall in support for Donald Trump in the last week is supportive, reducing potential economic and geopolitical uncertainty. Lifting economic confidence in the USA and globally. But I think we can work too hard trying to fit the market developments to current events.

JPY bull-trend may have come to an end

The timing of the rebound in USD/JPY may have much to do with the start of a new financial half-year in Japan and a degree of exhaustion in the bull-run in JPY.

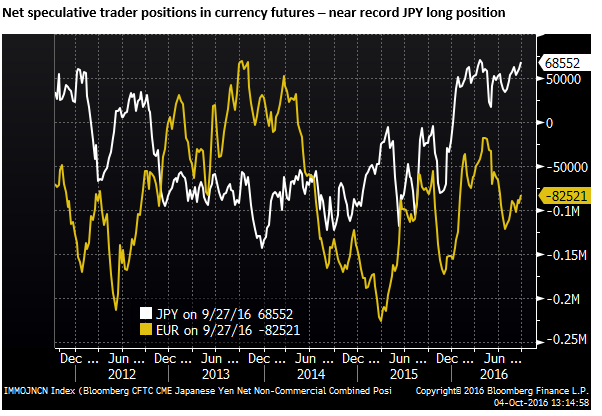

Sentiment towards the JPY had appeared to become somewhat irrationally bullish. At the end of the day, the BoJ is still expanding its balance sheet at an alarming rate and rates are negative. The strong JPY itself was generating a number of the credibility problems for the BoJ, feeding on its own momentum. A modicum of fundamental support could be found in the current account surplus, boosted by lower oil prices and modest global demand.

However, the primary argument for its rise this year has been ‘the trend is your friend’. The speculative trading market has established a near record net long JPY position. The risk now is that as the market questions the fundamental case for a perpetually strong JPY, these speculative long positions will be squeezed.

The BoJ policy of Yield Curve Control (YCC) since 21 September may get a second look and be seen as restoring some BoJ credibility, setting up a framework via which it can sustain its policy easing for longer, while now pursuing an inflation overshoot.

I don’t want to give the BoJ a glowing review of its new NIRP/QQE with YCC. I think they have sent a muddled message and are caught somewhere between two competing polices of a quantitative and yield target. Nevertheless, the policy is more flexible and has the potential to be eased further via a cut in short-term rates while retaining a steeper yield curve. This flexibility may just be enough trigger a turn the JPY trend.

Just as a rising JPY tended to be self-perpetuating by undermining confidence in the BoJ, a falling JPY will tend to reinforce policy easing in Japan, help boost inflation expectations and create some upward pressure on Japanese bond yields that the BoJ can lean against with its QE bond purchases.

The modest but reasonably broad uplift in commodity prices in recent months can also help lift inflation expectations in Japan, help restore faith in BoJ policy and contribute to reversing some of the JPY gains this year.

It is interesting that just as the JPY has started to weaken, news from Japan has seemed to support the status quo of a stronger JPY. A number of key officials, including the leader of the LDP government’s coalition partner, The Komeito Party, Yamaguchi, and an advisor to the PM, Nakahara, have openly criticized BoJ Governor Kuroda and panned his latest policy steps. The Tankan survey pointed to weaker inflation expectations, and flat-lining economic performance. In past months such news might have triggered further JPY gains. This again highlights that FX and other markets have dubious anchors and may be subject to whims of the shifting herd.

US economy just strong enough to sustain a period of USD recovery

As such, we must be cautious to not over-interpret either news or market swings. Probably the clearest and most sensible trend is towards a weaker GBP, although jumping on this bandwagon is dangerous since it left the town some time ago. We see scope for further JPY weakness if only because its gains this year seem excessive.

The case for broad gains in the USD seems fairly dubious based on the latest developments in the US economy. However, the combination of falling GBP, falling gold, and possibly a falling JPY (albeit still in its early stages) is likely to have a broader spillover to a stronger USD. The recent US economic data has been mixed, but it is strong enough to suggest that progress is being made towards generating inflation. As the Fed pointed out, “Near-term risks to the economic outlook appear roughly balanced” and this may be sufficient to make the case for a period of gains in the USD.

European bank problems highlight ECB policy limits

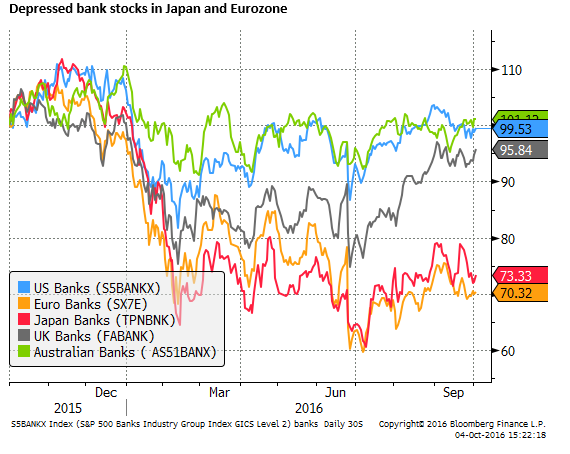

Outside of these nebulous FX developments, we have seen a considerable focus on the weakness in the European banking sector, led by troubles at Deutsche Bank. This had generated some risk aversion and distracted the market from other positive developments including firming global economic indicators and commodity prices.

The pressure on European banks has had little net impact on the EUR. Some have treated the troubles as bullish for EUR, encouraging banks to repatriate from abroad to help shore up their balance sheets and reduce the risk of a dealing with offshore funding stress. Others may have thought it negative for the EUR, damaging the economic outlook, encouraging some capital flight, and prolonging the outlook for ECB policy easing.

The troubles at European banks parallel those in Japan. Banks and financial sector companies have suffered from a squeeze on their profit margins from negative rates and limited capacity to earn returns on depressed long-term yields.

ECB Executive Board Member Yves Mersch in a speech on Monday made many of the same observations that BoJ Kuroda made ahead of the BoJ’s introduction of YCC. Like Kuroda, Mersch noted policy must now be considered in a cost vs benefit analysis. The costs are weaker financial sector profits, weakening their capacity to lend and support growth in the private sector. Both central bankers noted that the costs increase the more prolonged the NIRP/QE policy is maintained.

Of Course, like Kuroda, Mersch concluded that the policy is working and benefits outweigh the costs. However, their analysis illustrates limited scope to ease further, and a need for some mitigation policy to prolong policy easing. At some point, it may make sense for the ECB to also consider a form of Yield Curve Control and a tiered interest rate approach to help support financial sector profits.

Upward pressure on global bond yields

The shifting views at the BoJ and ECB towards finding ways to prolong policy easing may tend to support a fledgling rise in global bond yields. Yields were pushed lower by a sense that both the BoJ and ECB were running out of bonds to buy. Falling or stagnant inflation expectations well below target in these two regions led investors to conclude that both central banks would need to prolong QE purchase programs for the foreseeable future, squeezing yields to extreme lows. However, if the shape of the yield curve now matters to central banks, then the market may be less keen to buy bonds at negative yields.

A second reason to see upside risk for bond yields is increasing evidence of fiscal expansion. The UK, Japan, Canada, USA, Korea, China are all employing fiscal expansion or are likely to in the next year. Many G20 policymakers have argued that at current low yields it makes sense to increase spending on infrastructure. G20 central banks are loudly calling on governments to expand fiscal policy now that monetary policy is reaching the limits of its effectiveness and costs of are becoming more apparent.

A third reason is that industrial commodity prices are firming albeit from relatively low levels, generating some positive inflation impulse, and this is being supported by a modest recovery in global growth indicators.

Many commentators are fearful that we have entered a period of secular decline in inflation and bond yields related to aging demographics, excessive global debt, and weaker productivity growth. However, even in this scenario, there is scope for bond yields to rise significantly from record low levels.

From higher yields to lower gold

Higher bond yields contribute to a weaker outlook for gold. Extreme low bond yields and negative cash rates supported gold as an alternative safe asset. A firmer outlook for commodity markets and global growth also should encourage capital to flow towards commodity and EM assets. As investors are willing to take more risk they have less need for gold.

As such, the fall in gold through key support is consistent with both the rise in bond yields and the recent improvement in industrial commodity prices. Gold will also tend to fall when the USD is strengthening. While we see little direct US economic factors supporting a USD rebound, the USD is stronger against a weaker GBP and JPY. As such the fall in Gold is contributing to the broad evidence of USD strength and tending to validate this trend.

We cannot characterize current events in the context of a risk-on or -off market. As volatility picks up in rates and currency markets it can threaten to spill over to weaker equity markets. But the rise in bond yields, fall in gold and fall in JPY can be regarded as risk positive developments. The rise in USD might be supported by improved risk appetite, since it would instill some confidence that the Fed can raise rates. A stronger USD may be an indication that the market is switching to funding riskier bets out of the JPY (rather than the USD). This is consistent with a recent revival in JPY crosses against AUD and other commodity currencies.

Taper tantrum anyone?

Bloomberg reported today that unnamed officials, “asking not to be identified because their deliberations are confidential” have said that they have discussed tapering the ECB QE program. The report is about as vague as it could possibly be. The report placed no timing on when this might occur and even said that they, “do not exclude that QE could still be extended past the current end-date of March 2017 at the full pace of EUR 80bn a month.”

ECB Said to Build Taper Consensus as QE Decision Time Nears – Bloomberg.com

Talk of tapering appears very premature considering stagnant inflation and modest growth trends in the Eurozone. Political risk in Italy is rising ahead of a referendum in December, and Brexit is also a negative factor for the Eurozone. At the previous ECB policy meeting on 8 September, the market was anticipating possible expansion of QE policy, extending it beyond Mar 2017, or easing the rules, such as the capital key or minimum yield at which the ECB could purchase bonds.

Talk of tapering appears to be related to the same issues that led to the BoJ’s new YCC policy – the concern that the ECB is approaching limits on the bonds available for it to purchase. It may also reflect the concerns over the costs of driving down yields and damaging financial sector profits.

The market has taken this initially as positive news for the EUR. However, if it is tapering designed to lessen excessive downward pressure on yields in segments of the bond market, it might also be combined with a more prolonged period of negative interest rates. If currencies are ultimately driven by the level of yields, primarily short to medium term yields, then the rise in EUR may be limited and later reversed.

The news, as vague as it is, does add to the upward pressure on global yields. Tapering for yield curve control and to prolong ECB policy easing fits with the theme of monetary policy reaching its limits and central banks responding to the increased costs on their financial sectors.

A rise in yields based on a notion of tapering does tend to threaten to tip the market into a risk negative frame of mind. In which case rising yields could turn from capping equities to pushing them into steeper falls. In turn, this could feedback to cap yields, reverse some of the falls in JPY and rebound in JPY crosses against EM and commodity currencies, and help gold recover.

Taper talk by the ECB is an added complication and has already added to volatility. It is difficult to be sure there is a dominant theme in markets, but I’m leaning towards a weaker GBP, weaker JPY and higher bond yields for the time being. This may tend to support the USD more generally, while EM and commodity currencies may be mixed. EUR is harder to call in the near term, but buying it on taper talk seems short-sighted.